- The past year was turbulent as major changes in trade policy and shifting expectations for monetary policy were key factors that shaped financial markets.

- It’s clear that Fed policymakers continue to face a delicate balance ahead—inflation remains stubbornly above target, yet the labor market continues to soften.

- Markets remain highly sensitive to even small policy shifts, with tariffs, inflation data and Fed communications driving the swings in sentiment.

Economic vista: Changing expectations?

Jose Sevilla, Senior Portfolio Manager

Looking in the rear-view mirror, it’s clear that there was no lack of drama for financial markets in 2025. In fact, the year might be best characterized by some sizable policy shifts that also changed investor expectations. For example, trade policies shifted early in the year and roiled markets. Expectations for monetary policy shifted several times until the Federal Open Market Committee (FOMC) finally became more accommodative and cut rates late in the year. Thus, we should not be surprised that both fixed income and equity markets experienced their share of volatility. Looking ahead, one must wonder: does 2026 have more such shifts in store for investors?

Looking back

Many investors began the year rooted in optimism—inflation appeared to be cooling, consumer spending was resilient, and there were widespread expectations of multiple rate cuts by the Fed. However, this optimism quickly faded and transformed into something more complex. Tariff-driven inflation risks, a gradually weakening labor market and unpredictable Fed policy repeatedly reset investor expectations. Layered onto this backdrop was the powerful rise of artificial intelligence (AI), which fueled long-term enthusiasm about productivity gains while injecting bursts of short-term volatility into markets.

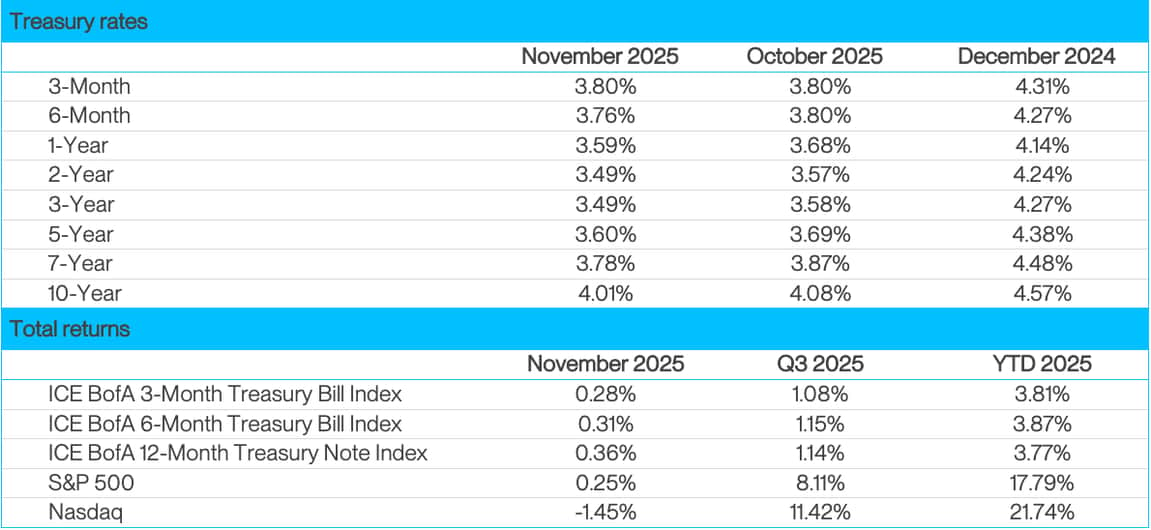

At the start of the year, the Fed’s policy trajectory looked relatively clear. Inflation had eased through late 2024, economic growth remained steady and investors broadly expected meaningful rate cuts by mid-year. In response, Treasury yields drifted lower as markets positioned for a shift to a more accommodative policy. But sentiment soured quickly once the Trump administration began hinting at severe new tariffs. Each adjustment in tone sent yields swinging, forcing investors to reassess whether renewed trade tensions might keep inflation higher for longer and further delay any Fed easing. Bond markets turned volatile as inflation expectations were recalibrated, business investment softened, consumer confidence slipped and hiring moderated.

In the first few FOMC meetings of the year, the Fed kept rates unchanged as growth projections were lowered while inflation projections were recalibrated higher. Policymakers signaled they needed more definitive signs of cooling inflation before implementing rate cuts. Investors increasingly believed that any shift to lower rates would hinge not only on moderating inflation, but also on sustained labor-market easing.

