- The length of time for early-stage life science and healthcare startups to raise funds from seed to Series A is widening.

- It is important to find trusted partners who can guide you through this challenging landscape.

- You should plan for unexpected shifts — longer gaps between rounds, valuation fluctuations, macroeconomic changes — and stay flexible enough to adapt quickly.

For many, 2024 began with a sense of cautious optimism that the investment landscape would pivot from the downward and flat trends of 2022 and 2023, respectively. There were hopes that the IPO window would open, and that public markets would be more favorable for healthcare and life science companies spurring more investment in the private markets, specifically early-stage ones. These hopes and expectations were left unfulfilled as private investors shifted towards more mature and established companies with a clearer path to exit or profitability.

At Silicon Valley Bank (SVB), a division of First Citizens Bank, we recognize the difficulty of being a first-time founder. Not only are you expected to bring a new innovative therapy, medical device or healthcare solution to market, but you’re also expected to do it with minimum funds, minimum resources and to hit a bullseye with a moving target.

Widening funding gaps

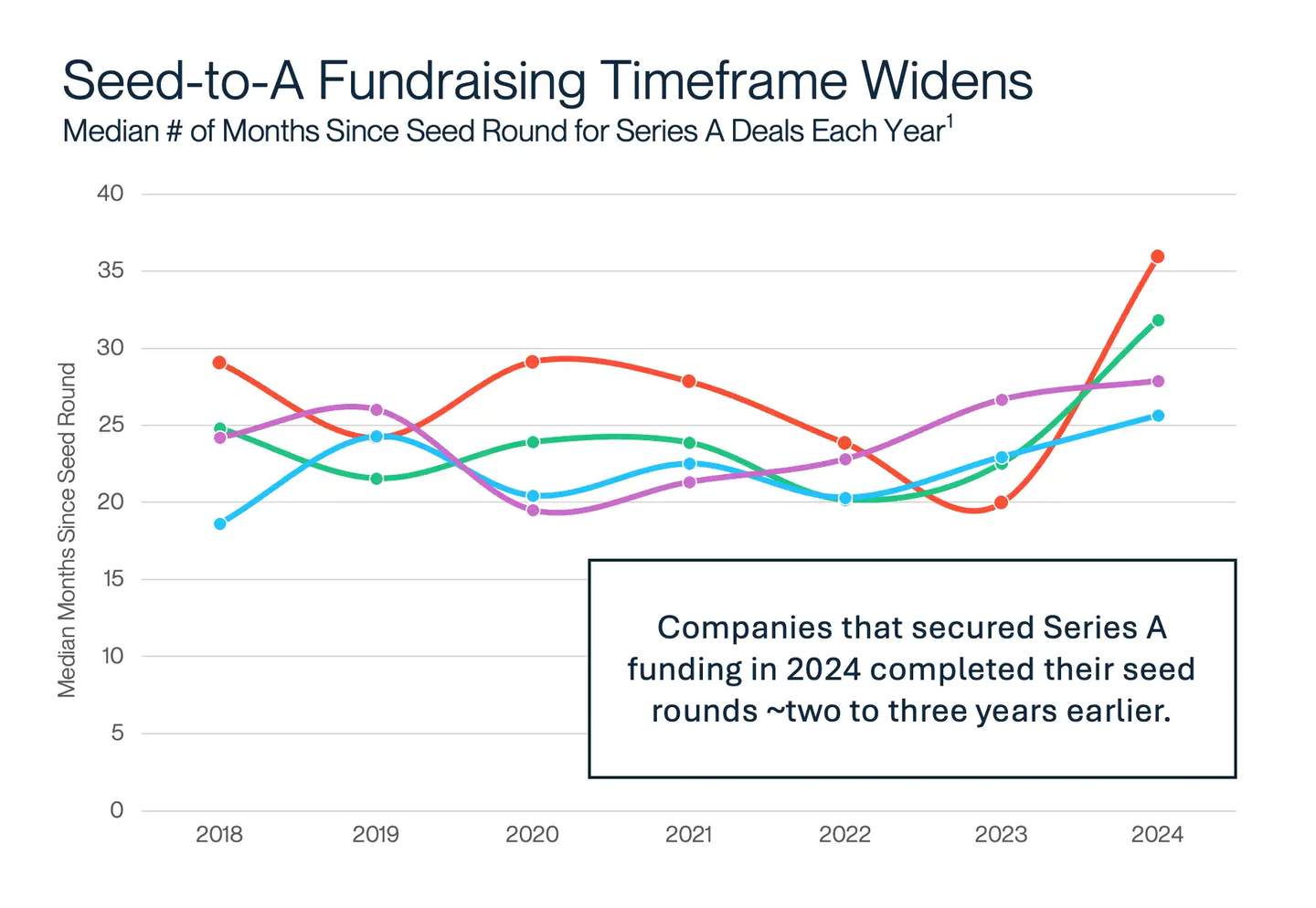

According to our latest Healthcare Investments and Exits report, based on data from Pitchbook and proprietary SVB data, we see timeframes widening with marginal growth in median deal size for healthcare and life science early stages. The chart below, taken from the report, illustrates how the median number of months has increased when raising funds from seed to Series A across all healthcare subsectors.

Note: 1) Analysis provides the timeframe between seed to Series A rounds by showing the median months since seed at the time of a company’s Series A funding round.

Source: PitchBook Data, Inc. and SVB proprietary data.

Trusted partners can help

As a first-time founder facing extended fundraising cycles, you need trusted partners who can guide you through this challenging landscape. At SVB, we're passionate about being your strategic financial ally, offering invaluable insights, industry connections and tailored solutions to help you traverse the widening gaps between funding rounds. Our deep experience in the life science and healthcare sectors positions us uniquely to propel your journey forward, even as timelines stretch and market dynamics shift.

