Quarterly Economic Report

Q1 2026

Key Takeaways

The SVB Asset Management Economic Report is a quarterly review and outlook on economic and market factors that impact global markets and business health.

01 The FOMC made a third consecutive cut to the fed funds rate in December 2025.

Further rate actions in 2026 will be informed by a wide range of incoming data to ensure balance.

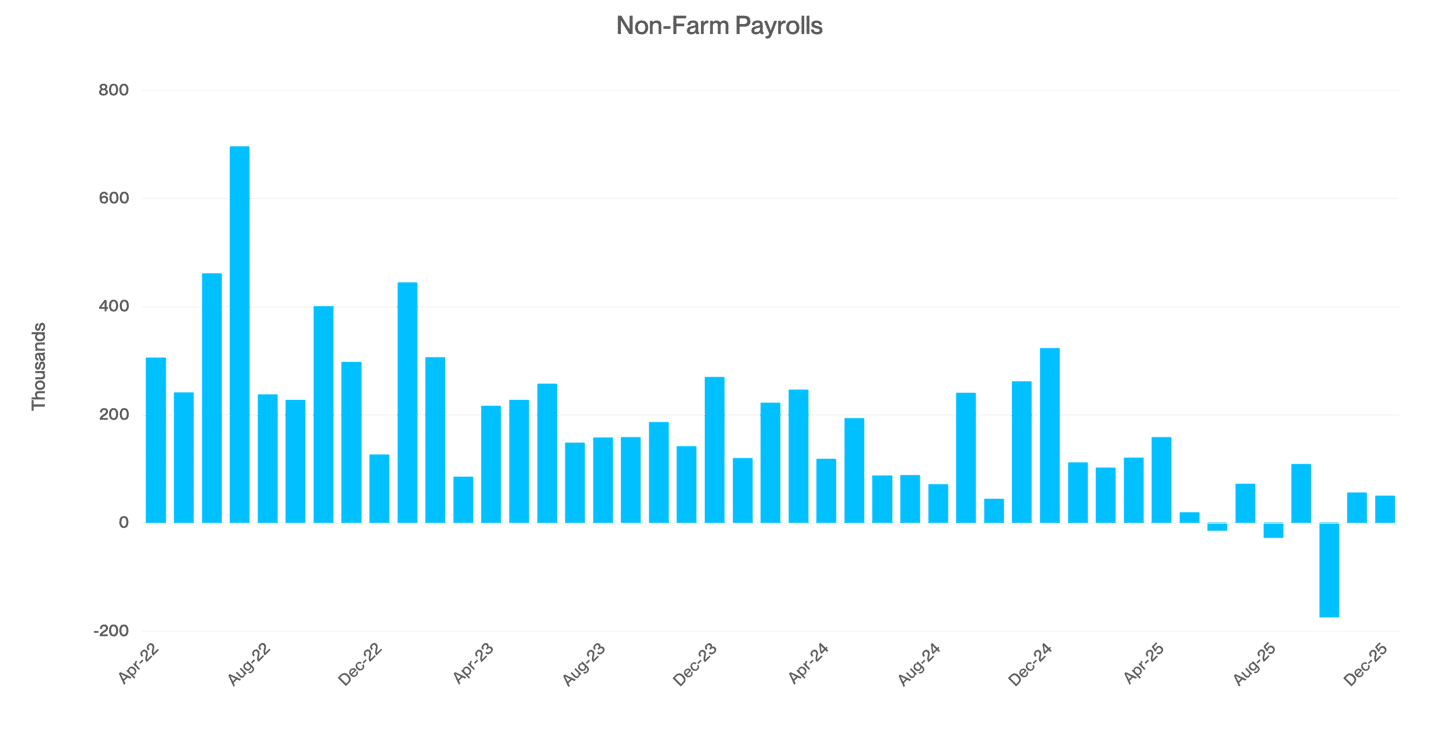

02 The US labor market softened, and job creation slowed.

The softening in the labor market supported the rate cut by the Fed at the December FOMC meeting.

03 Q3 GDP grew at an annualized rate of 4.4%.

Moderate Q4 growth is expected due to the government shutdown which impacted economic data and consumer spending.

