2018 Startup Outlook

US Report

US Startups are Ready to Hire, Say Fundraising Easier

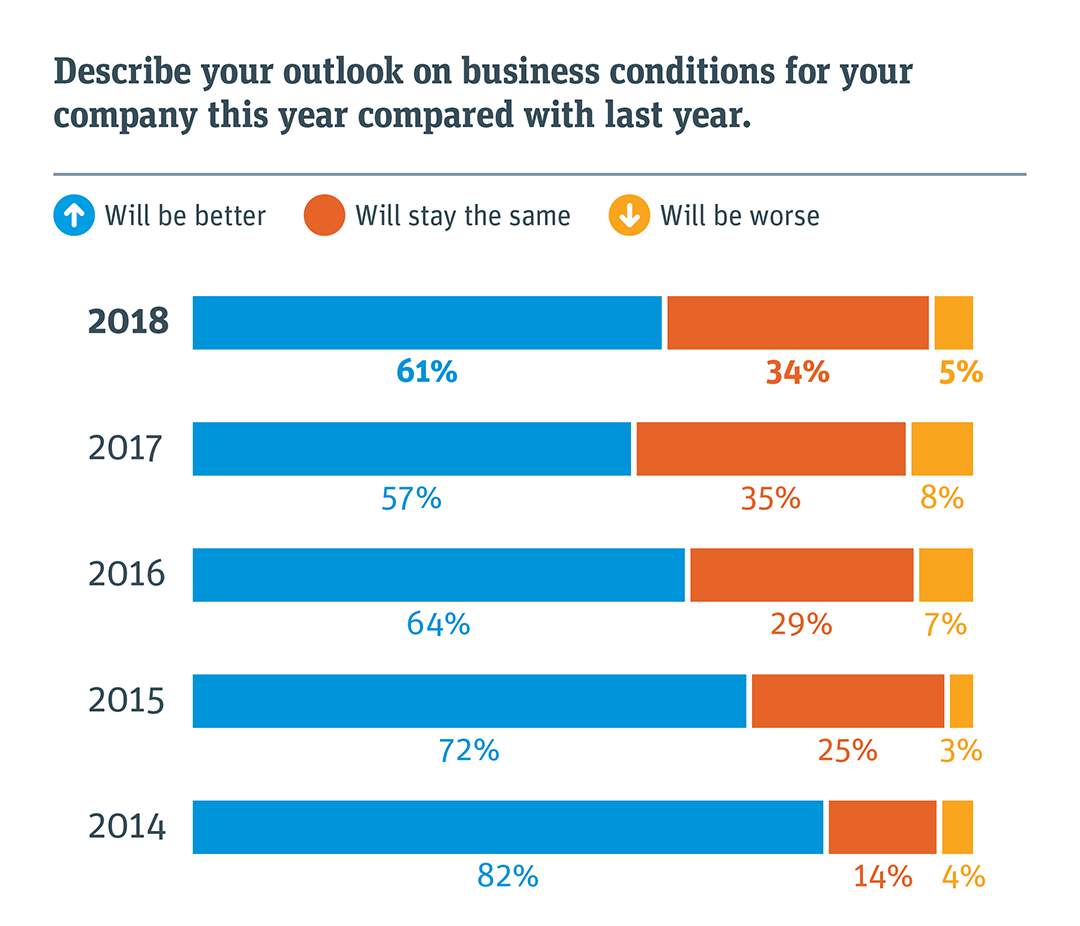

Nearly two of three US startups believe that 2018 will be better than last year, and the number that plan to hire is at a five-year high. There are challenges of course, including access to talent, healthcare costs, diversity in tech leadership and — increasingly — cybersecurity and consumer privacy issues.

