Key Takeaways

- Given the Federal Reserve’s aggressive pivot to a more restrictive monetary policy in early 2022, last year’s portfolio theme was all about getting defensive on duration.

- The macro environment is shifting, and now we see an opportunity to extend duration and lock in yields.

- We think that investors need to pay attention to reinvestment risk, particularly if lower yields are in our future.

This month’s main article, Shifting from Defense to Offense, focuses on future monetary policy shifts from the Fed and how tactically extending duration to reduce reinvestment risk may be a strategy for locking in yield.

Also included are the following themes:

Economic Vista: 2023 Portfolio Themes — Shifting from defense to offense

If 2022 was the year of being defensive on portfolio duration, 2023 is shaping up to be more about playing offense. By that we simply mean that now looks like the right time to consider extending duration in your portfolio and locking in attractive yields.

You may be wondering how we came to that conclusion in this era of heightened volatility. By looking at where yields are today and then overlaying that with a macro view, we can formulate an effective strategy on how to position portfolios for the year-ahead.

Given the Federal Reserve’s aggressive pivot to a more restrictive monetary policy in early 2022, the portfolio theme last year was all about getting defensive on duration in the face of sharply rising interest rates. This meant shorter maturities and a greater allocation to overnight investments, which not only helped to mitigate unrealized losses, but also allowed us to have cash available to play offense at the appropriate moment and take advantage of higher rates. Now just might be that time!

Why? It appears that the Federal Reserve front-loaded its interest rate increases and is now nearing the end of the rate-hiking campaign. If that’s the case, we think it would be smart to lock in elevated yields ahead of the next inevitable rate cut pivot. As always, there are diverging views on if and when those cuts might ultimately arrive. For example, the Fed itself has been suggesting no rate cuts for 2023 but is factoring in the possibility of 100 basis points (bps) of rate cuts in 2024 and 2025. On the other hand, the bond market is pricing in an earlier timeline on when the Fed will likely pivot, as the market is pricing in rate cuts towards the end of 2023.

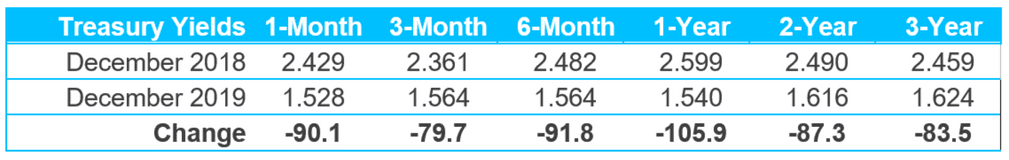

Who will be right? Although we don’t have a crystal ball, it’s a safe assumption that at some point the Fed will be forced to cut rates again to stimulate what looks to be a slowing economy. So even if the timing is yet to be determined, it seems like a good idea to lock in attractive yields rather than over-analyze and debate the issue. We can also look back and use 2019 as a great example to help us confirm our strategy. This was a time when the Fed had to pivot to a more accommodative stance after their rate hikes in 2018. Here’s what we learned:

- At the beginning of 2019, maturities from 1 month to 7 years were yielding around 2.4%.

- By the end of the 2019, the Fed had cut rates 75 bps and bond yields were 80 to 100-bps lower.

- Anyone who bought a 3-month bill probably wished they would have bought a 3-year note instead.

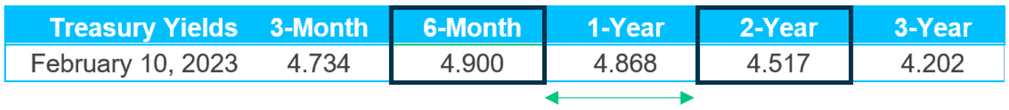

Is history repeating? Currently we are seeing similar temptations in the front-end where 6-month bills are yielding close to 40 bps more than 2-year notes. However, the consensus among more than 40 Wall Street strategists is for the 2-year note to be yielding around 3.69% by the end of 2023.

As far as we’re concerned, we believe that one of this year’s critical themes centers around reinvestment risk. If yields in the future are going to be lower, future bond maturities will be reinvested into lower yields and result in lower portfolio income.

From a portfolio construction standpoint, we are still taking a disciplined approach to duration management. However, this year we have been tactically adding duration to lock in current yields. Even though there is still uncertainty when it comes to timing of future rate cuts, we believe that in one year from now rates are likely to be lower. Some pundits feel that rates will be lower because inflation will continue declining, thus allowing the Fed to be less restrictive. Others believe that the U.S. economy is headed for a recession and the Fed will be forced to cut rates to help spur growth. Regardless, it appears that the general direction of rates will soon turn lower.

As income protectors, we are still taking advantage of the attractive bond yields in the front-end such as commercial paper which is yielding over 5% but we are also thinking ahead and wanting to protect future portfolio yields. That’s why we’re not hesitating to be offensive on duration — finally.