The average number of jobs fell by 23,000 per month.

Between October and December 2025, the labor market continued to soften as indicated by jobs data.

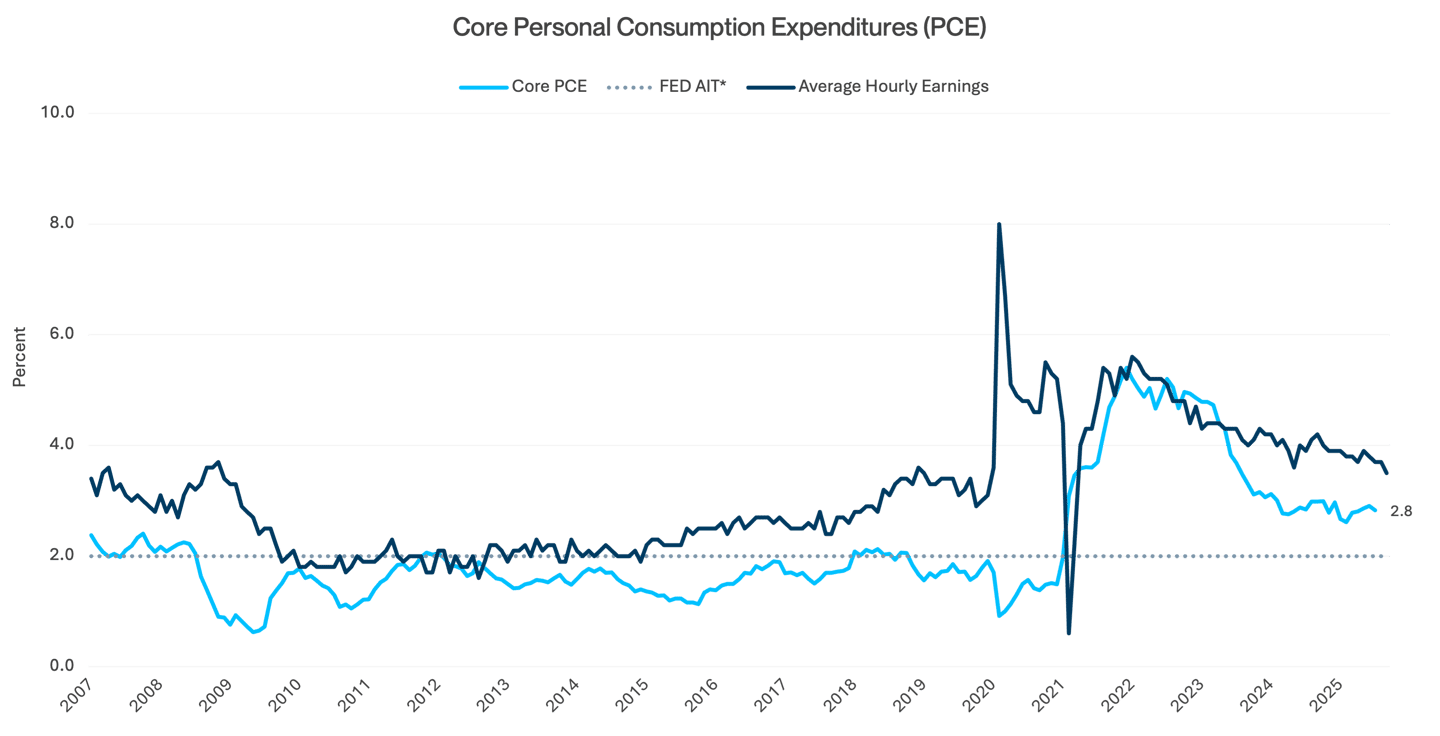

Inflation progress has been limited and remains above target.

Core PCE decreased to 2.8% YoY in November, but the Fed stated it expects tariff-related pressures to decrease over time.