Jump to Business Conditions | Funding | Hiring & Talent | Public Policy

Raising capital gets easier

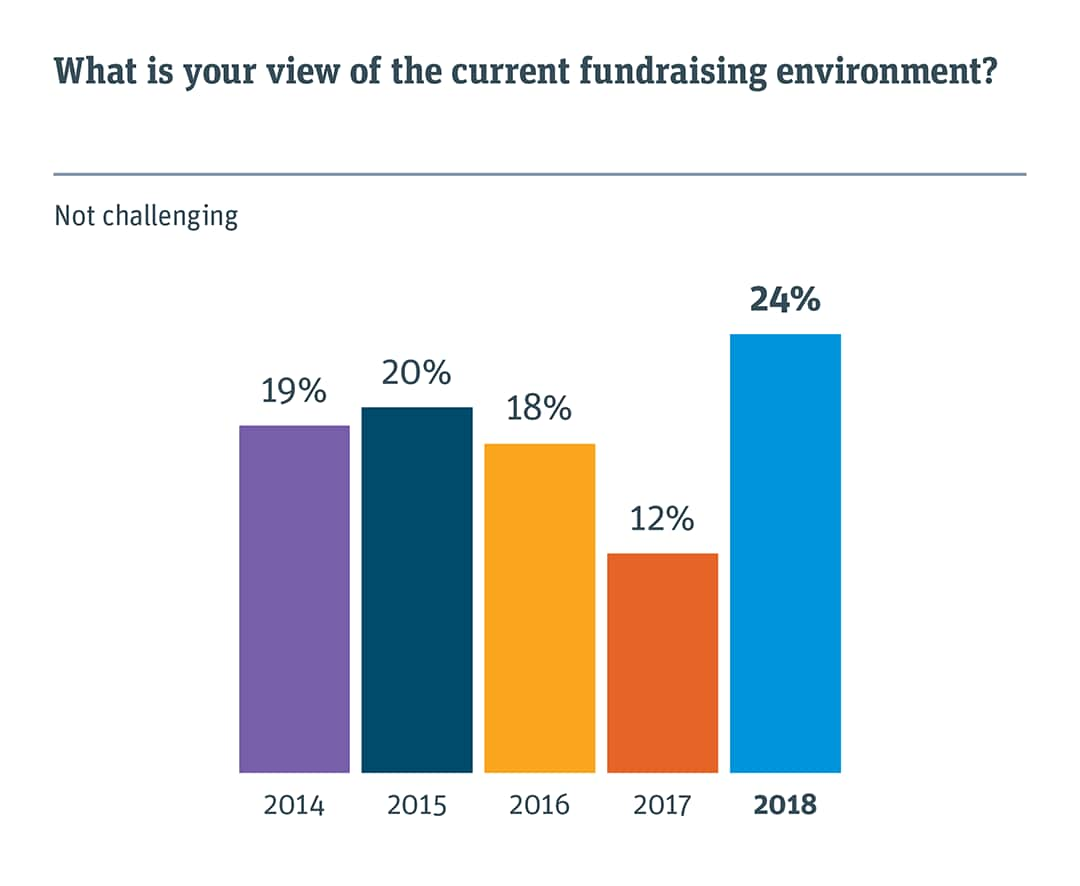

In 2017, 69 percent of startups surveyed successfully raised capital, and nearly one-quarter of them say the current fundraising environment is not challenging. This is a significant change from the year before, when only 12 percent said that it was not challenging to fundraise. The number who say it is extremely challenging vs. somewhat challenging dropped.

Note: Asked of private companies that successfully raised capital.

