Key Takeaways

-

Currency movements are difficult to forecast, and consensus forecasts may not be reliable

-

Currency movements are erratic over short periods, but can be sizable over long periods

-

Expecting currencies to return to previous values often disappoints

-

Currency correlations are time-varying and unpredictable

-

Understanding currency behaviors is an important step in the risk management process

Currency movements are difficult to forecast, and consensus forecasts may not be reliable

Banks, think tanks and academics regularly publish individual currency forecasts. Business market news providers such as Bloomberg act as central repositories for individual forecasts, actively monitoring and reporting on contributor accuracy, and publishing the median forecasted values of all data submissions as consensus forecasts. Generally speaking, these consensus forecasts are not necessarily reliable predictors of future currency prices.

In his book Wisdom of the Crowd, James Surowiecki writes that the collective opinion of a group is often superior to that of any one individual in the group. He supports this conclusion with examples including the jelly-beans-in-the-jar experiment in which 56 people were asked to guess the number of jelly beans in a jar that held 850 beans. The average of all guesses was 871. Notably, of the 56 guesses, only one guess beat the group average estimate.

When applied to currency forecasting, you would expect the median of all submissions to be a more accurate predictor of a future currency price than forecasts produced by individual forecasters. However, this is not the case. Evidence demonstrates that when forecasting currency behavior, consensus data is not the most accurate predictor of currency price.

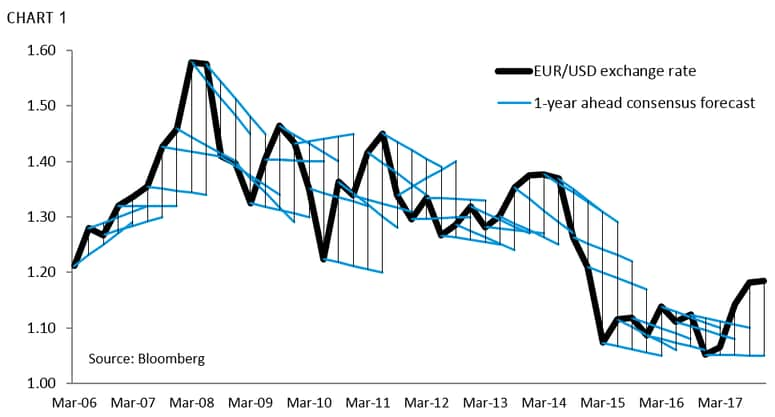

Chart 1 below tracks the EURUSD exchange rate and quarterly 1-year-ahead consensus forecasts for the period beginning March 2006 through year-end 2017.

The solid black line represents the actual FX rate (“spot rate”), and the lighter black vertical lines represent the size of the forecasting error (the amount the actual spot rate deviated from the forecasted rate as published in consensus data).

For the 10-year period in this illustration, the average deviation between consensus forecasts and actual spot rate 1-year later was 7.3 percent, with the largest deviation measuring 20.9 percent. When the direction of the change is considered, consensus forecasts were correct only 57 percent of the time.

Established statistical theory shows Mr. Surowiecki’s “collective opinion premise” does not hold for currency forecasting.2 Since currency forecasters have access to other forecaster predictions, individual forecasts may be significantly influenced by the published predictions of peers.

Implication: During your annual financial planning and budgeting (FP&A) process, you may be better off avoiding consensus currency forecasts2 when valuing future non-USD revenues and expenses. Rather, use current market rates available contemporaneously with budget rate planning, and consider using derivative hedging or natural offset strategies to better position your company to meet targets.

Currencies movements over short periods are erratic, but can be sizeable over long periods

When playing Plinko3 a flat disk is released from the top of a flat wooden board. As the disk descends, its fall is interrupted by pegs which alter its direction left or right. Where the disk finally comes to rest is virtually impossible to predict. Currencies can move from period to period as randomly as the Plinko disk moves from row to row.

