After 10 years of economic expansion, institutions ranging from the IMF, the World Bank, the US Fed to global corporations have expressed concerns of an economic slowdown in the US and abroad. No clear exit has opened for Theresa May and the UK as the March 29 Brexit’s deadline quickly approaches. Trade tensions between US and China have strengthened headwinds to global growth, leading central bankers to take notice and pivot their forward guidance.

What's in play?

Brexit countdown: Time is running out for the March 29 deadline with no clear indication of a deal in sight. PM Theresa May has held steady with her intent to reach a deal and extend the deadline if possible. Opposition party leader Jeremy Corbyn has not ruled out a second referendum altogether. The GBP has rallied with speculation the UK will ultimately “Bremain”, however a messy no-deal and potential collapse looms over the pound.

US/China trade negotiations: US Tariffs on $200 billion worth of Chinese goods will jump from 10 percent to 25 percent on March 1 unless Trump and Xi reach a trade deal which includes larger purchases of US goods and reformed practices on intellectual property from the Chinese. Trump and Xi were scheduled to meet toward the end of February, but the meeting this month in Vietnam is now “unlikely” according to Trump. This puts the 15% tariff increase on crash course to US importers on March 1. The Chinese renminbi furthered its retreat from 7 yuan per USD, reaching 6.7 as the saber rattling tempered down during the stock market sell-off at the end of 2018.

Venezuela on the brink: Amidst the state’s complete collapse, Juan Guaidó, leader of the National Assembly, proclaimed control of the government while President Nicolas Maduro clings to power through military support. The newly issued currency, the Sovereign Bolivar, linked to the oil backed cryptocurrency “the petro”, has seen inflation skyrocket over 1 million percent in months. US sanctions on state owned oil company, PDVSA, and fears of further supply disruptions could drive crude and currencies of resources producing nations higher.

What's next?

Global growth slowdown: Fears of a slowdown in global growth have spread with central banks setting accommodative tones for their paths ahead.

Federal Reserve: The Federal Open Market Committee (FOMC) signaled patience on raising rates in the minutes from January’s meeting. The committee also caution in trimming its balance sheet, reversing expectations of tighter monetary policy in 2019. This may stifle the dollar strength and cap the greenback’s performance in 2019.

ECB: ECB President Mario Draghi’s acknowledgement of the Eurozone’s growth risks having “moved to the downside” now reduces the likelihood of a previously anticipated summer rate hike. With disappointing German economic numbers, uncertainty of Brexit’s outcome, look for the ECB to remain dovish and accommodative.

Kim Jong Un and Trump round 2: North Korea’s supreme leader and President Trump are planning to kick off a second round of talks near the end of February in Vietnam. Denuclearization of the North Korean regime will be front and center. A hostile result may lead to a short-term rally in safe haven currencies, JPY, EUR, CHF.

What happened?

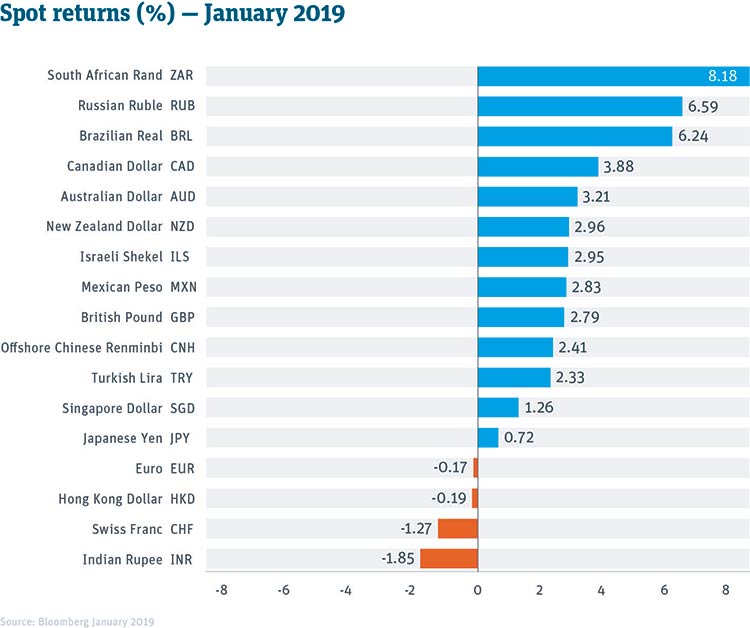

Red light, green light: The ugly end of 2018 for global stocks has almost recovered form losses as nearly every major global equity index is now positive for 2019 to date. Emerging market currencies have rallied on the back of investors’ regained appetites for risk assets.

US Government shutdown: After a record 35 days of impasse, Trump passed a bill to temporarily open the government until February 15. The dollar index fell as much as 1.4 percent, while government workers were furloughed and lines grew at TSA checkpoints across the US.

Protecting and growing your business

A focus on foreign exchange usually requires proactive efforts to safeguard cross-border business. We can help you add to your success by helping you reduce your currency risks.

SVB’s FX team has been ranked by Bloomberg as one of the most accurate FX forecaster in the world.* We leverage unique expertise to provide you with the ideas to help protect your business in turbulent times.

If you’d like to discuss your specific situation or to explore the merits of active FX management, contact your SVB FX Advisor directly, or email us at fxadvisors@svb.com.

Learn More

- Track the euro’s performance over its first 20 years; learn which Eurozone countries benefited the most/least in our latest FX Market Insight article.

- Learn How Currency Movements Can Affect Your Global Business.

- Explore all the tailored services SVB offers for your foreign exchange needs.

Sources: All data Bloomberg 2019

*Bloomberg Q3’ 2018 FX forecasters are ranked based on three criteria: margin of error, timing (for identical forecasts, earlier ones received more credit) and directional accuracy (movements with the currency’s overall direction). The rankings which were based on Bloomberg’s foreign exchange forecasts (FXFC), were for forecasters who provided forecasts for Q3’ 2018 in at least three of the four preceding quarters but no later than one month prior to September 30, 2018.

Scores were calculated each quarter for the three criteria, which were weighted 60 percent, 30 percent and 10 percent, respectively. The final score for each currency pair was the time-weighted average of the four quarterly scores.

The best overall forecasters were identified by averaging the individual scores for each firm on all 13 currency pairs and all four quarters. Forecasters had to be ranked in at least eight of the 13 pairs to qualify for the overall ranking (54 firms qualified). All ranking tables display the top 20 percent of the forecasters who were eligible, to a maximum of 10 names.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates. This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal, accounting and other advisors and only make investment decisions on the basis of your own objectives, experience and resources.

All non-SVB named companies listed throughout this document, as represented with the various statistical, thoughts, analysis and insights shared in this document, are independent third parties and are not affiliated with SVB Financial Group.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates.

This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal, accounting and other advisors and only make investment decisions on the basis of your own objectives, experience and resources.

All non-SVB named companies listed throughout this document, as represented with the various statistical, thoughts, analysis and insights shared in this document, are independent third parties and are not affiliated with SVB Financial Group.