Key Takeaways

- Incorporating foreign exchange (FX) budget rates can enhance business performance measurement, assessment, and communication, enabling global corporations to make informed decisions.

- FX budget rates can play a key role in annual financial planning, budgeting and contract negotiation.

- The likelihood of meeting a budget rate varies according to the rate methodology used.

View PDF. Innovation sector companies expanding globally are exposed to foreign currency exchange risk: the risk that movements of a foreign currency exchange rate will impact business performance (cash burn, revenues, margins, earnings, etc.). A “FX budget rate” incorporated into financial planning, budgeting and contract negotiation processes can be used in conjunction with strategies intended to help mitigate the effects of adverse currency moves.

FX budget rate

The FX budget rate is the exchange rate used to convert projected non-USD expenses, revenues, investments, grants, etc. (denominated in a foreign currency) into US dollars (USD). FX budget rates can help:

-

Analyze and measure performance to plan. A FX budget rate can help a company understand the extent to which currency gyrations impact year-over-year operating expenses, cash burn, revenue, margins, and other important business metrics.

-

More accurately communicate performance. The ability to separate FX currency market fluctuation from other factors means companies are able to report business results more accurately without obscuring FX impacts, internally and externally. Along these lines, FX budget rates are central to the communication of non-GAAP constant currency metrics which are increasingly being used by global public companies.

-

Pave the way for the development of a risk management strategy. Buying and holding foreign currency and/or a forward hedge strategy can help with mitigating the impact of adverse currency outcomes and uncertainty around the FX budget rate. Options-based currency strategies may be used by corporations looking to outperform FX budget rates. That is, in order to achieve a realized budget rate that is more favorable to the business than the budget rate established at the beginning of the year.

-

Determine individual and operational metrics. An FX budget rate provides a benchmark against which management, treasury, and sales professionals charged with overseas business unit performance can be evaluated.

FX budget rate methods

Commonly used FX budget rates methods include:

-

Current spot: Current FX rate (“spot rate”), which represents the price of the foreign currency for an exchange that typically occurs two business days after the trade.

-

Current forward rate: The price of the foreign currency for an exchange that typically occurs more than two business days (and up to many years) in the future.

-

Prior period average: Average of prior comparable period FX rates.

-

Off-market rate: Spot rate plus/minus a predetermined cushion (i.e., one standard deviation).

-

Consensus forecast: Median FX rate derived from aggregated independent forecast data.

Example:

Consider a US corporation with expenses denominated in euros and a 10 million euro buy projected over the next year. After a year, if the actual annual average FX rate exceeded the FX budget rate, the actual spend in USD would be higher than the budgeted amount and bottom line performance metrics would be negatively affected. The company would use the FX budget rate to measure performance, interpret and communicate results both internally and externally.

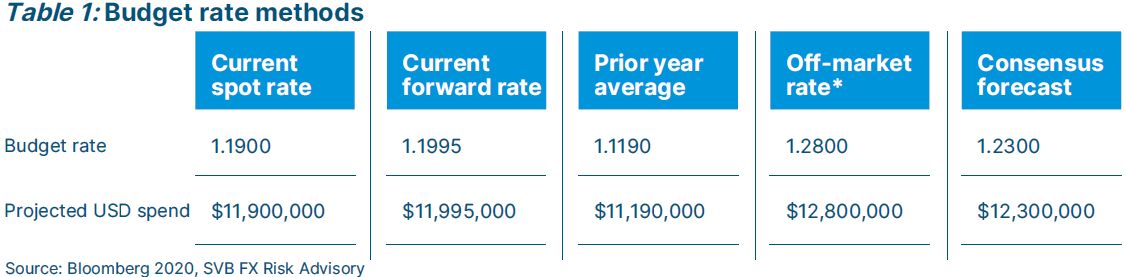

Table 1 compares five FX budget rate methods and projected spend in USD. Depending on method, reporting can differ, sometimes materially.