But we understand that success requires more than just financial support. The big question is: How do you find trusted partners? Here are key actions to strengthen your startup's foundation:

- Bring on experts as board members

- Secure the best angel or investor syndicate

- Recruit operators that have experience

- Consult with key opinion leaders

Four key considerations for life science and healthcare founders

As you navigate the current challenges of fundraising, consider these four key areas each with its own set of critical questions and considerations:

1. Strategic partnerships and team building

- Are you getting the right people involved, establishing the right narrative and improving operational efficiency wherever possible for future fundraising?

- Are you aligning yourself with strategic partners or strong institutional funding early so you can lay the groundwork for later raises?

- Do you have access to the broader startup ecosystem to help you make the contacts you need to bring the appropriate knowledge and expertise onboard early?

- Have you identified the key full-time hires to support your work and your fundraising story?

- Are you seeking out experienced service providers who deal with successful companies all the time and can help shape your pitch?

2. Funding strategy and runway

- Do you have enough funding to make it to Series A, considering today’s extended timelines?

- If not, do you have trusted partners who can supplement your funding or improve your operational efficiency?

- Are you forging connections with existing companies or health systems that could potentially act as incubators for your technology?

- What if it takes twice as long or costs twice as much to reach a milestone? Do you have a contingency plan?

3. Leveraging non-dilutive capital

- Are you tapping non-dilutive sources of funding as fully as possible?

- Are you and/or your partners current on funding opportunities from government sources, such as the Biomedical Advanced Research and Development Authority (BARDA), Congressionally Directed Medical Research Program (CDMRP), National Institutes of Health Small Business Education and Entrepreneurial Development (NIH SEED) program or Advanced Research Projects Agency for Health (ARPA-H) grants?

- Have you considered outsourcing your grant writing to a trusted partner expert who can help increase your chances? These experts know how each government agency operates differently and can structure your grant to fit their criteria.

4. AI integration and investor appeal

- Are you leveraging AI in a way that is attractive to investors?