By spring, the sweeping “Liberation Day” tariff package sparked one of the year’s sharpest market reactions. Yields spiked as inflation expectations jumped, only to fall back when the administration softened some provisions. The episode underscored how sensitive fixed income markets had become to even small shifts in policy. Through the second quarter, yields steadied as investors gravitated toward safety, favoring Treasuries and other high-quality, short-term instruments. Meanwhile, the Fed reiterated its patient, data-driven stance. Uncertainty persisted, and bond markets continued to respond swiftly to every inflation report, labor-market update and tariff development.

Equity markets also experienced a similarly turbulent path given the policy shifts. The year began with solid gains driven by healthy earnings and rate cut optimism. But as tariff announcements multiplied, sectors tied to global trade—industrials, consumer discretionary and materials—stumbled. Technology stocks remained the standout exception, with AI-focused companies outperforming and drawing investor interest even during periods of heightened volatility. Their resilience provided a stabilizing counterweight to weakness elsewhere.

When GDP growth rebounded to nearly 4% annualized at midyear, equities rallied. Recession fears faded, and the Nasdaq led the charge higher, once again fueled by companies linked to AI-powered innovation. However, momentum slowed in the fall as ongoing geopolitical tensions, trade disputes with China and a prolonged government shutdown weighed on sentiment.

In terms of monetary policy, the path got slightly clearer as we moved deeper into the third quarter. The Fed highlighted mounting evidence of a cooling labor market, which set the stage for the first rate cut of 2025. At the September FOMC meeting, the committee lowered the fed funds rate by 25 basis points (bps) to a range of 4.00%–4.25%. Even with the shutdown restricting access to fresh data, the Fed proceeded with another 25-bps cut in October, citing concerns that a weakening labor market could push the economy toward recession, even as inflation remained above target.

By December, those same concerns were still front and center. At the December FOMC meeting, the Fed delivered a third straight 25-bps cut, bringing the target range down to 3.50%–3.75%. Policymakers acknowledged that inflation had eased somewhat, but they also made it clear that the job market was losing momentum and needed support. No doubt the Fed will reinforce its mantra that future moves will be contingent on incoming data rather than preset timelines. Of course, investors will be parsing every word the Fed utters to decipher the likelihood and timing of any future rate moves.

Looking ahead

Looking ahead to 2026, the trajectory of Fed policy will hinge on how quickly inflation converges toward the 2% target and whether labor-market weakness deepens. If that happens, the Fed may have room to deliver additional cuts next year, potentially bringing the policy rate closer to 3.25%. Such a path would provide relief to credit markets and support a rebound in economic activity. Equity markets may face bumps in the road, though we would not be surprised to see continued strength concentrated in certain sectors. AI-driven companies should continue to attract capital and drive productivity narratives, while trade-sensitive sectors may struggle under the weight of ongoing tariff disputes and geopolitical uncertainty. For the broader US economy, 2026 could prove to be a transitional year—one where Fed policy gradually shifts from fighting inflation to fueling growth. With the Fed's decision to cut a third consecutive time, the shift may already be starting. Innovation and productivity gains could set the stage for stronger growth, but global uncertainty and policy risks may continue to complicate the landscape. Investors will need to adapt. We’ll be watching closely and will adjust portfolios along the way. Happy New Year!

Credit vista: What’s driving MMFs?

