- The Federal Reserve (Fed) recently announced the end of quantitative tightening (QT), and market participants have been closely monitoring liquidity and functioning of the markets.

- The Fed is clearly approaching this most recent QT ending cautiously, and we don’t anticipate a repeat of turmoil in short-term funding markets. The Fed has learned a valuable lesson.

- The Fed will likely use reserve management purchases (RMPs) in the coming months to help maintain liquidity without affecting longer-term borrowing costs, which is a goal reserved for quantitative easing (QE).

Economic vista: So long QT!

Steve Johnson, CFA, Senior Portfolio Manager

The Fed has an impressive array of tools that it uses to not only fulfill its dual mandate, but also to maintain liquidity and stability in the face of unusual economic circumstances. As we head into year-end, the Fed is finally putting away one of those vital tools. Will we see any turmoil in the aftermath of this latest policy shift, or has the Fed learned from experience?

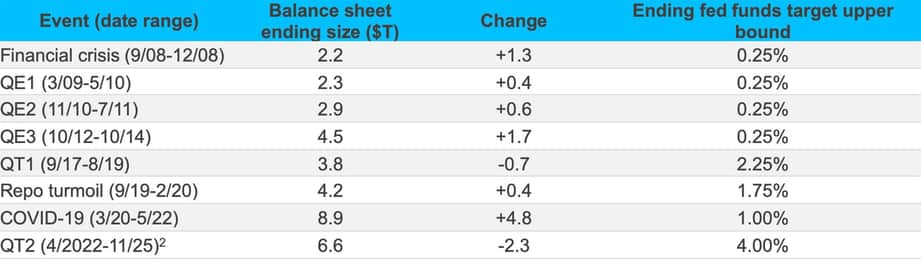

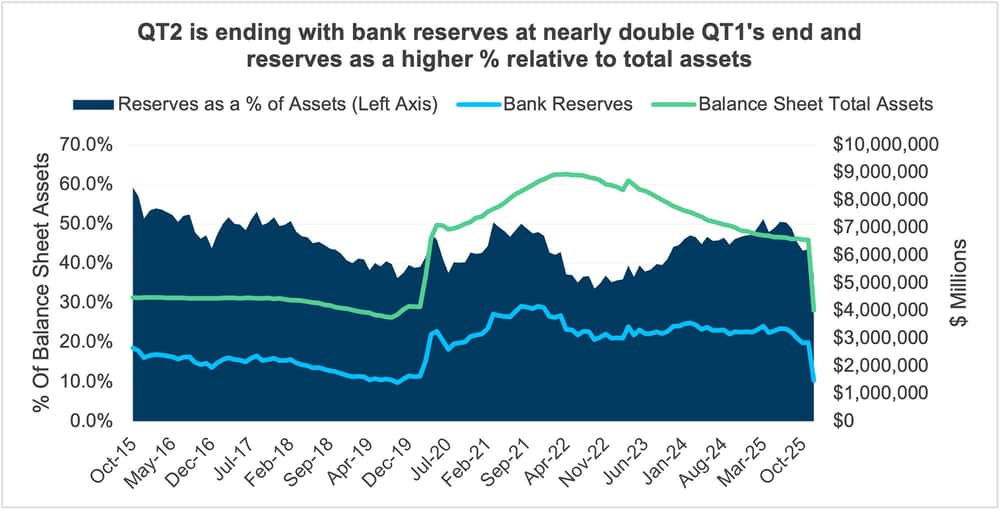

At its October 2025 meeting, the Fed announced an end to QT—a policy stance of reducing the size of its balance sheet by allowing bonds to mature without reinvesting the proceeds. The Fed has been in QT mode since mid-2022, in an attempt to reduce its bloated balance sheet that had swelled during COVID-19-era large-scale asset purchases. But QT requires nuance so as not to stress funding markets and keep bank reserves ample. Technically, the most recent balance sheet runoff (i.e., QT2) officially ends December 1, 2025. This is the second time the Fed is ending a QT program in the past 10 years.