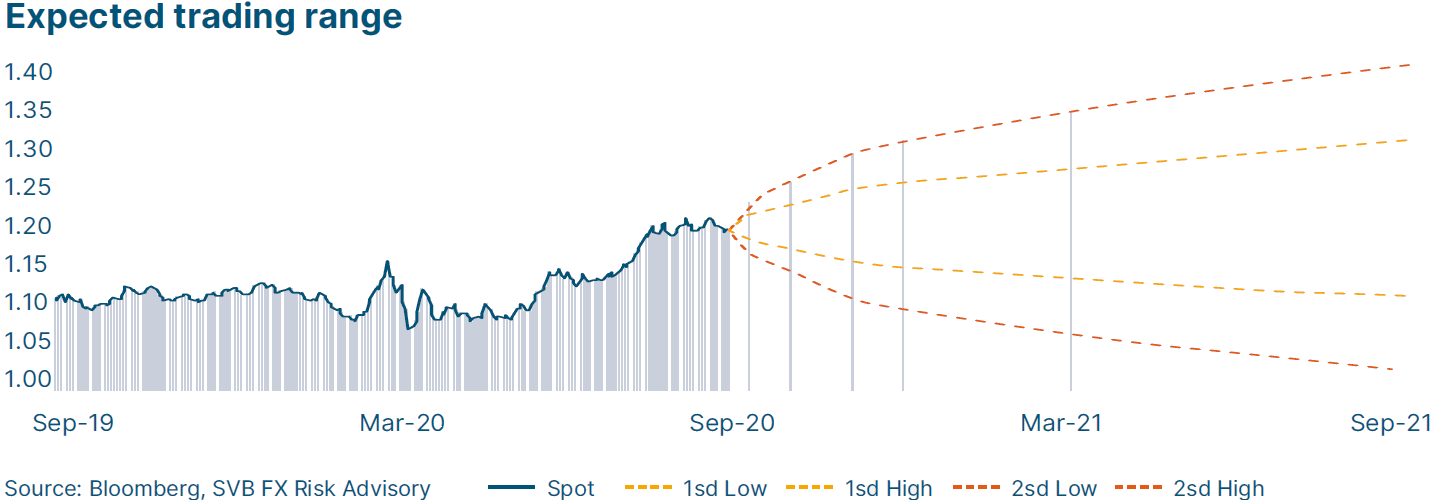

Below is a projection of how much the euro can move versus the USD based on historical statistical patterns.

FX budget rate methods perform differently

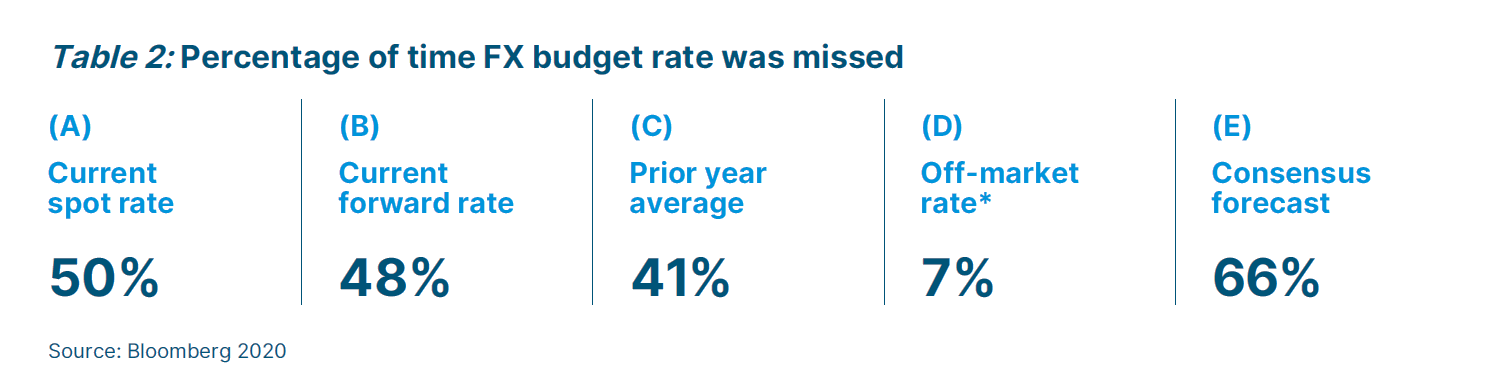

To get a sense of how the various budget rate methods are expected to perform, we ran an empirical study covering the years 2006 to 2016. Analysis assumes that a US-based corporation sets a budget rate at the start of each quarter for a euro purchase that will take place one year in the future (44 total 1-year periods). Both the frequency and the magnitude of budget rate misses (expressed as a percentage of spot) are reported for each method in Table 2.

