The following article appeared in the Pitchbook-NVCA Venture Monitor report. Read other articles and learn more about our new partnership.

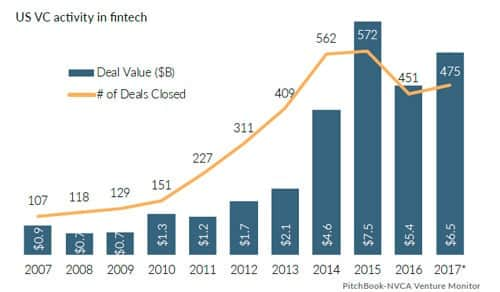

Fintech established itself as a key standout category in 2017, posting the strongest year for investment since the 2015 peak. Aggregate fintech investments reached approximately $6.5 billion in 2017. Major contributing categories have been alternative lending, payments, wealth management, and more recently blockchain/cryptocurrency, insurtech and real estate tech.

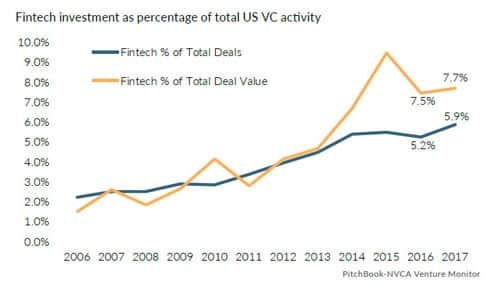

Quarterly global fintech investment as a percentage of total VC investment

The numbers are only part of what’s interesting about the fintech story, with unique challenges relative to disruptors of other major industries. Specifically, scaling has been difficult for fintech companies dealing with compliance and regulatory issues, access to capital hurdles and intense competition from startups and incumbents. Despite these challenges, we believe the investment pace will continue due to two core reasons: increasing customer demand and enabling platform technologies that provide key infrastructure for young fintech companies to launch and grow. These fintech infrastructure companies, analogous to how Amazon Web Services and open source supported software companies, are lowering the barriers to new company creation and helping them scale.

Successful fintech companies are finding that partnerships often are key, including with fintech infrastructure companies—developer-focused platform technologies based on APIs to solve complex operational challenges of providing financial services. These companies use software to leverage existing infrastructure such as payment rails, all types of bank accounts, customer information databases and certain compliance functions. This allows other fintech companies and incumbent banks to focus on building the core aspects of their businesses instead of spending on costly infrastructure, which lowers barriers to entry and promotes innovation.

- Consider processing payments of all types: There’s a patchwork of government regulations that is expensive, complicated and risky. Enter Stripe, a payment processing company for Internet businesses, and Marqeta, an API platform for prepaid debit and credit cards.

- Data aggregation: Consumers and businesses keep their money and investments in myriad financial accounts and are constantly trying to simplify their financial lives. Enter Plaid and Quovo (aggregating account data in an app-based world).

- Customer retention and cross-selling: Finding new revenue streams from current and prospective customers is critical. Enter DriveWealth (natively embedded modern brokerage platform).

Capital invested and number of deals - U.S. fintech companies

While global opportunities abound for fintech, there could be some bumpy times ahead. We will eventually head into a less buoyant economic climate, with interest rates rising and access to capital (potentially) shrinking. Fintech business models will be tested in new ways. We have already started to see the number of deals taper over the past two years.

As with other tech industry sectors, we are seeing a flight to quality: VCs are focusing investment on the “best of breed” fintech companies. In this environment, we believe fintech infrastructure companies are poised to continue to drive innovation in financial services by providing the tools and services that will become even more critical for other fintech companies and incumbent financial services firms to start and survive. These are the fintech companies to watch.