- The Supplementary Leverage Ratio (SLR) remains a vital regulatory tool for financial markets, but it has also produced some unintended consequences.

- Reforms are being discussed with the goal of enhancing liquidity and market function without sacrificing the invaluable safeguards provided by the SLR.

- Reforms may include easing leverage rules and eliminating central bank reserves and Treasuries from the SLR calculation to provide added flexibility during periods of stress.

Economic vista: What’s the scoop on SLR?

Jose Sevilla, Senior Portfolio Manager

The economy is complex and always evolving, so it’s no surprise that we need dynamic financial regulations that can keep pace with changes to maintain stability across markets. A prime example is the Supplementary Leverage Ratio (SLR), which was introduced after the global financial crisis (2008-2009), and has become a crucial tool for limiting risky behavior in the banking sector. But is the SLR a tad outdated, and what’s the story on the proposed reforms?

The SLR states that banks must hold a certain amount of capital compared to their total exposure, regardless of the perceived risk of their assets. Its purpose was to prevent the type of excessive leverage that contributed to the global financial crisis, serving as a safeguard to ensure that banks maintain adequate amounts of capital reserves. However, the SLR has, in recent years, created some unintended consequences that sometimes hinders banks from acting as effective intermediaries. This could potentially impact market stability in a crisis. Today, proposed reforms aim to address these issues in hopes of creating more stable financial markets and unlocking opportunities for fixed income investors. In this article, we explore the origins of the SLR, outline the current reform proposals and assesses the potential impact on the Treasury and broader bond markets.

Background: The origins and mechanics of the SLR

The global financial crisis revealed that many banks remained highly leveraged despite appearing well-capitalized under risk-weighted frameworks. In response, regulators developed the SLR as a non-risk-based capital requirement that would serve as a backstop to prevent excessive leverage, no matter how safe a bank’s assets might seem on paper. Introduced to the US in 2014 as part of the Basel III reforms, SLR required banks to have a minimum amount of high-quality capital (Tier 1) compared to their total on-balance and off-balance sheet exposures, which includes US Treasuries and central bank deposits.

In the US, the minimum SLR is 3% for most large banks. However, for Global Systemically Important Banks (G-SIBs), more stringent thresholds apply — a 5% requirement at the holding company level and 6% at insured depository institutions. The SLR is calculated by dividing Tier 1 capital by a bank’s total leverage exposure, which includes not just loans and securities, but also derivatives, repo positions and certain off-balance-sheet exposures. The intent is to ensure that no amount of accounting maneuvering or risk-weighting can obscure the true size of a bank’s obligations.

Why is reform being considered?

Following the Fed’s large-scale asset purchases and a surge in government debt issuance, banks have been inundated with high-quality, low-risk assets like US Treasuries and central bank reserves. Although these instruments are crucial for financial stability, they still count fully toward the SLR denominator. This inflates banks’ leverage ratios and discourages them from holding or trading Treasuries, particularly in times of market stress. So, while the SLR aims to curb high-risk behavior, it can undermine liquidity in one of the most important global asset classes. During the COVID-19 pandemic and in an effort to support credit availability during the pandemic-induced turmoil, regulators temporarily excluded US Treasuries and reserves from the SLR calculation. This allowed banks to expand their balance sheets without breaching regulatory thresholds, facilitating continued lending and market-making.

However, when the temporary SLR “relief” expired in March 2021, concerns resurfaced that leverage constraints might again reduce banks’ capacity to act as intermediaries in the Treasury market. Despite its reputation as the world’s most liquid bond market, the US Treasury market has experienced notable episodes of elevated volatility and temporary dysfunction. Market participants widely attribute these episodes to regulatory capital constraints, including the SLR, which have limited banks’ ability to absorb sudden surges in Treasury supply. Because the SLR treats all assets the same, banks are penalized for holding risk-free reserves, which are viewed similarly to other types of riskier debt through the SLR lens. Critics argue that this approach discourages prudent behavior, such as maintaining large buffers of liquid assets or supporting repo markets, which are essential sources of short-term funding in the financial system.

Reform proposals under consideration

There's an ongoing debate among US regulators about reforming the SLR, with the goal of modernizing and mitigating its unwanted effects while still preserving its essential role in preventing banks from taking on excessive leverage. A highly debated proposal is the permanent exclusion of central bank reserves and US Treasury securities from the SLR calculation. Advocates contend that these risk-free assets should not be treated the same as riskier exposures. Excluding them could release bank capital, potentially strengthening their ability to absorb shocks and support Treasury market liquidity, particularly during times of stress. However, critics warn that such exclusions could dilute the SLR's role as a simple, risk-neutral capital requirement. Critics also note that while Treasuries and reserves have minimal credit risk, they are still vulnerable to interest rate fluctuations, especially on longer duration assets. Thus, some experts question whether these reforms would materially improve market stability during times of stress.