Credit Vista: Tuning out the noise

Investment grade credit over the last two years has affirmed its position as an excellent place to park excess cash, even if overall returns have been uninspiring. Now we’re hearing some “noise” that the lower end of the credit markets, particularly distressed credit, is in store for pain. Yet despite all the uncertainties and the general skittishness prevalent across financial markets, we believe that investors can largely ignore the rumblings impacting the lower-credit tiers of the fixed income markets—for now.

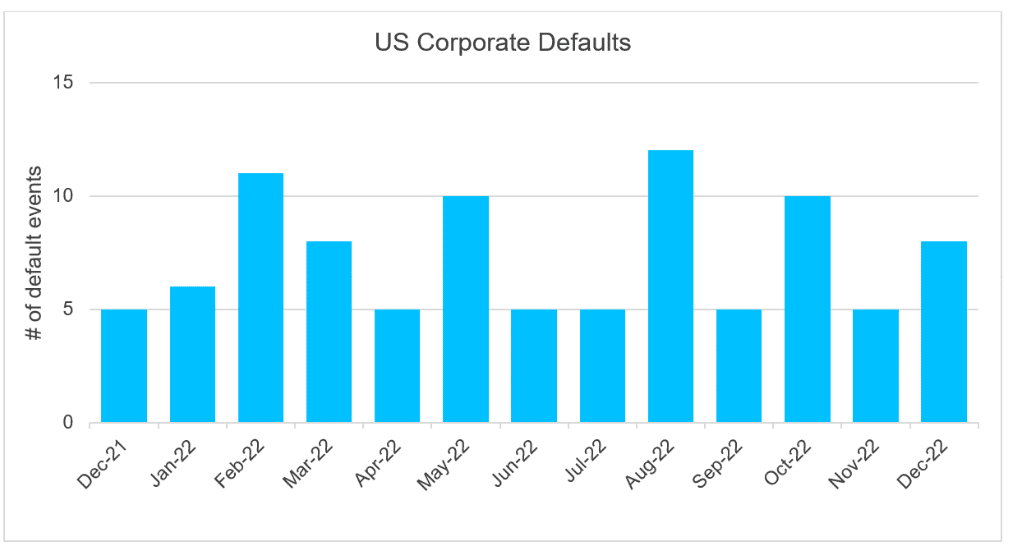

We focus most of our attention at the lowest end of the credit spectrum in the distressed exchanges. According to Moody’s, the number of distressed issuers failing to work out a deal with creditors and thus defaulting on obligations doubled in the fourth quarter of 2022. However, if we look closer, the actual notional value of the debt in question was less than the prior quarter, and nearly three-quarters of these were repeat defaulters. This helps allay our concerns.

While we fully expect the default rate for credit to rise, especially in the lowest-rated debt tier, we remain at very low levels in the context of historical averages. Tightening economic conditions may accelerate the default rate in the riskiest debt, but this low-ranked debt is far below the investment-grade universe and seems unlikely to cause significant ripple effects.

It's important to remember that distressed debt is structured (and performs) differently than investment-grade credit. A distressed situation is already in conversation with creditors for restructuring and a good portion of it is backed by private equity vehicles. Distressed credit sits one level lower than high-yield debt, and two tiers below investment-grade. Thus, we view distressed exchanges as an indicator of credit conditions at the far end of the credit spectrum. Moody’s projects that defaults in high-yield credit, the slice above distressed, will rise to roughly 5% by year-end 2023. But that’s only one percentage above the historical average.

It's easy to understand if that makes investors a bit jittery. After all, financial market volatility erodes investor sentiment and often disrupts borrower’s access to funding. Recent economic reports suggest a slowdown in economic activity, which in turn negatively impacts business sentiment. A challenging political climate and brinksmanship over the debt ceiling adds to the uncertainties, while the war in Eastern Europe has kept commodity prices elevated.

