- The bond market zigged and zagged throughout 2023, but 2-year Treasury yields finished virtually unchanged from where the year began.

- At present, it appears that the Federal Reserve has deftly maneuvered to control inflation without derailing the economy. As ever, the story continues to unfold.

- Interest rates have likely peaked for the near term, and investment portfolios may benefit from locking in duration and preserving attractive income as we head into 2024.

Economic vista: The winding road

Jon Schwartz, Senior Portfolio Manager

It’s been anything but a straight line for the bond market as investors hung on every economic data release and every clue provided by the Fed in 2023. Through all the twists and turns, however, bond investors enjoyed a healthy bounce-back year after a dreadful 2022. And now, 2024 begins with yields remaining quite attractive for investors. This should provide an opportunity to capture elevated levels of income, though we all know that the once-sleepy bond market is plenty capable of throwing an unexpected curve.

Let’s look back on an eventful 2023. To begin the year, markets were focused on how high interest rates would need to go to tame inflation, even if that meant slowing economic growth or even risking recession. In 2022, we had just gotten through one of the most hawkish monetary policy periods in history, where the Fed increased the fed funds rate from a range of 0%-0.25% to a range of 4.25%-4.50% over the course of 10 months. As we began 2023, the hawkish policy continued, although the rate increases slowed with three consecutive 25 basis point (bps) hikes.

Turbulence in March

Quantitative easing (QE) throughout 2020 and 2021 had flooded the banking system with reserves, driving the uninsured deposit base of many banks to excessive levels. In March of 2023, deposit flight had reached an extreme when SVB and Signature Bank, along with First Republic, were taken into receivership by the Federal Deposit Insurance Corporation (FDIC). While two of these three bank failures were some of the largest in US banking history, the risk of contagion was largely contained, primarily due to swift action taken by the Fed and the FDIC. In response, the Fed instituted the Bank Term Funding Program (BTFP), whereby banks could pledge any eligible collateral (US Treasuries, agency debt, agency mortgage-backed securities) in exchange for funding of 100% of the face value of the collateral. This facility stood as a backstop for the banking system and eased fears around the impact of unrealized losses in bank investment portfolios as well as the downstream liquidity/solvency impacts. Kudos to the Fed for keeping the banking system “sound and resilient.” However, the turmoil did cause a massive flight to quality in March that took US Treasury yields lower by well over 100 bps in under a week. This accelerated expectations for rate cuts that the Fed would deliver to protect the economy from a crisis in the banking space. As we ended March, the bulk of the deposit outflows were behind us. Although concerns remained elevated, it was becoming clear the crisis in the banking space had been contained. At this juncture, the market refocused on the Fed’s mandate to fight inflation.

Changing Expectations

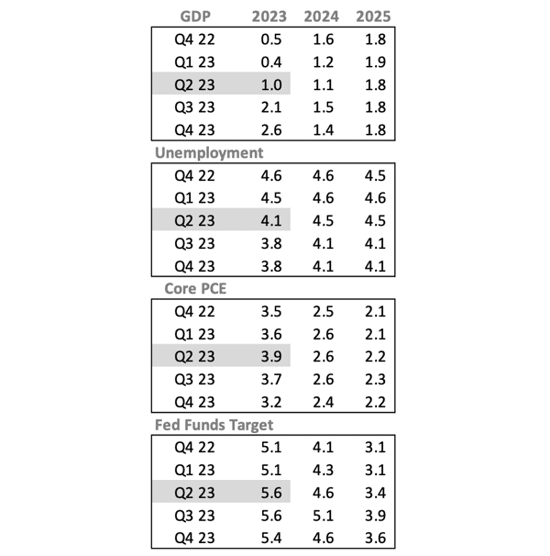

The Fed’s economic forecasts for 2023 also exhibited plenty of twists and turns. Early on the Fed had very benign growth expectations for GDP, which was forecasted to end the year at +0.5% year-over-year (YoY). Along with this slower growth came expectations for unemployment to rise to 4.6% by year-end 2023, while inflation (Core Personal Consumption Expenditures [PCE]) was expected to remain elevated at 3.5% YoY. In fact, many forecasters were predicting a recession at some point in 2023, which was a call that was largely abandoned as the year progressed.

Evolution of the Fed's Summary of Economic Projections for 2023

At the June 2023 Federal Open Market Committee (FOMC) meeting, the Fed delivered its first “pause” in this rate-hike cycle but still maintained a hawkish message. Given the changing GDP growth and inflation outlook, the Fed said there would be at least two more rate hikes coming, which would bring the fed funds rate up to the range of 5.50%-5.75% by year-end. Ultimately, the Fed moved on to deliver the final rate hike of the year in July. Actual Core PCE came in higher than expectations for every month of 2023 through July, but finally in August inflation came in below expectations. Chairman Powell and company continued to talk tough on inflation by keeping the door open to further rate hikes at the September meeting. The hawkish messaging was necessary as the economy was proving resilient, and GDP expectations were being revised higher while labor markets remained tight. This shows just how keenly the Fed was focused on inflation. Interest rates on the front of the curve were peaking in September as expectations for at least one more hike was reflected in market pricing.

