- ABCP can be a smart way to boost income in a risk-appropriate manner, thanks largely to its many embedded risk mitigation features.

- ABCP is a deep and liquid market, but it still requires careful analysis and attention to detail before allocating.

- We believe ABCP can offer investors the trifecta of enhanced yield potential, added diversification, and flexibility when incorporated into short-duration fixed income portfolios.

Economic vista: Diving deep into ABCP

Christi Fletcher, Senior Portfolio Manager

As the Federal Reserve starts down the path of cutting rates, yields have been trending lower across the spectrum of fixed income products. Now more than ever, every basis point counts. So which products should investors consider when it comes to enhancing yields? We think that asset-backed commercial paper (ABCP), which is a short-term debt product collateralized by a package of loans, could be a prudent portfolio addition with the potential of boosting yield while managing—even mitigating—overall portfolio risk.

Too good to be true? Maybe not. Let’s take a deeper look into why we like ABCP in the current environment.

Structure & collateral

In technical terms, asset-backed commercial paper is a bankruptcy-remote special purpose vehicle (SPV) or conduit with typical maturities of 397 days or less. Banks or financial institutions sponsor these programs backed by collateral. Put more simply, it’s a short-term debt instrument backed by a pool of financial assets. But as ever, the details matter. It’s imperative to understand the structure and collateral associated with these short-term money market instruments to ensure you are stretching for yield in a risk-appropriate manner.

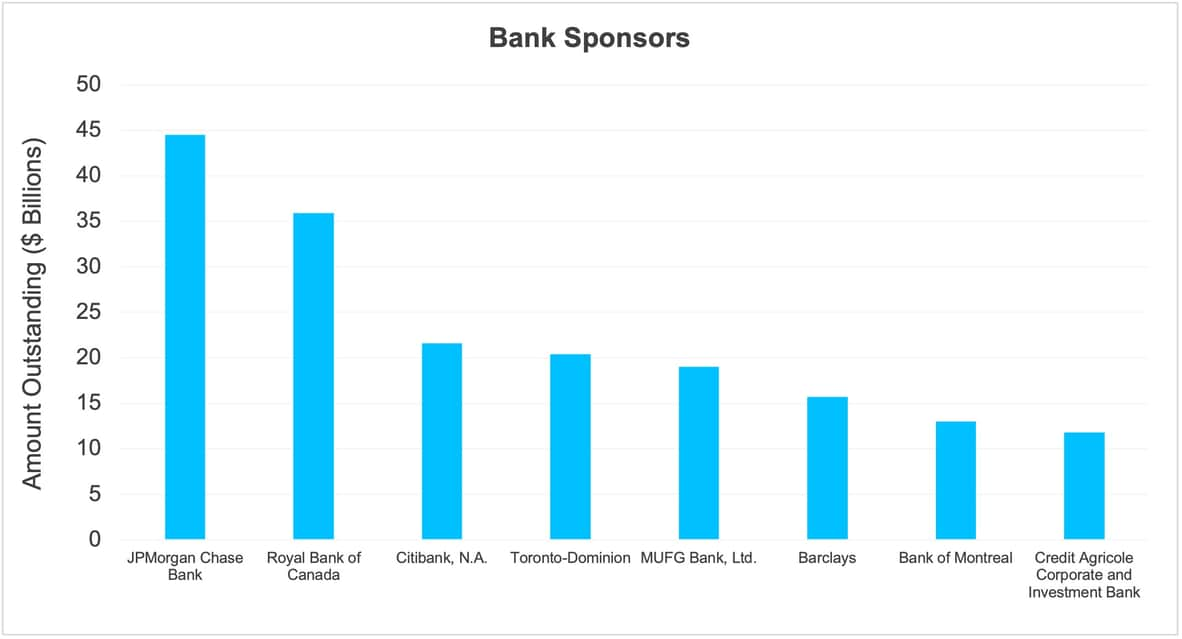

Source: Moody’s. Data as of 04/23/2025.

