Quarterly Economic Report Q4 2024

Key Takeaways

The SVB Asset Management Economic Report is a quarterly review and outlook on economic and market factors that impact global markets and business health.

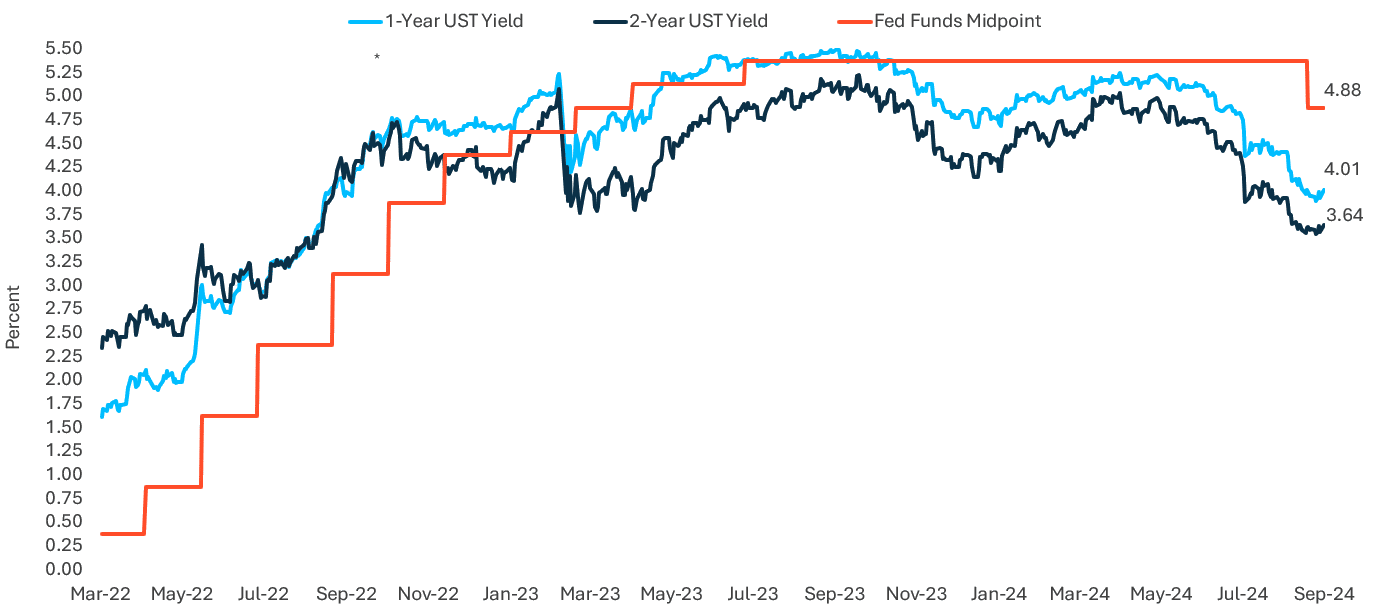

01 September’s FOMC meeting concludes with a rate cut.

The committee reduced the fed funds rate by 50 basis points in its first rate cut in four years.

02 Both Inflation and the labor market have softened.

Core PCE rose 2.7% year-over-year in August 2024. The Fed observes that “job gains have slowed.”

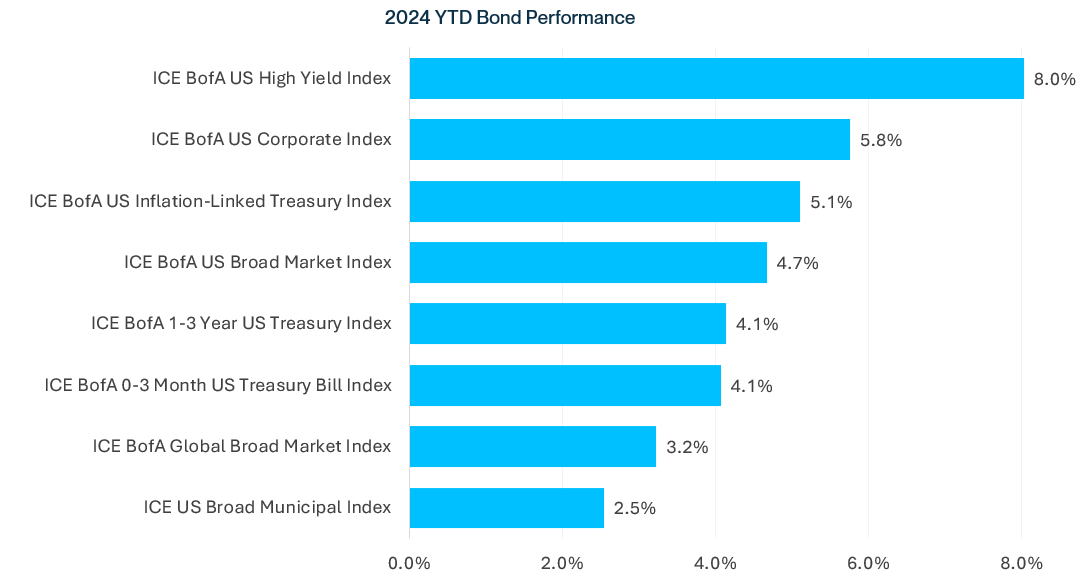

03 Lower rate expectations boost fixed income performance.

Both government and corporate bonds perform strongly in Q3 2024.

