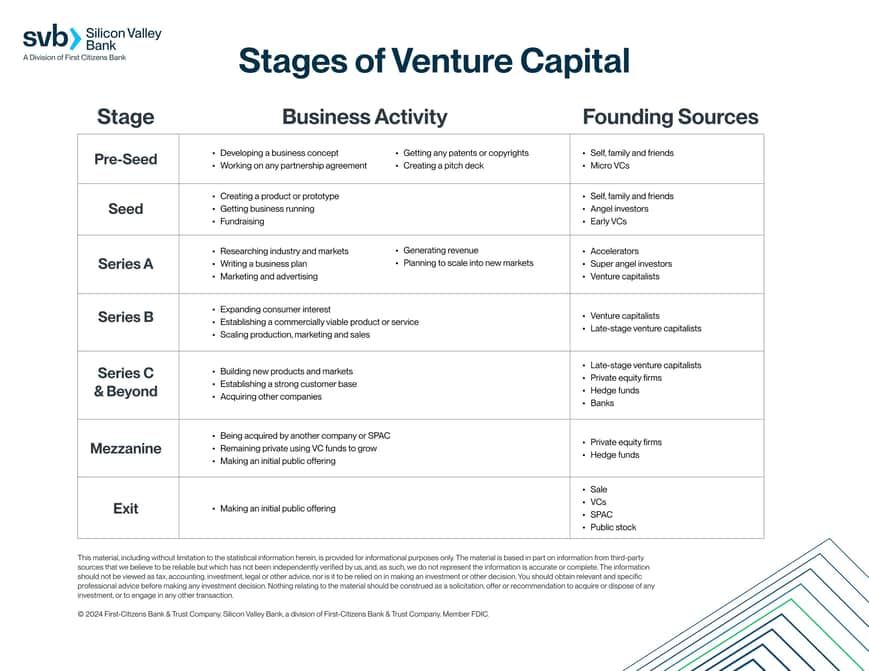

- There are seven key stages of fundraising for startups comprised of five stages of venture capital and two additional stages that occur before and after VC funding.

- There are different funding sources available to help you scale at different points along your entrepreneurial journey.

- To gain funding, your company needs to be mature enough to draw investor interest.

Venture capital (VC) helps make it possible for promising entrepreneurs, some with little or no operating history, to secure capital and launch their businesses. The financing pattern of venture capital typically follows through a series of funding rounds starting from pre-seed, seed, Series A, B, C, and sometimes D rounds, each stage representing a different level of company maturity and investor risk tolerance. VC firms will pool money from multiple investors to help fund companies with high growth potential. In addition to VC firms, corporate VC funds, and more frequently, high-net-worth family offices, are investing in startups.

In exchange for the investment, VC firms take equity or an ownership stake in your company. As a founder, you'll want to understand the strategies behind equity distribution among co-founders and investors.

When choosing companies, VCs and other investors consider:

- Your growth potential

- The strength of your management team

- The appeal or uniqueness of your products or services

VC firms can generally absorb several losses as long as they occasionally invest in a runaway success to distribute returns to investors. To improve the chances of success, when you take VC funding, you’ll likely get guidance from experienced investors and entrepreneurs. Often, these firms will also expect some say in decision-making, including a seat on the board.

There are seven key stages of fundraising for startups comprised of five stages of venture capital and two additional stages that occur before and after VC funding.

Pre-seed stage

Before accessing VC capital, there is the pre-seed or bootstrapping stage. This is the time you spend getting your operations off the ground and when you begin to build your product or service prototype to assess the viability of your idea. At this point, it is unlikely that VCs will provide funding in exchange for equity, so you need to depend on your personal resources and contacts to launch your startup.

During the pre-seed stage, many entrepreneurs seek out guidance from founders who have had similar experiences. With this advice, you can begin developing a winning business model and a plan for creating a viable company. This is also the time to hammer out any partnership agreements, copyrights or other legal issues that are central to your success. These issues could become insurmountable later, and no investor will fund a startup with open legal questions.

The most common investors at this stage are:

- Startup founder

- Friends and family

- Early-stage funds (micro VCs)

Examples of pre-seed stage funds are:

- Seedcamp

- K9 Ventures

- First Round Capital

Seed stage

Your company now has a degree of experience and can demonstrate the potential to develop into a vibrant company. You now need a pitch deck to demonstrate to VCs that your idea is a viable investment opportunity. Most of the modest sums you raise in the seed stage are for specific activities such as:

- Market research

- Business plan development

- Setting up a management team

- Product development

The goal is to secure enough funding now to prove to future investors you have the capacity to grow and scale.

Often seed stage VCs will participate in pitching additional investment rounds at the same time to help you convey credibility. Someone from the venture capital firm likely will take a seat on the board to monitor operations and ensure activity is done according to plan. Generally, it takes around 12 to 18 months between the seed and Series A stages, though this can vary.

Because VCs are assuming so much risk at this stage, this is possibly the most expensive funding you can take in terms of equity you’ll need to give up to secure the investment.