To address these concerns, regulators are also considering changes to the Enhanced SLR (eSLR) applicable to GSIBs. Recall that GSIBs are required to maintain a 5% capital buffer at the holding company level — which is the standard 3% SLR plus an additional fixed 2% buffer. One key proposal is to replace the current fixed 2% buffer with a variable add-on that is linked to each GSIB’s specific capital surcharge. This approach is intended to better align the eSLR with risk-based capital rules and reduce disincentives for GSIBs to engage in low-risk activities like US Treasury market intermediation. Additionally, regulators are contemplating making the SLR more dynamic by adjusting thresholds based on economic conditions or stress test results. This approach could allow for temporary relief during market disruptions and stricter controls during stable periods.

Taken together, these reforms aim to fine-tune the SLR so that it continues to serve as a credible backstop without inadvertently discouraging crucial financial intermediation.

Implications for financial markets

In theory, one of the most immediate and significant consequences of SLR reforms would be improved liquidity and pricing in the Treasury market. By easing leverage rules, banks would be better positioned to act as market intermediaries, resulting in tighter bid-ask spreads and greater market stability during volatile times. The reforms are also expected to revitalize repo markets by reducing the capital costs associated with banks offering short-term loans backed by Treasuries, thereby increasing funding availability. This could help avert future liquidity shortages and support the smooth operation of collateralized lending markets. Corporate credit markets are also likely to benefit from the reforms, as reduced capital constraints would enable banks to better facilitate the underwriting and trading of corporate bonds, leading to better liquidity and price discovery. Financial sector bonds in particular could benefit, as lower capital costs may enhance bank profitability which could translate into healthier credit fundamentals leading to tighter bond spreads.

Conclusion

There’s no denying that the SLR has played a critical role in strengthening the financial system since the global financial crisis. Its simplicity and transparency make it an effective tool for limiting leverage and risky behavior. However, in an environment increasingly dominated by low-risk assets such as central bank reserves and Treasuries, the current structure of the SLR produces some unintended side effects. Ongoing reform efforts seek to modernize the SLR by preserving its role as a capital safeguard while adapting it to the realities of today’s markets. As long as they are implemented prudently, we believe reforms have the potential to improve liquidity in critical markets, stabilize short-term funding channels and support broader financial system efficiency. The SLR story is evolving, but we will be watching closely as any changes could shape the landscape of global markets going forward.