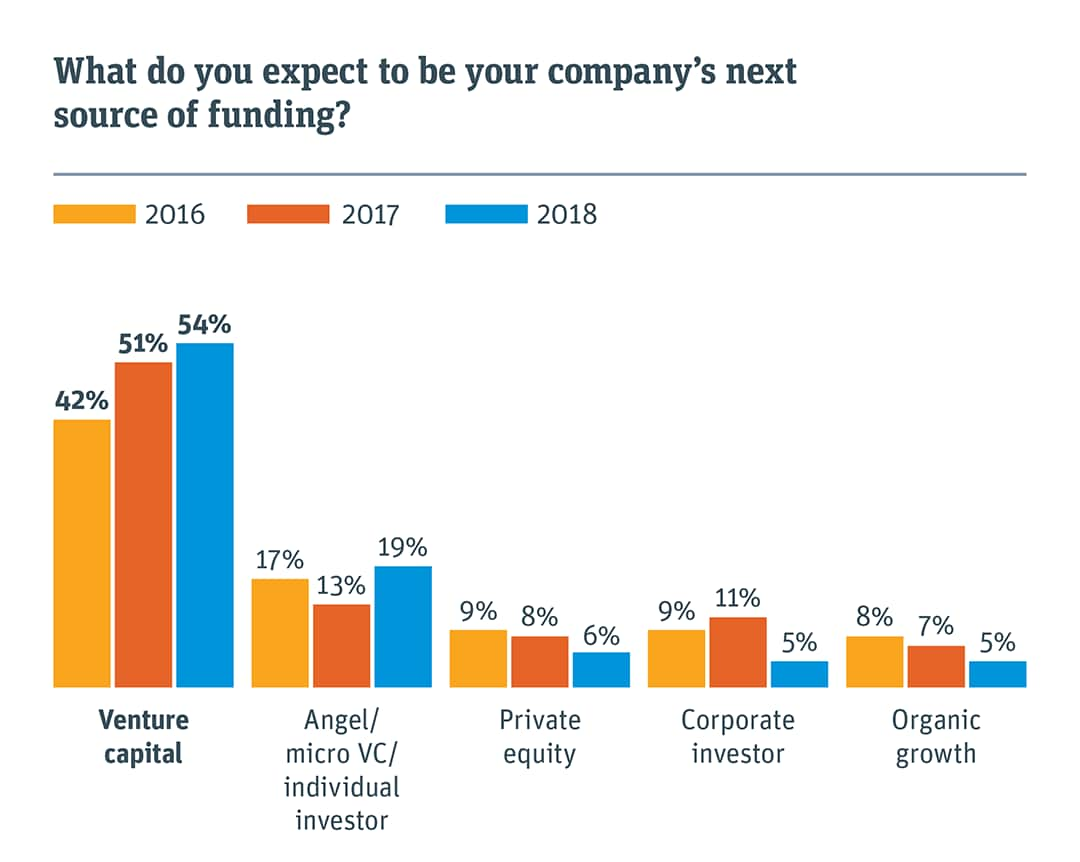

Despite ICO debut, venture capital remains the primary funding source

Despite an increasing number of sources from which startups raise funds to grow their businesses, including ICOs, more than half of startups say they expect to obtain their next source of funds from venture capitalists.

“Increase federal investment in startups to enable a path to market for high-risk technologies.”

—President, hardware company,

Menlo Park, California

Note: Asked of private companies that successfully raised capital. Other sources of funding include bank debt, IPO, merger, government grants and crowd funding and represented 15% in 2016, 10% in 2017 and 11% in 2018.

