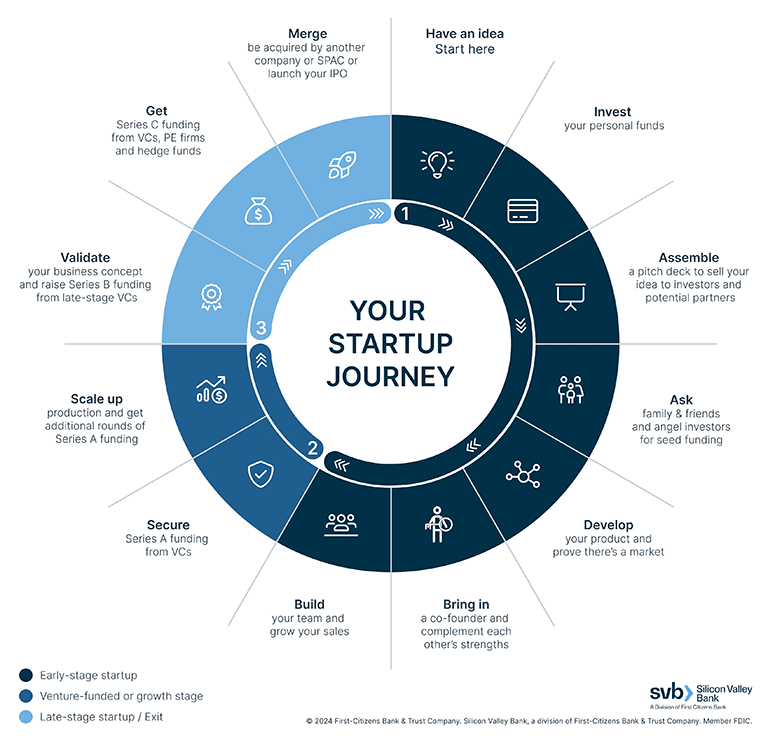

- There are three startup stages: early-stage, venture-funded (growth) stage and late-stage.

- Moving from early-stage to venture-funded stage is well delineated, but other phases are only loosely defined.

- Knowing where you are along the continuum helps you anticipate what’s coming next and prepare accordingly.

What is the lifecycle of a startup?

An early-stage startup is launched to evolve an idea with the potential for significant business opportunity and impact. Sometimes the idea is a flash of insight, but more often, it begins with extensive development of an idea or solution to a meaningful problem with an identifiable market. This phase often involves forming a small, committed team working toward launching the initial product.

The venture-funded stage starts with securing Series A funding, which marks the transition from potential to expected performance. The company typically scales its operations, hires more staff, and establishes a sales function to grow, expand the customer base, and prepare for further funding rounds.

The late-stage company now relies on dependable financing and emphasizes performance. This stage involves potential for product line expansion, entering new geographies, or considering acquisitions to drive further growth. Depending on the stakeholders' goals, founders and investors at this stage may also consider an exit strategy, such as an IPO or selling the company.

Knowing where you are along the continuum is useful, particularly for early-stage startups. Your position can help investors, partners, prospective employees and others frame their thinking about your current growth and potential for success. Fundraising throughout the process is always a challenge, so start with a solid idea, a clear business plan and a strong founding team. With these in play, your probability of success can increase.

As the startup progresses through the different stages, the expectations and dynamics shift significantly. The following paragraphs will explore the three stages of a startup lifecycle in greater detail.

The early-stage startup begins with a scalable idea that attracts funding

This early-stage startup phase begins with a potentially scalable idea for a product or service targeting a market that is poised to generate value. Your team may be small, just you and one or two other people. Although there is no formal structure or solid commitment to the concept or business, you and your team are trending in the same direction and are eagerly building the foundations for a launch.

