Getting from Series A to Series B requires lots of work, planning and grit. Silicon Valley Bank invited Weebly Founder and CEO Dave Rusenko to share his advice as a founder and an investor on how to prep for Series B and asked Khosla Ventures’ Partner Keith Rabois to describe what he looks for before making a Series B investment. Read on to get their advice. And read this related article for tips on becoming a successful Series B CEO.

The journey should start with a gut check.

Failing in his first Series B pitch, Dave Rusenko, founder and CEO of Weebly, recalls the experience was like going from flag football to tackle.

“It’s shockingly different,” he adds: “Series A is selling the dream. Series B is about delivering on that dream.”

Silicon Valley Bank invited Rusenko to share his advice as a founder and an investor on how to prep for Series B and asked Khosla Ventures’ Partner Keith Rabois to describe what he looks for before making a Series B investment.

Understand where you stack up

There’s good reason why Redpoint Ventures partner Tomasz Tungus calls Series B the “hardest round to raise.” Only the strongest companies preparing for Series B have a good handle on product-market fit, as most others are still building out their teams – and all are burning cash.

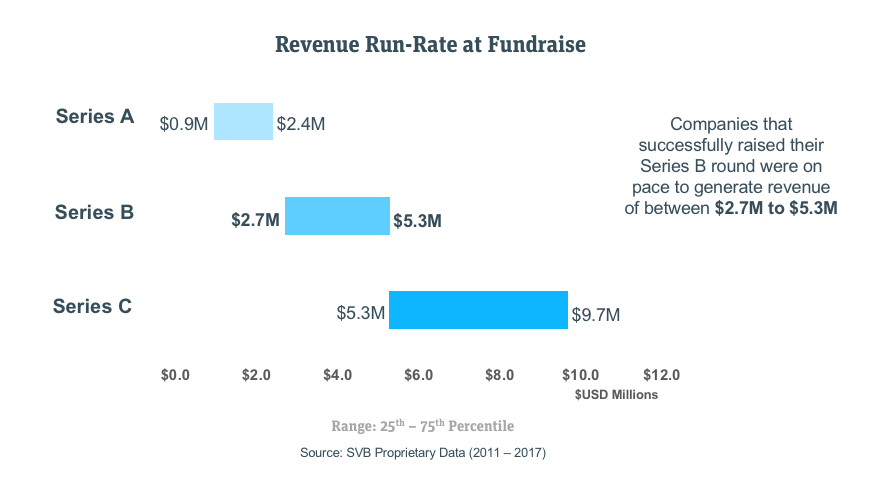

This SVB analysis may help you see where you stack up:

- Companies that successfully raised their Series B round in 2017 were on pace to generate between $2.7M to $5.3M annually

- Those companies had median operating expenses 120% higher than revenue. In comparison, Series A companies expenses were 145% higher than revenue.

Think like the people who write the checks

If you spent a week or two slapping together a Series A pitch, set aside a month to six weeks to work full-time on your Series B pitch.

When preparing your pitch, put yourself in Rabois’ shoes: When he’s considering writing a $3 million check at Series A, he expects a good chunk of startups to fail; at Series B, when it’s a $10-$25 million check, he wants to be “directionally right” half to two-thirds of the time.

At Series A, investors evaluate how ripe the startup’s target market is for disruption. By Series B, he says, the key question becomes “Is this the team that can pull it off”?

Negotiating the deal – how to impress investors

The best investors will dive deep for details: They will be far more interested in financial metrics than hearing how your company will change the world, or where it will be in 10 years.

Expect questions such as:

- What’s changing in the market that benefits your company, and why are you in the best spot to take advantage of it?

- How scalable are your customer acquisition channels?

- Why are you the right person to lead this team?

Identify leverage points

Leverage in negotiations is about understanding motives. It often boils down to how much they want to invest in you vs. how badly you need their money. Treat every investor interview like a final exam and practice financial literacy: Nothing sours a prospective investor faster than if you don’t have your financial metrics on instant recall, suggests Rusenko. Rabois also recommends leaving out the exit slide. In fact, he won’t invest if a founder talks about exits at the pitch.

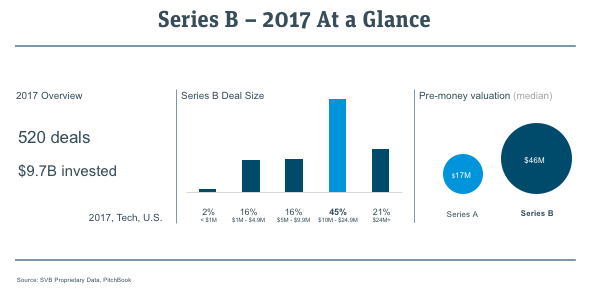

Don’t get too caught up in valuations

While Rabois as an investor gives more consideration to valuation at Series B than A, Rusenko says founders should worry less about it. Instead, he says focus on the value-add of the investor. Picking the right investor may lead to a better long-term outcome than demanding a certain value. A recent SVB analysis found that the median Series B pre-money valuation for 2017 deals stood at $46M, more than 2.5 times the median Series A ($17M) and most Series B round sizes fell between $10M and $24.9M (45%), with 21% of rounds raising more than $25M.

Be prepared to live with the terms

Do focus on the terms. From a founder’s point of view, be vigilant about understanding the short- and long-term implications of those terms, including seniority and participation rights, liquidation preferences, board seats and voting rights. Says Rusenko, “Be prepared to live with the terms you negotiate; they’ll be there every round.”

# # #

COMPID 1242

© 2018 SVB Financial Group. All rights reserved. SVB, SVB FINANCIAL GROUP, SILICON VALLEY BANK, MAKE NEXT HAPPEN NOW and the chevron device are trademarks of SVB Financial Group, used under license. Silicon Valley Bank is a member of the FDIC and the Federal Reserve System. Silicon Valley Bank is the California bank subsidiary of SVB Financial Group (Nasdaq: SIVB).

The views expressed in this column are solely those of the author and do not reflect the views of SVB Financial Group, or Silicon Valley Bank, or any of its affiliates. This material, including without limitation the statistical information herein, is provided for informational purposes only. The material is based in part upon information from third-party sources that we believe to be reliable, but which has not been independently verified by us and, as such, we do not represent that the information is accurate or complete. You should obtain relevant and specific professional advice before making any investment or other decision. Silicon Valley Bank is not responsible for any cost, claim or loss associated with your use of this material.