Firstly, an SPV is a legally separate entity established by a sponsor to isolate financial and credit risk. The sponsor securitizes assets into a distinct entity (program) and is maintained off the balance sheet. In the event of a sponsor’s bankruptcy, the ABCP is legally secured, and vice versa. Thus, a sponsor may provide credit enhancements if an ABCP faces difficulty. That’s a key feature, so the strength of the sponsor must be considered when purchasing these securities. JP Morgan is one of the largest sponsors with $44.5 billion outstanding in six different ABCP programs. This accounts for roughly 14% of the US ABCP market.

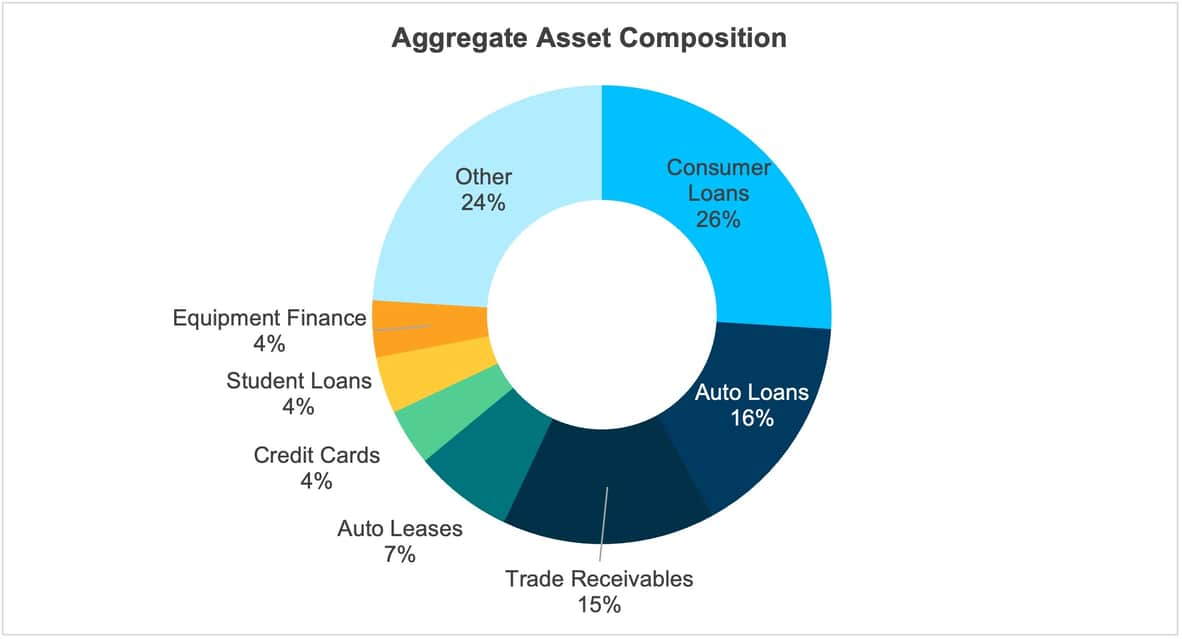

ABCP plays an important role in financing businesses and even consumers. The collateral for ABCP usually consists of expected future payments or receivables (i.e., trade receivables, auto loans, credit card debt, student loans). Well capitalized financial institutions (i.e., sponsors) securitize these assets with an objective to lend high-quality assets. This provides investors, who purchase through broker-dealers' counterparties, an attractive cost of funds and ample liquidity. When analyzing asset composition of the overall ABCP market, auto loans, trade receivables, and consumer loans comprise 58% of the assets. Since these programs are collateralized by a variety of assets, they are referred to as “multi-seller programs.”

Source: Moody’s Data as of 04/23/2025.

