Key Takeaways

- Employee burnout, anxiety and depression continue to rise

- Investment into mental health companies this year is slightly down from 2021’s blockbuster levels (but well ahead of 2020’s pace) as investors focus on quality mental health care

- Mental health valuations and deal sizes up in 2022 despite broader downturn

According to SVB’s latest report, The Future of Healthtech 2022, investment in mental health companies this year is down from 2021’s blockbuster levels — mirroring a broader downtrend in investment from 2021’s record pace — but remains strong and well ahead of 2020 investment, with rising deal sizes, valuations and mergers and acquisitions (M&A) activity.

So far this year, the mental health space has seen promising developments, including improvements in mental healthcare accessibility and prioritization of high-quality mental healthcare for underserved populations.

Venture capital investment in mental health companies: emphasis on quality care

Mental health companies are not immune to the market downturn, with investments slowing from 2021 levels this year. However, while the broader healthtech industry saw deal sizes and valuations lower in 2022, mental health companies uniquely saw increases: median venture capital (VC) deal size in 2022 grew to $10 million from $8 million in 2021 and median post-valuation in 2022 grew to $97 million from $40 million in 2021.3

Mental health VC deals and dollars

Source: SVB’s The Future of Healthtech 2022

The development and delivery of mental health services remain ripe for innovation as challenges persist. At the same time, while market size grows (mental health spending in the US is slated to increase to $99 billion in 20284), demand continues to soar. Despite the broader downturn, increasing deal sizes and valuations in mental health demonstrate investor confidence boosted by recent, tangible improvements in mental healthcare, particularly in expanding accessibility. These improvements are partially attributed to the record capital deployed into mental health-focused companies in 2021, enabling them to develop and scale their platforms. Higher quality mental healthcare may also prevent costly inpatient psychiatric visits. Promisingly, the use of inpatient mental health services in 2020 remained unchanged from 2013 despite a much higher rate of mental illnesses in 2020.5

Deal size and valuation by year

Mental health deals and dollars by top conditions

US & EU 2020-2022

Source: SVB’s The Future of Healthtech 2022

Accessibility ― a considerable focus in the last three years ― has improved as employer-sponsored mental health support expanded in 2022. Evolving virtual care options also enhanced patient access to providers. Still, access and affordability remain challenging for many, with 25%6 of US adults with a mental illness reporting an unmet need for treatment and 46%7 reporting treatment as unaffordable.

In 2022, the focus shifted beyond access to high-quality, outcome-based mental healthcare. Tighter financial markets have shifted investment into top-quality mental health companies that deliver quality outcomes and effectively reduce costs.

Preventive care measures are expanding to deliver higher quality care, enabled by virtual care models that allow for more touchpoints with providers. Culturally appropriate mental healthcare services that meet patients’ social, cultural and linguistic needs are growing. For example, the Bronx-based company Health in Her Hue connects Black women to appropriate healthcare providers, including mental health. Shine, acquired by Headspace this year, provides mental health-related activities for many patients with diverse backgrounds and cultures.

Point solutions (companies focusing on a single mental health condition) grew in popularity in 2021 and continue to show promising results. Interestingly, point solutions’ median deal size in 2022 ($12 million) is double that of platform-based business models (companies that focus on more than one mental health condition, $6 million). The focus on single conditions can offer high-quality, specialized healthcare, especially for higher-acuity mental health disorders like treatment-resistant depression or OCD. Brightline, which closed the largest point solution deal this year ($115 million Series C), focuses on mental health for children, teens and their families. Equip Health ($58 million Series B) provides virtual, affordable care for eating disorders, with aims to expand services nationwide this year. Eleanor Health ($79 million Series C) provides a wide range of outcome-based services for substance use disorders.8

Notable 2022 mental health private VC-backed deals

Source: SVB’s The Future of Healthtech 2022

Venture capital backed M&A in mental health

Last year, the mental healthcare industry saw a handful of public exits, including CareSpan, TalkSpace and Highmark Interactive. This year, public market pressures shut the public exit window for healthtech companies. As public markets remain volatile, I expect Initial Public Offering (IPO) and De-SPAC (Special Purchase Acquisition Company) activity in the space to remain muted. Instead, private M&A activity is promising this year, with some notable deals spurring the industry. Headspace expanded its platform with two acquisitions this year: Shine and Sayana. As the market becomes saturated with point solutions, I expect more consolidation. As effective and affordable mental healthcare increasingly tops the concerns of patients, employers, investors, payers and providers, investment and M&A activity will remain steady in Q4 2022 and 2023.

Notable 2022 mental health VC-backed M&A

Source: PitchBook, SVB proprietary data and SVB analysis.

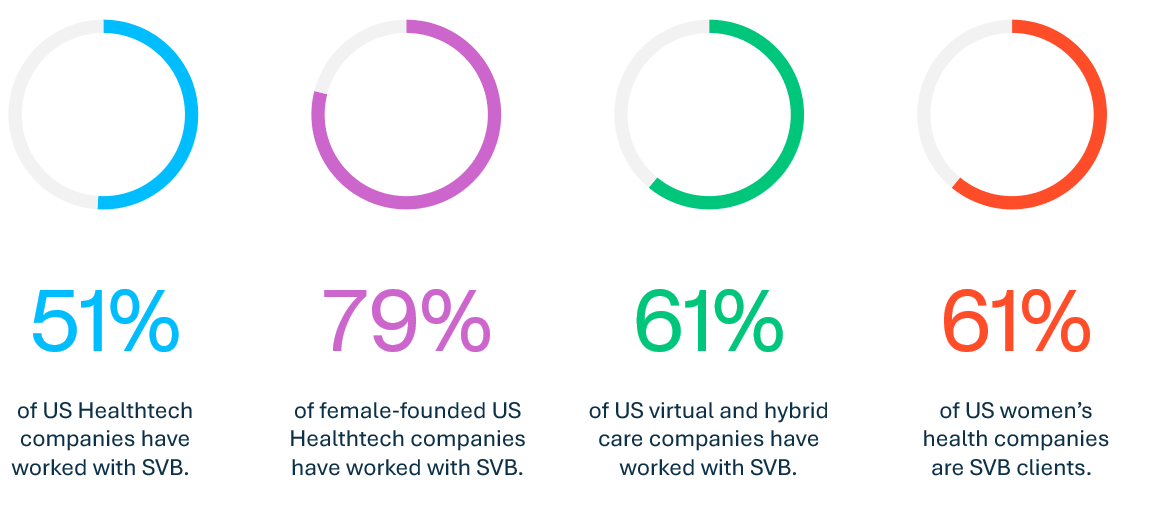

SVB healthtech market share

Source: SVB’s The Future of Healthtech 2022

At SVB, we are encouraged by the entrepreneurs leading these companies and how they navigate this increasingly challenging environment. At SVB, we have a pulse on life sciences and healthcare and believe in its innovators and were proud sponsors of HLTH 2022.

For a deep dive into investment and exit information across healthtech, please read The Future of Healthtech report, including detailed analysis across a variety of subsectors such as alternative care, provider operations, clinical trial enablement, wellness & education, healthcare navigation, medication management and spotlights on mental and women’s health.