Key Takeaways

- Early-stage startups typically cannot access loans or capital markets directly, so they rely on VC funding instead.

- In exchange for VC funding, founders offer investors a percentage of ownership and perhaps a board seat.

- VCs can be a critical source of funding, but there are other paths you can use to achieve success.

Venture capital definition

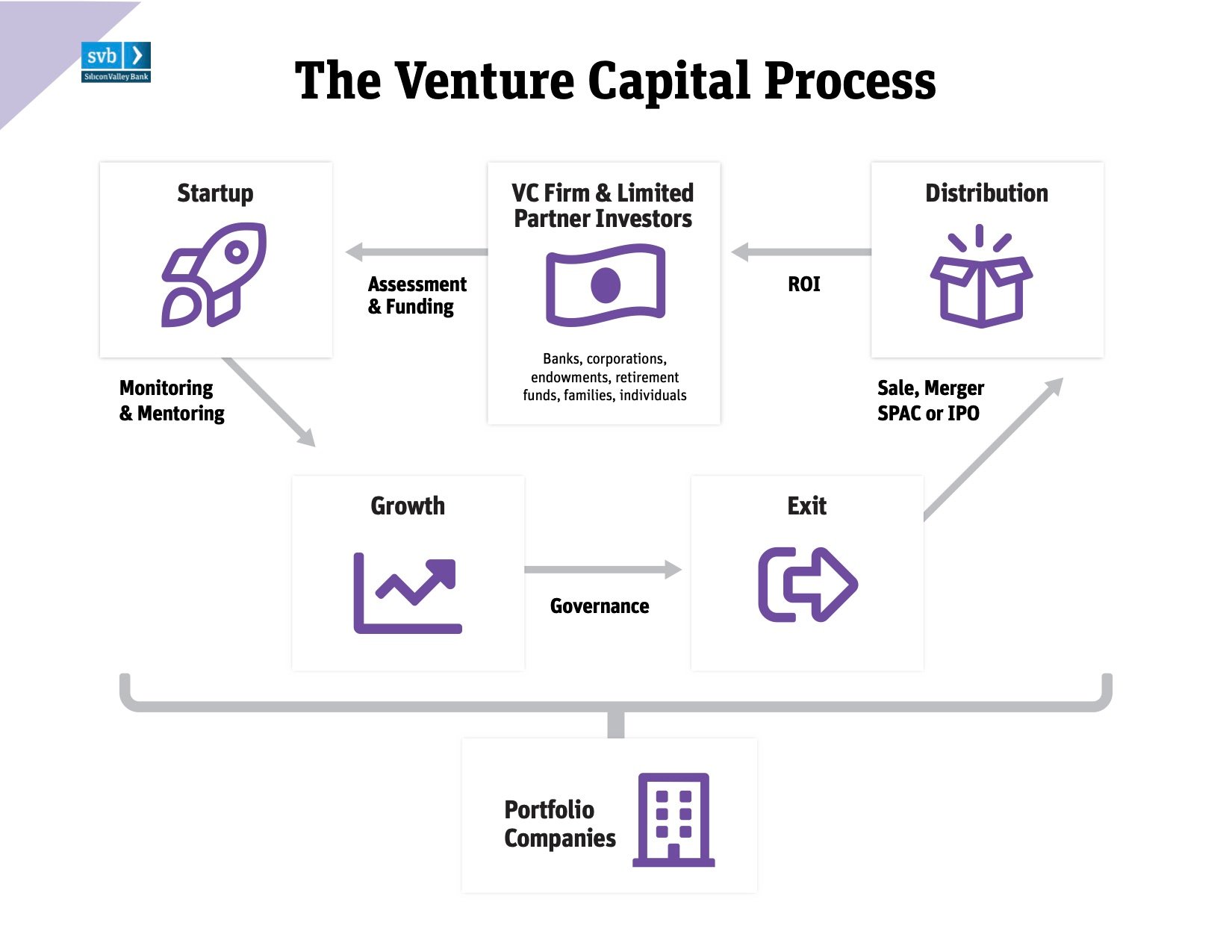

Venture capital (VC) is generally used to support startups and other businesses with the potential for substantial and rapid growth. VC firms raise money from limited partners (LPs) to invest in promising startups or even larger venture funds.