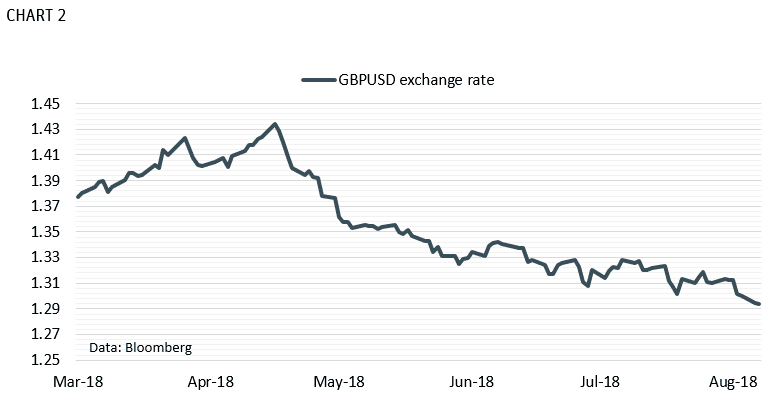

Chart 2 below reports the British pound to US dollar (GBPUSD) exchange rate (dollars needed for each pound) for the six-month period from March through August 2018. Resurging Brexit concerns resulted in a bearish couple quarters for the GBP. A more granular look, however, reveals the GBP rose 65 of 135 days (48.1% of the time) and fell 70 days — a statistical coin toss. Thus, over short periods, the movements are erratic, near random. However, the magnitude of the moves on down days was greater than that of up days and the sum of the individual daily changes over the longer six-month period was material, with the GBP dipping almost 10% v. the USD.

Implication: Yes, (as reflected in this example) there is about a 50 percent chance your business could benefit from an upside swing in currency exchange rates, but there is also about a 50 percent chance FX rate fluctuations will adversely impact your business in the future. Over time, the magnitude of that risk can be profound. If a currency’s magnitude of movement over the medium to long term could be material to your bottom line, consider hedging strategies to counteract the effects of a dramatic change in that currency’s value.

Expecting currencies to return to previous values often disappoints

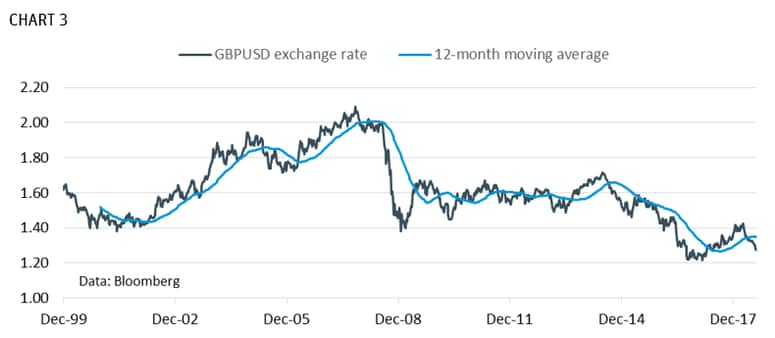

On any fishing trip, you could discover the fish you planned to catch at your favorite fishing spot have moved away. You have two options: you can wait for the fish to come back, or you can find another spot. Currency trends, like the conditions of your favorite fishing spot, last for unpredictable periods, and changes are unpredictable in magnitude. Some believe that after a currency rate drop, with time, the currency will recover and return to an earlier value, or “revert to the mean”. Data shows that currency values do not always return to previous values, and it is even less likely that they will return on your timetable.

For example, in December of 2008, the GBPUSD exchange rate was around 2.00. During that month, the value dropped precipitously. If you were a US corporation earning revenues denominated in GBP with a plan to repatriate back to USD, but only if proceeds are sold at a rate of 2.00 or better, you would still be waiting almost 10 years later. Similarly, as of September 2018, those waiting for the return of the GBP to post-Brexit lows of May 2016 are still waiting.

The story for companies with businesses in emerging market currencies is even more grim, because it is increasingly unlikely that earlier currency prices will be revisited again in the near term. For example, in the chart below, the rate for the US dollar to Mexican peso (USDMXN) has slowly drifted higher for decades as the peso has devalued. Regressing to 11 or even 13 pesos per dollar could take much longer than you may be able to wait.

Implication: If you are under water on your budget rate or FP&A plan rate for your overseas ventures (or you have not yet set these rates), we suggest that you do not wait for the market to come back. It may be better to act now to help limit losses.

Currency correlations are time-varying and unpredictable

Modern portfolio theory4 maintains that a group of diverse assets exhibits less volatility than an individual asset. The theory is appropriate to equity markets, where, generally speaking, correlation relationships are stronger and more stable. Portfolio theory has been extended to help explain currency exchange risk through the use of ‘value-at-risk’ (VaR) models. VaR models have been challenged however, as1. currency markets demonstrate less correlative behavior than equity markets;

2. correlated relationships vary over time with changes occurring rapidly and without warning; and,

3. regulatory constraints, capital controls, and convertibility issues unique to currency exchange likely understate currency exchange risks.

