Key Takeaways

- While a number of venture investors have pushed the pause button in the near term, spectacular biopharma IPO performance in 2019 and high-value public mergers and acquisitions activity position biopharma as a key area of venture investment.

- Some investors with capital to deploy are switching focus from private markets to recently public companies — 250+ biopharma IPOs have occurred since 2014 — looking for value plays.

- We are cautiously optimistic that despite coronavirus impacts on market activity and clinical trials, the healthy run in biopharma will continue.

Recent historical and current financing and IPO markets in biopharma

Why the optimism? In one word: performance. Namely, the continued strong performance of venture-backed biopharma IPOs and the emerging, very lucrative M&A activity seen in recent public deals. Since mid-Q1, with the onset of COVID-19, venture investing and IPO activity have slowed; but as we note below, IPOs and high-valued public M&A activity continues.

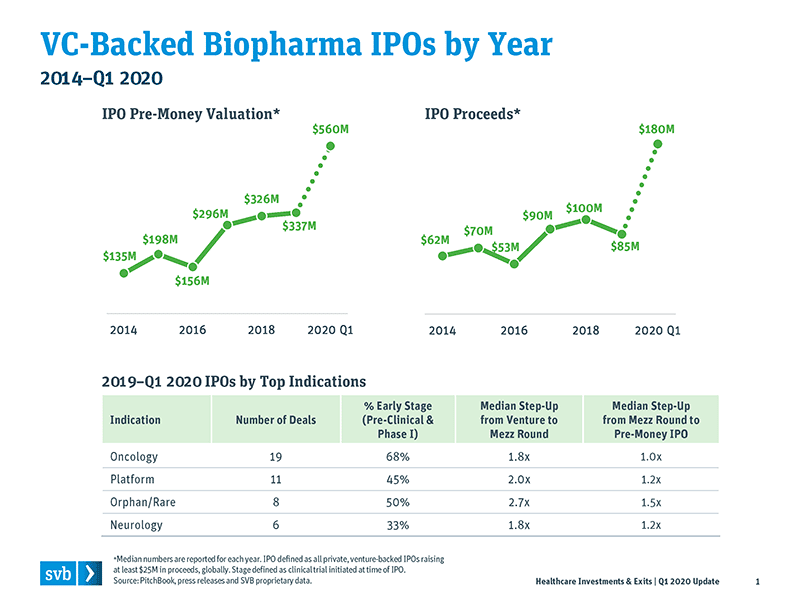

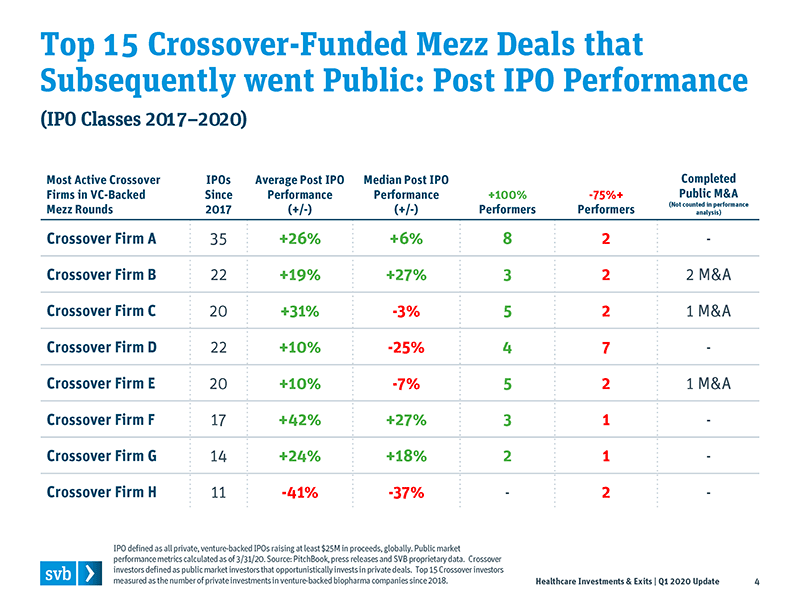

There were 50 venture-backed biopharma IPOs in 2019, and those deals hit a record median IPO pre-money value of $337M. The venture financings leading up to the IPOs built value round by round, with a median 2.1× step-up from last venture round to mezzanine (mezz) pre-IPO round, and then another step-up in valuation (median 1.2×) from the crossover-led mezz to the pre-money IPO value. That is all good news for both venture and crossover investors. (As noted in earlier reports, I define “crossover investors” as public-minded investors or private equity firms that opportunistically invest in private venture-backed deals; examples of crossover investors include such groups as Cormorant, RA Capital, Redmile, Deerfield and Logos Capital, among others.) Those crossovers seek to leverage the open IPO window by investing in the private mezz round of biopharma companies and then doubling down by also investing in the IPO. They have been a very important part of the biopharma venture ecosystem over the past six years.

