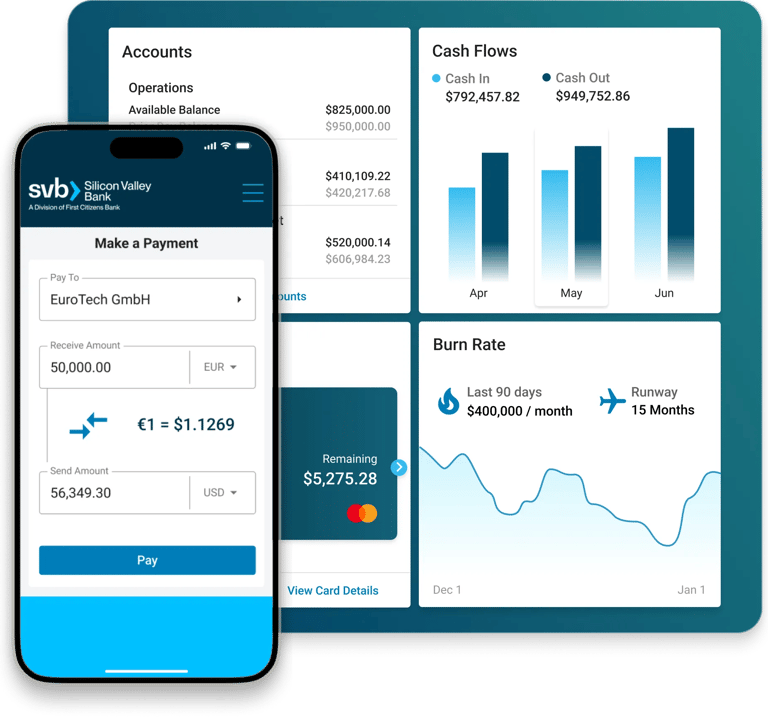

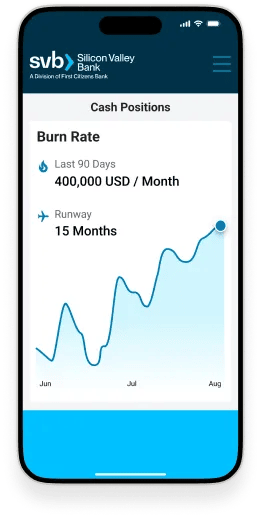

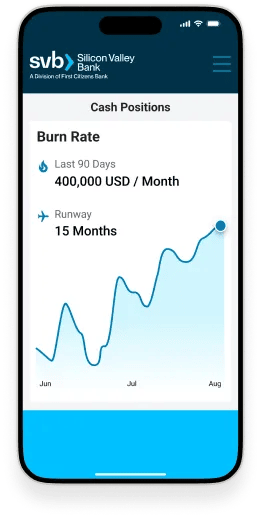

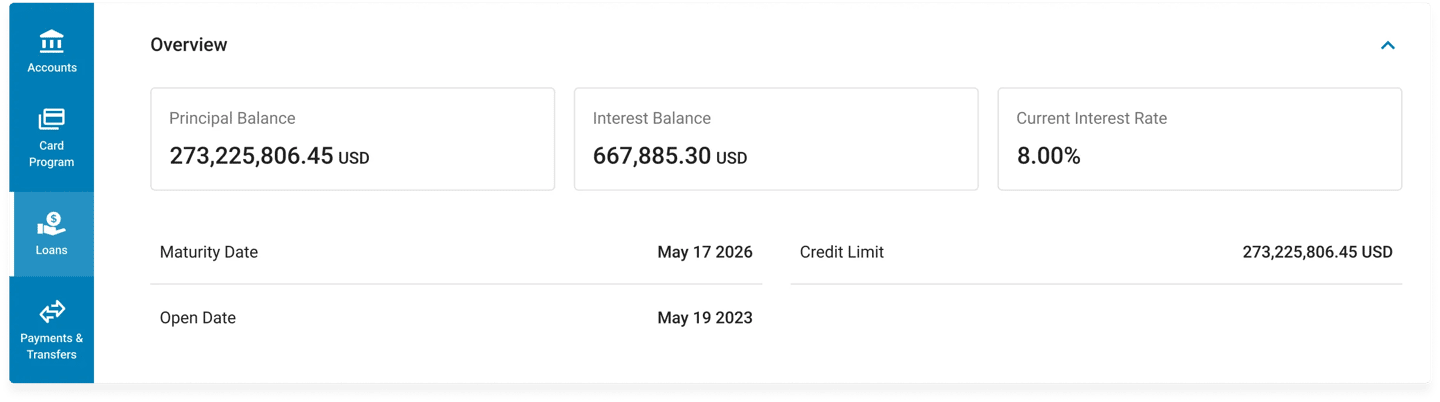

Dashboard

Monitor your cash positions with real-time data, custom alerts and critical metrics on any device.

