Business Checking

Growing your company with SVB begins with your business checking account. From seed stage to growth stage to late stage we have a business checking account tailored to supporting your success.

Tailored business checking

Services that grow with you so you can focus on what matters most—your success.

SVB Edge

Optimized for startups

Banking services for pre-series A companies to help jump-start your business.

Free checking for your first three years¹, up to 3.30% annual percentage yield (APY)² on savings, and 1.5x unlimited reward points³ on card purchases.

- A business checking account with no maintenance or transaction fees, free¹ online banking, unlimited incoming wires and ACH, unlimited outgoing wires including FX, bill payments and mobile deposits.

- Connections to Quickbooks, Xero, Expensify and other authorized applications.

- A startup money market account with up to 3.30% annual percentage yield on qualifying balances.2

- A business credit card with 1.5x unlimited points³, no annual fee and no foreign transaction fees.

SVB ScaleUp

Optimized for startups, Series A and venture-funded

Banking services for growing companies with an increased number of transactions.

Accelerate your business with up to a $500 monthly credit that can be applied to your service fees.4

- $50 monthly fee waived subject to qualification criteria.5

- Online banking including foreign exchange, customized reporting and connections to authorized accounting applications.

- Wires - incoming and outgoing (USD domestic and international, FX).

- Lockbox Services - including remote, wholesale and imaging.

- Payment automation through back-office accounting software or ERP.

- Remote Deposit Capture to scan and send electronic images of checks.

- Fraud Control Services including Positive Pay with Payee Validation and ACH Blocks/Filters.

Analyzed Checking

Optimized for venture-funded and corporate banking

Banking services for scaling companies with higher transaction volumes.

Service charges can be offset with earnings credit (ECR) based on your account balances.

- Access to full suite of cash management services for more complex banking needs.

- Receive earnings credit on balances that can offset most maintenance and service fees.

- Access cash management services to help you simplify accounting, lower business costs and better manage cash flows.

- Group accounts together to simplify cash management by combining earnings credit and eligible fees.

- Detailed monthly analysis statements let you easily monitor account activity.

Explore more ways SVB can help you

Our banking products can help support you as you look to unlock new opportunities no matter your stage of growth – contact us today to learn how SVB can help your business.

Ready to get started?

Learn how SVB banking services can help support you as you build a high-performance business.

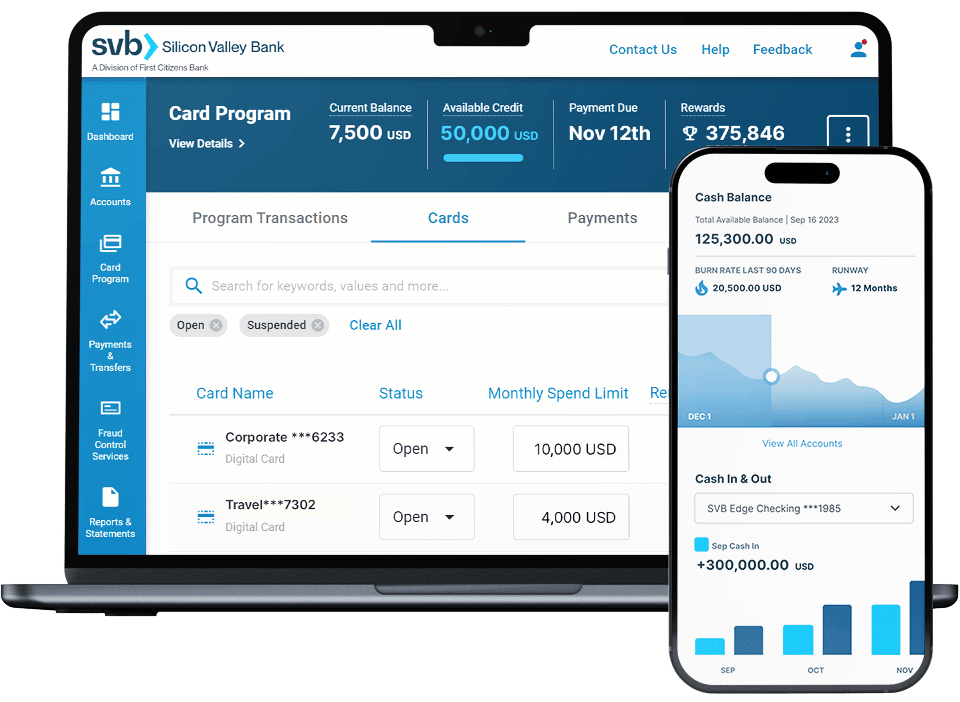

What’s included with our business checking solutions

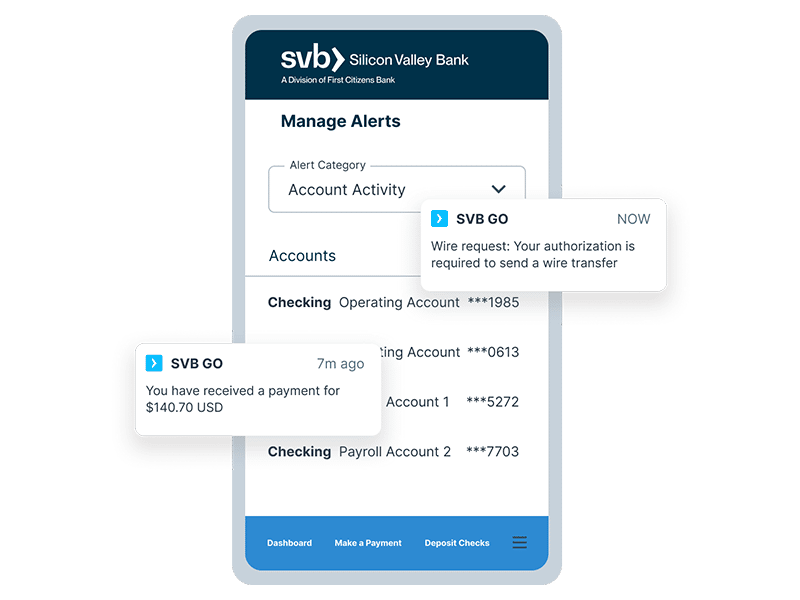

More ways SVB can help you bank smarter and more efficiently

Integrated solutions designed to help streamline and connect your business processes

SVB is here for you at every stage

With 40+ years of innovation experience, SVB has the products, services and deep knowledge that evolve with your business as you grow over the long term.