Key Takeaways

- Early-stage life science investment is optimistic despite overall market unease.

- Deals are flowing into emerging US hubs, decentralizing from core markets and opening new regional opportunities for founders.

- As life science venture capital investors shift their approach, fundraising rounds could take longer.

If you’re wondering what this year will hold for your life science startup, stay vigilant. Broader market challenges are casting a long shadow over the startup ecosystem. Although the start of 2022 showed record levels of early investment in new scientific innovation, it was tempered in the second half of the year with speculation of more modest activity ahead in 2023.

Yet, it’s clear that innovation persists, especially as startup founders make phenomenal new advancements in healthtech, genomics, personalized medicine and more. We see a virtually limitless array of disruptive scientific innovation — similar to what we saw in the tech industry with cloud computing and other advancements over the past decade.

Check out the recent top trends of life science venture capital investment and early-stage startups as you plan for what’s coming next.

Valuation shifts aren’t as impactful at the earliest stages

To look ahead, we’ll also look back. In 2021, many startups celebrated reaching historically high valuations. Valuations were especially impressive for non-invasive monitoring and drug delivery companies, according to SVB’s Healthcare Investments and Exits report for that year. This biannual report, led by SVB’s Jonathan Norris, breaks down valuations and other key data points across stages and sectors.

But during 2022, valuations noticeably dropped for later-stage companies — and many business leaders are now pivoting their fundraising strategies accordingly. Companies that have a priced round on their cap table are trying to avoid a down round which might discourage existing investors because it can affect equity dilution and market perceptions, instead raising insider/bridge rounds to give these companies more time to meet stringent new investor expectations.

Most early-stage companies... don’t have to beat their own record in upcoming rounds to paint a picture of growth.

However, seed-stage life science companies are not experiencing the same shift. The median seed/Series A pre-money valuation did not significantly decrease in 2022, and actually increased in every sector except biopharma, which was stable. This is a positive sign for life science startups.

Distance from the market further insulates early-stage startups from this drop. Life science companies take a long time to reach commercialization, so they tend to have more protection against short-term market shifts than other industries like traditional tech. Sometimes, they turn to alternative, equity-deferring fundraising options that don’t involve a valuation, such as SAFEs (Simple Agreement for Future Equity) and traditional convertible notes.

In addition, seed rounds often don’t vary as dramatically as they can in later rounds. For example, the difference between a seed round at $17 million versus $12 million is not as steep as between a Series B round at $165 million versus $90 million.

Seed-stage companies’ circumstances help to avoid the same pitfalls that many later-stage companies are now facing. Most early-stage companies don’t have to worry about the specter of a prior valuation, especially in the case of SAFEs and convertible notes, so they don’t have to beat their own record in upcoming rounds to paint a picture of growth.

Enough dry powder to ignite life science innovation

Throughout 2022, life science and healthcare investors ramped up substantial dry powder ready to deploy throughout the industry. It’s the good kind of powder keg. Investors have ample funds to keep making deals despite broader economic uncertainty.