For example, when investing in a startup, VC funding is provided in exchange for equity in the company, and it isn’t expected to be paid back on a planned schedule in the conventional sense like a bank loan. VCs typically take a longer-term view and invest with the hope they will see outsized returns should the company be acquired or go public. VCs usually take only a minority stake — 50% or less — when investing in companies, also known as portfolio companies, because they become part of the firm’s portfolio of investments.

VC firms raise money from limited partners to invest in promising startups or even larger venture funds.

Another example is investing in larger venture funds. The larger venture funds can have a clear target in mind for the kind of companies they want to invest in, like an EV (electric vehicle) company. So, rather than invest in a single startup, they are investing in multiple companies.

Venture capital fills the void

A venture capital investment by its nature is risky and takes place before a company goes public or, in early-stage companies, even before a company has an established track record. The possibility of large losses — even the entire investment — is factored into the VC’s business model. In fact, VCs anticipate that they’ll lose money on most investments. The odds of hitting a “home run,” earning over 10X the venture capital investment, is small and can take years to realize. The calculation is that a few successful companies can pay dividends that far offset the losses.

Despite the long odds, venture capital is a major economic engine that:

- Generates job growth

- Spurs innovation

- Creates new business models that change the world

The funding VCs provide give nascent businesses — and industries — the chance to flourish. They help to bring ideas to life and fill the void that capital markets and traditional bank debt leave due to the high risk associated with limited operating history, lack of collateral and unproven business models. VC funds play a particularly important role when a company begins to commercialize its innovation.

Venture capital fundraising and investment are on track for record years. Much of this is due to recycled liquidity from a highly active exit market that is looking to reinvest. There are also nontraditional investors entering or vastly expanding participation in the VC arena, including:

- Private equity

- Corporate venture

- Hedge funds

- Sovereign funds

According to PitchBook, angel, seed, and first financings are exploding with more than $7 billion in capital invested across angel and seed deals in 1H 2021, surpassing the total deal value of every year prior to 2017.*

How venture capital works

At the start, companies often “bootstrap” their operations. Funds are provided by the founder and founder’s friends and family who want to be supportive and hopefully are confident that the young company will succeed. However, there comes the point where the fledgling company needs to scale, sometimes years ahead of profitability. At this point, founders seek more formal sources to finance their growth.

Tapping venture capital is a logical choice. There are many sources and, as noted above, nontraditional investors are joining an already large mix of traditional VC firms. Many funds target a specific industry or sector, geography or stage of company development. Many connections are made through startup networking groups, accelerators and mentoring programs. Among the first items is to create a pitch deck and target firms that appear to be good fit for your company and business model.

If an investor is impressed by your pitch deck and business plan, they will do their due diligence to verify your point of view. This will include a full analysis of your business model, products or services, financial position and performance — now and in earlier ventures.

Suppose the decision is made to go forward. In this case, the venture investor will present a term sheet that will include:

- The venture capital investment amount they are proposing to make

- The equity stake in the company that they expect in return

- Other conditions of the deal

There may be conditions you need to meet before they release their funds, including additional fundraising on your part. You should expect that VC money can be structured to come in several rounds over several years.

If you are fortunate to have a choice of VC firms, use this scorecard to help evaluate multiple VC offers and select the one that aligns best with your goals.

Most terms are negotiable; however, you should prioritize those that are the most important to you and your partners, particularly other financial partners. Be specific and realistic when you’re negotiating or you run the risk of coming across as inexperienced or overly confident. Either way, this can lead to getting off on the wrong foot with your new VC partner.

Stages of raising capital

- Pre-seed stage: Typically, modest early-stage funding is for product development, market research or business plan development. The pre-seed stage is to prove product/market fit, to test the waters, and to see if there is a market for what you are creating. It is called a “pre-seed round” and the fund source is typically a microVC or angel investor. In exchange for their pre-seed round, investors are usually given convertible notes (short-term debt financing that may be convertible to equity), equity or preferred stock options.

- Seed stage: This money supports growth during your first expansion phase. The funds are usually significant and are meant to address the capital needs for operations such as hiring, marketing and operations once a company has a viable product or service. This venture capital is also known as Series A funding, with future rounds known as Series B and so on.