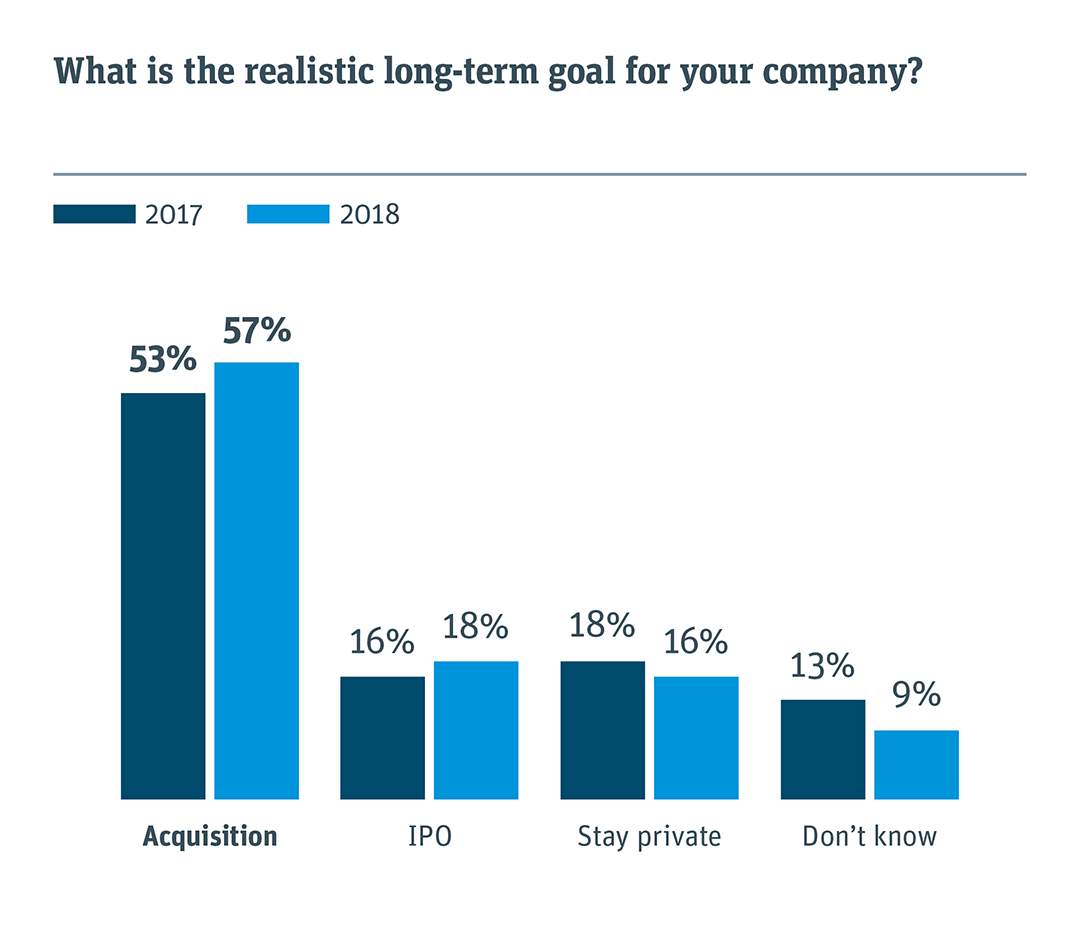

An IPO is not the realistic goal for most startups

With an improved outlook for IPOs, there is a small increase in the number of startups that eventually expect to go public. Acquisition, however, has long been the most common path to exit, and an overwhelming number of startups continue to believe that they will be acquired. Abundant access to private capital and the challenges of operating a public company influence startups’ decisions to be acquired or remain private.

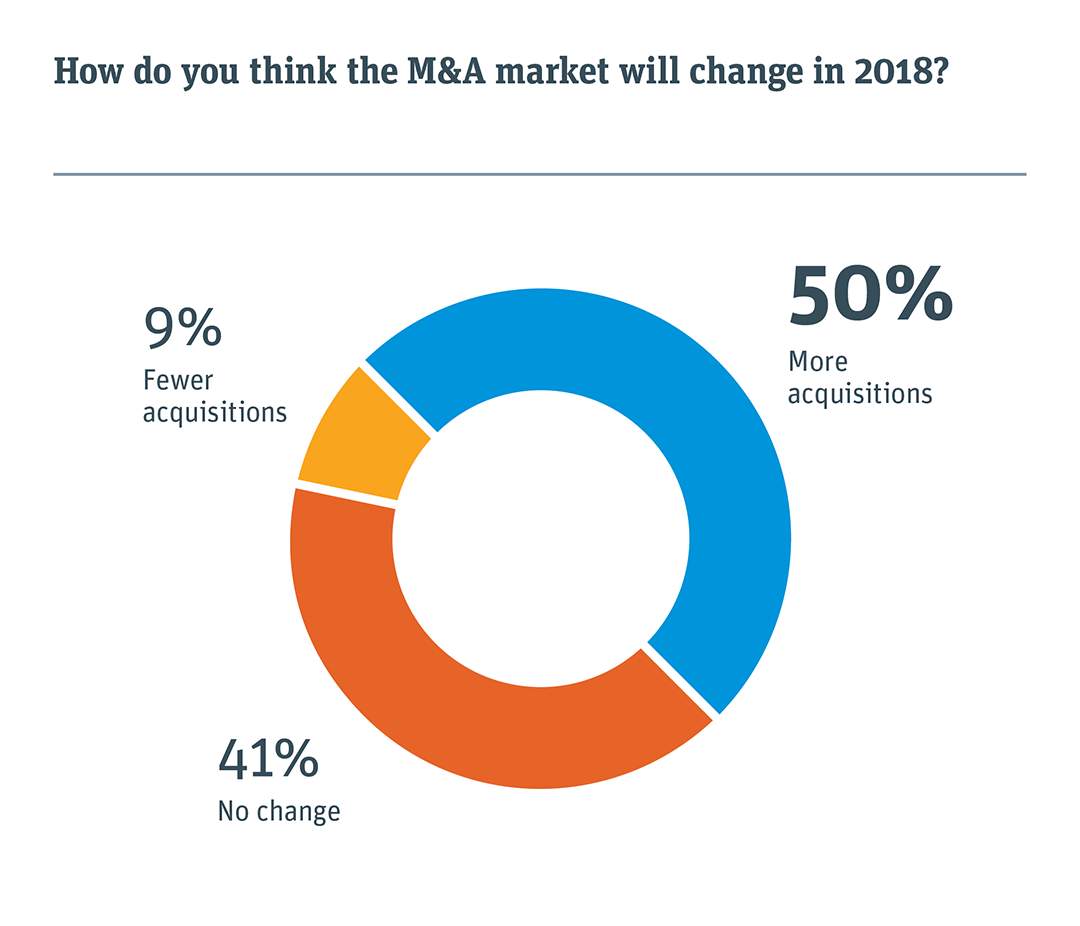

Startups expect M&A to remain strong

More than 90 percent of startups believe that there will be as many or more mergers and acquisitions in 2018 as in 2017.

