- Macroeconomic factors — such as inflation and interest rates — are having a large impact on the private markets. As these factors stabilize and public markets enter bull market territory, PE/VC investors are gaining confidence.

- Although there are signs of the IPO window cracking open, exit markets remain muted overall. This is causing GPs to consider alternative liquidity solutions, such as secondaries, continuation vehicles and, perhaps most notably, NAV loans.

- A weak exit environment has had two key knock-on effects: less fundraising and less deal activity. Still, optimism remains about the longer-term prospects in private markets.

Introduction

Since the beginning of the COVID-19 pandemic, the macroeconomic environment has played an outsized role in the private equity (PE) and venture capital (VC) markets. At the beginning of this period, easy money policies reigned, which led to a boom in both private and public markets. After a sharp rise in inflation, however, the Fed stepped in with the fastest rate hike cycle in recent history.

Now midway through 2023, PE and VC investors face a dynamic environment because of various macroeconomic factors, many of which are carry-overs from 2022. Some — such as inflation and a depressed public market — appear to be resolving. Others, however, are persistent, such as high interest rates and low initial public offering (IPO) activity.

These challenges are having a direct impact on the private market investment landscape, resulting in a difficult exit environment, lower fundraising numbers and fewer deals. Despite these challenges, fund managers are finding creative ways to adapt and thrive — for example, by taking advantage of specialty lending or liquidity options. This article dives into the state of the private market landscape and the forces driving these key market trends.

Macroeconomics in the driver’s seat

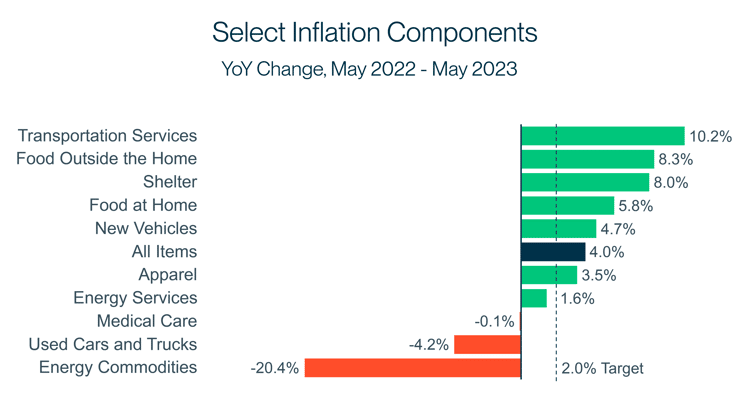

Inflation is coming back to Earth. The May numbers show a 4.0% annualized inflation rate, down from a height of 9.1% in June 2022.1 While some areas of the economy continue to see high inflation, such as dining and shelter, inflation in other areas has calmed substantially with some components falling in price over the past year. Among the most notable for consumers is the energy commodities category, which includes gasoline. Prices for goods in this category have fallen by over 20% in the past year.

While some areas of the economy continue to see high inflation, inflation in other areas has calmed substantially, with some components falling in price over the past year.1

While some areas of the economy continue to see high inflation, inflation in other areas has calmed substantially, with some components falling in price over the past year.1

Lower inflation has led to a pause in interest rate hikes at the Fed, with the financial world expecting that we have nearly reached a plateau. The Federal Open Market Committee (FOMC) recently reinforced this sentiment when it signaled two more quarter-point increases this year with its median federal funds rate expectations.2 Meanwhile, the Federal Reserve Bank of Philadelphia’s Second Quarter 2023 Survey of Professional Forecasters found that most forecasters see inflation decreasing from over 3% in 2023 to the 2% to 3% range in 2024.3

Interest rate stability may spur confidence among limited partners (LPs) and general partners (GPs). In a recent survey of LPs, 57% of North American LPs noted that they believe 2023 will be a stronger vintage year for North American PE than 2022; only 15% believe the 2023 vintage will be worse.4

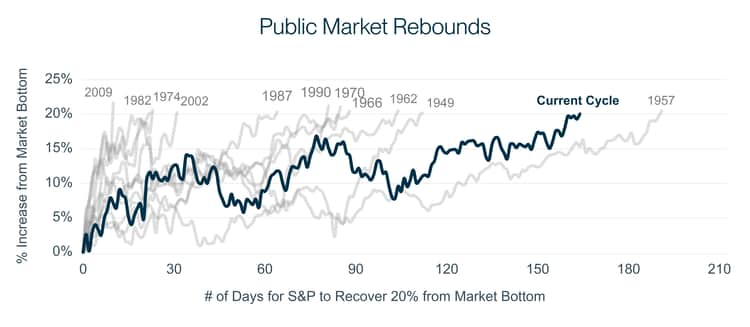

The public market rebound has also bolstered investor confidence. After a year-plus of trending sideways, the public markets have reached an oft-cited marker of a bull market: 20% growth from the market trough. The current cycle took the second longest for the S&P 500 to reach this threshold since 1949, trailing only the 1957 bull market. But what exactly has driven this slow rebound?