Risk analysis

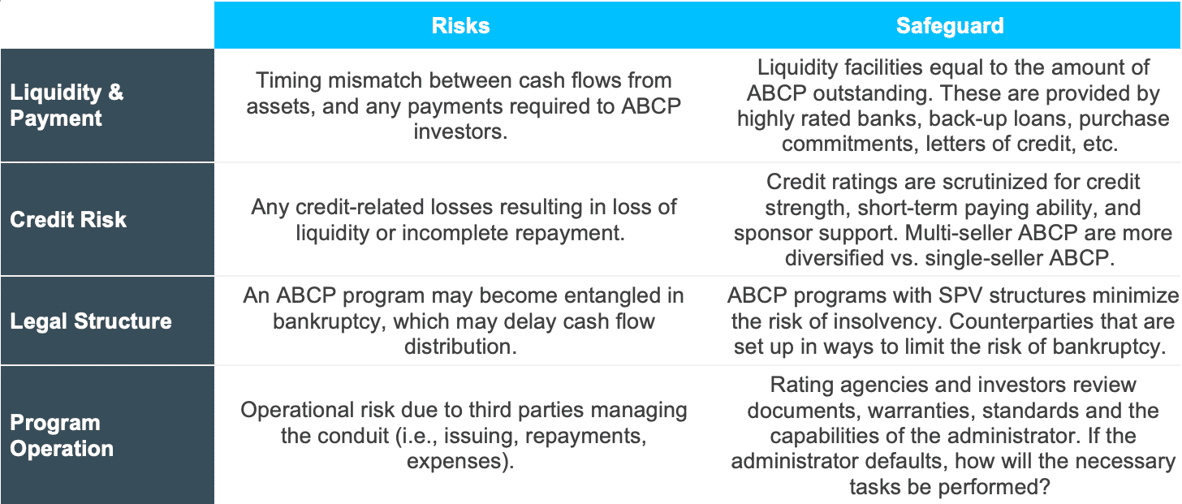

As with other collateralized securities, risks must be carefully examined. That said, it’s important to understand that ABCP has evolved with many safeguards now in place that help mitigate risk. Let’s look at two safeguards that are intended to protect principal.

- Credit enhancements: A sponsor or administrator may provide various credit enhancement features to make the investment more attractive, including overcollateralization of the underlying assets and third-party credit support (i.e., LOC, guarantee). Overcollateralization is defined as having excess assets held over the ABCP program’s face value. Rating agencies evaluate these enhancements and may give a better credit rating if there’s more collateral. These features help protect investors from obligor default risk, servicer risk, and receivables dilution risk.

- Liquidity providers: Liquidity risk is defined as the sponsor’s inability to refinance a maturity or inability to produce the cash flows required for a maturing note. This likely occurs when there is a mismatch between liability and asset cash flows. A facility is provided by the sponsor bank and can come in many forms. For example, a liquidity loan agreement (LLA) enables the ABCP to borrow without reducing assets, which allows for flexibility in volatile markets.

The table below summarizes the high-level risks and safeguards involved with investing in ABCP.