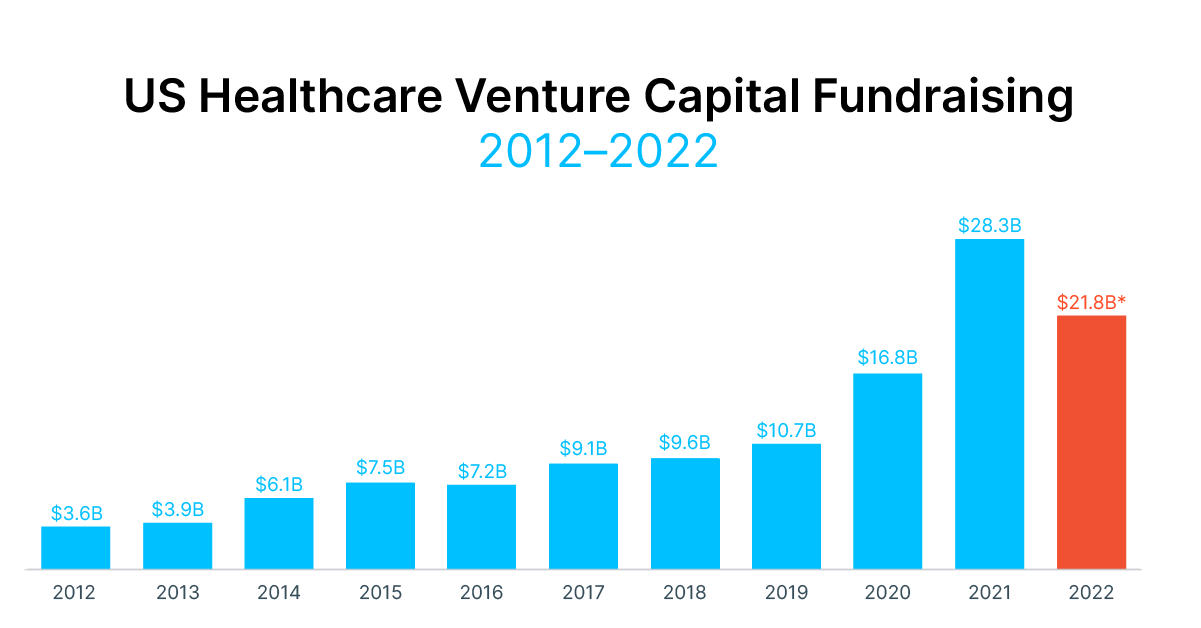

Notes: US Healthcare Venture Capital Fundraising is defined as an approximation of healthcare investment dollars to be invested by firms that historically invest in +50% US companies. *2022 estimate is based on anecdotal conversations with investors and expert analysis of last fund deal pace and focus on healthtech.

Source: PitchBook and SVB proprietary data. Chart originally appeared in the Annual 2022 SVB Healthcare Investments and Exits report.

2022 was the second best yet for dry powder, rivaling only 2021’s amount. In just the first half of 2022, we noted that healthcare venture capital firms collected $15.8 billion, which is almost as much as the entire amount they raised in 2020. Looking ahead, VC funds might raise less over the course of 2023 now that many of them already secured funding over the past two years, but these funds have built a strong foundation to start deploying capital across the industry.

At first glance, it could seem like life science investment is about to boom. And it might — but it also might not be widely distributed. It is possible that investors could participate in fewer overall deals with the continuation of historically elevated dollar amounts. With the level of risk in the broader market and uncertainty about Federal Reserve policy, they may seek to rally around companies that can demonstrate high perceived investment quality.

Once this high level of dry powder is ready for deployment, early-stage startups that meet this level of perceived quality may be in a good position to attract it, especially for first priced rounds that don’t suffer the cap table conflict that later-stage companies can encounter. Based on what we saw during a similar scenario in 2009 through 2011, it can be difficult for companies to accept outside capital in later rounds because the level of dilution could be too adverse for existing investors and management. In contrast with that period, we’ve seen rising seed investment in recent years, though that level dipped in the second half of 2022 and may soon resemble the pace of 2020. We also see far more dry powder.

It’s possible that relative stability in seed investment activity could continue through 2023 before once again shifting back toward later-stage companies in 2024. By then, those companies could be ready to seek outside investor capital after exhausting the available dry powder of existing investors. Though there’s a chance that the market could behave differently at that point than it does today, these sizable funds point to a positive sign for the future of the industry.

Young companies aren’t stuck at the kids’ table

As the financial community braced for a potential recession throughout much of 2022, it was unclear how venture capital firms and other investors would respond. There was speculation that they might reinforce their portfolio companies rather than branch out to fund new business. Rallying in this way would have set early-stage startups on an uphill climb to get initial funding.

In the life sciences and healthcare industry, that wasn’t necessarily the case. While many investors spent time on their existing portfolios in 2022, young companies weren’t locked out of funds. In fact, 2022 activity — while down from 2021 historic record investment levels — remained stable, mirroring or beating 2020 levels.

