The Visegrad Four are not a gang of bank robbers from the 1930s…or the latest superheroes from Marvel.

The "V4" are an alliance of four central European states -- Hungary, Poland, the Czech Republic and Slovakia -- which cooperate on political, economic, cultural, energy and military issues. The origins of the V4 date back to a summit meeting in the Hungarian castle-town of Visegrad in 1991. All countries are NATO members and all joined the European Union on May 1, 2004.1

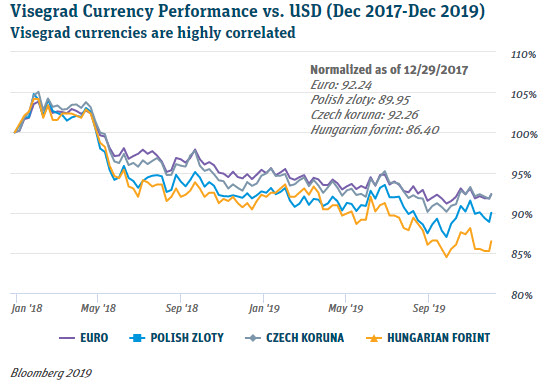

CURRENCY PERFORMANCES

Despite the fact that all four Visegrad countries are members of the EU, Slovakia is the only V4 member to have adopted the euro as its official currency (in 2009). In the graph below, you can see that over the last eighteen months the Polish zloty, Czech koruna, and Hungarian forint have joined the euro in a weakening trend versus the US dollar. Within the group, the euro and Czech koruna have consistently outperformed both the Polish zloty and Hungarian forint.2

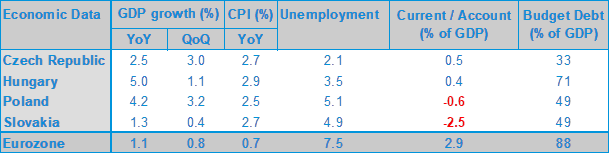

ECONOMIC DATA

- V4 growth has been impressive compared to the growth of its biggest trading partner, the eurozone. Notably, this is despite a sketchy record on political reform.

- All are high-income economies, defined by the World Bank as countries with GDP per capita of $12,376 or more in 2018.3

- Hungary and Poland have outperformed most other EU economies, at least partly through not adopting the euro.

- Loose monetary policies in Hungary and Poland have supported growth without fueling inflation.

- Interest rates in all V4 countries are lower than their respective inflation rates, producing negative real interest rates, which are typically unattractive to most global emerging market bond investors.

- If counted as a single nation state, the Visegrad Four would be the fifth largest economy in Europe and the 12th largest in the world.4

Source: Bloomberg 2019

Source: Bloomberg 2019COUNTRY DATA

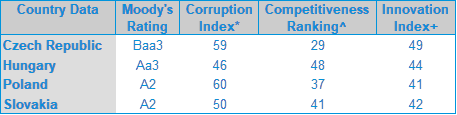

In terms of qualitative analysis, the V4 members are not all that dissimilar. All have investment grade sovereign debt5, and are ranked comfortably in the middle of various popular country assessment measures.

*Corruption Index = countries ranked between 100 (very clean/Denmark) and 0 (highly corrupt/Somalia) by perceived level of public sector corruption. Transparency International

^Competitiveness Ranking = assesses ability to provide high level of prosperity to their citizens; ranges from high 85 (Singapore) to low 35 (Chad). World Economic Forum

+Innovation Index = assesses business outcome of innovation and government's ability to support innovation through public policy, including tax incentives, immigration, education and intellectual property; ranges from high 67 (Switz) to low 14 (Yemen). Boston Consulting Group and National Association of Manufacturers

FINAL REMARKS

The economic performance of the Visegrad Four has been fairly strong and country qualitative assessments are fine. However, expect further currency depreciation over the coming months, as above trend growth and slightly elevated inflation will not offset negative real yields and a generally strong US dollar.

- en.wikipedia.org

- Bloomberg, December 2 2019

- blogs.worldbank.org

- Deutsche Welle. "Visegrad Group: A new economic heart of Europe?", July 5 2019

- www.moodys.com

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates. This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal, accounting and other advisors and only make investment decisions on the basis of your own objectives, experience and resources.

All non-SVB named companies listed throughout this document, as represented with the various statistical, thoughts, analysis and insights shared in this document, are independent third parties and are not affiliated with SVB Financial Group.

The views expressed in this article are solely those of the author and do not necessarily reflect the views of SVB Financial Group, Silicon Valley Bank, or any of its affiliates.

This material, including without limitation to the statistical information herein, is provided for informational purposes only. The material is based in part on information from third-party sources that we believe to be reliable but which has not been independently verified by us, and, as such, we do not represent the information is accurate or complete. The information should not be viewed as tax, accounting, investment, legal or other advice, nor is it to be relied on in making an investment or other decision. You should obtain relevant and specific professional advice before making any investment decision. Nothing relating to the material should be construed as a solicitation, offer or recommendation to acquire or dispose of any investment, or to engage in any other transaction.

Foreign exchange transactions can be highly risky, and losses may occur in short periods of time if there is an adverse movement of exchange rates. Exchange rates can be highly volatile and are impacted by numerous economic, political and social factors as well as supply and demand and governmental intervention, control and adjustments. Investments in financial instruments carry significant risk, including the possible loss of the principal amount invested. Before entering any foreign exchange transaction, you should obtain advice from your own tax, financial, legal, accounting and other advisors and only make investment decisions on the basis of your own objectives, experience and resources.

All non-SVB named companies listed throughout this document, as represented with the various statistical, thoughts, analysis and insights shared in this document, are independent third parties and are not affiliated with SVB Financial Group.