Source: SVB Asset Management

An expanding opportunity

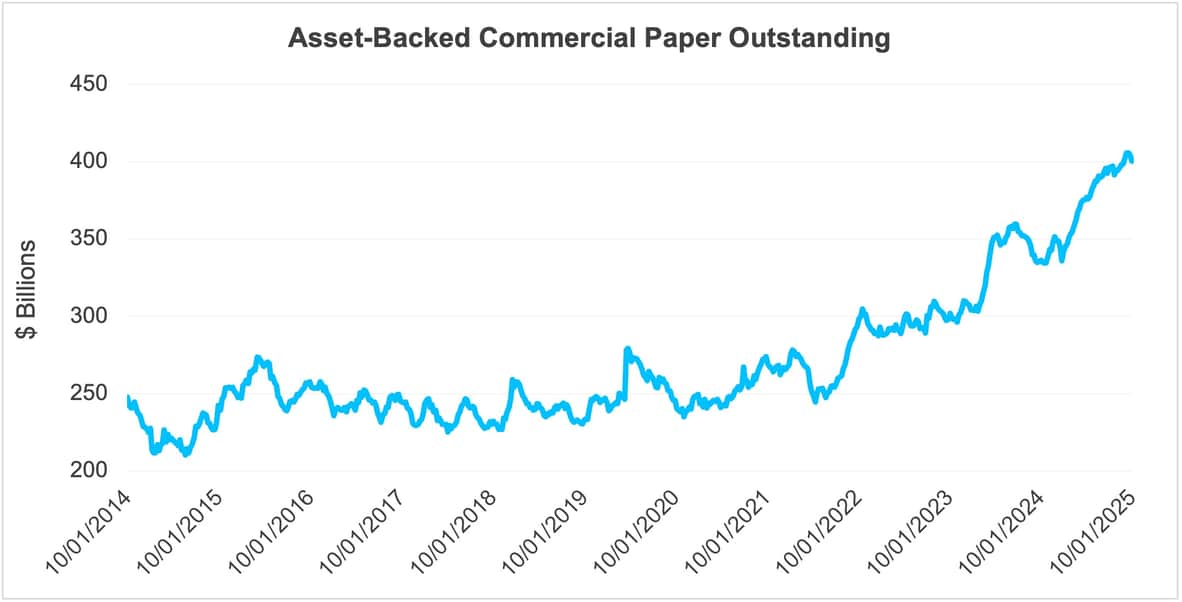

It’s important to emphasize that ABCP is not some insignificant fixed income niche. Rather, it’s a large segment of the overall short-term debt market. In fact, ABCP accounts for about 30% of the total commercial paper outstanding with $400.2 billion outstanding as of the third quarter 2025. Since 2024, thirteen new programs have launched and have met with robust investor demand, which has remained elevated due to supply constraints in the broader short-term commercial paper (CP) market. Today, we see ABCP as a favorable alternative to unsecured CP, which has seen a 24% decline in issuance since the 2020 peak.

Source: https://fred.stlouisfed.org/series/ABCOMP

ABCP advantages

Given the robust market and ample safeguards associated with many of these investments, we believe that ABCP has the potential to enhance portfolio yields while simultaneously reducing overall portfolio risk. Consider these three advantages:

- Attractive yields: ABCP is far more intricate than unsecured commercial paper, but due to its complexity and research requirements, investors are usually compensated two to 15 basis points (bps) or an average of nine bps (2019-2024) over unsecured top-tier financial commercial paper. The potential for capturing attractive yield, particularly when rates are trending lower due to monetary policy, is a key feature attracting investors today.

- Ample liquidity: The great financial crisis in 2008-2009 led many investors to scrutinize—even shun—asset backed securities. However, strong regulatory framework and healthy balance sheets have enabled ABCP to remain stable. This allows ABCP to remain prevalent in many short duration portfolios and prime money market funds. As of the end of January 2025, 27% of CP holdings were ABCP in prime money market funds. The strong investor demand illustrates the ample liquidity.

- Diversification: Including ABCP in a portfolio may boost diversification benefits. Consider how utilizing multi-seller ABCP programs reduces single issuer concentration. For example, purchasing JP Morgan-issued unsecured commercial paper would expose a portfolio to the credit worthiness of JP Morgan itself. However, purchasing Chariot Funding LLC sponsored by JP Morgan reduces issuer specific credit risk, as the ABCP is secured with various loans, receivables, etc.

The end result

With vigorous credit analysis and risk mitigation measures, we believe that ABCP may offer enhanced yield potential, liquidity, diversification, and flexibility in short-duration fixed income portfolios. These securities may seem intimidating and overly complex; however, with diligent analysis and asset selection, we think that cash managers can use ABCP to build more attractive income-oriented portfolios. With improved regulatory measures, enhanced safeguards, and a compelling track record, investors may see for themselves that the mechanism of ABCP is investor friendly.

Trading vista: Get the skinny on spreads

Jason Graveley, Senior Manager, Fixed Income Trading

Where has all the spread gone? Lately, we’ve found ourselves asking that specific question when looking broadly at the fixed income markets. Market technicals are driving levels in one direction, while benchmark Treasury rates have also been grinding lower. Never a dull moment.

