Key Takeaways

- Data insights by Silicon Valley Bank indicate that addressing currency risk may help support profitability at high-growth technology firms.

- S-1 filings suggest that firms preparing for IPOs had significant exposure to currencies, but had much less visibility into the materiality of their FX risk than they should have based their size and global footprints.

- Follow-up research examined post-IPO companies. We found that, as a group, small-cap public US tech companies that hedged FX risk with derivatives performed better on key profitability metrics than those that did not.

Data insights by Silicon Valley Bank indicate that addressing currency risk may help support profitability at high-growth technology firms. Click here to view PDF.

For years, investors in early-stage technology companies rewarded top-line growth above all else. The environment changed abruptly in 2019, highlighted by the contrast between IPO successes at profitable firms like Zoom and the challenges faced by a number of unprofitable technology companies. This climate heightens the need for emerging firms to focus on the bottom line. That emphasis includes understanding, quantifying and managing the full range of risks to earnings. Foreign exchange (FX) represents one key risk.

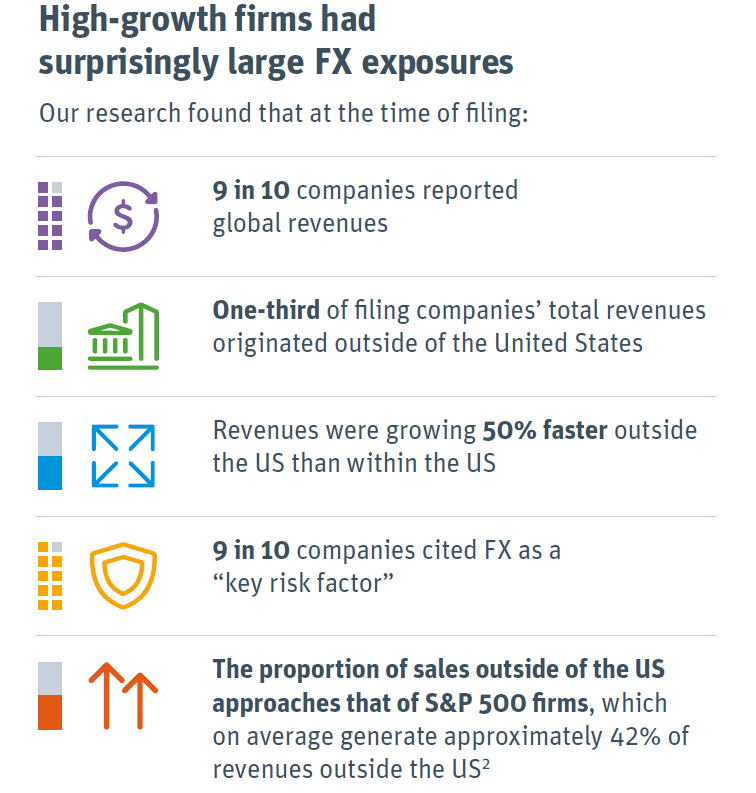

To gain insight into the currency exposures and practices of high-growth venture-backed tech companies, Silicon Valley Bank (SVB) analyzed data from tech companies’ filings for US initial public offerings between 2016 and 2019. These filings include information about actions the firms had taken during the previous 18 to 24 months, offering a snapshot of the currency-related practices of private, high-growth companies during venture rounds of funding.

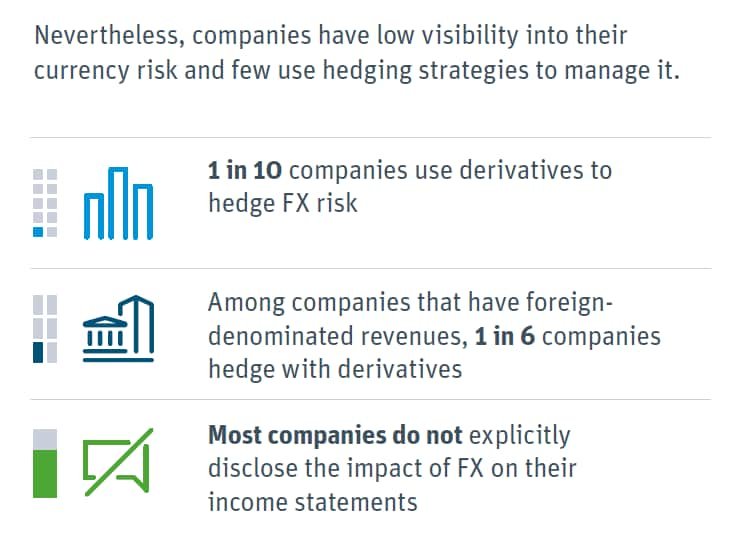

The SVB study identified considerable currency risks for these firms. Technology companies that went public during the four-year period under review listed substantial revenues outside of the United States at the time of filing and overwhelmingly recognized FX as a key risk factor. Yet relatively few companies actively managed currency risk by using derivatives1 In fact, S-1 filings suggest that firms preparing for IPOs had much less visibility into the materiality of their FX risk than they should have based their size and global footprints.