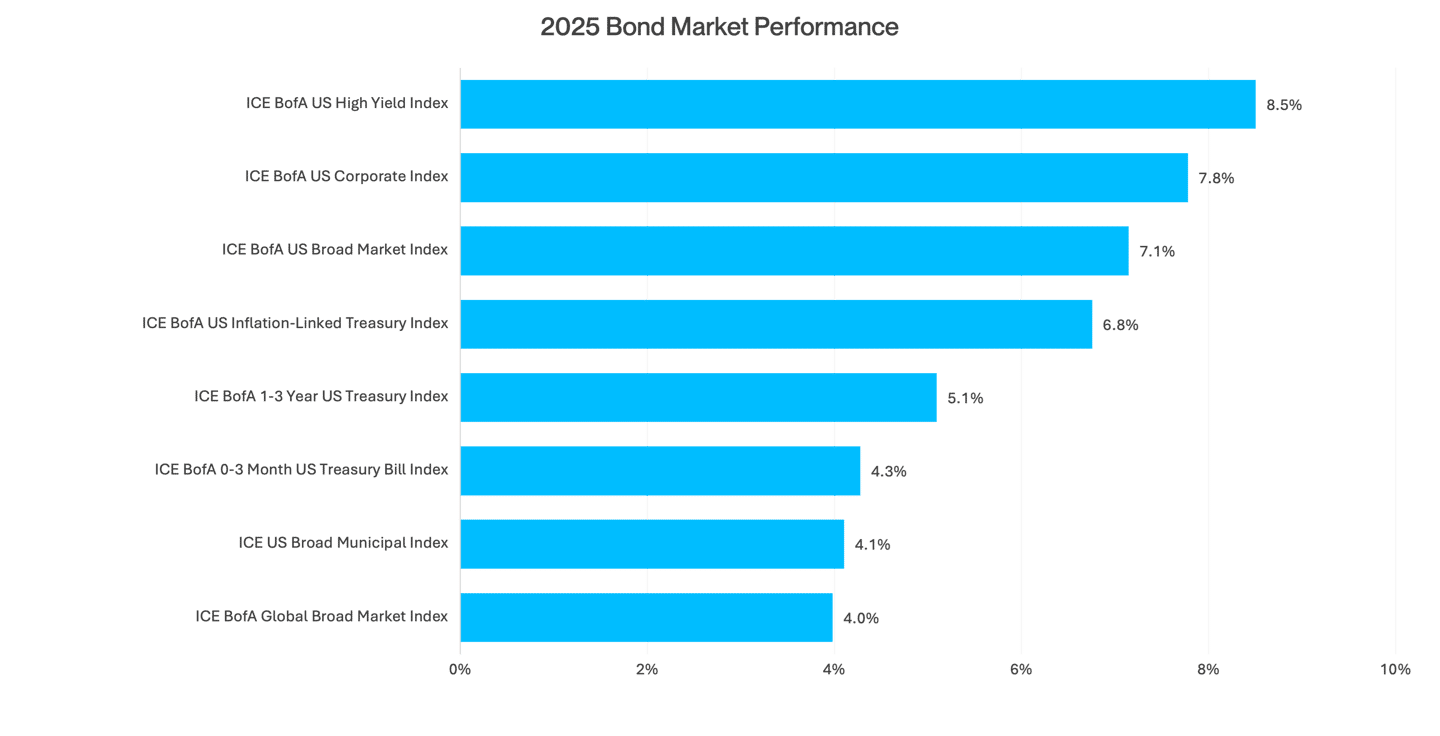

US Treasury markets rallied in tandem with Fed easing.

Fed rate cuts and healthy corporate balance sheets benefited US high-grade credit and returns were enhanced across bond markets.