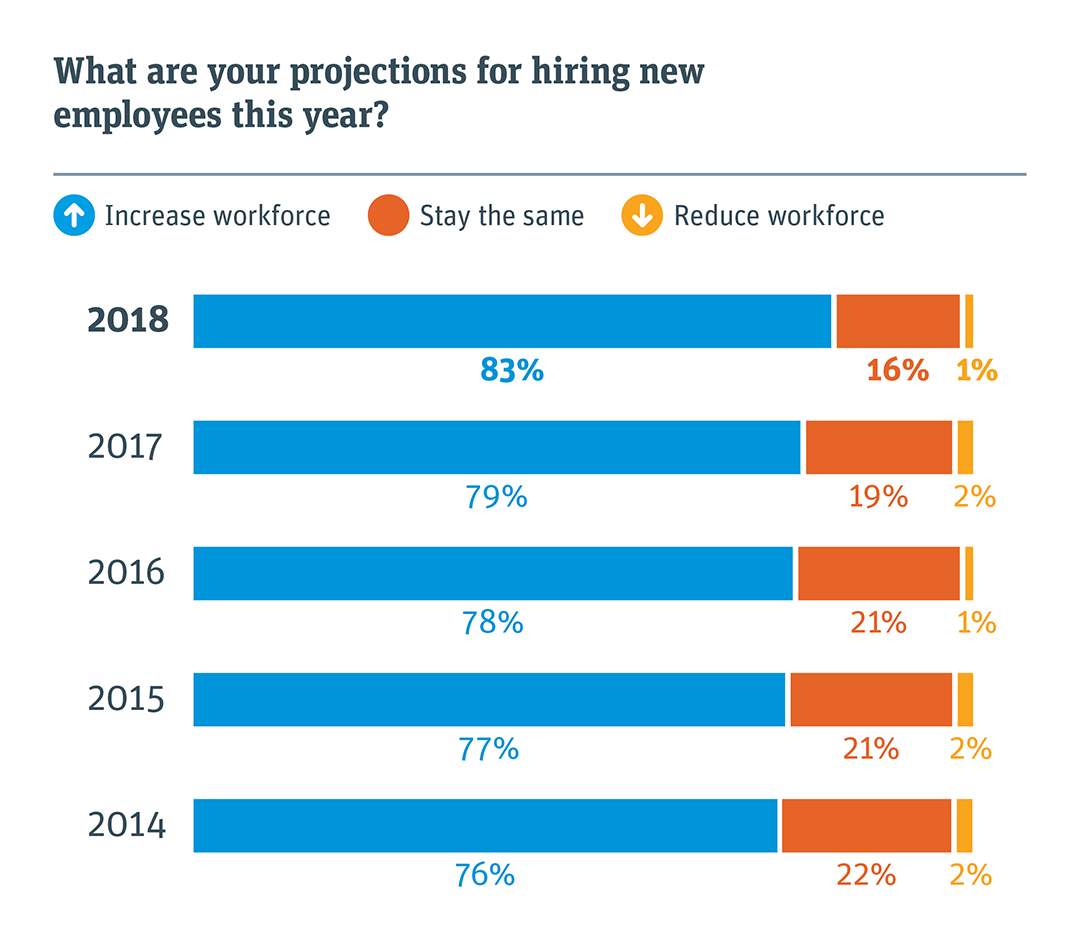

Hiring outlook reaches a five-year high

Startups are growing. More than 80 percent say they are adding employees, while just 1 percent plan to cut their workforces in 2018. The top three job descriptions that startups are seeking to fill are product development, technical positions and sales.