- Late stage: This funding is for more mature companies that have proven a substantial ability to grow and generate revenue, and sometimes profits. VC firms tend to be less involved in late-stage funding. More typically, private equity firms and recently hedge funds become involved at this point because the risk is lower and the potential for hefty returns is higher.

There are good reasons to work with a VC firm that go beyond just funding.

Benefits of venture capital

Although you may have few funding alternatives if you’re looking to scale your young startup quickly, working with a VC firm can offer other advantages.

- Expansion capability

If you have high initial costs and limited operating history but significant potential, venture capitalists are more likely to share your risk and provide the resources for success.

- Mentoring

In addition to funding, venture capitalists are a valuable source of guidance, expertise, and consultation. Often, they have worked with many startups and investors during good and bad cycles. They can help:

-

- Build strategies

- Extend technical assistance

- Provide resources and additional investor contacts

- Help recruit talent

They are committed to your success since their investment only performs well if you do.

- Networks and connections

Venture capitalists typically have a huge network of connections in the innovation community. They are willing to make introductions and give references to help you find:

-

- Advisors

- Funding resources

- Skilled talent

- Business development connections to help you scale

- No repayment

Unlike loans requiring a personal guarantee, if your startup should fail, you are not obligated to repay venture capitalists. Likewise, there are no ongoing monthly loan repayments. Again, this helps to facilitate your cashflow and chance for success.

- Confidence

VCs are regulated by the US Securities and Exchange Commission (SEC) and their financing mechanisms are subject to similar regulations as private securities investments. In addition, Know-Your-Customer (KYC) and anti-money laundering regulations also apply when venture capital funds are provided by depository institutions or banks.

- The cost of venture capital

Obtaining VC funds can be a long and complicated process. These investors are looking to become partners in your business and want to be confident that your team has the resources, market potential and business skills to create a success. They also seek an eventual payout from the investment that is sufficient to cover the risk they are assuming.

- Dilution of ownership and control

As means for protecting their investment, venture capitalists will take a slice of company ownership and usually join your board of directors to give them a voice in your decision-making. Major decisions may require the consent of investors, and this can lead to uncomfortable conversations when opinions diverge.

- Early redemption

A VC who wants to redeem their investment within three to five years may not be well suited to provide support. Early-stage companies often need more time to deliver a profit or execute an exit.

- Timing

You need to set aside enough time to create (and rehearse) an effective pitch deck, develop a compelling business plan and then search for an interested VC who makes a good fit. The VC then needs time to do their due diligence and make their decision. After that, you’ll need a series of one-on-one meetings to review the plan and agree to terms before funding can commence.

- High return on original investment

VCs who require a high ROI within a short time frame may cause stress that can impact your business decisions.

- Incremental funding

Most VCs will require that you reach certain business milestones before releasing subsequent rounds of funding. This assures them that you’re using funds wisely and growing as planned.

- Undervaluation

Some venture capitalists are eager to sell their equity stake and may pressure you to exit through either a sale or an IPO. There are solutions to avoid a scenario that results in an undervalued exit.

How to know when a VC is right for your business

Whether you need VC funding depends on the nature of your business. If your startup requires heavy upfront investment — manufacturing facilities or a large sales team, for example — or will take years to realize commercialization and revenue, then seeking VC funding may be critical.

Many startups are successful having never sought VC funds.

However, many startups are successful having never sought VC funds. In fact, according to Fundera only a tiny percentage of startups raise venture capital. Funding alternatives can include:

- Commercial loans and debt vehicles

- Venture debt in conjunction with Series A to reduce dilution

- Licensing deals and partnerships with corporations

Some startups with low initial costs, like software, can get started with founder funding and scale using proceeds from sales.

This decision workflow can help you decide if VC funding is right for you.

Be sure you understand how funding decisions now will affect your company in the long and short term so you can choose the course that best aligns with your mission and vision.

Running a startup is hard. Visit our Startup Insights for more on what you need to know at different stages of your startup’s early life. And, for the latest trends in the innovation economy, check out our State of the Markets report.

*Source: SVB Q3 State of the Markets Report