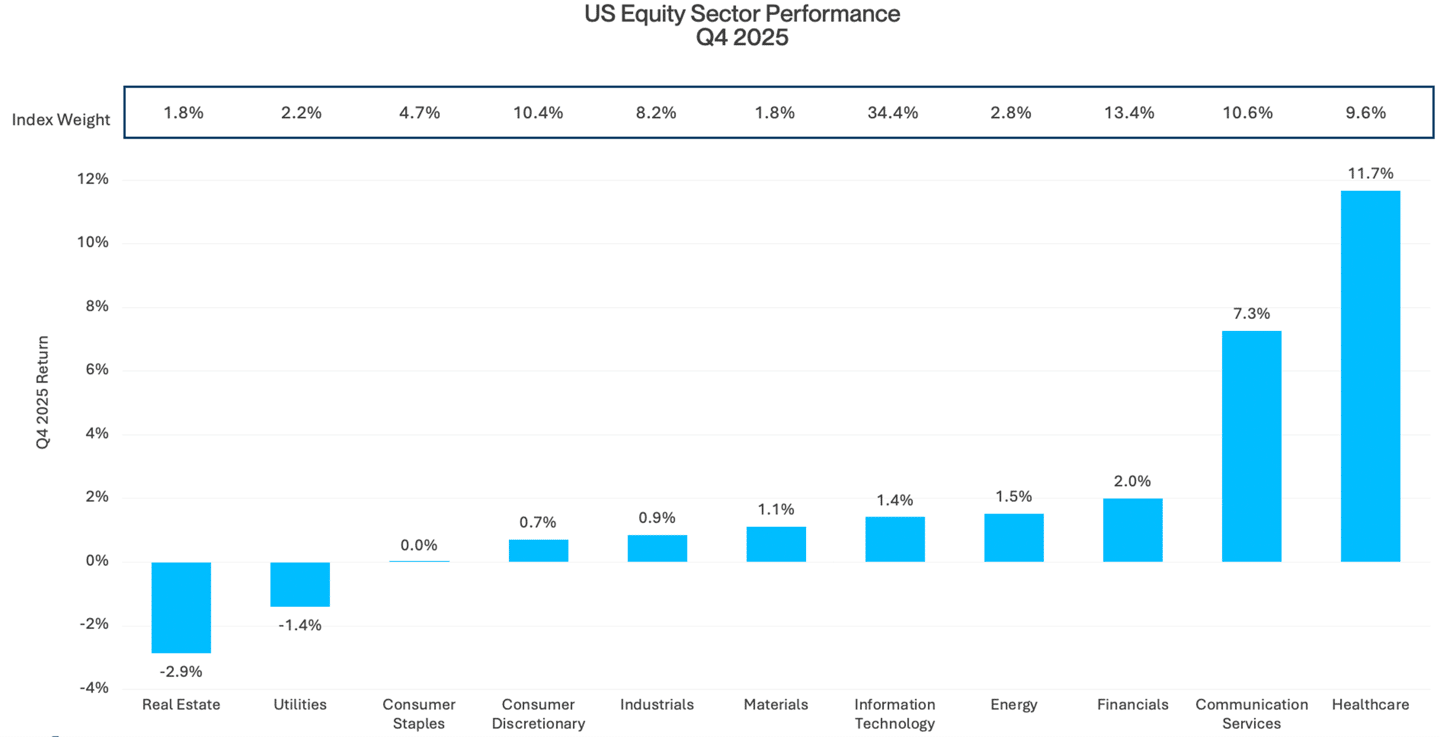

The S&P 500 ended 2025 with strong returns.

Healthcare was the top performer, while technology and AI continued to be solid, heavily influencing index performance.

Read the full Quarterly Economic Report

Written and researched by SVB dedicated professionals.

Views expressed are as of the date of this report and subject to change. None of this material, nor its content, nor any copy of it, may be altered in any way, copied, transmitted or distributed to any other party, without the prior express written permission of SVB Asset Management.

SVB Asset Management is an investment advisor registered with the US Securities and Exchange Commission (SEC). Registration with the SEC does not in any way constitute an endorsement by the SEC of an investment advisor’s skill or expertise. Moreover, registration does not imply that an investment advisor has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its clients. For institutional purposes only.

For Global Investment Performance Standards (GIPS®) Composite Reports for SVB Asset Management’s strategies, please contact the Liquidity Account Management team via email at liquidityaccountmanagement@svb.com.

Investment products and services offered by SVB Asset Management:

| Are Not insured by the FDIC or any other federal government agency |

Are Not deposits of or guaranteed by a Bank |

May Lose Value |

#0126-0005AD-013127

© 2026 First-Citizens Bank & Trust Company. SVB Asset Management is a wholly owned, non-bank subsidiary of First-Citizens Bank & Trust Company.