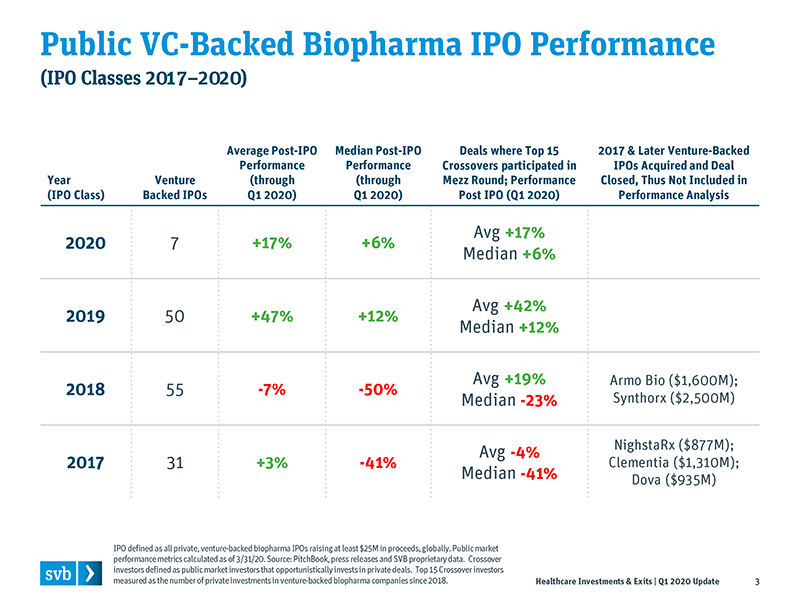

Once public, the IPO class of 2019 saw an unprecedented public market run-up. By the end of 2019, those deals had an average IPO share price increase of +56%. Those are heady numbers for both the venture investors who participated in the Series A but also for the crossover investors who led the mezz round. Measuring IPOs, public M&A and overall returns, I would characterize 2019 as the best year ever for venture-backed biopharma.

The books have closed on Q1 2020, which was disastrous for the overall public markets due to the COVID-19 pandemic. Still, the average share price of the class of 2019 IPOs is still up an average of 47%, with positive median performance as well. This means those 2019 IPOs were treading water through that very difficult quarter, with venture investors and crossovers still riding significant gains. In addition, there were seven venture- backed biopharma IPOs in the first quarter of 2020 -- before COVID-19 became all encompassing. The median pre-money value and dollars raised far exceeded previous years, as the seven 2020 IPOs had a $560M median pre-money value (a 50%+ increase over the 2019 record pre-money IPO valuation) and raised median proceeds of $180M per IPO (2× larger than what IPOs raised in 2019). These Q1 2020 IPOs occurred before mid-March, so one would assume that those companies fared poorly in the last two weeks of the quarter as the financial markets were reeling; however, at the end of the quarter, five of the seven were trading higher than their IPO price, with an average IPO price increase of 17%.

Despite pandemic impacts in March, the number of Q1 2020 IPOs nearly matched Q1 2019, and pre-money valuations more than doubled. Five of the seven Q1 2020 IPOs raised more than $200M pre-IPO.

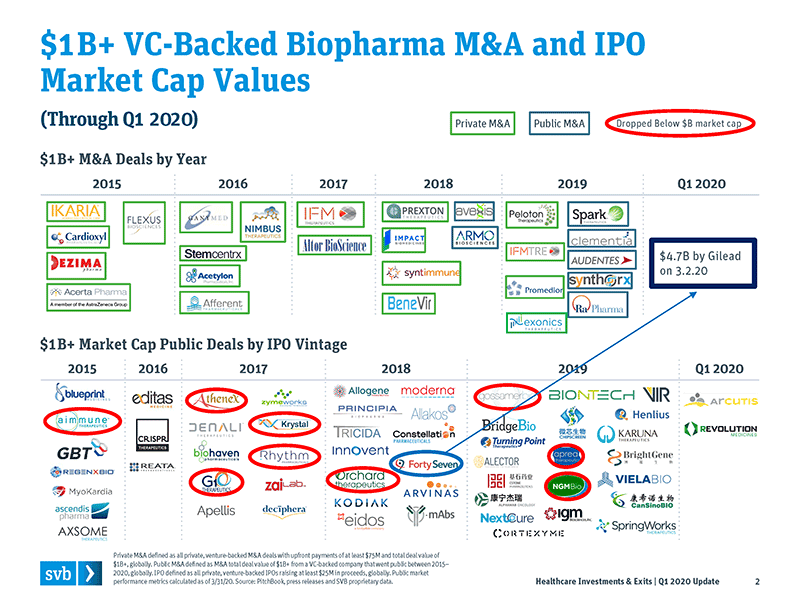

With those performance numbers as a backdrop, our perspective is that venture investors and crossovers appear to remain in a very good position to continue generating significant returns on these public companies (with the caveat that volatile markets are likely still ahead of us). There is also opportunity to supplement public market performance with the rash of highly valued M&As involving recent venture-backed deals. A good example is Forty Seven, a company that was backed by both venture and crossover investors. It went public in 2018 and was acquired by Gilead Sciences, at a significant premium, for $4.7B in early March 2020. In addition, in 2019 five recently public companies were subsequently acquired at heady premiums, representing a total deal value of more than $13B.