The top finance teams in technology, healthcare and life sciences

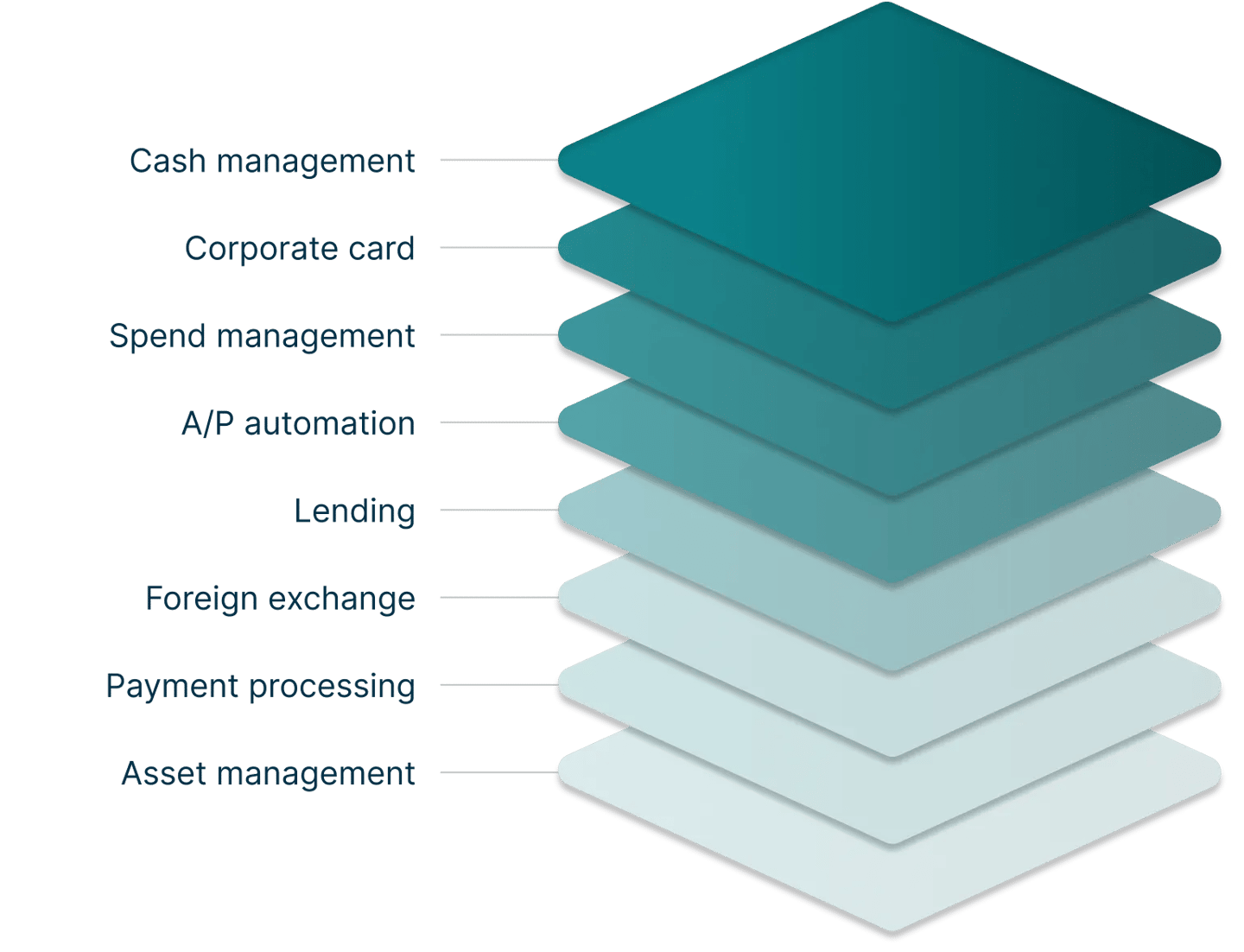

manage cash, control spend, trade FX and more on SVB’s digital banking platform.

Dashboard

Monitor your cash positions with real-time data, custom alerts and critical metrics on any device.