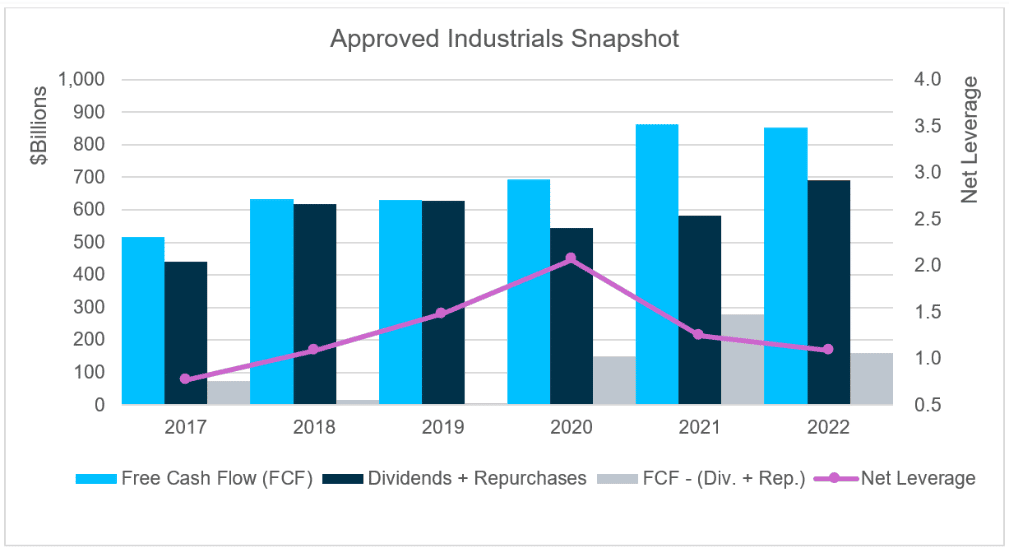

All this can chip away at investor confidence. However, it’s important to remember that SVB Asset Management’s approved-issuer list is a carefully selected and well vetted group of issuers, many of whom have made meaningful credit improvements during the recent period of accommodative monetary policy. Moreover, our approved issuer list appears to be well insulated from the challenges facing the lowest end of the credit spectrum. Of course, we continue to monitor distressed credit and all tiers of the market, but we remain constructive on higher quality investment-grade credit and feel comfortable tuning out the noise at the lower fringes.

Trading Vista: Improvement, technically speaking1

Jason Graveley, Senior Manager, Fixed Income Trading

There has been a lot to unpack to start 2023, but the turn of the calendar has brought some new market technicals that investors have been hoping for. While investors have embraced positive returns across both domestic bonds and equities, skepticism lingers around the Federal Reserve’s resolve and the pace of future rate hikes. The most recent remarks by Chairman Powell, at the press conference following the February FOMC release, were largely perceived as a less hawkish pivot and further ignited a rally in risk assets. The S&P500 and Nasdaq have risen approximately seven and 12%, respectively, during January as financial conditions have eased. This is in stark contrast to year-end 2022, where stocks closed at their steepest losses since 2008.

This positive equity backdrop has also allowed corporate issuers to take advantage of lower volatility for funding needs. As mentioned in last month’s article, new deals price aggressively when issuers believe they have optimal market conditions to attract investors, and in general, appetite for risk assets accelerates as market conditions and sentiment improve. January primary markets saw lower benchmark yields across the curve, tightening spreads, lower new issue concessions and higher oversubscription levels compared to 2022 averages. As a result, January finished as the second busiest month on record, with the $144 billion in investment grade issuance. Only January of 2017 was busier when $174 billion was placed. The amount of liquidity in the front-end is also worth noting, as investors can exit their overnight vehicles and push into the short duration market at any time that yields compel them to do so. Estimates show government money market funds increasing to $4 trillion at year-end, while the Fed’s reverse repo facility set a record high of $2.55 trillion.

Although January served as a bit of a Goldilocks market for participants, risks remain. Specifically, markets are keeping the divergence in rate expectations and the unresolved debt ceiling debate in its periphery. Chairman Powell stated for the first time that the “disinflationary process has started,” although the two CPI prints between this FOMC meeting and the March date could challenge that narrative.

It is also worth noting that both traders and the Federal Reserve are not aligned on the “higher for longer” mantra. Despite the repeated assertions from Federal Reserve officials and Chairman Powell himself that rate cuts are unlikely in the short-term, market implied probabilities are showing a likelihood of a rate hike pause after March and lower rates as soon as November. The highest yielding point on the curve remains the on-the-run 6-month Treasury bill at a 4.77% yield, which when compared to the 2-year Treasury yielding 4.07% best visualizes the market’s bet on monetary policy. Additionally, the debt limit fight is ongoing in Congress. Although it is early in the process and has not had any effect on Treasury bill valuations yet, this will change if negotiations drag on and the Treasury approaches its technical default date in the latter half of 2023. It was only a decade ago that S&P downgraded the credit rating of the United States, citing the same partisanship that is often quoted today. So, while investors have cheered the turn in calendar and risks appear better socialized than in 2022, there are still plenty of risks in full view.

_____________________

1Sources Bloomberg

https://www.wsj.com/market-data/stocks/us/indexes

https://www.cnbc.com/2022/12/29/stock-market-futures-open-to-close-news.html#:~:text=Final%20market%20stats%20for%202022&text=down%208.78%25%20for%20the%20year,down%204.17%25%20for%20the%20month

https://markets.jpmorgan.com/research/email/r7mr799h/rKm5ORu5B2nPtlOmX3zjUQ/GPS-4300160-0

https://www.bloomberg.com/news/articles/2023-02-01/fed-traders-see-half-point-cut-pivot-over-second-half-of-year

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html?redirect=/trading/interest-rates/countdown-to-fomc.html

Markets |

|||

|---|---|---|---|

| Treasury Rates: | Total Returns: | ||

| 3-Month | 4.64% | ICE BofA 3-Month Treasury | 0.31% |

| 6-Month | 4.89% | ICE BofA 6-Month Treasury | 0.34% |

| 1-Year | 4.65% | ICE BofA 12-Month Treasury | 0.35% |

| 2-Year | 4.20% | S&P 500 | 6.28% |

| 3-Year | 3.90% | Nasdaq | 10.73% |

| 5-Year | 3.62% | ||

| 7-Year | 3.57% | ||

| 10-Year | 3.51% | ||

|

Source: Bloomberg and Silicon Valley Bank as of 1/31/2023. |

|||