- AI is now table stakes for early-stage companies. Is your company built from the ground up to accelerate AI and use it to inform all decisions (including hiring and headcount needs)?

- Are you communicating clearly what proprietary data set you’re using and how unique it is in the space?

- Do you know how to build your AI to native versus AI-enabled?

Mapping a changed funding landscape

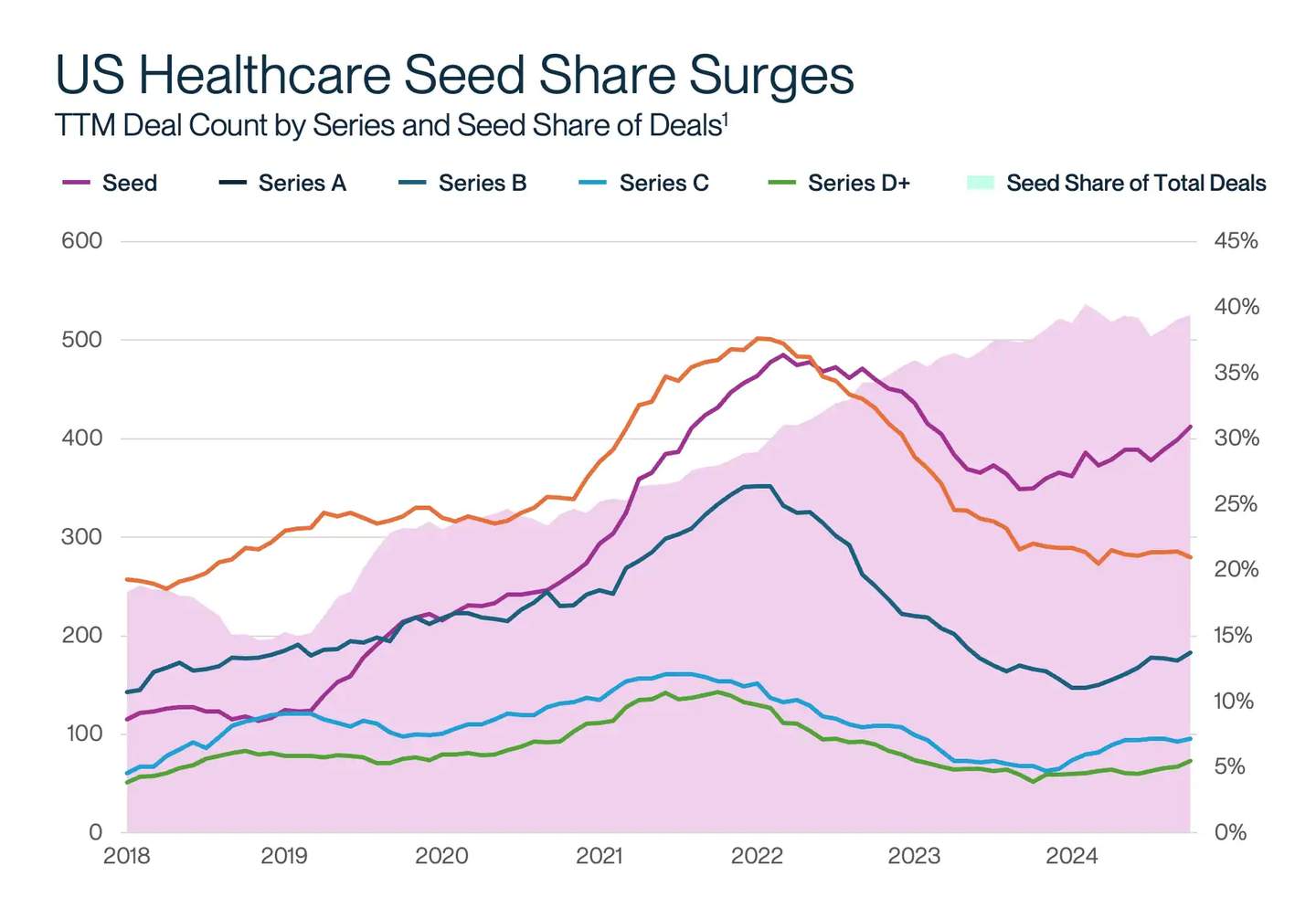

As healthcare startups work to bridge this widening gap in fundraising, an increasing number are raising additional seed rounds (i.e. Seed Extensions, Seed+, etc.). As a result, seed-stage companies are receiving greater share of overall deals in the healthcare space. In 2024, they accounted for nearly 40% of all deals, up from just 26% in 2021 (refer to the chart below).

Note: 1) Analysis includes only rounds with a declared series round.

Source: PitchBook Data, Inc. and SVB proprietary data.

However, the trends aren’t consistent across sectors:

- Biopharma is rebounding more strongly than healthcare as a whole, the ratio of seed to Series A deals is closer to 1:1. Biotech companies are receiving fewer seed investments than other sectors, but those deals have generally been larger and higher stakes. Proposed changes to federal funding support for early-stage bio innovation and administration changes at federal health agencies could also lead to increased time, cost and uncertainty as growth-stage biopharma companies navigate the funding environment.

- Healthtech saw roughly twice as many seed deals as Series A. Still, valuations in healthtech are generally lagging other sectors.

- Diagnostics and tools seed funding remains relatively flat, though there are some glimmers of potential for future growth.

- Device saw a significant increase in recent months since seed round raised paired with the lowest proportion of companies leveraging AI. Is there an opportunity for AI to impact device sector lagging behind the others?

What the current landscape means for early-stage life science and healthcare founders

The flight to established players and high quality means it’s more important than ever to plan your funding strategy carefully. At each stage, you must be sure you have what you need to reach the milestones and valuation inflection points necessary to progress to the next one, as well as access to funding to bridge any gaps that may arise unexpectedly. That includes fully understanding your revenue model and being able to articulate how it plays into current industry trends. For example, device and diagnostics tools companies should be able to demonstrate a well-thought-out plan for navigating reimbursement long before they reach commercialization.