Inflation Trends Downward

Core PCE rose 2.7% YoY in August 2024, which is down from 3.8% in August 2023.

The Fed Cuts Rates

A softening labor market and moderating inflation lead the Fed to cut rates by 50 bps in September.

“We now see the risks to achieving our employment and inflation goals as roughly in balance, and we are attentive to the risks to both sides of our dual mandate.”

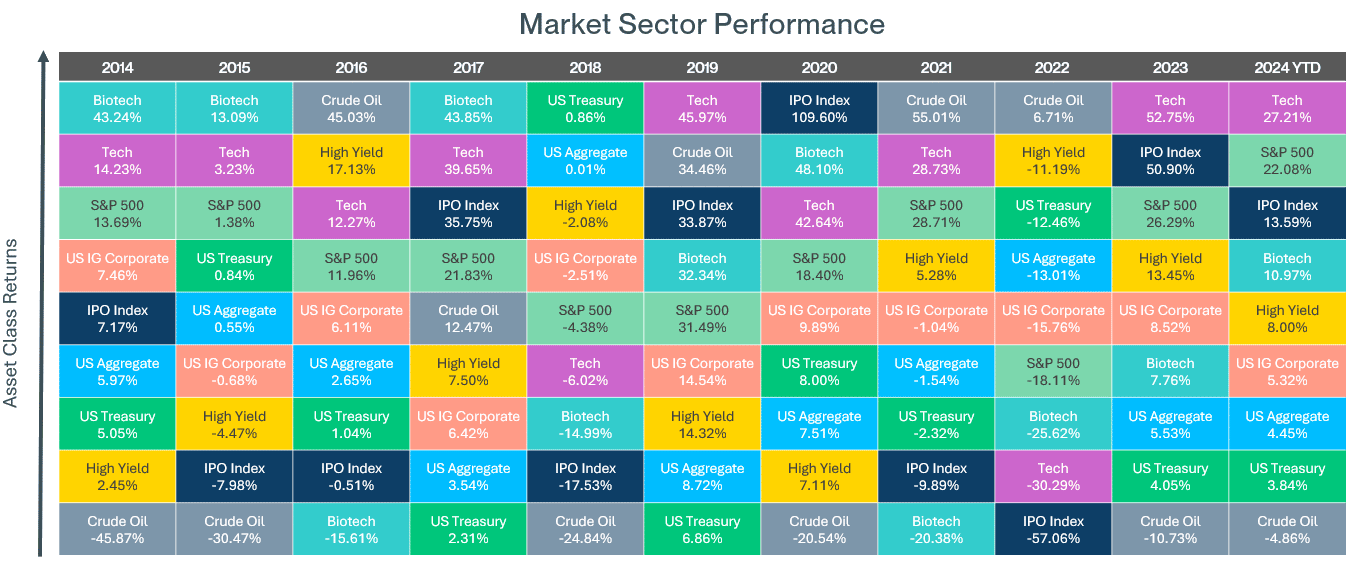

Strong Returns Across Major Asset Classes

Despite some volatility, Q3 2024 saw strong performance in equities and fixed income markets, encouraged by the prospect of lower rates.

Bond Market Performance is Solid

The shift in market expectations for interest rates helped propel performance for both government bonds and credit.

Read the full Quarterly Economic Report

Written and researched by SVB dedicated professionals

Stay up to date with SVB

Get startup insights in your inbox.

Oops, we ran into an error loading the form, please check back later.

Views expressed are as of the date of this report and subject to change. None of this material, nor its content, nor any copy of it, may be altered in any way, copied, transmitted or distributed to any other party, without the prior express written permission of SVB Asset Management.

SVB Asset Management is an investment advisor registered with the US Securities and Exchange Commission (SEC). Registration with the SEC does not in any way constitute an endorsement by the SEC of an investment advisor’s skill or expertise. Moreover, registration does not imply that an investment advisor has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its clients. For institutional purposes only.

For Global Investment Performance Standards (GIPS®) Composite Reports for SVB Asset Management’s strategies, please contact the Liquidity Account Management team via email at liquidityaccountmanagement@svb.com.

Investment products and services offered by SVB Asset Management:

| Are Not insured by the FDIC or any other federal government agency |

Are Not deposits of or guaranteed by a Bank |

May Lose Value |

1024-0139TD-093025

© 2026 First-Citizens Bank & Trust Company. SVB Asset Management is a wholly owned, non-bank subsidiary of Silicon Valley Bank, a division of First-Citizens Bank & Trust Company.