Corporate Banking

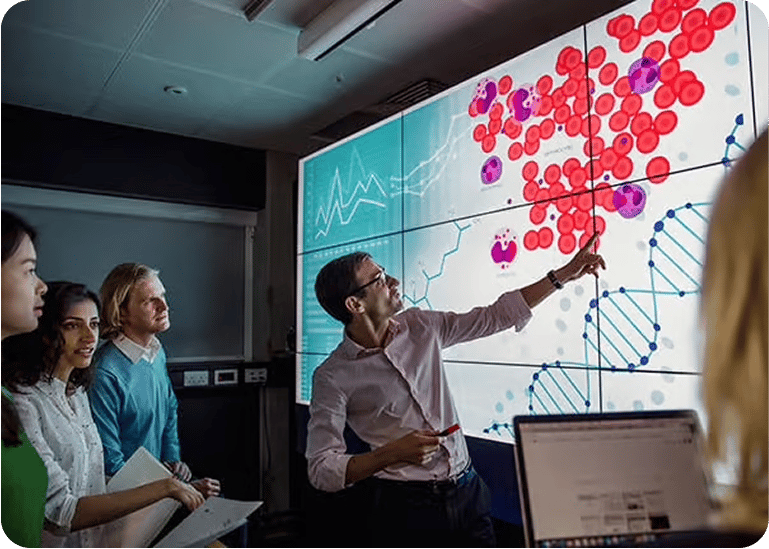

Break through challenges with the help of a dedicated team of banking experts in technology, life sciences and healthcare.

Your essential financial partner with industry-leading expertise

From navigating global expansion to driving growth in a competitive landscape and managing complex operations, we've earned the trust of our clients to anticipate, understand and support their companies’ needs through ups and downs.

Comprehensive debt and equity financing

Access tailored debt and equity solutions to help fuel bold organic growth, acquisitions, global expansion or balance sheet optimization.

Best-in-class service

Work with a partner whose service is purpose-built around the unique needs, sophisticated solutions and fast pace of scaled innovation companies.

Unparalleled sector expertise

Leverage our deep connections and understanding of the innovation economy to access experts, network with peers, and stay informed.

$220B

Assets¹

$40B

Total loans²

$99B

Total client funds³

Banking and financial solutions designed for business and life

Discover the dynamic banking and financial solutions curated for your corporation.

Global banking

Manage your growing transactions and payments requirements.

- Treasury services

- FX management and trade finance

- Card and merchant services

- Liquidity solutions Investment management

Credit and capital solutions

Take a broad and long-term view of your financial goals.

- Growth capital and working capital solutions

- Asset-based lines of credit

- Acquisition financing and syndicated financing

Wealth management and private banking

Access expert advice and guidance to help you achieve your next personal financial milestone.

- Flexible credit solutions and personalized banking services for complex needs

- Strategic liquidity planning

- Tax-smart investing and wealth planning

Specialized corporate banking solutions that advance your financial strategy

Global corporate bankers and specialists are ready to partner with you

Decades of experience in technology, life sciences and healthcare at every stage – makes us better bankers. Our commitment is exceptional service, valuable advice and a full spectrum of financial services for executives, and private equity and venture capital professionals.