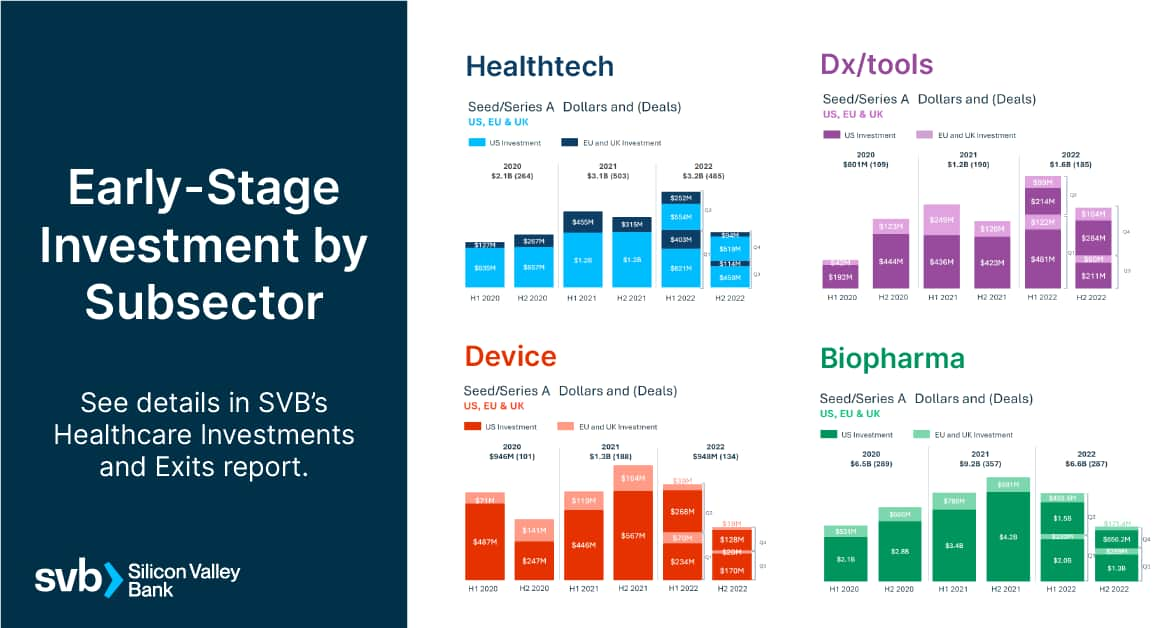

Notes: Seed/Series A includes first-time investments from institutional or corporate venture investment in the US, EU, and UK and any first-round investments equal to or greater than $2M, regardless of investor. Dates of financing rounds are subject to change based on add-on investments. All data as of 12/16/2022.

Source: PitchBook and SVB proprietary data. Charts originally appeared in the Annual 2022 SVB Healthcare Investments and Exits report.

Looking at the full year of 2022, we saw historically strong deal activity (including follow-on activity) for both seed and Series A priced rounds. Note that this dataset does not show how many of these deals involved follow-on activity, so the balance of outside capital versus seed or Series A extensions at a prior valuation is unclear.

However, the annual data doesn’t tell the entire story. A mid-year shift disrupted the strong activity of the first half of 2022, and the deal pace began falling in the second half of the year. Therefore, early-stage companies are still seeing an evolving, competitive fundraising environment.

Though companies may see some variation between subsectors, as is often the case, overall seed and Series A investment is primed to grow as the extra dry powder fuels opportunity.