Data shows the following:

-

22 of 44 quarters saw less favorable euro rates compared to FX budget rates.

-

The probability of meeting the FX budget rate when using the current spot rate (column A) or the current forward rate (column B) is essentially a coin toss.

-

The off-market rate strategy (column D) was the most successful method, meeting FX budget rates 93 percent of the time.

-

Companies relying on consensus forecast data (column E) would have reported performance that missed actual reported rates 66 percent of the time — the worst performing method.

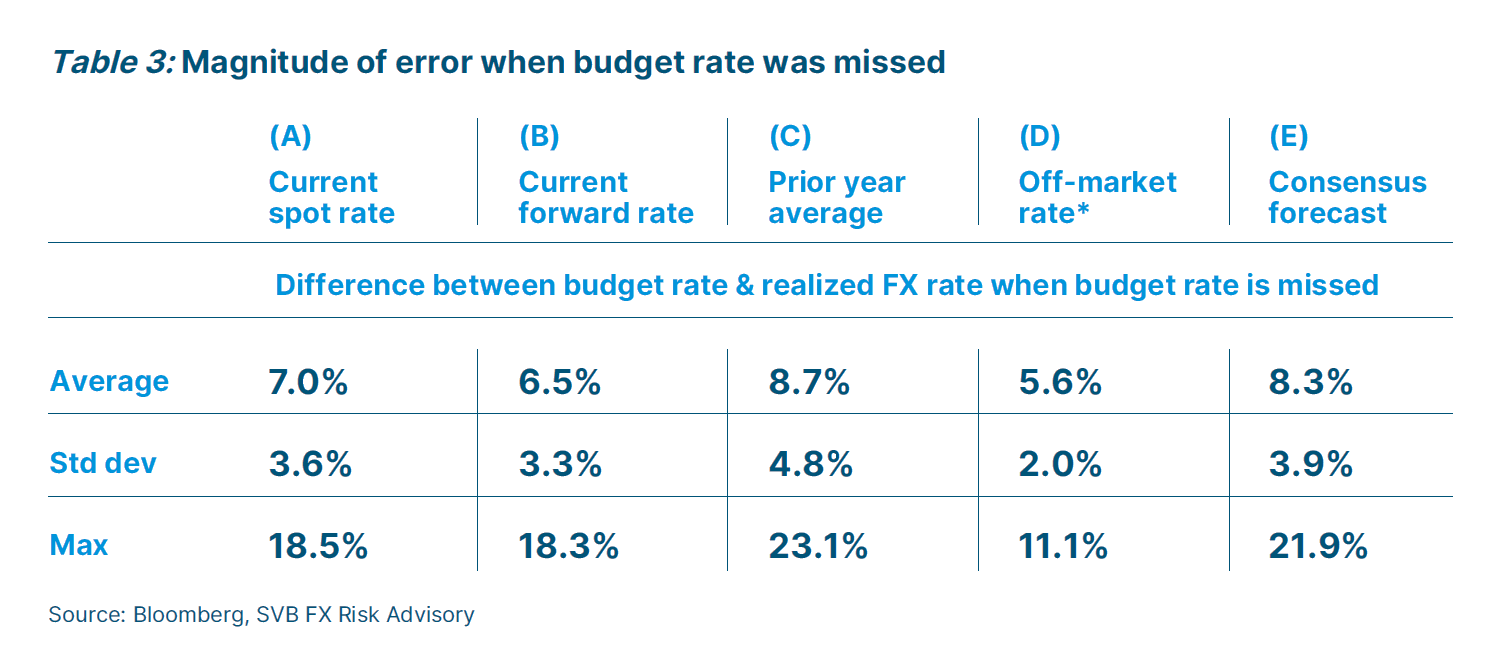

Understanding the magnitude of a miss is equally important. Table 3 provides a summary of FX budget rate performance (how closely a FX budget rate tracked with the spot rate).

Data shows the following:

-

Average magnitude of misses (expressed as a percentage of the spot rate) was 7.0 percent.

-

Prior year averages (column C) is the underperformer.

-

Consensus forecasts for FX budget rates (column E) was second only to the prior year average in its magnitude of error. To learn more about why consensus forecasts fail to perform as anticipated, see the wider discussion in How currency movements can affect your global business.