Biopharma companies mostly held their values in Q1 2020: Only 9 of 55 recently public companies valued at $1B+ fell below that threshold during the quarter.

If an alternative scenario had developed with all recently public biopharma company stocks down and the IPO window closed, it would be easy for crossovers to leave the sector and pull the plug on their private investments. The strong performance we have observed, however, means that most crossovers are not pushed to leave the sector through poor returns and rebalancing considerations. This leaves crossovers in an interesting position to consider the option of either (1) leaving the private market to focus on public stock investing or (2) continuing to support private mezz rounds with the expectation that the IPOs will continue. I think many will continue to invest in private deals, and in support of this thesis four crossover-led mezz rounds closed in late March/early April (Pandion Therapeutics, Legend Biotech, ElevateBio and SutroVax), each raising rounds of more than $100M.

Recently, there have been some headwinds for crossovers. Mezz investors received a flat (1×) step-up from mezz to pre-money IPO in several public offerings in Q4 2019 and Q1 2020. If that flat trend continues, the benefit of “getting in early at a lower price” may be extinguished. The other significant reason to invest early, however, is to secure an ample allocation in the public offering; if IPO activity continues apace, that allocation remains an important consideration.

Overall, biopharma public company performance has been good over the past three years, particularly when top crossover investors are involved in the pre-IPO mezz round.

Good returns mean crossover investors won’t be forced to reduce participation or exit the market for poor performances if they are confident that the IPO window will stay open.

We expect some crossover shakeout in the coming quarters, but I think most of the top 15 most active crossovers1 will remain venture-backed mezz investors, based on commitment to the venture thesis and expectation that IPOs will continue. A number of these crossover investors have raised their own venture funds and are likely to stay and invest in venture long-term, while pure hedge and institutional funds may find the public market more intriguing.

Venture perspective going forward

For venture deals that were not already in the queue in early Q1 2020, the prospects for financing are more uncertain. Some deals will be completed, but certainly at a reduced pace and dollar volume compared with 2019. Venture investors are working through a number of challenges, including the following.

1) The need to stratify their existing portfolio to respond to cash needs, identify major value inflection points and assess potential delays, and fund their own reserves.

-

There will be clinical trial delays as doctors divert their traditional practices to help fight COVID-19. The stay-at-home mandate will likely affect enrollment. Additionally, data collection of ongoing trials may be difficult. Many VCs predict three- to six-month delays in their portfolio companies’ clinical development plans.

-

Investors are looking for portfolio companies to maintain cash well into 2021, so significant work (and significant time) will be needed to shore up balance sheets, which will limit investors’ ability to conduct due diligence and fund new deals.

-

Adding to this, we have seen the phenomenon of some Series A investors overinvesting in Series A to the detriment of their reserves. These investors deployed more capital early in Series A because large mezz rounds at significant step-ups and subsequent IPOs happened like clockwork. If that IPO cycle slows down, however, it will be more difficult to support these companies in a Series B and beyond with their lower capital reserves. These funds may need to cut back on the number of new investments to shore up those reserves, which means less money in the market for new deals.

2) Another question facing investors, of course, is “How long will this pandemic last?” Major financial impacts include the near- and medium-term ramifications of public market volatility and the volume of IPOs. These questions are important in matching the underlying investment thesis to current and near-term financial market fluctuations. Here’s what we see so far:

-

A significant number of investors have pushed the pause button for the next quarter as they assess.

-

Some investors with capital to deploy are spurning private deals for the public markets, as they review the 250+ biopharma companies that have gone public since 2014, searching for value plays.

-

Others will focus investment on early, pre-clinical private companies to ride out the expected clinical development delays over the next few quarters while continuing to invest in compelling technology.

-

It is important to note that most biopharma-focused venture funds still have fresh capital or recently raised a new fund. These funds are focused on the thesis of investing in innovation, so despite the evolving financial markets, these funds will continue to deploy capital, although the pace of investment will be affected.

3) And, finally, how to view valuation. We think seed pricing will remain constant in biopharma, but if IPO volume drops, we will certainly see a decline in Series A and Series B dollars and valuations, as many of these companies raise less cash and search for M&A interest rather than an IPO. We noted that many recent deals (including mezz rounds) closed at the agreed-upon valuation, but we have heard anecdotal notes of new deals that are reopening valuation discussions.

Conclusion

We have cautious optimism that mezz rounds will continue, as evidenced by the recent deals mentioned above. Adding to that, we still see companies filing to go public and even saw two recent venture-backed IPOs. On April 2, Zentalis Pharmaceuticals priced at the top of its range and raised $165M on a $394M pre-money valuation. Keros Therapeutics, another venture-backed biopharma, went public on April 8. Venture funds continue to raise capital even during these trying times. More than $3.3B in new venture funds closed in the first week of April — by Arch Therapeutics, Flagship Biotech, Deerfield Management and venBio. Combining sustained public market appetite, good performances by crossover investors and traditional funds working with new or recently raised assets, we believe that the healthy run in biopharma will continue.