- US-based venture and private equity funds are increasingly looking beyond US borders for investment opportunities.

- As a cross-border M&A deal progresses from concept stage to closing, there are important considerations which may impact deal viability, probability of close, and ultimately profitability.

- Your FX contact can provide valuable insights throughout the process, as well as assist with the development of actionable FX and liquidity strategies to help protect USD returns.

The landscape for cross-border mergers and acquisitions (M&A) is complex and ever-evolving. Understanding key foreign exchange (FX) and liquidity considerations may prove to be not just advantageous but imperative to deal success and profitability.

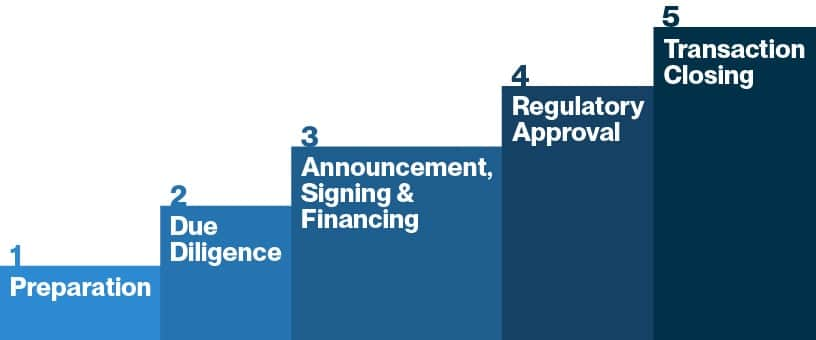

Managing currency risk across the 5 phases of cross-border M&A

Phase 1: Preparation

FX risks start to surface when the overseas target company is identified. The SVB Global Fund Banking FX team can provide insights on macro risks, highlighting country risk, economic downturns, cost of carry/hedging, and projected inflation to help make informed investment decisions. Due to the confidential nature of this phase, we can assist without the need for specific deal details, increasing the protection of sensitive information.

Phase 2: Due Diligence

FX risk becomes a live factor during this crucial 4-6 week window. Most common considerations include regulatory hurdles, time uncertainties, financing calculation in a foreign currency, and other unique factors. Thoughtful planning is essential to mitigate these risks.

Given the significant uncertainties involved, the FX team assists in closely monitoring the market, modeling, and quantifying these risks. Options-based hedges that offer protection, but do not present a residual obligation should the deal fail to materialize, may be appropriate at this stage. Hedging cost can be funded by tapping into subscription lines, a widely used cash liquidity strategy which helps preserve IRR metrics.

Phase 3: Announcement, Signing & Financing

The involved parties focus on finalizing and signing the agreements, with the purchase price as a key element. Funds may add to the options-based derivative position, subject to projected timeline, identified source of financing, and probability of deal close.

Phase 4: Regulatory Approval

The timeline for regulatory approval can range from 3 to 12 months, depending on the countries involved. It is worth noting that the approval process can be lengthy and extend the overall timeline. While waiting, funds may continue to increase and fine-tune the position. As a result of the growing likelihood of deal close, the suite of potential hedging products expands beyond options.

Using forward, window forward contracts or collars on a portion of the exposure may be used as deal certainty grows. Any gains on options executed in previous stages may be rolled in to achieve better hedge rates. The certainty provided by hedging can aid in better budgeting and planning, strengthening overall liquidity management.

Phase 5: Transaction Closing

Upon completion of all required documentation, the closing can take place within a few days. Utilizing a subscription line can help enhance financial flexibility during this period. Our team can provide guidance and support throughout the hedging settlement process to help secure a smooth transaction, whether or not a subscription line is involved.

An in-depth look at phases where FX solutions are typically implemented

Let us help

Cross-border mergers and acquisitions are complex and dynamic. SVB can help you understand and manage the key FX and liquidity considerations of these transactions. If you’d like to discuss your specific situation or for more information regarding our tailored FX risk management services, reach out to your SVB FX contact or send an email to groupfxsalesgfb@svb.com.

Read our other FX Risk Advisory papers