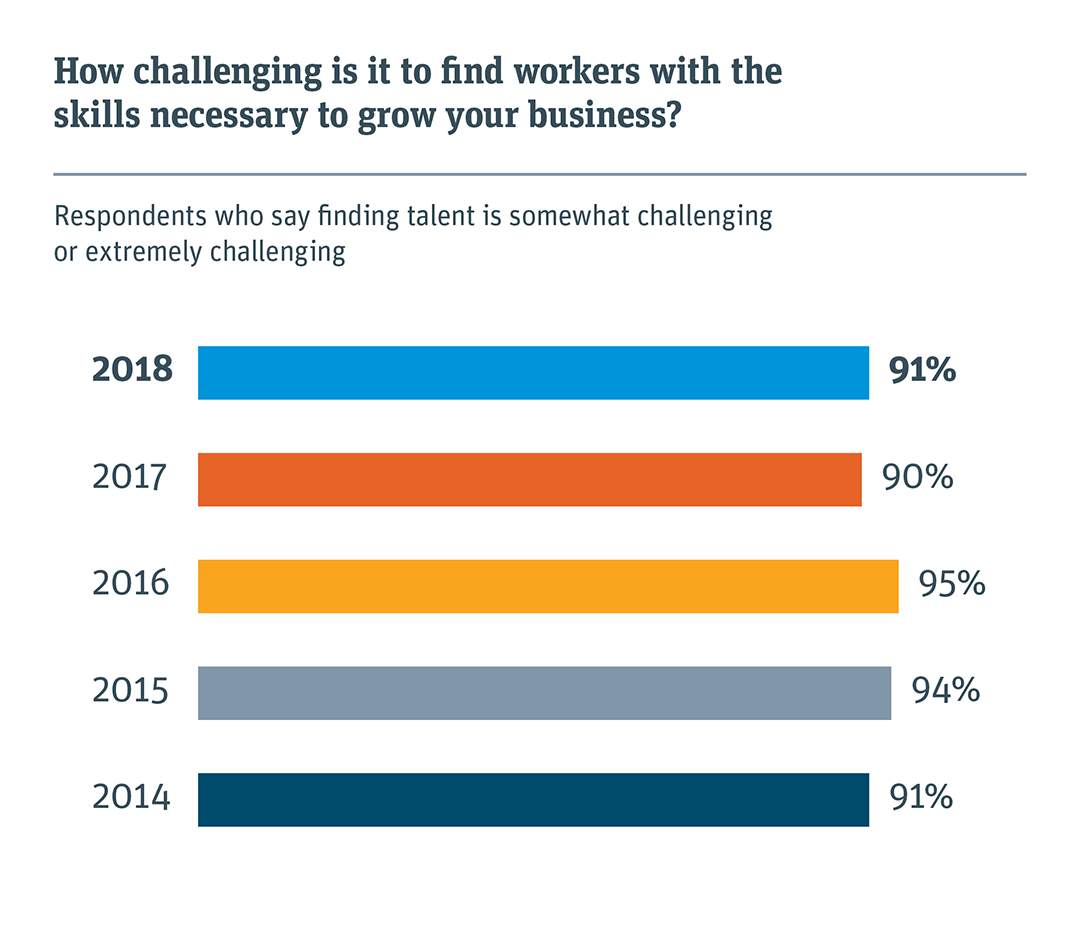

The talent crunch continues

While startups plan to hire, most continue to find it somewhat challenging or extremely challenging to find workers with the skills necessary to grow their businesses. The number of STEM — science, technology, engineering and mathematics — graduates is increasing slowly, and the newest technologies require specialized engineers and data scientists, who are in short supply.

“We need faster and different ways to accelerate education for technical talent. Cybersecurity and coding are the new shop class.”