The Dovish Pivot

Rates took an abrupt turn, dropping in October and into November as non-farm payroll data came in below expectations and the unemployment rate ticked up to 3.9%. Concerns about an economic downturn flared, and doubts were cast on the Fed’s plan to hike more in 2023. In fact, the market was increasingly pricing in multiple rate cuts for 2024. In the December FOMC meeting, the Fed seemingly acquiesced to what the market had already figured out — no more rate hikes for this cycle — and the Committee dropped the expected 2024 fed funds target to 4.6% from 5.1%. Employment data finished the year on a positive note with the unemployment rate dropping to 3.7%, but some investors worried that Fed policy may have become too restrictive if inflation continued to fade. Chairman Powell stated that the Fed would want to cut “well before” inflation falls to 2% YoY, which can be interpreted as a threshold of around 2.5% with an expectation of ongoing declines. Thus, the timing of rate-cut expectations was pulled forward with the odds of a March cut landing above 90%, according to the fed funds futures market. The market reacted swiftly to this dovish pivot. It was an astonishing end to a volatile year, and somehow yields for the 2-year Treasury closed the year within a bp of where we began 2023.

Looking Ahead

As we head into 2024, the factors that will continue to drive the bond market and shape the curve will be economic growth and how successful the Fed will be at achieving the “last mile” of the disinflation process. The Fed has messaged that it may cut 75 bps in 2024, while market pricing reflects expectations for rate cuts closer to 150 bps. The more dovish market participants clearly expect a slowdown in growth or even a recession, while the Fed remains confident in its ability to orchestrate a “soft landing.” Regardless of where we land, interest rates have likely peaked for the short term, and investment portfolios may benefit from locking in duration and preserving elevated and predictable income.

Trading vista: Same as it ever was?

Jason Graveley, Senior Manager, Fixed Income Trading

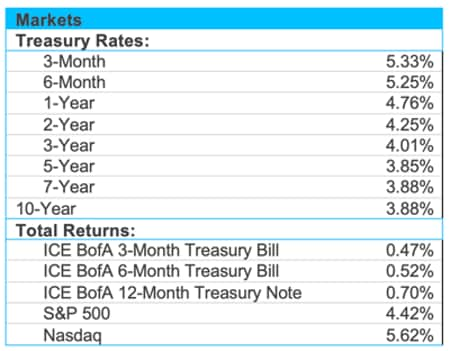

The new year always gives everyone — including investors — a fresh start. But as much as we love turning the page into a new calendar year, it’s likely that investors will remain focused on the same old story — for now. The themes that garnered headlines in 2023 — inflation, volatility and the Fed’s monetary policy — are likely to dominate our thoughts in early 2024. Of course, the narrative has already shifted somewhat. We’re no longer talking about peak rates and record inflation; instead, we’re focused on potential rate cuts and inflation normalization. Bond yields are declining, which is quite the shift from the beginning of the fourth quarter when they were hitting their highest levels since before the financial crisis. The yield on the 2-year Treasury — the point considered to be most sensitive to monetary policy — has dropped from its most recent high of 5.22% in October to 4.35% at the time of this writing. Falling inflation and slower economic growth are the base case for this year, although uncertainty around the depth and timing of potential rate cuts is expected to hang over the markets through the first quarter.

We believe that volatility will remain the norm as we head deeper into the first quarter, particularly since there is such disparity among market strategists around the future path of monetary policy. Currently, future implied probabilities reflect a market consensus of six 25 bps cuts in 2024, while some individual investment firms have published forecasts with an upward bound of 11 rate cuts. That would correspond to a 2.65% 2-year Treasury yield by the end of the year. If we compare this to the most recent release of the Summary of Economic Projections (SEP) and the associated “dot plot,” it’s easy to see how far ahead the market is compared to the Fed’s stated expectations. The median projection among FOMC members for 2024 only implies three 25-bps rate cuts for 2024. Although the SEP summarizes projections from individual members and is not a representation of forward policy, it does provide a window into the individual thinking of FOMC members and helps to establish any perceived gap between the market and committee members. Simply stated, the market is pricing in a much faster pace of unwinding than the Fed envisioned.

It’s also worth noting that despite 2-year Treasury yields ranging from 3.77% to 5.22% in 2023, year-end rates for these bonds in both 2022 and 2023 were within 20 bps of each other, closing at 4.42% and 4.25%, respectively. So while volatility resulted in large swings throughout 2023, the last two year-end closes were virtually unchanged. How this all ultimately materializes through 2024 will be a function of the economic data. The Fed’s data-dependency stance has been well noted, and the market will be attuned to each release as a consensus continues to form and competing views converge. There are a wide range of expectations, and the path to consensus could be bumpy, so buckle up. We expect to continue investing opportunistically along the way.

Source: Bloomberg and Silicon Valley Bank as of 12/29/2023.