Key Takeaways

- The benefits of incorporating in Delaware generally favor large public corporations with thousands of stockholders.

- If you are seeking outside funding for your startup, Delaware incorporation may be required by VCs or angel investors.

- For smaller, privately held companies, it is generally more efficient to incorporate where your main office is located.

More than a million businesses — including half of all US firms and two-thirds of Fortune 500 companies, publicly traded companies, and most technology startups — have incorporated in Delaware, one of the country’s smallest states. The reason is that Delaware has a well-respected and established corporate court system as well as business-friendly tax, legal and regulation policies.

Should you incorporate in Delaware? The answer is, “it depends.” For VC-backed startups and many large companies, Delaware incorporation can make doing business easier and less expensive. But this isn’t true for everyone. For many startups in tech hubs like California, Boston, New York and Austin who don’t require VC-backing, it may make the most fiscal sense for them to incorporate in their home state. And if you’re a typical small business, you may never see any of these benefits, and filing in Delaware can add cost and complexity. You may find that incorporating a company in your home state is a better option.

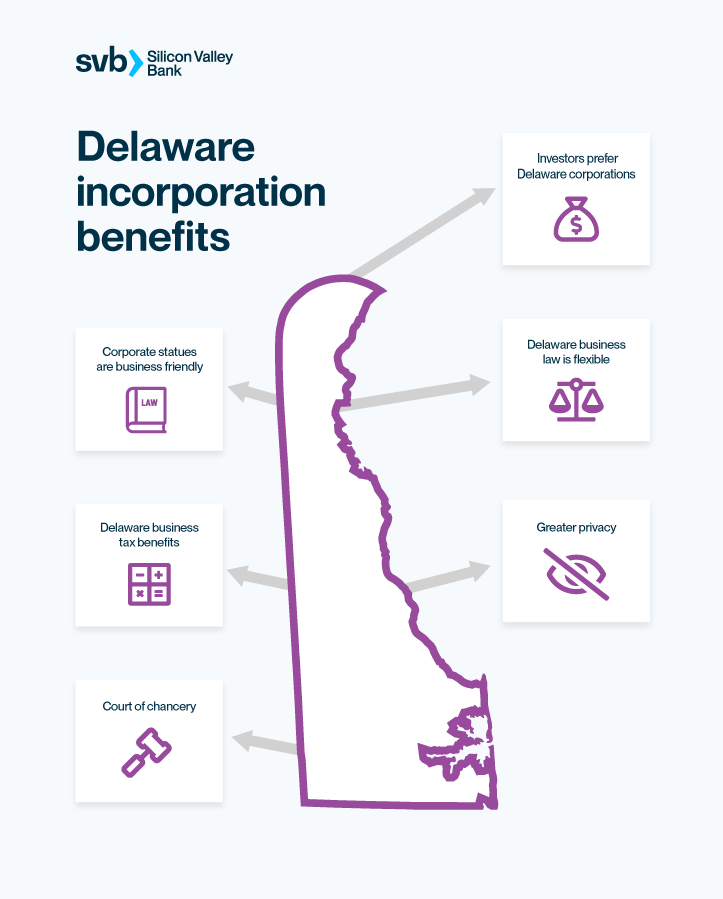

Benefits of incorporating in Delaware

It’s important to incorporate as early as possible to minimize your exposure to liability, protect intellectual property and establish the credibility needed for investors and customers. Corporations can seek incorporation in any state and there are different ways to incorporate, yet more VC-backed startups choose Delaware to set up a C-Corp even though they never intend to have an office there. Here are reasons why.

Delaware business law offers flexibility

Delaware’s statutes are often used as a model for other states. The state’s statutes—like the Delaware General Corporation Law and the Limited Liability Company Act — are the foundation for some of the most business-friendly legal environments found in other, but not all, states. To keep Delaware in the lead of offering incorporation benefits, its legislators work with corporate attorneys to regularly update these business-friendly statutes.

Court of Chancery

This is one of the country’s oldest law courts and they only handle corporation cases. Instead of juries, decisions are made by judges who are corporate law experts, so decisions handed down by the court are generally more predictable than those in other states.

If your business should become involved in litigation, you’ll likely have a judge with considerable expertise in complex law. Similarly, because Delaware is such a popular state for incorporation, corporate attorneys are generally very familiar with Delaware's business law. As a result, you can anticipate that your company attorney will likely be familiar with Delaware law.

Delaware business tax benefits

Although other states are attracting founders who are incorporating with no corporate taxes, Delaware still has very business-friendly tax law. Rather than taxing income in the state where the business actually occurred, the “Delaware loophole” makes it possible for companies to declare certain types of revenue in Delaware. In addition, Delaware:

-

-

Does not collect corporate taxes from companies formed in Delaware when they do not conduct business in the state

-

Does not tax royalty payments or other “intangible assets” to the business owners

-

Does not tax stock shares owned by people outside of Delaware

-

Corporate statutes are more flexible

The legal framework for corporations in Delaware is accommodating and convenient. You can complete your incorporation paperwork quickly and the state will process it promptly. Business owners may not be required to identify shareholders and company officers; and, how you organize your corporation and allocate shareholder and board member responsibilities is left essentially to your discretion.