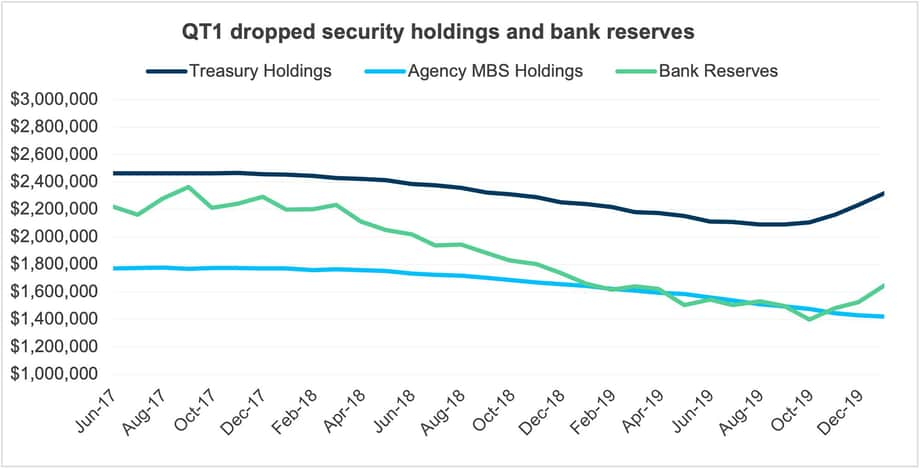

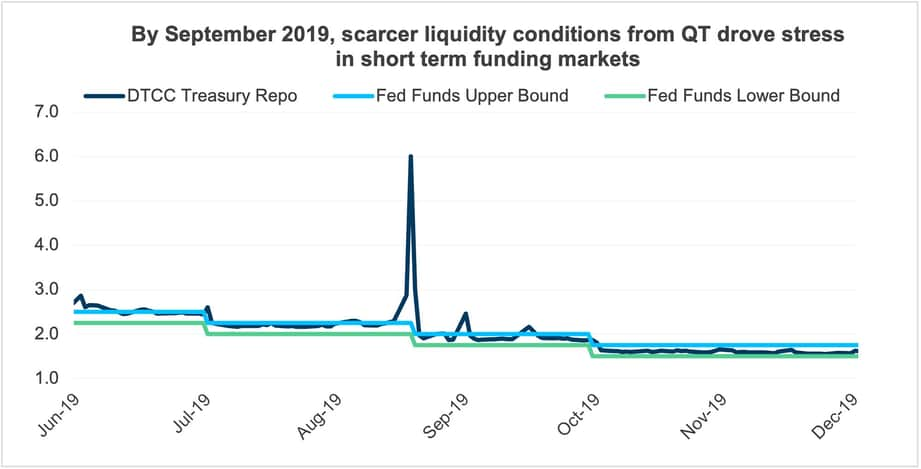

Let’s look back at the previous balance sheet runoff from 2017 to 2019 (i.e., QT1), which incidentally ended with significant turmoil in repo markets. Will history repeat itself?

A brief history

The Fed’s balance sheet expanded rapidly in the aftermath of the 2008 financial crisis. On three separate occasions the Fed attempted to lower long-term borrowing costs and simulate growth through large scale purchases of Treasuries and agency mortgage-backed Securities (MBS). This became known as quantitative easing (QE). These purchases were deemed a necessary addition to cutting traditional policy rates, which were already at the effective lower bound and couldn’t be lowered further. Importantly, law requires that the Fed’s purchases of Treasuries and agency MBS be executed on the open market (referred to as open market operations). The open market requirement means that the Fed cannot purchase Treasury securities directly from the US Treasury, but instead must transact with a group of banks knows as “primary dealers,” a set of broker-dealers active in Treasury and agency MBS markets. Additionally, when the Fed buys securities in the open markets, it funds purchases by increasing bank reserves (money held by banks in accounts at the Fed to make and receive payments from other banks), thereby increasing liquidity in the financial system.1

A brief history of the Fed's balance sheet

Later, with the financial crisis in the rearview, the Fed began raising policy rates gradually in 2015. By 2017, the Fed saw no need to continue reinvesting maturing proceeds from its newly expanded balance sheet. Rather, the Fed began to unwind its holdings in a process that became known as QT.

QT1 dropped both the asset and liability sides of the Fed’s balance sheet as securities matured, bank reserves were gradually reduced and overall liquidity in the financial system declined. By late 2019, bank reserves had been reduced to approximately $1.4 trillion, a level that strained short-term funding markets.3 Q3 2019 saw the repurchase (repo) markets clearing levels rise well above the Fed’s targeted range for the fed funds rate as supply and demand in short-term funding markets was imbalanced.

RMPs to the rescue

Somehow, the Fed needed to bring bank reserves back up out of scarce territory and improve liquidity to calm funding markets. To do this, the Fed executed a series of reserve management purchases (RMPs), which is one way that the Fed helps to manage the supply of reserves in the banking system. The Fed initially began open market purchases of Treasury bills (at a rate of $60 billion per month4). This increased bank reserves, liquidity and greatly reduced funding market stress. Importantly, Treasury bills were selected due to their short duration nature (less than one-year maturities) to differentiate RMPs from prior QE efforts. While Treasury bill purchases increased bank reserves, they didn’t lower longer-term borrowing costs as other QE purchases did.

