- When selecting an asset manager, investors should understand the entirety of the fee structure and how the manager gets compensated.

- There are important differences between RIAs and broker-dealers, particularly in terms of how each is paid for the work they perform on behalf of the client.

- To understand the full costs associated with their broker-dealer relationship, clients may want to look at the bid-ask spread for all bond transactions in their portfolio.

Please also be sure to read this month’s Trading Vista, Where to from Here?

Economic Vista: No Such Thing as a Free Lunch

Travis Dugan, CFA , Managing Director, Portfolio Management

My first job after college was working in the back office for a fixed income asset manager. Back then, trade processing was still done via scanners and fax machines. Whenever there was a mortgage pool delivery day, the sheer volume of trades that needed to be processed was so overwhelming that all teams were asked to work through lunch. As a reward, the boss provided free pizza for everyone.

Naturally, fresh out of college, I was never inclined to pass up free pizza! But it soon became apparent there was a very real cost associated with this so-called free lunch. After all, we were skipping our break to process trades at a feverish pace to meet settlement deadlines, and there’s no doubt that we worked hardest on those “free lunch” days.

Beware the Hidden Costs

Most things in life are not free. That includes asset management. When choosing an asset manager, it’s critical to understand the fees, whether explicitly stated or less obvious. Typically, Registered Investment Advisors (RIAs) charge a management fee based on the assets they manage, and this fee is clearly stated and agreed upon with the client. Broker-dealers, on the other hand, have a different model for earning income — even when some claim they don’t technically charge management fees.

Remember, broker-dealers typically sell bonds from their own inventory into client accounts and earn their fees via the bid-ask spread. The difference in prices where broker-dealers buy and sell inventory is how they make money. Broker-dealers buy at a lower price (the bid) and sell at a higher price (the ask). The difference between bid and ask can be 5-10 basis points (bps) on any given trade (and often more depending on liquidity and other market factors). Thus, a broker-dealer technically may not charge any fees, but they are definitely not working for free. For clients to understand what their broker-dealer is really getting paid, they may want to ask their broker-dealer to state the bid-ask spread for the bonds in their portfolio.

RIAs differ from broker-dealers in various ways, but one key difference is that RIAs tend to have a true consultative relationship with clients and are a fiduciary that acts in the best interest of their clients. On a more granular basis, it’s also important to understand that RIAs do not own an inventory of bonds. Rather, RIAs source bonds at the best prices across a wide universe of broker-dealers. By sourcing bonds across many broker-dealer inventories, RIAs can find the best prices for bonds to include in client portfolios, and those potential savings can add up materially over time.

Importantly, the broader search that RIAs employ also provides greater diversification opportunities. RIAs, through a large network of counterparties, have access to the inventories of many broker-dealers. This not only helps RIAs source a greater number of individual bonds, but can also help them identify different pricing on the same bond held at multiple dealers. Price differences are commonplace, and they even occur with Treasury bonds, which might surprise some investors. The Treasury market is very liquid with tight bid-ask spreads; however, due to differences in broker-dealer inventories and timing of purchases, Treasuries can be offered at slightly different prices. RIAs will always seek to purchase bonds from the broker-dealer who offers the best price — that’s part of being a fiduciary.

We all love free stuff. But if a broker-dealer claims to charge no fees, you are right to be skeptical. For clients who hire a broker-dealer, it can be difficult to determine exactly how much they are actually paying in fees. In contrast, RIAs will provide full disclosure and full transparency and work tirelessly to execute trades for clients at the best available terms. Small price differences on individual bonds can add up across a broader portfolio, and over time it can materially have an impact on net performance.

Trading Vista: Where to from Here?

Jason Graveley, Senior Manager, Fixed Income Trading

Despite October’s solid payroll data, there was little change in the market’s expectations for the path of monetary policy. We did see a slight shift higher in the implied probability of a November rate hike, but consensus held that the Federal Reserve will look to aggregate more data before deciding. The futures’ probabilities are currently 70-to-30 in favor of holding the fed funds target range at its current level at the next meeting in November, although the “higher-for-longer” mantra of Fed officials seems to have finally been accepted by the market.

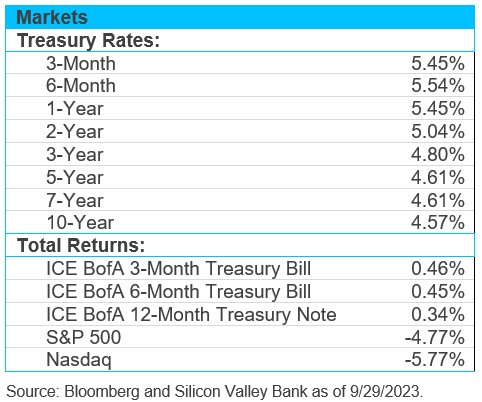

How has all this manifested? Treasury yields have been climbing in recent weeks, with two-year yields making a recent high of 5.17% in September. At the time of this writing in early October, two-year yields remained comfortable, sitting above 5%. The most recent data has reinforced the notion that the economy remains resilient while inflation has moderated. Thus, there does not seem to be an immediate need to hike rates. We must, however, still acknowledge that there is a lagging impact to monetary policy, and we will need to monitor the data over the next couple of months.

By and large, the technicals in the front end of the curve remain strong ahead of year-end. While there have been pockets of softness within the money market space, spreads have remained relatively stable despite the record issuance of Treasuries and a surge in US bank commercial paper issuance. The Bloomberg Short-term Corporate Index, which is used to aggregate spread activity for investment grade money market instruments, is registering around 60 bps. This is only an increase of 5 bps month-over-month, while the 2023 high and low for the index covered a range of 170 bps to 30 bps, comparatively.

The new issue market has been humming along, with year-to-date (YTD) volumes close to $1 trillion in the investment grade space, which is within $10 billion of last year’s October YTD volume. Primary market issuance is on pace to finish in line with January’s forecasts. In terms of primary spreads, the average investment grade corporate bond has moved approximately 7 bps higher in the last month, but the last print of +127 bps is relatively subdued compared to the high of 163 bps posted in March. So while there are near-term catalysts that might push front-end yields out of this range, even the $1.3 trillion more in outstanding Treasury bills hasn’t quite moved the needle just yet. Moreover, as assets continue to pour into the front end, where institutional government money market yields have climbed over 5.2% and balances have risen to almost $4.7 trillion, there appears to be plenty of dry powder ready to move into any rate dislocations. We, too, will be ready.