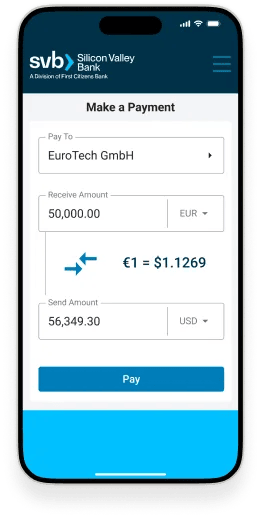

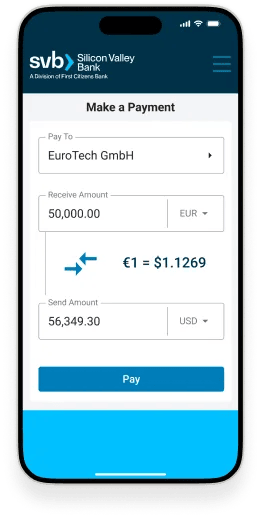

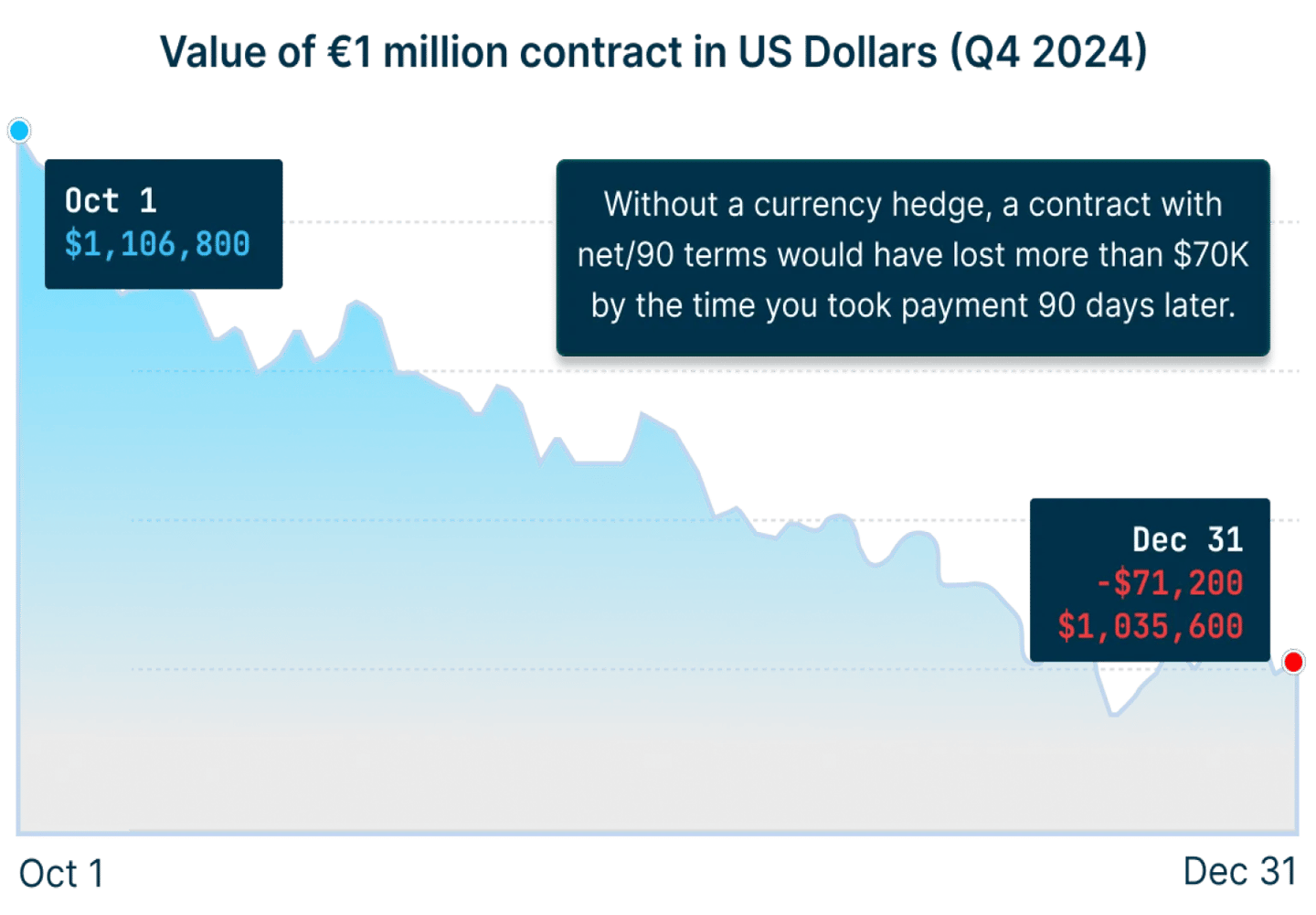

Payments

Send payments domestically or internationally in over 90 currencies from the same screen.

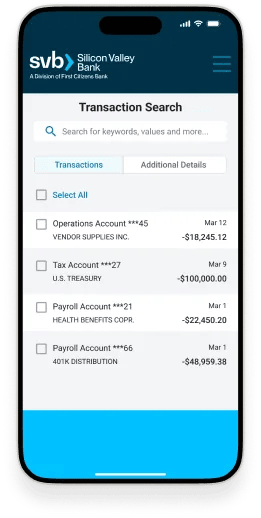

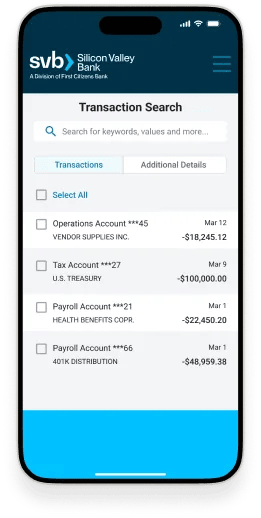

Reporting

Generate dozens of report types in seconds and search for transactions as easily as you talk.

Save on the products and services you're already using when you open an account with SVB.4

Pay in bulk

Bulk import 50+ payments at a time from your spreadsheet, ERP or accounting software.

Pay in bulk

Bulk import 50+ payments at a time from your spreadsheet, ERP or accounting software.

1 Free checking through SVB Edge available for up to three years from account opening on included services. Transactions processed, such as for overdrafts, NSF’s, returned and collection items will incur a fee as described in the Schedule of Fees. Click the ‘Learn More’ link above for additional terms and details on the free checking available with SVB Edge.

2 SVB Innovator Card Unlimited Rewards Points earnings are based on net purchases (minus returns/credits) with the SVB Rewards Program for Cards. SVB virtual cards can earn 1x rewards on purchases, or revenue share at the rate determined by the client relationship. Points can be redeemed for a variety of rewards, including travel and cash back. Cash back can be redeemed as a statement credit to your card account using rewards points. For more information about the SVB Rewards Program for Business Credit and Charge Cards, view the latest SVB Innovator Card Rewards Agreement.