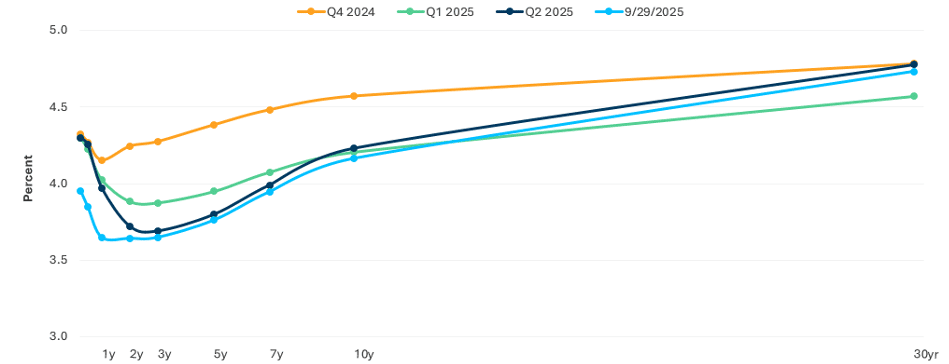

The 2-year Treasury yield hit its lowest level of the year in September, sinking below 3.50% at that time. This is down from a high of 4.38% in January of this year. Although that’s not an insignificant decline, the move lower hasn’t been much of a shock and was largely telegraphed thanks to constant communications from the Federal Reserve. The arrow was clearly pointing down for rates as we progressed through the calendar year. The more important questions surrounding interest rates were focused on “when” and “how far.”

In September, the Federal Reserve finally delivered on a rate cut—its first cut since December 2024—to help support the economy and combat disappointing jobs data. Still, the market seemed to want more and pulled forward its collective rate-cut expectations. Currently, there are two additional 25-bps cuts priced in through the end of this year, but there are no guarantees.

So how does rate direction inform spreads here? As rates moved lower, we began to see investors more focused on the all-in yield and less concerned about the credit spread component of their return. This was specifically the case as front-end investments hovered around 4% all-in yields. Investors were more than comfortable paying a tighter spread on an issuer if it still allowed them to lock-in 4% for their preferred duration. It was during this time that we saw spreads stagnate and dealer inventories shrink. This market environment was often described as “grabby” by insiders. Market flow and liquidity providers were finding it difficult to source bonds, but they found many outlets and less friction when they did. For context, the option-adjusted spread (OAS) on the ICE BofA US Corporate Index, which tracks the performance of US denominated investment grade debt, recently hit a multi-decade low. Spreads have been fluctuating around these tight levels since the middle of August, yet this hasn’t seemed to deter investor demand.

So how is the supply side of the equation looking? In the Treasury market, auction sizes have been increasing with a record 6-month Treasury bill auction of $75 billion in October. More bill issuance could elevate front-end Treasury yields if buyers struggle to absorb the increased issuance. On the corporate side, however, fixed income bond funds have experienced strong flows throughout 2025. In August, fixed income bond funds saw their largest monthly inflow since 2021. Low-duration or ultrashort bond funds specifically have been in demand, given the lower volatility of their holdings and relatively attractive all-in yields. Estimates now show that holdings in ultrashort bond funds total over $350 billion, with holdings in some bond funds more than doubling year-over-year. There hasn’t been a significant uptick in new issuance of corporate debt though, with year-over-year primary market run rates largely unchanged.

We believe that this imbalance will continue to weigh on spreads, which further emphasizes the need for credit selectivity. Stretching for yield at the expense of quality could prove to be dubious, so investors need to remain committed to their risk management. Nevertheless, even at tight spreads, we believe opportunities will arise for patient buyers.