The current cycle took the second longest to reach a 20% growth threshold since 1949, trailing only the 1957 bull market.7

The current cycle took the second longest to reach a 20% growth threshold since 1949, trailing only the 1957 bull market.7

From a macro perspective, expected interest rate stability combined with a resilient labor market could be giving investors hope that a recession will be brief and shallow. Despite the turmoil in the banking industry, The Conference Board Measure of CEO Confidence found that the percentage of CEOs expecting a deep US recession has halved between Q4 2022 and Q2 2023. Simultaneously, the percentage of CEOs expecting a brief and shallow recession has remained nearly unchanged and is the dominant expectation among survey respondents.5

Digging deeper, however, recent stock market gains have been driven by a handful of big tech companies, such as NVIDIA, Meta, Tesla, Amazon, Microsoft, Apple and Alphabet. These companies are all benefitting from optimism surrounding the future of artificial intelligence (AI). For example, the S&P 500 is up 15% year-to-date (as of June 16), but an equal-weighted version of the index is up just 5%. Time will tell if the mega cap tech stocks can continue to carry the market. If public markets remain strong for an extended period, the exit window could reopen more fully, allow funds to return capital to their investors and keep the PE/VC machine running.

"As fund managers are faced with difficult exit markets, they are increasingly considering alternative forms of liquidity, such as NAV loans or secondaries. While these are not silver bullet solutions, they can help alleviate liquidity pressures."

Exit markets: alternative routes in focus

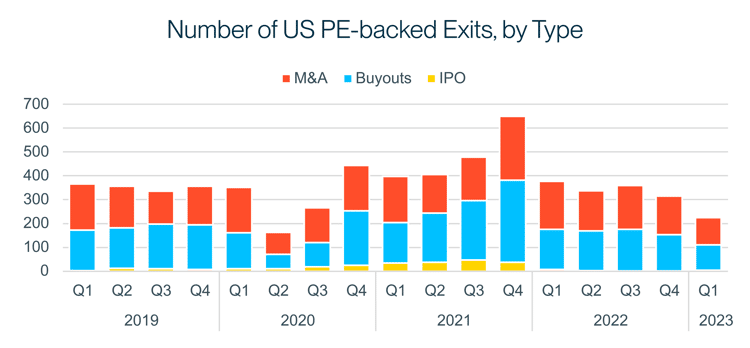

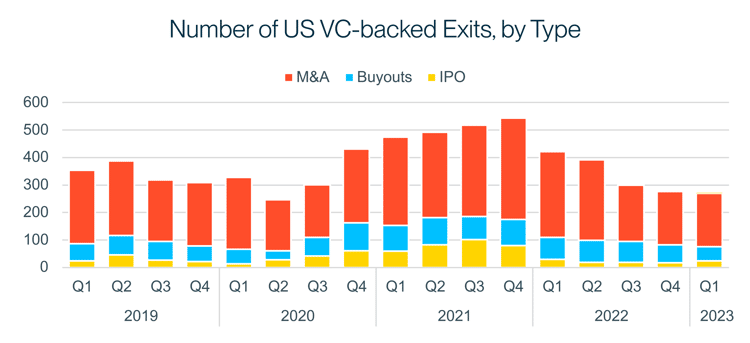

While some macro headwinds may be subsiding, they have so far stifled the ability of PE and VC funds to exit their investments. The traditional exit routes of mergers and acquisitions (M&A), buyouts and IPOs have all become more difficult over the past year due to the intertwined issues of the rising cost of debt for acquiring companies and the difficulty of calculating valuations based on a volatile public market and fewer private transactions.

Stock market volatility and the slow rebound have driven down valuations for private companies, particularly at later stages. The median pre-money valuation for US Series C deals has declined 46%, from $325 million in January 2022 to $175 million in June 2023.6 This has made it more difficult for funds to find buyers for their portfolio companies at attractive prices or exit via IPO.