So, did the Fed learn any lessons from its prior balance sheet unwinding? We think so. First, this time around the Fed telegraphed a specific end date for QT2 prior to any signs of stress in funding markets. Second, bank reserves today have not dropped into scarce territory, hovering at a level double where they stood in the third quarter of 2019. Finally, bank reserves compared as a percentage of the Fed’s balance sheet assets are higher compared to the third quarter of 2019. The bottom line is that the Fed has indeed approached the end to QT2 much more carefully and cautiously.

The path ahead

Similar to what transpired in 2019, RMPs are likely to be an important tool used by the Fed in the coming quarters. The QT runoff will be over, and reserves will still decline due to the growth of non-reserve liabilities (like currency in circulation). As such, it follows that some purchases of securities (likely Treasury bills again) in the open market will serve to keep bank reserves and liquidity healthy. It’s clear that the Fed is approaching the end of QT2 with the benefit of hindsight, and that’s good news for all market participants. As always, we will be monitoring to see if things play out as we expect, and aim to shift portfolios opportunistically in the absence of QT.

Trading vista: Popular themes prevail

Jason Graveley, Senior Manager, Fixed Income Trading

The more things change, the more they stay the same. That’s the mantra for fixed income markets as the calendar grinds toward year-end. In other words, we think many of the prevailing challenges that fixed income markets wrestled with this year are expected to continue into 2026. Themes like liquidity fragmentation, dealer balance sheet constraints, monetary policy-induced volatility and market electronification aren’t going away anytime soon. That said, we may get more clarity on some key issues that have dominated conversations through 2025. With that in mind, let’s unpack some of these themes and think about how they might influence portfolios in the weeks and months ahead.

Liquidity fragmentation and market electronification have been top of mind for many investors, and these two issues are undoubtedly linked. As market participants embrace new advancements across technology and execution platforms, the additional access and the ease of execution have had ramifications for investors. While new technologies and trading platforms can broaden liquidity, they also splinter the market to some extent. More ways to find and execute securities also means there are more places to look for, track and access trades than ever before. This leads to lower utility across each platform, as it’s increasingly difficult for dealers to manage risks across four or even five different avenues. As a result, dealers will likely quote smaller size and wider markets to offset volatility. This is likely to emphasize relationship-based trading for specific size and target needs.

As dealers continue their role as market-makers, we acknowledge they have come a long way in balance sheet management in recent years. Long gone are the days where dealers needed to frantically pare down positions ahead of a quarter or year-end. Dealers appear to be keeping less inventory on their balance sheets and appear more conscious of what those positions are. This is likely being driven by two factors.

- For starters, competition for inventory has grown. If we’re looking specifically at the front end of the credit curve, for example, there have been anywhere between five and 10 different dealers who have built out networks in response to a shift in client demand and yield dynamics. Even the electronification of markets has put dealers directly in competition with many other market participants, numbering in the thousands. As a result, more buyers and sellers are pricing directly with each other and not facilitating flow through traditional broker-dealers.

- A second key reason is cost, and we know it’s usually all about the money! Dealers need to pay a certain amount to use their balance sheet, which is referred to as the cost to fund their book (i.e., funding cost). If the cost of holding the security is higher than the income, then there isn’t much incentive to hold inventory. This could lead to a change in pricing dynamics, with dealers bidding more aggressively to maintain market share or stepping back due to limited profit potential.

Volatility rules

Lest we forget, we must talk about rate volatility. The yield on the 2-year Treasury has gone directionally as expected, from 4.38% in January to 3.50% at the time of this writing. However, rate-cut expectations are still fluctuating. Fed Chair Jerome Powell stated that the (potential) December rate cut is “not a foregone conclusion” during the October Federal Open Market Committee (FOMC) press conference, contrary to the market expectation that was fully priced in at the time. Not surprisingly, there were 20 basis points (bps) of volatility just between the FOMC meeting and early November. With potential headwinds from a slowing economy and stubborn inflation still lurking into 2026, monetary policy will continue to be top of mind for the market, and it is likely to cause periodic bouts of volatility.

What does this mean for 2026? With many of today’s themes continuing in the foreseeable future, the ability to adapt and be nimble is critical. Evaluating new systems and workflows will continue to be paramount, as will monitoring shifts in the macro environment. Occasional pricing dislocations are likely with the shifting liquidity and volatility, and we expect to be able to take advantage of those opportunities for portfolios.