- Despite growing investment in women's health, access to capital in general has remained limited.

- Extending funds to bridge between rounds is increasingly challenging in the current fundraising environment, particularly for early-stage women's health startups.

- Women’s health startup founders should consider multiple options for funding, such as non-dilutive funding options.

SVB Startup Banking supports pre-seed to seed-stage companies as they approach the critical inflection point of raising a Series A round. For all founders, raising a Series A round is particularly high stakes because capital is essential for accelerating growth. Unfortunately, women's healthcare founders have struggled to raise an institutional round. In fact, access to capital in general has remained limited, despite growing investor interest.

The investment trend looks promising

According to the findings in our Women’s Health Report, that trend is changing for the better. The flow of investment dollars hit new heights for women’s health-focused startups in 2024. As the latest report says, “Investment in women’s health is gaining momentum, even if there is a lot of work to be done to close the gap in care for women. Not only was 2024 the largest year for investment by more than 55%, but the money is being spread around in a way that more closely resembles the wider healthcare industry... The difference between women’s health and all healthcare reduced significantly in 2024, with seed and Series A deals accounting for 70% and 67%, respectively.”

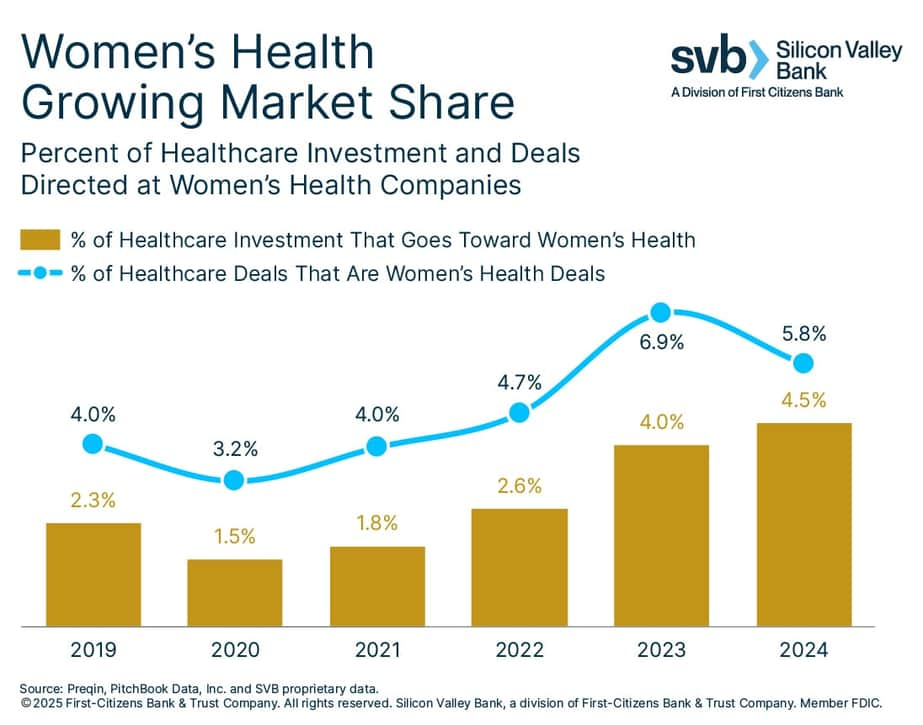

The chart below shows that the percentage of healthcare investment for women's health has grown steadily since 2020. Likewise, the percentage of healthcare deals has increased, despite a 1.1% decline between 2023 and 2024. Although the data shows a momentum shift in growing market share for women's health investments and deals, the chart may not be representative of the current struggles early-stage founders experience to raise funds. For that reason, early-stage women's health startups should plan for fundraising using a multipronged approach.

Funding options: Dilutive and non-dilutive

While the progress is promising, it underscores how heavily women’s healthcare startup founders rely on early-stage capital. And in today’s tightened venture environment, where many funds are prioritizing later-stage bets, founders need more than traditional venture capital (VC) to move forward. Extending funds to bridge between rounds is increasingly challenging in the current fundraising environment, particularly for early-stage startups.

Women’s health startup founders should consider multiple options for funding, such as non-dilutive funding options. Here’s a list of dilutive and non-dilutive options to consider:

- NIH Seed

The National Institutes of Health (NIH) offers SBIR/STTR grants designed for early-stage innovation. These can be particularly helpful for scientific validation and research and development (R&D)-heavy women’s health startups, and don’t require founders to give up equity. We have a series dedicated to non-dilutive capital options, including NIH Seed, BARDA, CDMRP and ARPA-H. - Grants and philanthropic capital

Public and private sector grants, including those from organizations like the Gates Foundation or Health and Human Services (HHS) — are increasingly targeting maternal outcomes, reproductive health and diagnostic access. These funding streams are competitive but can be powerful for mission-aligned startups. - Other non-dilutive resources

Revenue-based financing, milestone-driven corporate partnerships, and early commercial pilots can provide working capital without dilution. These alternatives may require strong early traction, but they’re increasingly viable for healthcare companies with a clear go-to-market path. - Angel checks – Dilutive, but strategic

Angel investors continue to be a vital capital source for women’s healthcare startup founders. These early supporters often invest through SAFEs or convertible notes and can bring more than just money. They often offer access to networks, advice and early validation. In many cases, angels are more flexible than institutional VCs and may be motivated by personal conviction or mission alignment, especially in underserved sectors like women's health.

Cultivating these relationships often starts well before a raise: through communities, pitch events, warm introductions or operator circles. The goal isn’t just to secure capital, but to bring on early believers who can champion your vision as you scale.

An SVB hosted panel discussion on women’s health

At SVB, we understand the importance of healthcare startup founders to network with potential investors. To that end, we host and participate in many panel discussions and events on women’s health throughout the year.

Positioning for success

In a market where institutional capital is harder to access, early-stage women’s health companies are finding momentum by diversifying their fundraising strategy. Knowing when to pursue non-dilutive versus dilutive funding and being intentional about your storytelling, traction and network can make the difference between waiting for capital and unlocking it.

Because at the end of the day your network is your net worth, and early capital is as much about relationships as it is about resources.

Final thoughts

As explored throughout this article, there are a variety of alternative funding paths available to founders in the women's health space, each with its own unique advantages and trade-offs. Ultimately, where and how you raise capital is shaped less by a single formula and more by the strength of your network and the alignment between you, your vision and your long-term strategy.

The value of connection cannot be overstated. Every conversation, no matter how casual, has the potential to unlock new opportunities.

At SVB, we’re committed to giving early-stage founders access to these critical conversations, helping build the relationships that can fuel growth, innovation and create a lasting impact.