The traditional exit routes of M&A, buyouts and IPOs have all become more difficult over the past year. IPOs include reverse mergers.6

The traditional exit routes of M&A, buyouts and IPOs have all become more difficult over the past year. IPOs include reverse mergers.6

Lackluster stock performance of recently-IPO’d companies has not helped matters. While the FTSE Renaissance IPO Index, which tracks the performance of recently public companies, is tracking higher this year, it remains down over 40% since January 2022.7 As a result, the percentage of PE- and VC-backed exits via IPO has plummeted, and previously announced IPOs such as Reddit and Instacart were paused indefinitely.8 For a market rebound to occur, there is a need for clarity on interest rates and the benefit of a “first mover” IPO — perhaps SoftBank’s scheduled IPO of British chip designer Arm or restaurant chain Cava’s June IPO.9,10 For companies that want to IPO when the market fully reopens, the time to prepare is now. With signs of increasing IPO activity, the time for a public market reopening could be late 2023 or early 2024.

The traditional exit routes of M&A, buyouts and IPOs have all become more difficult over the past year. IPOs include reverse mergers.6

The traditional exit routes of M&A, buyouts and IPOs have all become more difficult over the past year. IPOs include reverse mergers.6

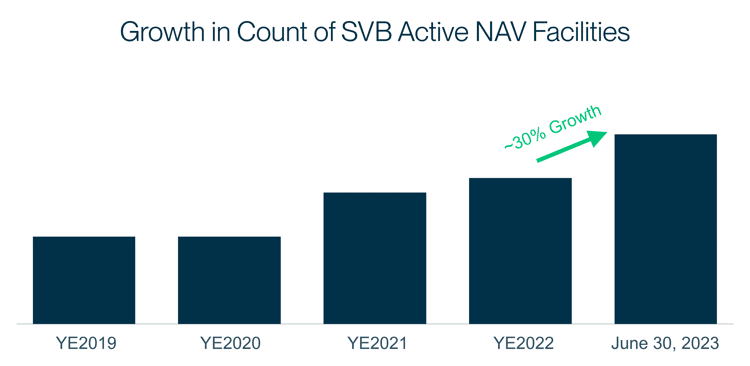

For the time being, this challenging environment has forced GPs to focus on extended hold times or alternative liquidity solutions. As one way to hold onto promising assets while exit routes recover, some fund managers have turned to continuation vehicles — funds established to take on part of the portfolio of a fund that is nearing the end of its lifespan. But with a volatile public market and less exit and M&A activity, valuing companies has become a significant obstacle for these transactions. As a result, GPs are showing increasing interest in SVB net asset value (NAV) loans to support their portfolio companies.

GPs are showing increasing interest in SVB NAV loans to support their portfolio companies.

GPs are showing increasing interest in SVB NAV loans to support their portfolio companies.

Interest in NAV loans has skyrocketed among firms of all strategies, as they can be helpful for GPs looking for financing for specific purposes, such as to make bolt-on acquisitions, to reinvest in existing portfolio companies or, in some cases, to provide distributions back to LPs. Look no further than PE bellwether Carlyle Group, which recently took out a €1.25B NAV facility on its fifth European buyout fund, the proceeds of which will be used to accelerate distributions back to LPs.11 This could signal a shift in the purpose of NAV facilities, putting the emphasis on consistent distribution to paid-in multiples (DPIs) rather than portfolio growth or internal rate of return (IRR) enhancement.

In fact, demand could be outstripping supply with more interest from fund managers for NAV lending products than banks may be able to provide. Rede Partners, for instance, recently projected that the market adoption of NAV loans is anticipated to rise to 80% by 2030, up from 15% in 2021.11 This has led non-bank lenders to increase their presence, with funds focused specifically on NAV lending being raised. Until the IPO market fully reopens, or companies become keener on acquisitions, NAV loans are likely to be a prevalent theme through the rest of 2023.

Fundraising and investment: market backdrop having knock-on effects

Fewer exits mean less capital flowing back to LPs. This is having two key knock-on effects: less fundraising and less deal activity.

Fundraising

As the Fed began raising rates in March 2022, PE and VC fundraising began to decrease. In Q2 2023, buyout and growth equity fundraising together were 24% lower than in Q2 2022. VC fundraising meanwhile saw a whopping 64% decline over the same period.12