Also of importance is that shareholders, officers, and directors don’t have to live in Delaware. The state will also allow just one person to be the director, shareholder and officer of a corporation. In other states, you may need at least three people to hold the officer and director positions.

Investors prefer Delaware corporations

If you’re a startup that anticipates needing outside investors to help scale your company, venture capitalists, private equity and investment banks often prefer investing in companies that are incorporated in Delaware. Instead of converting your company when an investment banker or venture capitalist demands a change, incorporating in Delaware is a logical first step.

There are benefits to companies who incorporate within Delaware…for large companies.

Disadvantages of incorporating in Delaware

There are benefits to companies who incorporate within Delaware, but they are primarily for large corporations. Carefully assess the additional cost involved against the benefits of incorporating in Delaware before deciding. You could be encountering considerable costs and other significant drawbacks. Here are several to consider.

Foreign qualification costs

If your company is incorporated in one state and is now seeking to do business in a second, you’re now a “foreign” corporation and need to register and pay a fee. When you expand and begin doing business in multiple states, you need to register as a foreign corporation in each new state. All 50 states require you to register and pay a fee that averages around $200 per state.

Registered agent costs

When you incorporate in Delaware, you are required to have a Delaware registered agent. This person or company needs to be in the state and be able to accept legal filings. If you need to hire someone to fulfill this role, it’ll be an additional cost for your business.

Franchise taxes

In addition to significantly higher filing fees in Delaware, you will be obligated to pay the Delaware franchise tax based on your share value. For small businesses, this tax is minimal. However, the costs increase as your number of shares and share value increase. You may also be obligated to pay a franchise tax in your home state in addition to Delaware’s tax.

Multiple reporting requirements

Although you’re incorporated in Delaware, to conduct business in your home state you are still required to also meet your state's filing and licensing requirements. Because you’ll need to file annual reports in both locations, you’ll be encountering twice the work and twice the expense.

Nominal tax advantages

Delaware is a “tax-friendly” state; however, taxes are paid where the money is made. If you’re incorporated in Delaware and don’t do business there, the state doesn't tax your company. However, you won’t avoid any tax liability because your home state will tax your company.

How to incorporate in Delaware

It isn’t difficult or particularly expensive to form a corporation in Delaware. Download our incorporation checklist and just follow these 11 steps.

1. Choose your corporate name

Your name needs to be unique — not deceptively similar to another firm — and it must include the word "association," "company," "corporation," "club," "foundation," "fund," "incorporated," "institute," "society," "union," "syndicate" or "limited.”

2. Choose your business entity type

Decide if you want to be a limited liability company (LLC), a C Corp, an S Corp, a statutory trust or a limited partnership.

3. Appoint a registered agent

Every Delaware corporation must have an in-state “agent for service of process.” This can be either an individual or corporation that can accept legal papers on the corporation's behalf if it is sued.

4. File a certificate of incorporation

Your corporation is a legal entity after you file a Certificate of Incorporation — Stock Certificate with the Delaware Secretary of State.

5. Secure a certificate of good standing

To open a corporate account, many financial institutions will require a good standing certificate or a certified copy of your new entity filing. You can order one at the same time you file your Certificate of Incorporation.

6. File articles of incorporation

These can be filed online or by mail and must include a Filing Cover Memo, the corporation's name, office street address and the name of your registered agent. You also need to specify the number of shares the corporation is authorized to issue, the corporation’s purpose, and the name and mailing address of the incorporator.

7. Prepare corporate bylaws

These aren’t required by Delaware, but an internal document that sets out your basic ground rules for operating your corporation helps to show banks, investors, the IRS and others that your corporation is legitimate.

8. Appoint directors and hold board meetings

The person who signed the articles is the “incorporator” and he or she appoints the initial corporate directors. At the first board meeting, the directors should:

-

-

Appoint corporate officers

-

Adopt bylaws

-

Select a corporate bank

-

Authorize the issuance of shares of stock

-

Set the corporation's fiscal year

-

Adopt an official stock certificate form and corporate seal

-

9. Issue stock

In return for capital contributions of cash, property, services or all three, you can issue stock. This is usually issued as paper certificates, and stockholders are recorded in the corporation’s stock transfer ledger.

10. File annual report and pay franchise tax

As a Delaware corporation, you are required to file an annual report and pay a franchise tax no later than March 1.

11. Obtain an EIN

You need to acquire an Employer Identification Number (EIN) by completing an application on the IRS website.

Delaware incorporation is good for some

Put simply, if you’re a large corporation — or anticipate becoming one — or you’re a startup looking to secure outside funding from VCs, PEs or angel investors, the benefits of incorporating in Delaware are significant.

On the other hand, if you’re smaller, locally focused and self-funded, Delaware incorporation may not be worth the additional cost or increased work. Better to incorporate in your home state. In any event, consult with your attorney, accountant and mentors to determine the best place for your company to incorporate.

Running a startup is hard. Visit our Startup Insights for more on what you need to know at different stages of your startup’s early life. And, for the latest trends in the innovation economy, check out our State of the Markets report.