Credit vista: Resiliency rules in IG corporate credit

Darrell Leong, CFA, Head of Investment Research

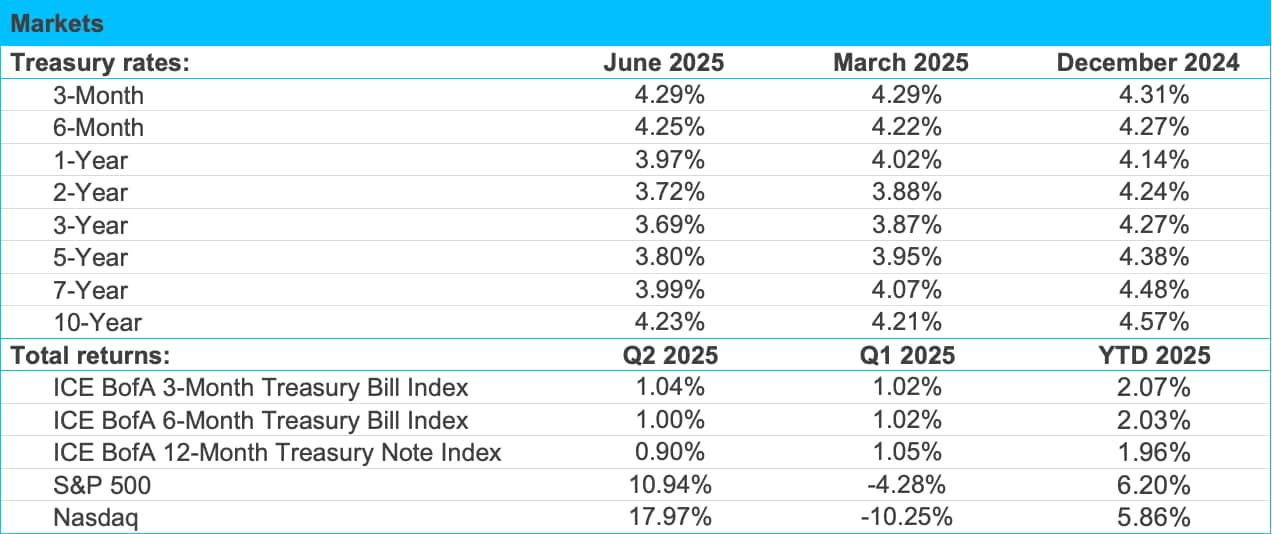

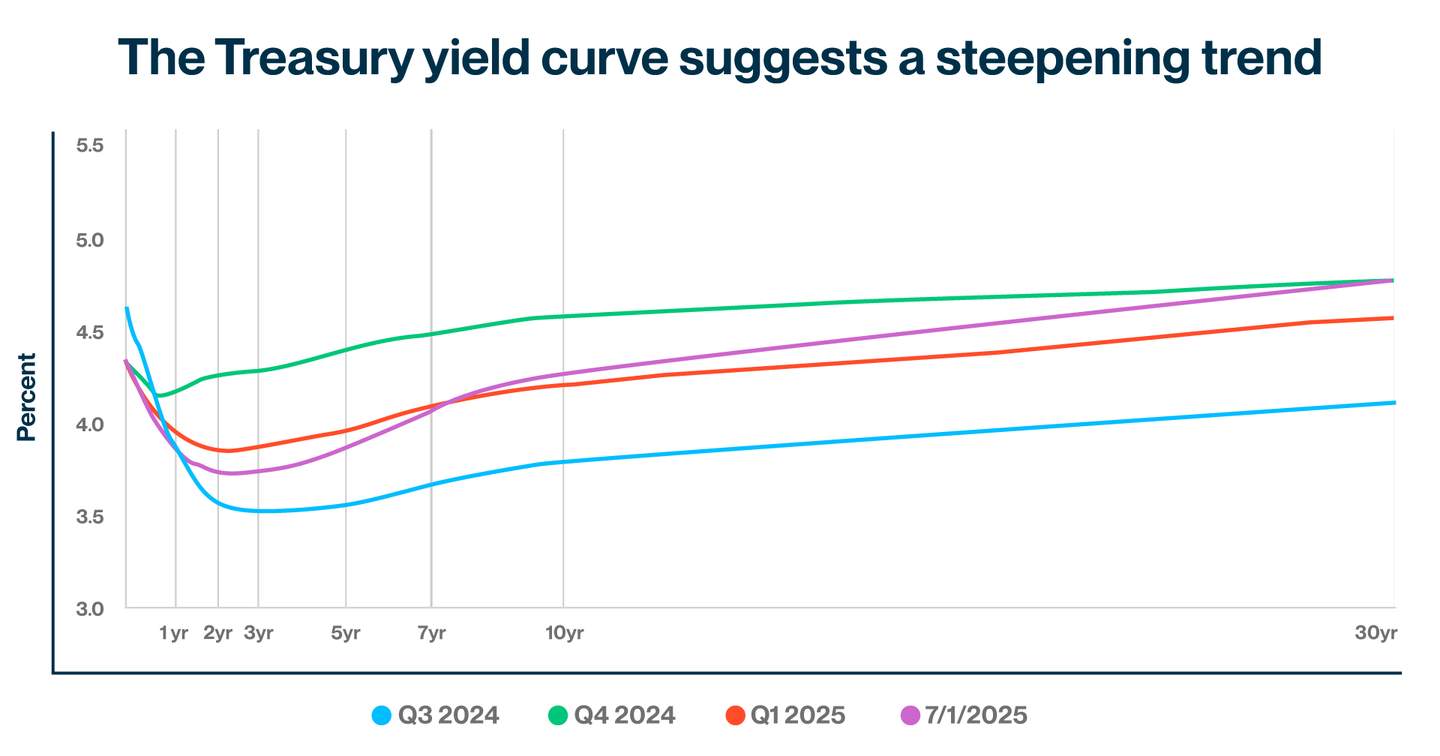

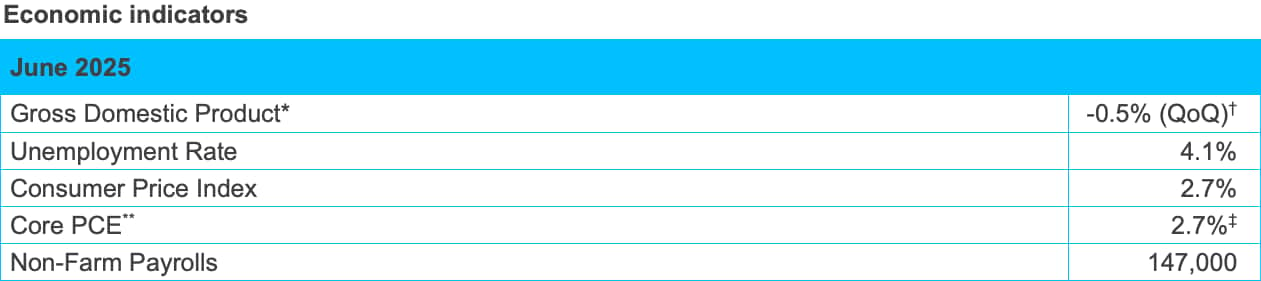

Market volatility was a defining, overarching feature during the first half of 2025. Investors have been forced to navigate wide-ranging uncertainties. Major shifts in US trade policy, questions surrounding economic growth and monetary policy, and the unfortunate and ongoing geopolitical tensions have all taken turns agitating markets. The issues have had rippling effects on the stocks, credit spreads and Treasury yields.

Amidst the fervor surrounding possible sweeping tariffs in April, the S&P 500 posted its fifth largest two-day decline since 1950. Bond markets also faced elevated volatility as Treasury yields bounced around and trended higher, even as they have backed off from their peak in April. Through all the turbulence, investment grade (IG) corporate credit has shown to be resilient, offering compelling opportunities for investors willing to look beyond the headlines.

