Key Takeaways

- Early-stage investment activity is robust with venture capital (VC) funds shifting focus to earlier stage companies while waiting for public market turbulence to abate.

- From our vantage point, today’s innovative companies are in a better position to weather a slowdown than in past down cycles.

- In times like these, we advise our clients to set priorities, reduce spending and prepare contingency plans.

The start-up investment landscape has shifted in 2022

The pace of venture investment and late-stage tech valuations have been declining throughout most of 2022. However, early-stage investment activity is robust with VC funds shifting focus to earlier stage companies while waiting for public market turbulence to abate. In the US, H1 2022 was the most active half ever in terms of seed deal activity with over 2,900 deals closed.

Against this backdrop, Investors are urging portfolio companies to reduce cash burn and seek other ways to extend their runways. We’re seeing companies refocus on their core business and cut expenses, such as payroll, advertising and cloud computing. As part of extending runway, many savvy companies are seeking non-equity financing, including debt financing — even companies that have just raised equity capital.

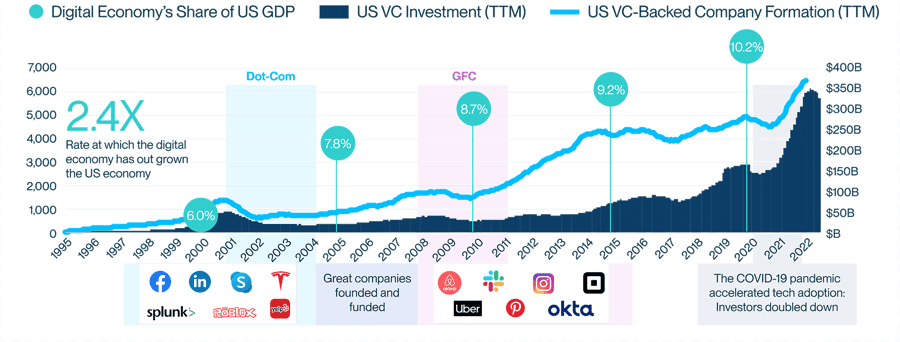

We learned important lessons from earlier economic cycles

Each downturn is different, but over four decades we’ve worked with founders, investors and executives through many economic cycles. From our vantage point, today’s innovative companies are in a better position to weather a slowdown than in past down cycles. First, the sector today is significantly larger — the digital economy has grown at twice the rate of the overall US economy since 2000 — and technology is embedded in everything we do. Second, record venture capital investment over the last two years has strengthened corporate balance sheets. Even with such investment, private equity and VC firms are sitting on record levels of dry powder ($269 billion through H1 2022) waiting to be deployed, and we fully expect they'll get back to business again once there is more certainty in the market and valuations stabilize.

US VC investment and company formation, and the digital economy’s share of US GDP

Note: Digital economy defined by the US Bureau of Economic Analysis (BEA) and used as a proxy for the value added to GDP by that sector. First VC round raised used as a proxy for company formation. Source: US Bureau of Economic Analysis, PitchBook and SVB analysis.

This likely will take some time to play out, and many firms are conducting a thorough review of business operations and strategies to address the new constraints. Use this time to identify your company’s strengths and look for competitive opportunities. For example, some costs for starting and scaling a company are dropping, notably the price for talented employees. Lessons from the pandemic on what motivates employees, coupled with big tech layoffs, mean more people may be open to joining a newer, smaller venture, even if it is risky. Make an offer to someone who previously might have been out of reach. A downturn can offer opportunities to build an even stronger team, focus on market needs and potentially create whole new categories. The 2007-2009 global downturn produced Airbnb and Uber.

Take action during this slowdown

Navigating through a slowdown is new for many. In times like these, we advise our clients to set priorities, reduce spending and prepare contingency plans: Craft a realistic, flexible short-term plan of action and then forge ahead with discipline.

In addition to keeping your financial house in order, expand your networks to increase insight, knowledge and access to opportunities. The most valuable relationships are often built during the toughest times. Seek advice from your trusted partners and leverage your contacts. Open communication with companies, lenders and investors that can help you analyze the pros and cons of your options. This includes consulting with people who know your business or portfolio companies and can provide guidance through unfamiliar scenarios. Lenders today, for example, want to know how a company is handling inflationary pressures and its plans to deal with higher interest rates.

Opportunities for growth in the future

Innovation is difficult in any circumstance and never static. As values dip, opportunities increase for companies looking to grow through acquisition — and even for those being acquired by unleashing entrepreneurs to move on to pursue their next big ideas. History shows us that the down times can embolden visionary founders and investors, even enabling new financing options. Crunchbase research from the 2008 financial crisis shows that while funding dried up for early- and late-stage firms, seed financing helped increase new company formation at the time and launched an established investor strategy that is still popular today.

Downturns can, in fact, be good times for founders with strong business plans and capital to start companies. As startups cut costs, including doing layoffs, access to talent becomes easier. What’s more, innovators who benefitted from a record exit environment in 2021 may have substantial capital available to launch a startup or become angel investors to support others, or both.

Why we are optimistic about innovation

When access to capital and company valuations decline, the disruption causes anxiety — and the innovation sector tends to see even more pronounced short-term swings than the greater economy. This is also when many new ideas are born. And, in the longer term, the innovation economy outpaces other parts of the economy. The world is thirsty for innovation, and that is not changing. The underlying fundamentals are still robust, and this explains our confidence in an even stronger overall economy in the future.

Learn more about the key trends reshaping the venture landscape in SVB’s State of the Markets Report.