Follow-up research examined post-IPO companies. We found that, as a group, small-cap public US tech companies that hedged FX risk with derivatives performed better on key profitability metrics than those that did not. Young, private technology firms may want to emulate the FX practices of their most successful post-IPO brethren.

Why FX matters

We wanted a way to determine whether actively addressing currency exposures translates to better business performance and/or greater shareholder value. To that end, we examined comparable companies that had reached the next stage of the business lifecycle: publicly traded small-cap US technology firms, represented by the Dow Jones US Small-Capitalization Technology index (Bloomberg ticker: DJUSSTH). We sought to gauge whether currency hedging at these firms was associated with improvements in profitability.

Our study placed the 79 firms in that index into two buckets: one for companies that used derivatives to hedge currency risk and one for those that did not. We found that the companies in the index were far more likely to use derivatives to hedge currency risk than their pre-IPO counterparts — four times as likely, based on pre-IPO firms’ S-1 filings. Moreover, our analysis found that, as a group, small-capitalization tech companies that hedged currency risk using derivatives had higher EBITDA, smoother EBITDA growth, wider EBITDA margins and a lower incidence of negative earnings than those that did not, after controlling for company size.

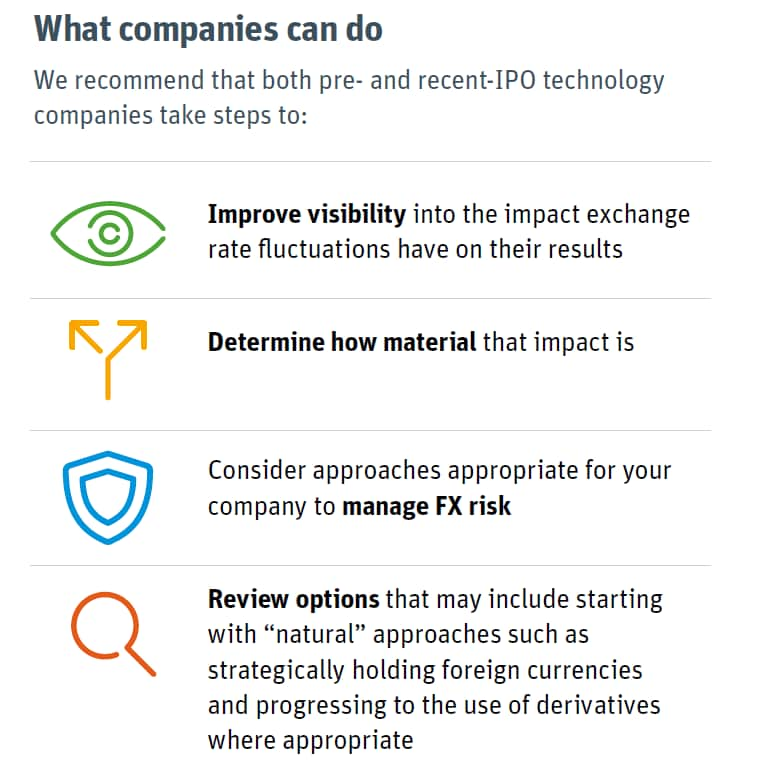

As young, private companies build toward and beyond their IPOs, they may want to consider incorporating the best practices of successful firms that have come before them — and in this climate, they may want to place particular emphasis on practices associated with profitability. The evidence indicates that more profitable small public companies are more likely to be conscious of their FX exposure and intentional about managing it. High growth and pre-IPO firms might weigh these more profitable firms’ example as they look to strengthen their bottom line and attract investors.

This kind of thoughtful approach to managing currency risk may help young, innovative firms position for success, in both today’s investment climate and tomorrow’s global marketplace.

Want to learn more? View the full study here.

Talk to us

Please contact us if you’d like to discuss your specific situation or discuss the findings of this study. You can contact your SVB FX Advisor directly, or email the author of this study, Ivan Oscar Asensio, Head of FX Risk Advisory, at iasensio@svb.com.