Emerging hubs rise as established hubs plateau

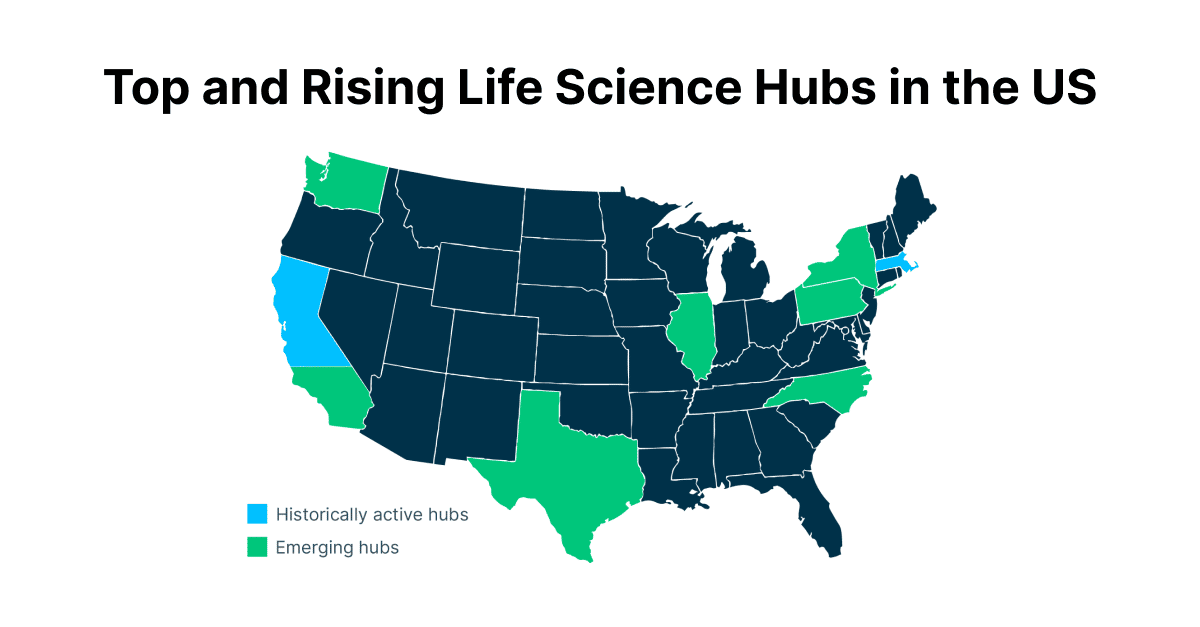

While the traditional life science hubs like Boston and San Francisco aren’t fully out of fashion, more early-stage investment deals are following unique geographic currents. Startup fundraising is rapidly growing in emerging hubs such as:

-

Raleigh/Durham

-

Philadelphia

-

Texas

-

Southern California, particularly San Diego and Los Angeles

-

Chicago

-

Seattle

This trend is unusual, and the root cause isn’t clear. Several factors may be contributing to this deal dispersion. For example, this fundraising shift may have followed general migration patterns of founders and workers during the pandemic. We’ve also noticed an increase of virtual scientific companies that view geographic location as irrelevant, in part due to outsourcing. Many states, such as New York and Texas, have invested billions of dollars in methods to attract new life science companies, which might have contributed to local startup creation and fundraising opportunities. There may also be better availability of lab space in cheaper areas of the US than in traditional hubs, which can be compelling for founders who face limited resources.

Notes: This map symbolizes an approximation of overall activity across life science and healthcare subsectors in the contiguous United States. Historically active hubs include areas with the highest volume of overall activity. Emerging hubs include areas where activity level has significantly increased in recent quarters.

Source: PitchBook, CipherBio and SVB proprietary data.

The longevity and magnitude of this trend is uncertain. For now, these rising areas show hopeful news for founders who aren’t interested in running a business in a larger, competitive and potentially more expensive hub.

Prepare for patience when closing the deal

The time between discussing a deal and actually accessing the capital has taken longer than expected for some startups. In 2021, the conditions of the market led VC investors to rush to issue term sheets and seize the chance to support a promising venture. Now, this process has slowed down.

Investing is a balancing act. Typically, early-stage investors structure their funds with the expectation that most startups in their portfolio could result in a loss. For the few startups that thrive, the return of a successful exit can offset those losses. It’s common for life science investors to aim for a specific multiplication of the amount invested to consider their exit successful. Valuations play a part in how favorable that return could be.

That’s why, given the prior high valuations and fast pace of dealmaking, some investors may now find themselves in a difficult position. The bar was set high for returns that might not reach critical mass in the short term as the economic tide turns.

Meanwhile, other investors may be in a better position because the pressure to compete for favorable terms in the most exciting — but often expensive — deals has eased. Many investors have stopped to catch their breath and conduct more thorough due diligence before closing deals. They are taking the time to evaluate whether a startup is the right match for their fund at an optimal level of risk versus reward. They have also gained leverage in making deals with investor-friendly terms.

As a founder, it’s not always possible to expedite closing a deal. One way to help smooth the due diligence process is keeping clear, detailed information ready to show to prospective investors. That information can help showcase why your company would be well positioned to offer them a favorable return in the coming years.

To discover more industry trends, read our latest Healthcare Investments and Exits report and The Future of HealthTech 2022 report.

Keeping steady through a storm

While the early-stage life science venture capital trends we saw take shape over the past year don’t necessarily fall into “storm” territory just yet, big changes in the market can be tricky to navigate. It’s smart to stay prepared for potential ups and downs. While leading an early-stage company, you may find yourself at a crossroads to either shift or maintain your current strategy. You might also decide to tweak your pitch, financial model and burn rate along the way.

But as we’ve seen throughout our history at Silicon Valley Bank, a resilient vision paired with a top-notch technical solution can carry a life science startup through difficult times.

Running a startup is hard. Visit our Startup Insights for more on what you need to know at different stages of your startup’s early life. And, for the latest trends in the innovation economy, check out our State of the Markets report.