The following article appeared in the Pitchbook-NVCA Venture Monitor report. Read other articles and learn more about our new partnership.

If there is an overall theme for the breakout year of life sciences/healthcare investments, it is this: Technology is driving the future.

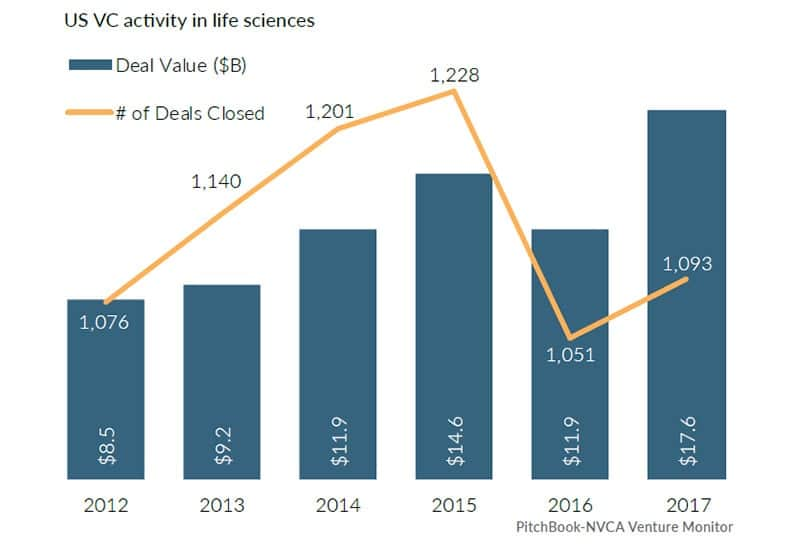

In 2017, investment into venture-backed companies hit the stratosphere, punctuated by several very large, $100 million-plus bets in biopharma and diagnostics/tools (Dx/Tools) companies. All told, PitchBook reports $17.9 billion was invested in life science companies last year, a 21 percent increase over the previous record of 2015 and 48 percent over 2016. In contrast, overall venture funding only grew 16 percent over 2016.

Traditional healthcare investors and generalist investors, many of the latter new to the life sciences industry, are quickly to staking out positions in the emerging ecosystem that is combining technology advancements in artificial intelligence (AI) with genomic data to develop groundbreaking diagnostic and treatment options.

These investors see healthcare as the next great frontier, one with enormous challenges but also full of potential for big payoffs.

Specifically, biopharma investments are focused on therapeutic developments, notably oncology and orphan/rare indications. The Dx/Tools sector is seeing huge investments in NGS technology and liquid biopsy companies that enable earlier and more accurate cancer detection.

New investors propel life science investing to new heights

What happened in 2017? Traditional venture capital investors, joined by corporate venture arms and crossover investors, provided a very large pool of capital for biopharma and Dx/Tools companies. Some interesting trends to watch: Generalist investors quickly are becoming the most active players in Dx/Tools. Traditional venture investors have returned to device, joined by private equity firms and family offices that often leading deals in commercialization rounds,

Biopharma leads the way

In 2017, biopharma saw a wave of IPOs, while M&A activity slowed. The open IPO window, in combination with record high pre-money IPO valuations, helped drive activity. Many biopharma IPOs earlier in the 2013-2017 cycle involved early-stage companies (pre-clinical and phase I). However, in 2017 we saw a dramatic shift from early-stage to phase II and phase III companies going public, according to SVB analysis.

The attractive IPO market in 2017 meant fewer M&A deals. The decline in deal values was partially due to this environment, and large private venture rounds raised over the last few years also made it difficult for companies to accept early-exit offers while maintaining robust multiples.

Biopharma investors see tremendous returns

That said, half of biopharma big exit M&A deals focused on early-stage (pre-clinical and phase I) companies, according to SVB analysis. Biopharma companies continue to buy early-stage companies in order to replenish their pipelines. This has driven down the time to exit from the close of Series A financing for biopharma companies, with the median time to exit at a record-quick 3.5 years. These deals had very healthy upfront multiples, providing tremendous returns for investors.

Dx/Tools investors bet heavily, but exits are scarce

Investments and exits have diverged for Dx/Tools. Despite heavy investment in the sector, exits proved elusive. The R&D tools subsector has largely dominated the few acquisitions that have occurred in the past five years.

Historically, the majority of Dx/Tools exits has been based on commercial revenue multiples rather than the enterprise values typically seen in biopharma M&A. Based on the current uptick in venture investment and soaring valuations, robust exit multiples will be difficult to achieve with the current acquirer pool.

However, we believe that large Dx/Tools companies will adopt M&A strategies similar to biopharma: These companies will fuel their primary R&D activities by acquiring early-stage, venture-backed Dx/Tools companies. At the same time, tech giants, including Amazon, Apple, Alphabet and Microsoft, are targeting Dx/Tools companies as an entry point into life science investing, and we expect their activity to grow and lead to big exits.

Large companies drive device M&A

IPOs and M&A activity remained stable for device in 2017. M&A deals were driven by large companies (J&J, Boston Scientific, for example), although longtime acquirer Medtronic continued to be absent. The acquisitions focused on companies that are developing minimally invasive solutions and advanced imaging/visualization platforms.

Interestingly, companies that require clinical trials (PMA/De Novo 510(k)) are being acquired early, while iterative 510(k) companies must prove themselves in the market first. Since 2015, PMA and De Novo 510(k) acquisitions generated larger upfront multiples and quicker times to exit than iterative 510(k) exits, and these acquisitions are now approaching the upfront deal values and multiples that we see in biopharma. We anticipate healthcare-focused investors to place bigger bets in innovative early-stage device companies.

To get deeper analysis, read the latest Healthcare Investments and Exits report.