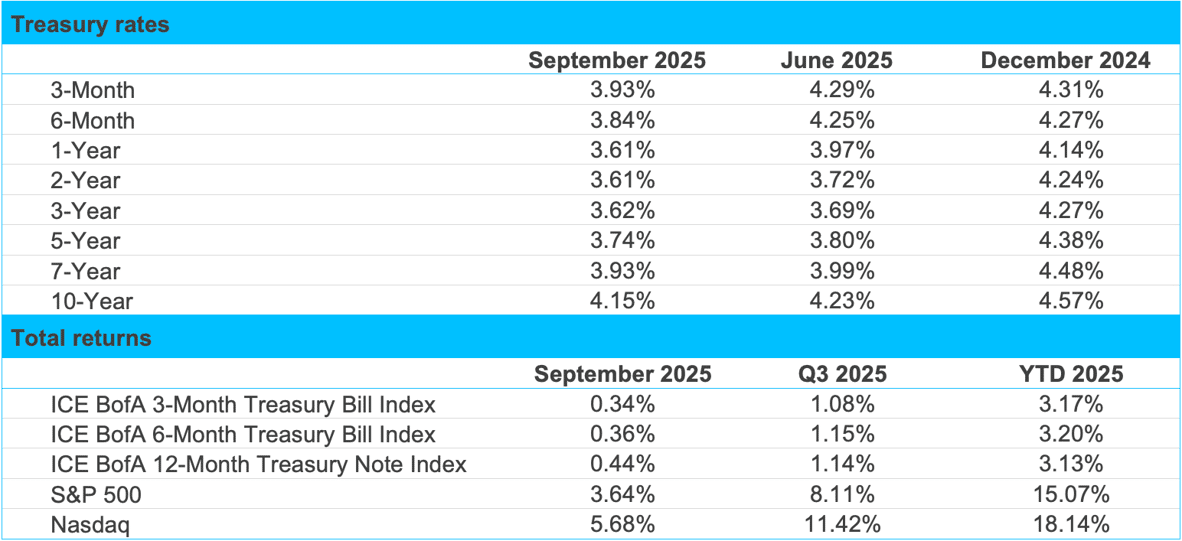

Markets

Source: Bloomberg and SVB Asset Management as of 09/29/2025.

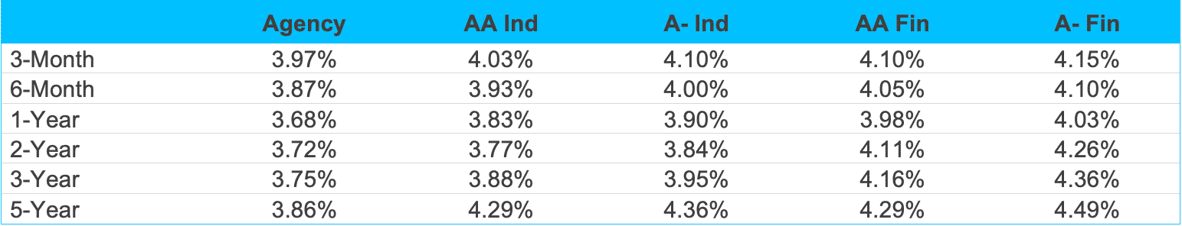

Agency and corporate yields

Source: Bloomberg, Tradeweb and SVB Asset Management as of 09/29/2025.

Front-end treasury yields have moved lower

Source: Bloomberg, Tradeweb and SVB Asset Management as of 09/29/2025.

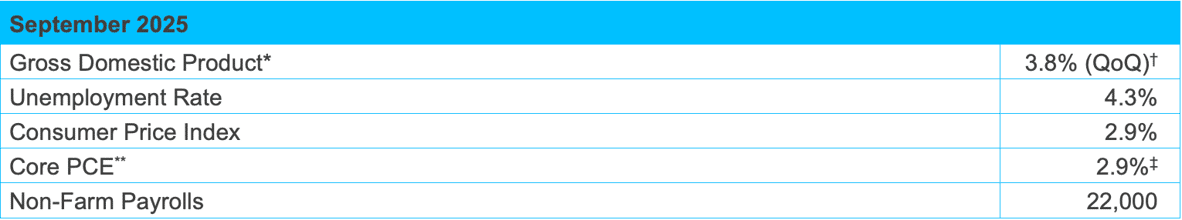

Economic indicators

Source: Bloomberg and Silicon Valley Bank as of 09/30/2025. US Bureau of Economic Analysis (BEA) and US Bureau of Labor Statistics. *Current GDP release as of 09/25/2025. †QoQ — Quarter-over-Quarter. **Core Personal Consumption Expenditures. ‡Current PCE release as of 09/26/2025.