When you're part of an early-stage startup phase, recognize that your investment of time, money, ideas, rent, supplies, equipment and even business relationships may all be at risk. Raising funds can be difficult at this stage, but there are ways you can kick-off your fundraising efforts to help pay necessities. One way to raise funds that reflects your commitment in your startup is to put your own money into the business. A second strategy is to ask family and friends to help fund your startup venture. There is a right way to approach family and friends, so be sure you know how to make the ask.

Now is when you define your vision and mission, establish key milestones and develop a schedule for reaching these goals. Core co-founders with complementary skills are committed to the company, and you are building a foundation to develop your initial product or service.

Later in the early-stage — after you’ve developed your product, a network and possibly some sales — an accelerator may be a good choice. Accelerators can help if you have limited business experience, a small network of professional contacts, or are in an unfamiliar market or sector. The purpose of a startup accelerator is exactly that: to help accelerate your startup’s growth. It’s a mentor-based program that provides intensive guidance, support and structure for a set period, typically three months.

When you apply to a startup accelerator program, you are expected to have more than an idea. Ideally, you'd have a prototype or an actual product. In exchange for 5%-10% of your equity, you can gain exposure to a wide range of advisors and experienced entrepreneurs who’ll help you develop your product, hone your business model and — most importantly — connect with investors. The goal is “demo day,” which is when you’ll present your idea to potential investors and other interested parties, including the media.

Investors in the early-stage — angel and venture capitalists — are taking on a lot of risk and want to be convinced that you have a solid product, an identifiable market and a business plan — with a strong team to execute it. Because of the enhanced risk component, the early-stage of fundraising often takes a long time, and it frequently involves assessing a range of financing options. What characterizes the early-stage more than anything is that you are still lining up the proof and performance metrics you need to create an intriguing pitch deck for seed money or Series A funding.

You’re in this stage if you’re:

- Building and deploying a product with early customers

- Demonstrating market fit for your product

- Proving out the sales dynamics that will support efficient growth

- Ensuring you have the team in place to execute

You can graduate to the next stage when you’re:

- Focusing on KPI-based measurable growth

- Expanding your customer base and need to scale production

- Building your team with designated roles and responsibilities

- Pursuing Series A financing with a succinct pitch deck based on your success

A venture-funded startup is expected to hit milestones

The venture-funded startup phase begins when you receive your first Series A round — each round is usually an 18- to 24-month period. Your first round is very significant in establishing a fundraising foundation that may help attract future investments.

You enter this phase when a Series A investor believes your company has a great product or service and you have a plan and the talent to scale. Your company is now making a complex transition from having the potential to scale to one that is expected to hit milestones laid out to investors. You may have additional Series A funding rounds, but the first round is often the most influential.

Series A funding enables you to build out your team and infrastructure to support your growing operation. Establishing your sales function is one of the main activities during the Series A phase. To scale smoothly, answer these questions early in your business plan: When do you hire more staff? How do you expand your marketing? Will you need to expand your physical space or technology infrastructure?

Another consideration you’ll want to be prepared for is determining whether you want to take on venture debt. A decision like this shouldn’t be made hastily. Turn to your advisors and your financial partner to help guide you on taking venture debt. It could be beneficial to bridge you financially between raising another institutional round.

The scaling process can be unpredictable — it's important to remain agile and willing to pivot quickly from obstacles and take advantage of opportunities. As a founder, you'll also focus on the big picture. Smaller tasks will need to be reassigned so you can focus on leading the company through the growth phase.

You’re in this stage if you have:

- A working product

- Proven product ROI

- Evidence that sales cycles are fast, and sales are efficient

- Secured Series A funding

You can graduate to the next stage when you’ve:

- Achieved significant growth

- Hired a more complete team, including sales

- Attracted incremental rounds of Series A funding

- Shifted corporate attitude from operating a risky startup to building a company with sustainable growth

For late-stage startups, it's all about performance

A late-stage startup typically has dependable financing sources and is executing on the business plan. When pitching investors for Series A funding, it’s all about potential. Now it’s all about performance. Investors are typically traditional venture capitalists, private equity firms, growth firms, corporate venture capitalists and family offices.