—CEO, security software company,

Atlanta, Georgia

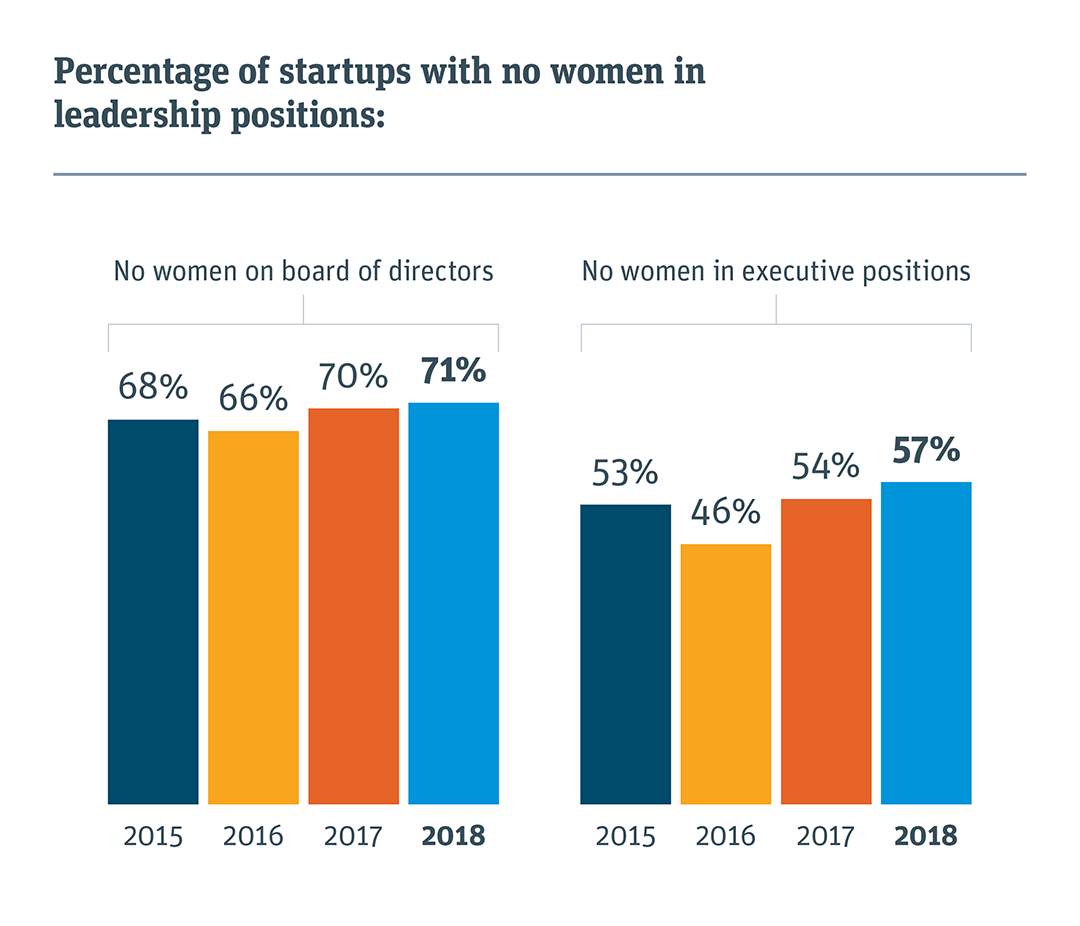

There is no progress for women in tech leadership

Seven in 10 startups have no women on their board of directors, and more than half have no women in executive positions. The number of startups that say they have programs in place to increase the number of women in leadership, however, has jumped significantly, from 25 percent to 41 percent.

The call for access to talent intensifies

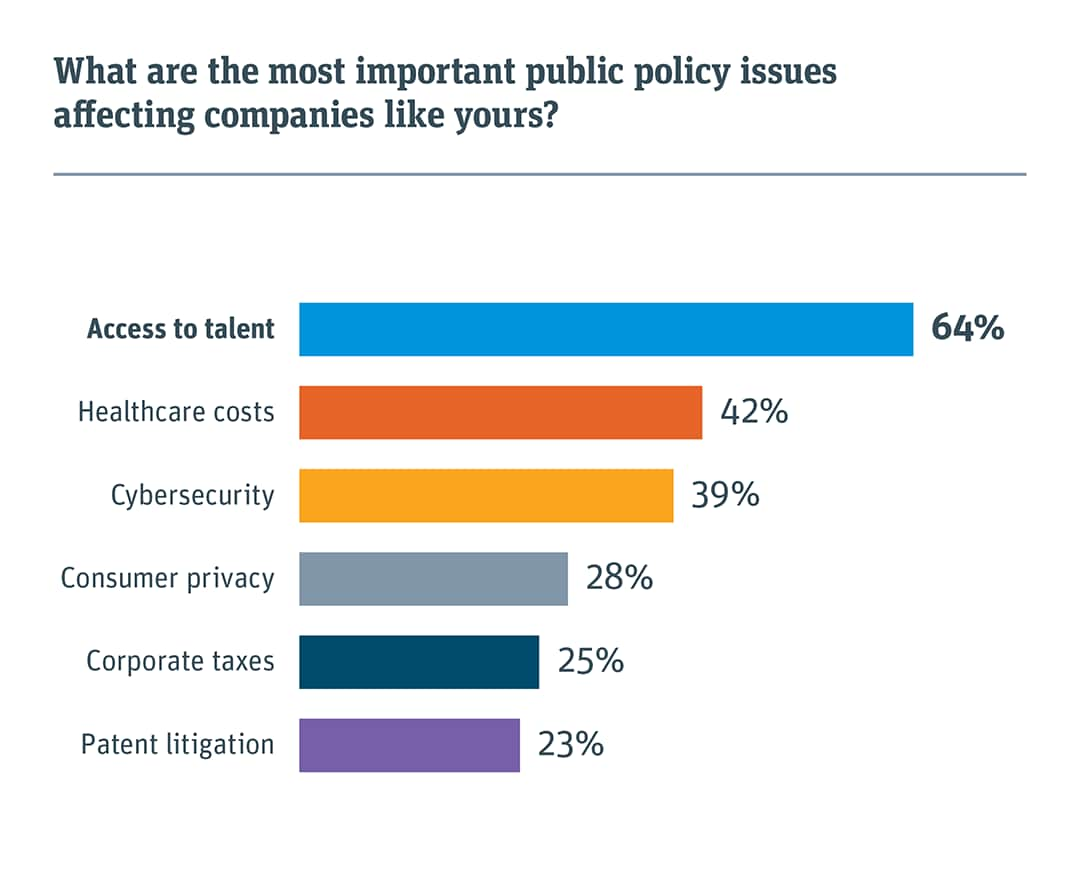

In this year’s survey, significantly more startups say access to talent is the most important public policy issue affecting companies like theirs. The focus on healthcare costs for employees remains in the No. 2 spot, and the percentage naming it a top issue has increased. Consumer privacy is among the top five policy issues, along with cybersecurity and corporate taxes.