The most common investors at this stage are:

- Startup owner

- Friends and family

- Angel investors

- Early venture capital

Examples of seed stage funds are:

Series A stage

Series A typically is the first round of venture capital financing. A venture funding round is a stage in which a startup raises capital from investors to grow and scale their business. At this stage, your company has usually completed its business plan and has a pitch deck emphasizing product-market fit. You are honing the product and establishing a customer base, ramping up marketing and advertising, and you can demonstrate consistent revenue flow.

At this stage, you should:

- Fine-tune your product or service

- Expand your workforce

- Conduct additional research needed to support your launch

- Raise the funds needed to execute your plan and attract additional investors

In a Series A round, you need to have a plan that will generate long-term profits. Despite how many enthusiastic users you may have, you need to demonstrate how you’ll monetize your product in the long run.

Series B stage

At the Series B stage, your company is now ready to scale. This stage of venture capital supports actual product manufacturing, marketing and sales operations. To expand, you’ll likely need a much larger capital investment than earlier ones. Whereas Series A investors will measure your potential, for Series B, they’ll want to see actual performance and evidence of a commercially viable product or service to support future fundraising. Performance metrics give investors confidence that you and your team can achieve success on a larger scale.

VCs, corporate VCs and family offices providing Series B funding specialize in financing well-established startups. They provide the funds you need to expand markets and form operational teams such as marketing, sales and customer service. Series B funding enables you to:

- Grow your operations

- Meet customer demands

- Expand to new markets

- Compete more successfully

The most common investors at this stage are:

- Venture capitalists

- Corporate venture capital funds

- Family offices

- Late-stage venture capitalists

Examples of Series B investors include:

Series C stage and beyond

When you reach the Series C stage, you’re on a growth path. You’ve achieved success, and incremental funding will help you build new products, reach new markets and even acquire other startups. It typically requires two to three years to reach this phase on a quick trajectory, and you’re producing exponential growth and consistent profitability.

To receive Series C and subsequent funding, you must be well established with a strong customer base. You also need:

- Stable revenue stream

- History of growth

- Desire to expand globally

Investors are eager to participate in Series C and beyond because your proven success means they shoulder less risk. Hedge funds, investment banks, private equity firms and others beyond traditional VC firms are more eager to invest at this stage.

The most common investors at this stage are:

- Late-stage venture capitalists

- Private equity firms

- Hedge funds

- Banks

- Corporate VC funds

- Family offices

Frequent Series C investors include:

Mezzanine stage

The final stage of VC marks your transition to a liquidity event, either an exit via going public or M&A. You’ve reached maturity and now need financing to support major events.

Entering the mezzanine stage — it’s often also called the bridge stage or pre-public stage — means you are a full-fledged, viable business. Many of the investors who have helped you reach this level of success will now likely choose to sell their shares and earn a significant return on their investment.

With the original investors leaving, that opens the door for late-stage investors to come in, hoping to gain from an IPO or sale.

Exit stage (IPO)

An IPO, or initial public offering, is the natural progression of funding beyond VCs. It’s the process of taking your private company public by offering corporate shares on the open market. This can be a very effective way for a growing startup with proven potential or a long-established company to generate funds and reward earlier investors, including the founder and team.

To go public, you need to:

- Form an external public offering team of underwriters, lawyers, certified public accountants and SEC experts

- Compile all your financial performance information and project future operations

- Have your financial statements audited by a third party who’ll also generate an opinion about the value of your public offering

- File your prospectus with the SEC and determine a specific date for going public

Some of the benefits of going public include:

- An effective way to raise significant capital

- Secondary offerings that will enable you to generate additional funds, typically used to pay off original investors and early leadership team

- Public stock that can be more attractive as a part of executive compensation and as an employee benefit

- Easier mergers because you can use public shares to acquire another company

Conclusion

All that said, you don’t have to go public. For example, one option is with a special purpose acquisition company (SPAC). SPACs are an option to raise capital faster and with fewer hurdles than a conventional IPO. You can remain private and continue to accept VC money to scale. SPACs may also offer you more price certainty and provide a clearer idea of who investors will be. This can help you weigh the value of short-term investors looking for a quick return — through a conventional IPO — compared to investors with a longer-term goal of helping you grow over time.

A successful startup requires much more than just a great idea. It needs a regular stream of funding provided by investors who believe in your company. Venture capital is an indispensable part of the fundraising ecosystem. Remember that VCs are looking for promising entrepreneurs to help them launch their businesses. VCs will typically invest again and again at every startup stage.

FAQs

A venture funding round is a stage in which a startup raises capital from investors to grow and scale their business. This process involves offering equity or ownership stakes in exchange for investment.

The rounds of venture capital include pre-seed, seed, Series A, Series B, Series C, and sometimes Series D. Each round represents a different level of company maturity and investor risk tolerance.

Typically, it takes around 12 to 18 months between the seed and Series A stages, though this can vary depending on the startup's growth, market conditions and investor interest.

Early-stage venture capital focuses on initial rounds of funding like seed and Series A, which support product development and market entry. Late-stage venture capital, including Series C and beyond, is for companies that have achieved significant milestones and are preparing for large-scale expansion or an exit event.

The 10x rule for venture capital is a guideline that suggests a VC investment should aim to return ten times the original investment. This high return compensates for the high risk and the potential for other investments in the portfolio to fail.