Michael Duranceau, Senior Credit Analyst

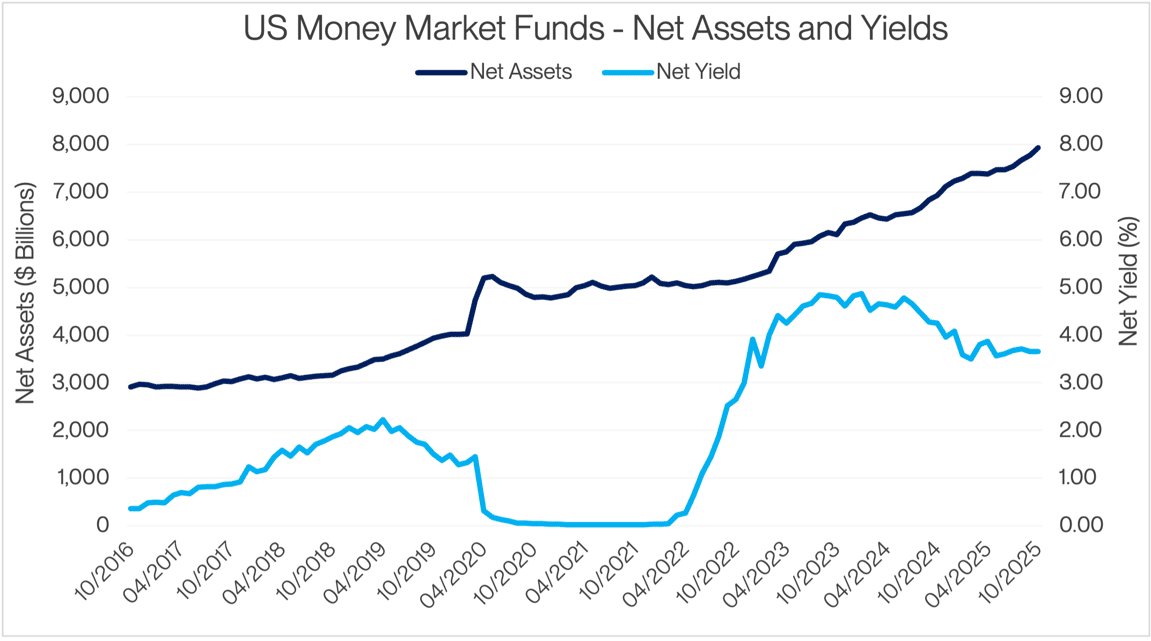

A new Federal Reserve easing cycle has begun, but there has been no easing of demand for money market funds (MMFs). MMFs continue to see robust inflows and record high balances, even though yields have been declining with the recent Fed rate cuts. What’s behind this dynamic, and will the emergence of new “tokenized” money market funds alter the landscape?

According to the United States Securities and Exchange Commission (SEC), total money fund assets rose by $153.2 billion in October 2025 to a record high of $7.93 trillion. Crane Data, a provider of money market analysis and information, recently reported money fund assets broke the $8.0 trillion barrier for the first time ever on December 1, 2025. This seems counterintuitive given the shifting monetary policy backdrop. What gives?