Key considerations:

Risk tolerance

There are risks to using a FX budget rate without a hedge strategy (i.e., remaining “under-hedged”). “Outperformance” cannot be achieved without taking risks or using options.

Cost

Hedging with financial contracts is generally less costly than self-insurance (using firm capital to absorb or cover FX losses).

Flexibility

In some cases, FX budget rates are fixed and cannot be changed in response to changes in business climate. Some corporations do have latitude to adjust budget rates as needed potentially impacting key performance metrics.

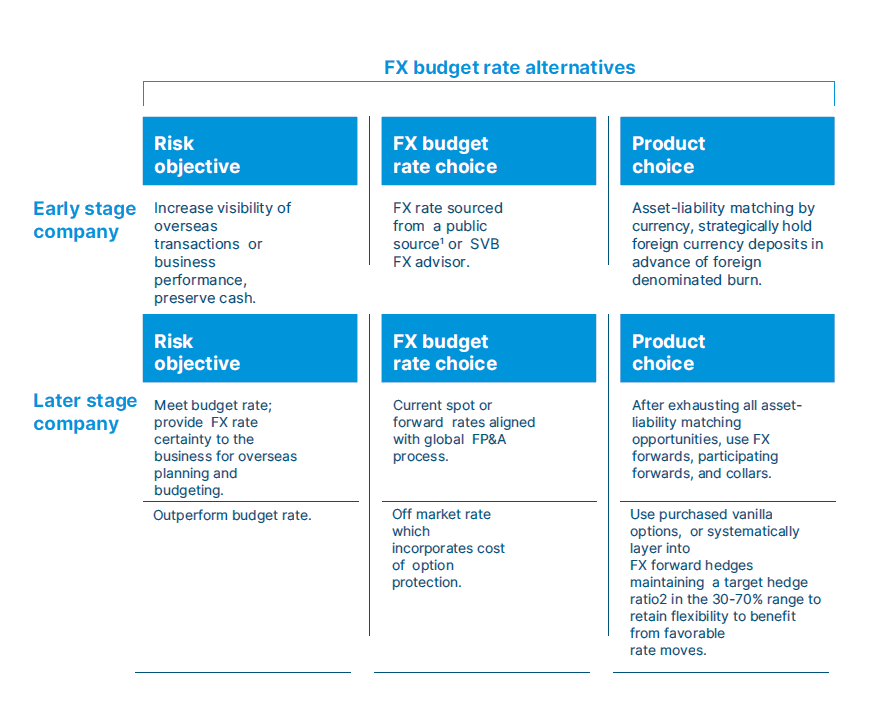

Corporate life stage

Early stage companies may use FX budget rates on an ad hoc basis to price and negotiate sales contracts or one-off projects. Later stage companies may use them to communicate corporate performance to investors, negotiate distribution contracts, or publish quarterly constant currency results. Your choice of FX budget rate depends on your corporation’s stage in the life cycle, risk management objective, and risk strategy or policy. As stated, there is no guarantee of meeting a budget rate without a hedging plan in place. The table below summarizes these tradeoffs.

Conclusion

Implementing an appropriate FX budget rate and hedging strategy into your company’s FP&A process can help with mitigating FX currency risk, providing more accurate reporting, and establishing benchmarks against which to measure performance. Rate choice should include input from key stakeholders such as management, treasury and investors, with accountability shared across your organization.

You should give careful consideration to your company’s stage, risk tolerance objective and strategy.

If you’d like to discuss your specific situation to determine if FX currency products may be right for your company, contact your SVB FX Advisor directly, or Ivan Oscar Asensio, Head of SVB FX Risk Advisory, at iasensio@svb.com.

Learn more

Read Executive Summary: Data Insights - Currency Management

Read FX Risk Advisory Library for Corporates

Read FX Risk Advisory Services

* Spot plus 1 standard deviation move.

¹ The target hedge ratio is the percentage of the total currency exposure that will be hedged according to a company’s FX hedge policy.

² Target hedge ratio for an individual cash flow or exposure is built up over time, generally at regular intervals or ”layers”, such that a corporation achieves USD cost averaging.

Bloomberg is an independent third party, and is not affiliated with SVB Financial Group.