3 For complete details about the SVB Innovator Card, including applicable fees and terms and conditions of the Card, please see the SVB Innovator Card Agreement Terms and Conditions for full program details. All credit products and loans are subject to underwriting, credit, and collateral approval. All information contained herein is for informational and reference purposes only and no guarantee is expressed or implied.

All credit products and loans are subject to underwriting, credit, and collateral approval. All information contained herein is for informational and reference purposes only and no guarantee is expressed or implied. Rates, terms, programs and underwriting policies subject to change without notice. This is not a commitment to lend. Certain terms, conditions, exclusions, and limitations apply, including a limit on cash advance capabilities. Additional fees include: Cash Advance — 3% of each Cash Advance amount, but not less than $3 or more than $50; Late Payment — $32 or 2.5% of the charges that have been billed on the periodic statement and remain unpaid for one or more billing cycles, whichever is greater.

4 Money Market Accounts (MMA) are interest-bearing accounts unless otherwise stated. As of December 10, 2025, a 3.30% annual percentage yield (APY) on the Startup Money Market Account * is available for deposit balances of $1,000,000.01 or more. If the Startup Money Market Account has deposit balances between $50,000.01 to $1,000,000.00, a 2.38% APY will be applied to the entire * Startup Money Market Account deposit balance. If the Startup Money Market Account has deposit balances of $50,000.00 or less, a 0.10% APY will be applied to the entire Startup Money Market Account deposit balance. The APY or interest rate depends on the tier associated with the amount deposited in the Startup Money Market Account. You must deposit and maintain the applicable account balance to earn the disclosed APY. Please refer to the Deposit Agreement and Disclosure Statement issued at opening and any updates thereto for more details. Changes to the interest rate and APY on the Startup Money Market Account is at our discretion and are reflected in your account statement. Interest is calculated daily and credited monthly to the account. If you close your account before interest is credited for the month, you will not receive the accrued interest during the month the account is closed. Applicable fees, including those contained in the Product Sheets and Schedule of Fees and Charges provided at account opening, could reduce earnings on the account. Account maintenance fees may apply for each month your balance falls below a disclosed minimum.

5 This material, including without limitation the statistical information herein, is provided for informational purposes only. This information should not be viewed as tax, investment, legal or other advice nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment or to engage in any other transaction.

None of this material, nor its content, nor any copy of it, may be altered in any way, copied, transmitted or distributed to any other party, without the prior express written permission of SVB Asset Management. SVB Asset Management is an investment adviser registered with the U.S. Securities and Exchange Commission (SEC). Registration with the SEC does not in any way constitute an endorsement by the SEC of an investment adviser’s skill or expertise. Moreover, registration does not imply that a registered adviser has achieved a certain level of skill, competency, sophistication, expertise or training in providing advisory services to its clients. SVB Asset Management is a wholly owned, non-bank subsidiary of First-Citizens Bank & Trust Company. For institutional purposes only.

Investment products and services offered by SVB Asset Management:

|

Are Not insured by the FDIC or any other federal government agency |

Are Not deposits of or guaranteed by a Bank |

May Lose Value |

6 $500 monthly credit does not apply to your $50 monthly fee and does not roll over to the next month. Standard fees apply to charges beyond $500 monthly credit. More details on the banking services that the $500 credit can be applied towards is found here. All fees listed here can be applied to the $500 credit except for the Ledger Overdraft fees and the ACH Direct Send File Transmission Implementation fee. For a full list of fees, please contact your Relationship Manager. Eligibility requirements apply for Mobile Deposit.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android, Google Play, and the Google Play logo are trademarks of Google Inc. Mastercard is a registered trademark of Mastercard International Incorporated and is an independent third party. The Contactless Symbol and Contactless Indicator are trademarks owned by and used with permission of EMVCo, LLC.

All non-SVB named companies listed throughout this document are independent third parties and are not affiliated with Silicon Valley Bank, a division of First-Citizens Bank & Trust Company.

Banking and lending products or services are offered by Silicon Valley Bank, a division of First-Citizens Bank & Trust Company. Accounts are subject to credit approval. Restrictions and limitations may apply.