If your initial venture-funded stage has been successful and you have secured Series A funding, your company has demonstrated your ability to grow. In the context of an enterprise, this usually means that you have all the basic sales, deployment and support teams in place.

At this point in the startup life cycle, perhaps you’ve hired a CEO who is better equipped to manage the day-to-day operations. Fractional hiring is another consideration and an option to hire experienced professionals on an as needed basis. Other staff are also in place, and your business has now firmly established its presence within the industry.

Although your company is up and running, it needs more fuel to exist. Your primary focus will need to be on fundraising and hiring talent.

As a founder, you're facing other decisions, too. Do you push for further expansion? For example, consider expanding your product mix or entering new geographies as you capitalize on your stability. If you decide to expand further, you will need to ask yourself how the business can sustain more growth through acquisition or additional fundraising. Do you go public to raise the necessary funds? Are there other opportunities? And are you financially stable enough to survive the risk of an expansion that doesn’t go as planned?

At this point in your journey, you could also consider exiting the business. Many founders and their investors at this stage look to move on through a sale or an IPO. You’ve worked hard to build your business. It may be time to realize the value of what you’ve built.

You’re in this stage if you are:

- Completely staffed

- Experiencing significant growth

- Looking for expansion opportunities

- Considering an exit

You can graduate to the next step when:

- You can raise funds based on performance, not just potential

- You can expand your business through organic growth or acquisition

- You’ve prepared your company for an IPO

- You’re an attractive acquisition target

Conclusion

Your experience may or may not include all of these three stages of the startup life cycle. Depending on your product and degree of success, it may take years to grow beyond Series A. On the other hand, you may experience phenomenal growth immediately and decide to cash out with an exit.

For many startups, however, you’ll progress along this continuum and reach each of the three stages in the startup life cycle. Being aware of your spot on the journey can help you prepare for what’s next and optimize your chances for success.

FAQs

The startup timeline has three core stages: Early stage, where a scalable idea is developed, a small team is formed, and seed funding is raised. The venture-funded stage begins with Series A funding, scaling operations, expanding the team, and achieving significant growth. Late-stage focuses on dependable financing, performance, potential expansion, and planning exit strategies like IPOs or acquisitions. Each stage presents unique challenges and growth opportunities.

While we focus on three main stages—early-stage, venture-funded, and late-stage—here are the seven commonly referenced stages: Pre-seed (defining the idea and pitching), Seed (initial funding and prototype development), Early (small team formation and market fit), Growth (Series A funding and scaling), Expansion (entering new markets and growing), Maturity (stable revenue and efficiency), and Merger and Acquisition (considering exit strategies like IPOs or selling the company).

The five stages of an entrepreneurial startup process include: Idea Generation, where the business concept is developed; Opportunity Evaluation, assessing the viability and potential of the idea; Planning, creating a detailed business plan and strategy; Company Formation/Launch, establishing the business entity and launching the product or service; and Growth, scaling the business, expanding the market, and increasing revenue. Each stage is crucial for startup success.

To evaluate your business idea's viability, research the market demand, identify your target audience, assess the competition, and validate the concept through surveys or prototypes. Analyze financial projections for profitability and seek feedback from industry experts.

Common challenges include managing cash flow, scaling operations, maintaining product quality, hiring the right talent, and adapting to market changes. Balancing rapid growth with sustainable practices is crucial.

Securing funding involves different strategies at various stages: bootstrapping or seeking seed funding from friends and family in the early stages, approaching angel investors for initial growth, and securing venture capital or Series A funding as you scale.

To scale effectively, focus on building a robust infrastructure, optimizing processes, hiring skilled employees, leveraging technology, and maintaining a strong customer focus. Develop a scalable business model and seek strategic partnerships to support growth.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB. All non-SVB named companies listed throughout this document are independent third parties and are not affiliated with Silicon Valley Bank, a division of First-Citizens Bank & Trust Company.

This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.