“There is fierce competition for technical talent, driving up salaries and making it difficult for small companies to compete.”

—Co-founder/CEO, enterprise software company,

Cambridge, Massachusetts

Note: Respondents could choose up to three responses.

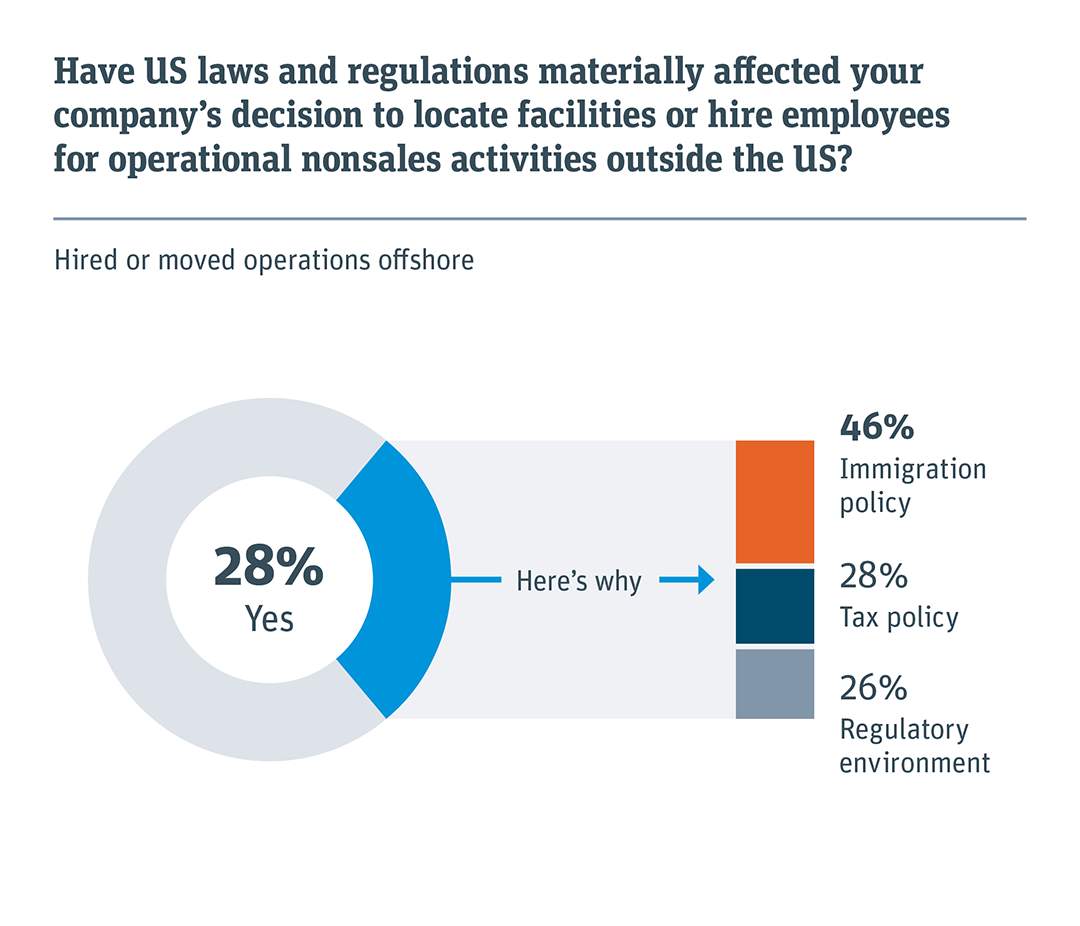

US policy drives some operations offshore

Nearly one-third of startups, ranging from pre-revenue to more than $25 million in annual revenue, say laws and regulations prompted them to locate facilities or move nonsales operations outside the US. The biggest driver is US immigration policy, followed by tax policy and the regulatory environment. With more than half of startups reporting that at least one founder is an immigrant, the innovation economy is deeply affected by US immigration policy.

“The US has succeeded in tech due to our ability to attract the world’s best and brightest. We need policies that encourage that to continue.”

—Co-founder/CEO, digital technology company,

Redmond, Washington

COMPID-1146