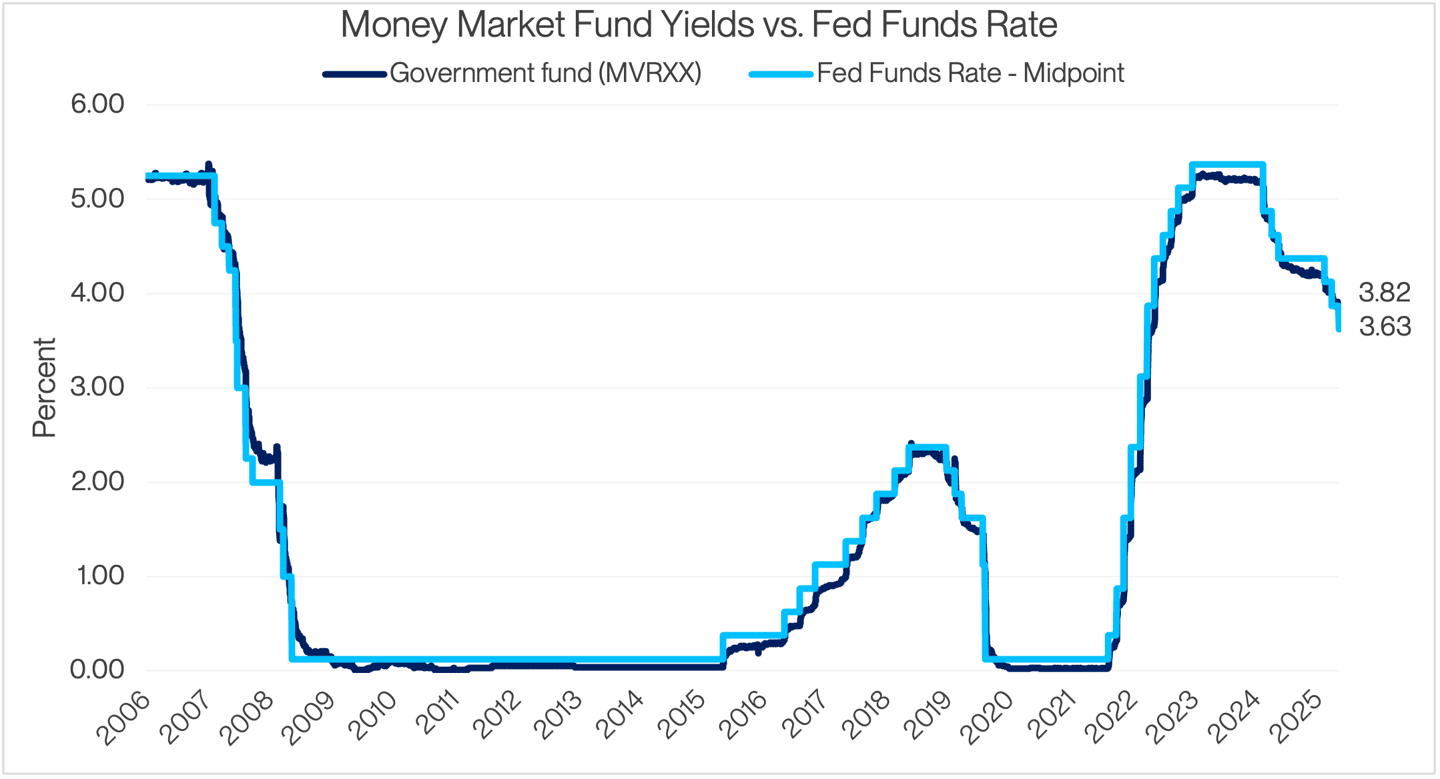

The US money market fund industry has skyrocketed in popularity over recent years, in part due to relatively lofty yields despite their low risk profile. Money market funds have seen particularly attractive yields over the past three years, in some cases over 5.0%, as the Federal Reserve battled record-high inflation with a series of rapid rate hikes beginning in early 2022. However, as the Fed began lowering its benchmark rate in the second half of 2024, money market yields have fallen in tandem as they tend to track very closely with the federal funds rate. As such, most large money market funds are now yielding below 4.0%.

Source: Bloomberg and SVB Asset Management. Data as of 12/12/2025. Money market fund yield refers to 7-day net yield.

The Crane 100 Money Fund Index which measures the 100 largest money market funds, was yielding 3.75% on average as of the beginning of December 2025. Nevertheless, MMFs are still yielding substantially more than they have on average over the past two decades when the financial crisis of 2008/2009 and the COVID-19 pandemic drove interest rates to ultralow levels (including money market yields).

Source: SVB Asset Management, SEC Money Market Fund Statistics October 2025 Report. Net Assets include Government, Prime and Tax-Exempt funds. Asset-weighted 7-day net yield. https://www.sec.gov/data-research/investment-management-data/money-market-fund-statistics.

While money fund yields will decline further if the Fed continues with its rate cutting cycle, a wide variety of investors and institutions continue to embrace MMFs as a key cash management tool. This reflects their (still) attractive returns in context to their liquidity and risk profile. Despite the declining rate environment, MMFs should continue to have an important spot in investors’ toolboxes.

A historical perspective

Ironically, interest rates have mattered little to money market fund balances. According to Crane Data across the 50-plus year history of money market funds dating back to the early 1970s, MMF assets have only materially declined during periods of severe economic downturns that led to protracted ultralow interest rates. In fact, money fund balances could see a further uptick in assets if the Fed continues cutting, in part given that alternatives such as Treasuries tend to see their yields adjust more quickly after rate moves.

Further bolstering record inflows and balances is the general increase in institutional cash now being parked in MMFs thanks to growing corporate balance sheets, particularly across the cash-rich technology sector (over 60% of total money-market fund balances consist of institutional cash). However, if yields ultimately fall below the 3.0% level for a sustained period, we believe that money fund inflows will gradually moderate as investors look towards alternatives, such as extending duration or investing in corporate bonds to capture higher yields. (See: The duration dilemma: Navigating fed rate cuts & fixed income investments.)

Tokenization drives demand

Another demand driver has been the recent rise of “tokenized” money market funds (TMMFs). TMMFs are effectively a hybrid financial instrument, combining the safety and stability of traditional money market funds with the speed and utility of digital blockchain technology. This gives investors direct, non-intermediated access to digital finance markets through products backed by familiar and safe assets, while also providing the potential for more transparency, flexibility and functionality when compared to a traditional money market fund.