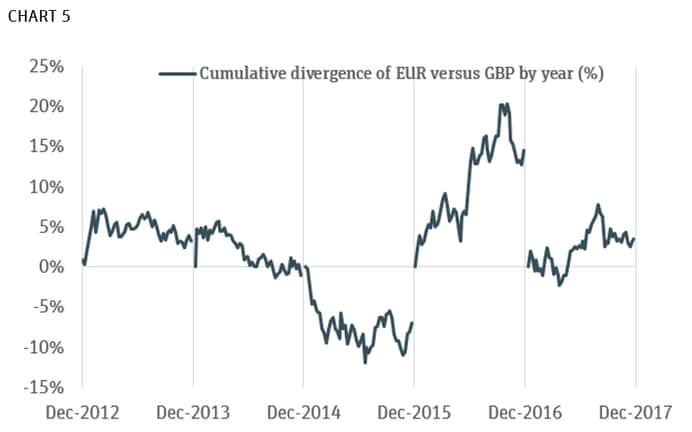

For example, at times the euro and pound have demonstrated correlated behavior. Global companies have funded expenses in euros with revenues in pounds as a means of managing potential downside losses from currency fluctuation. After considering the data however, as illustrated in the chart below, the two currencies do not reliably correlate; their values diverged materially over longer periods.

The data below shows the euro-to-pound correlation was strong for years 1, 2, and 5 (with a divergence of 5% or less for those years); but in years 3 and 4 the correlation broke down with divergence percentages well into double-digits.

Implication: Companies using VaR models and currency correlation strategies may unwittingly suffer large, unforeseen losses. In general, currency diversification may provide some off-setting benefits, but diversification to manage foreign currency risk is unreliable and may not constitute comprehensive, prudent risk management.

Conclusion

As you grow your business globally, carefully consider your operational currencies and how market fluctuations affect business performance. A prudent foreign exchange risk management strategy starts with a sensible view of currency behaviors and carefully considered vehicles for counteracting the risk of sudden and unexpected market upsets.

Talk to us

If you’d like to discuss your specific situation to see if vehicles like hedge forwards may be right for your company, contact Ivan Oscar Asensio, SVB FX Risk Advisory, at iasensio@svb.com, or contact your SVB FX Advisor.

Learn more

See all SVB's foreign exchange services.

Sources:

Chart data: Bloomberg 2018.

-

Although consensus forecasts are not very accurate, SVB’s Scott Petruska is consistently ranked in the top 10 of all forecasters, currently holding #2 overall ranking for major currencies for Q2 2018. Source: Bloomberg Q2 2018.

-

Specifically due to the central-limit theorem.

-

See Journal of Finance paper “Portfolio Selection” by Harry Markowitz.

Bloomberg Q2’ 2018 FX forecasters are ranked based on three criteria: margin of error, timing (for identical forecasts, earlier ones received more credit) and directional accuracy (movements with the currency’s overall direction). The rankings which were based on Bloomberg’s foreign exchange forecasts (FXFC), were for forecasters who provided forecasts for Q2’ 2018 in at least three of the four preceding quarters but no later than one month prior to June 30, 2018.

Scores were calculated each quarter for the three criteria, which were weighted 60 percent, 30 percent and 10 percent, respectively. The final score for each currency pair was the time-weighted average of the four quarterly scores.

The best overall forecasters were identified by averaging the individual scores for each firm on all 13 currency pairs and all four quarters. Forecasters had to be ranked in at least eight of the 13 pairs to qualify for the overall ranking (58 firms qualified). All ranking tables display the top 20 percent of the forecasters who were eligible, to a maximum of 10 names.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates. This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal, accounting and other advisors and only make investment decisions on the basis of your own objectives, experience and resources.

All non-SVB named companies listed throughout this document, as represented with the various statistical, thoughts, analysis and insights shared in this document, are independent third parties and are not affiliated with SVB Financial Group.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates.

This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal, accounting and other advisors and only make investment decisions on the basis of your own objectives, experience and resources.

All non-SVB named companies listed throughout this document, as represented with the various statistical, thoughts, analysis and insights shared in this document, are independent third parties and are not affiliated with SVB Financial Group.