Strong and stable

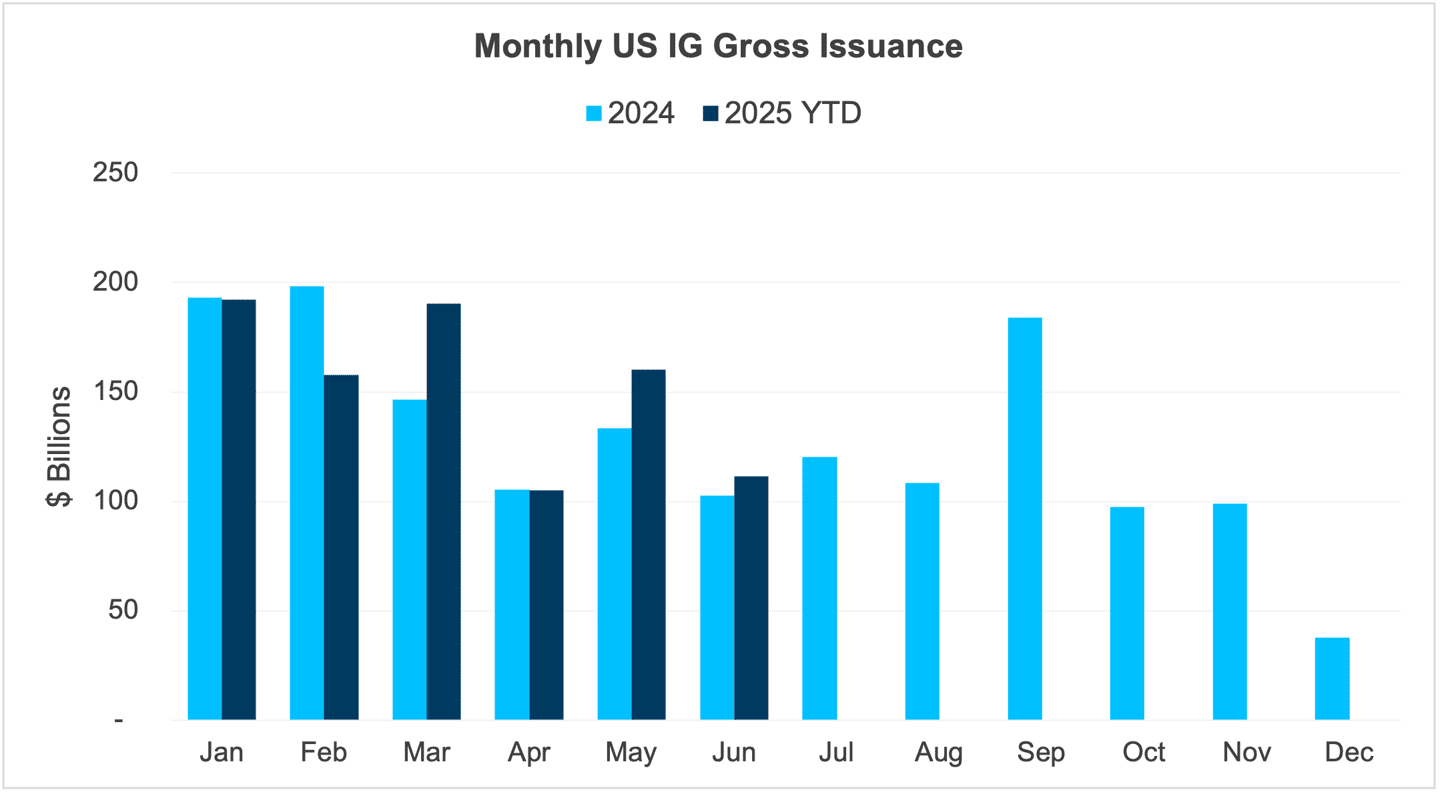

While volatility has been front and center for the markets, the underlying infrastructure of the IG credit market has remained robust. The US IG new issuance market has normalized and continued to operate smoothly, a vote of confidence for the health of the asset class. The stability is noteworthy given the substantial investor concerns that peaked in April over potential new tariffs and the follow-on impacts on corporate earnings. Through June 30, 2025, data from Bank of America Global Research shows gross issuance was $917 billion — an increase of 4.3% compared to the first six months ending June 30, 2024. This is impressive, especially in the context of elevated volatility and oft-shifting investor sentiment.

The recovery in the new issue market since April has been encouraging, with many corporations successfully tapping the capital markets to refinance debt and raise funds for operating activities. One area that has seen a shift in expectations is debt financed M&A activity. While M&A deals continued during the first half of 2025, many of these transactions are being completed with less debt financing. According to Morgan Stanley, M&A transactions represented 13% of total IG new issuance in the first half of 2025, down from 16% during the same period in 2024. Given the market backdrop, this is hardly a surprise.

For us, the key takeaway is that corporate credit continues to be a resilient asset class with a meaningful role in most investors’ portfolios. While spread volatility has certainly been significant during periods of market stress as seen in early April, corporate credit continues to stand out as a viable safe harbor for investors. Current yields and spreads remain attractive in the IG universe. Moreover, the volatility creates an environment that is particularly attractive for active investment managers employing bottom-up research methodologies. The dispersion in credit quality and pricing across issuers creates opportunities to find value and generate attractive income through careful security section.

Three key themes

Our research team continues to monitor several critical themes that could influence the market over the coming months.

- US trade policy remains front and center with the ongoing uncertainty around tariffs and their potential impact on supply chains, profit margins, and inflation. Although financial markets seemed to have retreated from their worst-case scenario, the policy landscape continues to evolve and is dynamic. This requires continuous monitoring and scenario planning.

- Rising geopolitical tensions provide investors with another wildcard and another layer of complexity. The ongoing conflict involving Ukraine and Russia along with the Israel and Iran conflict and ongoing turmoil in Middle East, is likely to continue creating periodic market volatility, particularly in oil markets with the risk of spillover to the broader market. These wars demand attention as they can rapidly shift from background concerns to market-moving events.

- Not to be overlooked, we are also closely monitoring the fiscal situation across major economies, which is one of the more structurally significant market themes of the day. The recent downgrade by Moody’s of the US government credit rating from AAA to Aa1 highlights the concerns expressed around growing fiscal deficits. This has longer-term implications for interest rate policies, government bond issuance, and the relative attractiveness of corporate credit compared to sovereign debt.

As always, our team continues to follow all the evolving policy, economic and geopolitical issues that tend to drive yields, credit spreads and otherwise shape markets. Credit selection, with a bias towards high-quality issuers, remains critical, and we are focusing on large companies with strong balance sheets, predictable cash flows and business models that can withstand a variety of challenging macro scenarios. An emphasis on diversification within each portfolio is especially crucial in this environment and should help instill investor confidence among all the uncertainties.

Looking ahead

The IG credit market’s performance during the first half of 2025 underscores its role as a core asset class. That said, we expect volatility to continue, which we acknowledge can sometimes unnerve investors. Nevertheless, we see attractive relative yields and the potential for active management to add value. All this positions IG credit favorably for the remainder of the year.

The Federal Reserve’s monetary policy outlook also remains a key driver, with markets watching for signals about the pace of any future rate cuts. Economic indicators including unemployment and inflation are currently in flux, suggesting a measured approach may be warranted with policymakers. At the same time, credit fundamentals remain generally supportive, with many companies boasting strong balance sheets and robust cash flows. But credit selection still matters as many companies including those in the manufacturing and energy sectors may face challenges due to trade policy changes and commodity price volatility. For investors seeking steady income within reasonable risk parameters, IG credit appears to be a compelling opportunity backed by solid fundamentals and reasonable valuations.