Fulfilling all your needs during a seed round can involve more than just getting the largest total-dollar funding. Assembling a solid team of experienced investors onboard early can help lay the groundwork for easier rounds down the line. The right service providers can help you establish a narrative that will appeal to venture capital investors — and ensure you maintain enough operational efficiency to stretch your funding even further as you do so.

“With the fundraising landscape constantly evolving, founders must ensure they maximize their seed round(s) to prepare for what’s ahead. That means planning for unexpected shifts—longer gaps between rounds, valuation fluctuations, macroeconomic changes—and staying flexible enough to adapt quickly,” says Jennifer Friel Goldstein, SVB Head of Relationship Management Technology and Healthcare Banking. “The best way to stay ahead is to build a strong contingency plan and develop the foresight to navigate both the unpredictable and the unlikely but possible scenarios.”

Final thoughts – Stay flexible

Markets are always changing, and early-stage life science and healthcare startups need more than just a promising product or therapy to survive. The quality of your team matters — your investors are betting on them as much as they are on your technology. Every problem is amplified, and dollars are short.

As an early-stage life science and healthcare founder, you're facing strong headwinds in an increasingly challenging fundraising environment. Though investors continue to focus on companies with a clearer path to exit or profitability, there are signs of seed investments improving for early-stage life science and healthcare startups.

Some key considerations to be attractive to seed investors are to build your team with trusted partners who can offer deep market understanding, fundraising experience, networking opportunities, as well as the flexibility and foresight that can help you adapt to unexpected changes.

At SVB, we're optimistic about the future of life science and healthcare startups. Our deep industry knowledge and extensive network position us as your ideal partner in turning possibilities into realities. Together, we can navigate challenges and seize opportunities in this dynamic landscape.