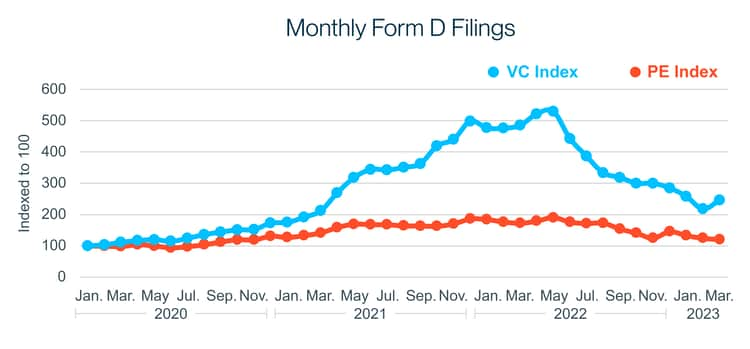

Additional context on fundraising sentiment comes from Form D filings, an SEC requirement for non-registered private funds selling securities.13 The volume of these filings can provide an indicator of fundraising activity and sentiment. Form D filings showed a clear run-up in fundraising activity through mid-2022, particularly in the VC space. The number of filings in May 2022 were 5x the number of filings from January 2020, just before the COVID-19 crisis hit the US. While the trend has subsided since that peak, monthly VC filing activity remains more than 2x higher than in early 2020. Still, fund managers remain cautious going to market and are adjusting to longer, more difficult fundraises.

While the number of Form D filings has decreased since mid-2022 peaks, they remain higher than early-2020.13

While the number of Form D filings has decreased since mid-2022 peaks, they remain higher than early-2020.13

Deal activity

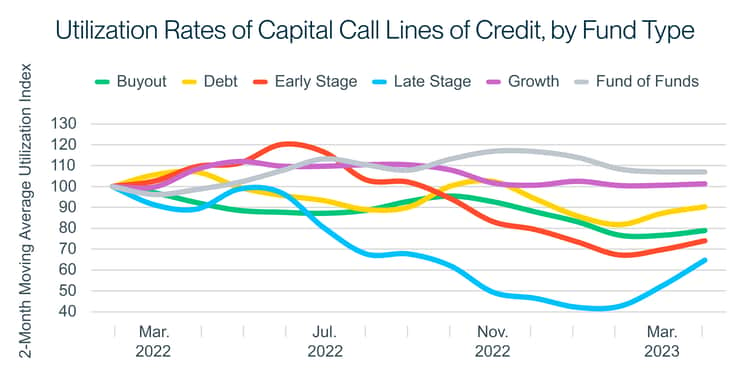

Meanwhile, deployment has also decreased. US buyout and growth equity quarterly deal counts are down 35% from Q2 2022 to Q2 2023, while VC deals are down 42% during the same period.14 This drop in activity is reflected in the utilization rates of capital call lines of credit.

Capital call lines are credit facilities that GPs can draw from on a regular cadence instead of calling capital directly from LPs. Trends in utilization rates of these lines reflect deal activity in the market overall. If there are fewer deals than expected, the GP will likely use less of the credit line, leading to lower utilization rates. SVB capital call lines have seen lower utilization rates across many fund types since the beginning of 2022.

SVB capital call lines have seen lower utilization rates across many fund types since the beginning of 2022.

SVB capital call lines have seen lower utilization rates across many fund types since the beginning of 2022.

Utilization rates had decreased most among VC funds, especially at the late stage. The decrease in late-stage capital call line utilization likely reflects the greater decline in late-stage deal activity compared to other deal types. However, as the stock market has rebounded, late-stage VC fund capital call utilization has trended upward. Meanwhile, buyout and debt fund utilization rates remain close to the pre-rate hike period.

The increased cost of capital call lines of credit dampens one of the benefits of these products: cost of capital arbitrage. When the cost of debt is low compared to a fund’s hurdle rate, there is a clear financial justification for capital call lines. However, as costs are increasing, fund managers are focusing on other benefits of these lines for themselves and their LPs.

For GPs, capital call lines can provide flexibility in deal execution through immediate access to capital. They can also boost a fund’s IRR by shortening the amount of time LP capital is deployed. LPs also benefit from a lower administrative burden. Rather than small, frequent capital calls, these credit lines allow GPs to call capital less frequently, simplifying transactions for LPs. Capital call lines still offer many benefits despite increased interest rates and less deal activity, leading to continued interest and demand from fund managers.

"Capital call line of credit utilization by VC funds has begun to tick up after a decrease over the past year. There is a lot of dry powder that investors need to deploy, and higher utilization numbers could reflect a willingness to do so as the macroeconomic outlook stabilizes."

Final thoughts

Private markets have faced a challenging year and a half due to myriad macroeconomic factors, such as rising interest rates and a depressed public market. These factors are making it difficult to exit investments and are leading to lower fundraising and deal activity. Despite these challenges, fund managers are seeking alternative liquidity solutions to support their portfolio companies.

While the outlook is uncertain, there remain signs of optimism. The stock market’s rebound is continuing, albeit at a slow pace. And although interest rates remain relatively high compared to recent years, they appear to be plateauing. Taken together, these trends suggest that the frozen exit markets are beginning to thaw. Ultimately, there is optimism about the long-term prospects for the industry and its ability to weather temporary market turbulence.