Key Takeaways

- FX rate uncertainty arises from the time an international fund investment is contracted and the time the deal is funded.

- The potential impact on the US dollars (USD) required to close the transaction can be significant.

- Short-dated forwards can be used to help mitigate the impact of currency fluctuations during this period.

Short-dated foreign exchange (FX) forwards can be used to help minimize the FX rate uncertainty that arises between the time a global fund investment is contracted and the time the deal is funded.

The situation

US-based global fund (“Fund”), has raised USD capital and submits a bid for an overseas asset priced in euros (EUR). The bid is accepted and will be funded three to four weeks later. Simultaneously with the acceptance of the bid, the Fund may look to make a capital call for the USD needed or instead opt to draw down from the capital call borrowing facility closer to the funding date. Either way, the amount of USD needed will change between the bid acceptance date and the date the transaction is funded.

If the EUR appreciates, more USD will be needed as the price is fixed in EUR. As a result, the Fund would need to call for more USD capital to close the transaction. This is an undesirable situation, as investors will have paid more for the asset than originally negotiated, eating into internal rate of return (IRR) and other investment performance metrics.

On the other hand, if the EUR depreciates and a capital was made on the bid acceptance date, capital will need to be returned, as fewer USD will be needed for the acquisition. Economics aside, giving capital back presents and administrative and operational burden which many times renders the windfall more trouble than it’s worth.

Why hedge?

According to the long-term average price for an at-the-money option in the EUR / USD exchange rate1, we can assign a 1 in 10 chance that the EUR may move more than 5.2 percent in either direction over a 4-week period2.

Solution

An FX forward is a contractual obligation to exchange one currency for another at a pre-determined fixed rate and specific date in the future.

The Fund agrees to pay €50.0M to acquire an asset from a European seller, which translates to $57.5M according to the spot rate on the day the bid is accepted. Funds will be remitted in 3 to 4 weeks.

- EUR / USD spot reference: 1.1500

- Direction: Buy EUR / Sell USD

- Notional: €50.0M

- Contract rate: 1.1530

- USD equivalent: $57.65M

- Tenor: 4 weeks

Scenario analysis

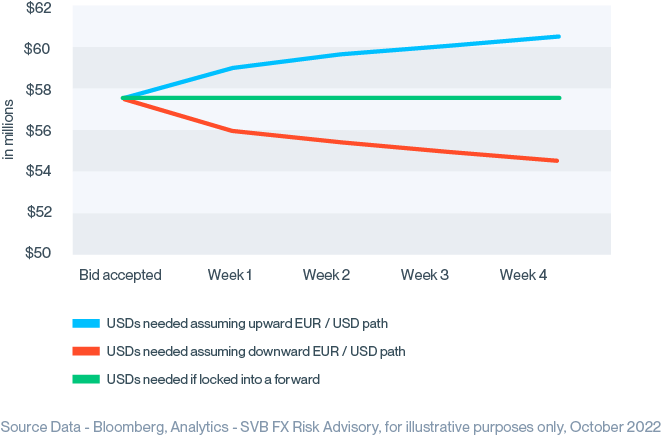

The total USD needed to close an overseas purchase can change materially over a 4-week period, from bid acceptance to deal funding. According to an objective probabilistic framework, there is a 10 percent chance that on a €50.0M price tag, the price can change by more than $3.0M in either direction.

However, regardless of where the EUR / USD exchange rate is trading on the expiration date, according to the terms of the forward contract, the Fund will be selling $57.65M in exchange for €50.0M to make the investment.

Additional considerations

-

A forward contract represents an obligation to buy or sell currency at a predetermined price. Should the deal fail to materialize, the Fund would need to cash-settle the forward hedge to fulfill the obligation, resulting in a gain or loss depending on spot movements during the hedge period.

-

In the event the deal were to close earlier than expected, forwards may be unwound early without penalty. As a result of the early unwind, the Fund would not be exposed to potential losses from movements in spot rates since trade inception, as the position is hedged. However, movements in the forward curve, which are less material over short horizons, may introduce residual gains or losses.

-

A delay in the expected deal close date can be handled by rolling the forward for an additional week, month, etc. as required. A “roll” is a standard FX contract, which requires a cash settlement.

-

An FX credit line or collateral posting is required to execute forwards. These are small for short-dated tenors.

If you’d like to discuss your specific situation or for information regarding SVB’s tailored FX risk management services, reach out to your SVB FX contact or send an email to GroupFXRiskAdvisory@svb.com.

Read our other FX Risk Advisory papers.