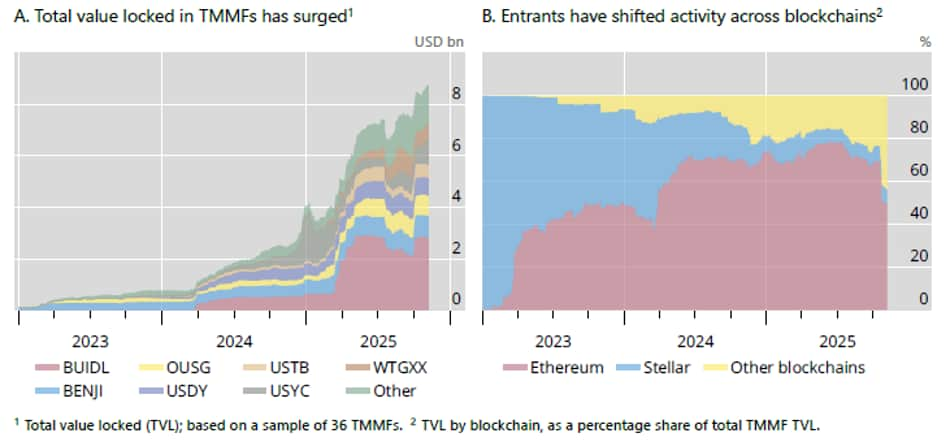

TMMFs are relatively new, but they are a rapidly growing segment bridging both traditional finance and decentralized finance. Decentralized finance, or DeFi, is an emerging peer-to-peer financial system attempting to remove third parties and centralized institutions (such as brokers, exchanges and banks) from financial transactions. While TMMFs saw slow investor acceptance after their initial introduction in 2021, they’ve seen particularly strong growth over the last two years, largely driven by near-term cash management benefits for investors over traditional funds, as well as the increasing acceptance of digital assets.

These TMMFs are measured by their total value locked (TVL), which is the equivalent of assets under management for traditional MMFs. At year-end 2023, TVL for the TMMF universe amounted to only about $770 million. That number spiked to almost $9 billion by the end of October 2025.1 Though TMMFs are still quite small compared to traditional MMFs,2 independent consultant McKinsey & Company projects a total asset tokenization of more than $2 trillion by 2030. Tokenized short-term liquidity funds, such as TMMFs, will likely be a core foundational tokenized product that supports the liquidity needs of this financial sector.3

Source: RWA.xyz; Bank for International Settlements (BIS).

Filling a need

Tokenized money market funds have multiple potential benefits over traditional funds, including:

- Heightened liquidity, settlement speed and trading flexibility. Investors can enter or exit multiple positions within a single day to optimize cash management. Transactions settle almost instantly, versus the T+1 or T+2 settlement typically seen with traditional funds. Plus, tokenized funds can be bought or sold anytime 24/7/365.

- Enhanced utility and collateral. Tokenized fund shares are “active,” meaning they can be pledged as collateral on crypto exchanges and in decentralized finance (DeFi) platforms. This has the potential to unlock new yield-generation opportunities.

- Increased transparency and reduced counterparty risk. Every fund transaction is recorded on secure and immutable public “ledger,” or DLT (distributed ledger technology), enabling investors to verify fund holdings and transactions in real-time. The transparent ledger also minimizes the risk of default or fraud as all transactions are publicly recorded and verified.

Source: Moody’s ratings

According to a recent Moody’s report on the topic of tokenized money funds,4 the rating agency noted that “although tokenization does not change the core credit risks of a money market fund or short-term bond fund – risks such as price and liquidity risk in a sudden, severe market downturn, for example, are common to all such funds, whether or not they have a “wrapper” of blockchain technology – tokenization can introduce novel risks, and in particular operational risks arising from blockchain use. Such risks include, but are not limited to, network availability, scalability limitations, and security vulnerabilities.”

While all investments carry various levels of risk, we expect the added operational risk of tokenized money market funds will be mitigated by their inherent transparency, increasing regulatory oversight, and improved controls. Though it still may be too early to tell what impact tokenized money market funds will ultimately have on the broader financial system, we expect TMMFs popularity to continue to grow as an alternative for money market investors. As always, we’ll be monitoring the growth of these funds and can help determine if they deserve consideration for your portfolio and specific circumstances. We’ll also be keeping a close eye on MMF yields in relation to other potential investment alternatives in the currently evolving interest rate environment.

Markets