- The Federal Reserve has a difficult dual mandate, and sometimes its interest rate decisions have political consequences.

- President Trump has voiced his displeasure with current Fed Chair Jerome Powell, which in turn has called into question the continued independence of the Fed.

- We believe the Fed must remain independent of political influence so that it can focus on its job and make decisions even when they are not popular.

Economic vista: The importance of independence

Travis Dugan, CFA, Managing Director, Portfolio Management

As we approach autumn and say goodbye to summer, Independence Day is deep in the rear-view mirror. But perhaps we should take a moment to discuss—and advocate for—a different type of continued independence. The US Federal Reserve (Fed), which was established in 1913 in the aftermath of a banking crisis, has been an independent and non-partisan regulatory body for more than a century. The Fed is far from perfect, but it has played a vital role in helping the country navigate various financial crises over the years. Fed independence is integral to its ability to continue making decisions to help steer the economy, even when those decisions are not popular.

The inner workings

The independence of the Federal Reserve Bank has recently been called into question from remarks made by President Trump about Fed Chair Jerome Powell. The Fed has always served as an independent body tasked with the dual mandate of maintaining maximum employment and stable prices. The Fed aims to accomplish these goals with a variety of tools, including adjusting the Federal Funds Policy rate and the money supply. Even though the seven members of the Board of Governors are nominated by the President, the decisions of the Federal Open Market Committee (FOMC) in setting the policy rate are meant to be independent of political influence. This independence is critical and has allowed committee members to remain focused on achieving their dual mandate. This independent structure has allowed the Fed to keep inflation under control, to the extent possible.

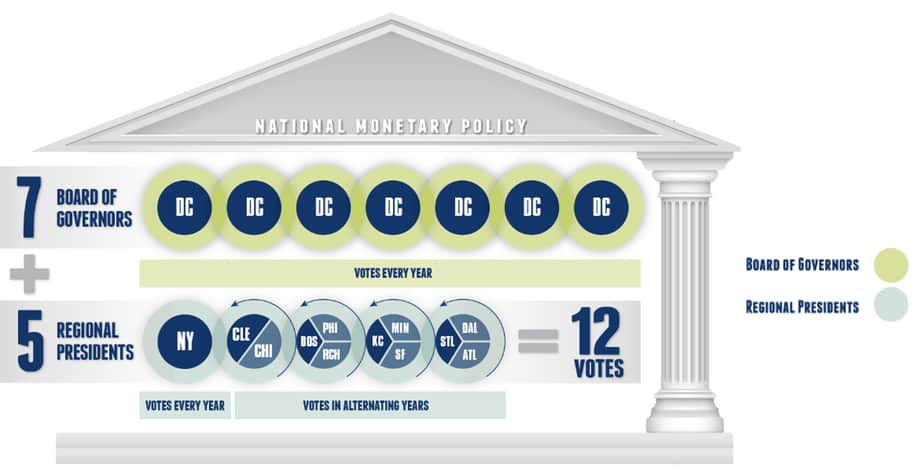

The FOMC is a committee within the Federal Reserve system that is comprised of twelve members. Seven members are from the Board of Governors and are based in Washington D.C. The president of the Federal Reserve Bank of New York is a permanent member who also serves as the Vice Chair of the committee. The remaining four members rotate annually from among the twelve Reserve Bank presidents. The seven Board members, inclusive of the Chair and the Vice Chair of the Board, are nominated by the President and confirmed by the Senate.

Federal Open Market Committee structure

Source: Federal Reserve Bank of Chicago; Federal Open Market Committee: Who Votes? - Federal Reserve Bank of Chicago.

The Fed’s job is never easy, trying to thread the needle between keeping inflation in check while supporting the economy and employment. This dual mandate requires some nuance, and its decisions are not always popular. That’s why independence is critical.

Recent comments by the President have called into question this independence. The President has suggested that the policy rate is too high and that it should be reduced to support the labor market, particularly after the most recent disappointing jobs data. The President has openly suggested that he could remove Fed Chair Jerome Powell. While this is not the first time a President has sought to influence the Fed, the current administration has taken a more aggressive stance in its ability to challenge historical decisions about Fed independence. The President nominates the seven Fed Governors, including the Chair, but the President is only allowed to remove a Governor “for cause,” which historically has meant for a dereliction of duties and not for policy disagreements. Also, the FOMC changes the fed funds rate via a majority vote amongst the twelve FOMC participants. Thus, the removal or a retirement of one Governor may not impact how the rest of the FOMC will vote on future policy rate decisions.

Staying impartial

We believe that influencing the Fed to support a political agenda is short-sighted. Presidents are, of course, politically motivated to keep a strong economy with full employment. Lower interest rates tend to stimulate investing by individuals and corporations, which in turn should contribute to economic growth. However, too much stimulation can lead to inflation, which is bad for everyone, as higher prices erode buying power and reduce risk appetite. This often slows economic growth and can even trigger a recession. Meanwhile, when the perceived risks of inflation rise, inflation expectations follow. Both the Fed and bond market watch inflation expectations closely, and higher expectations can put upward pressure on bond yields. In turn, this increases borrowing costs and can lead to lower corporate profits, lower consumer confidence and spending, and lower growth.

The Fed’s job is tricky, to say the least. But it is critical for it to be independent. Maintaining an independent Fed ensures that they can stay fully focused on their dual mandate of maintaining maximum employment and stable prices, which supports the long-term well-being of the economy. While it can be tempting for a sitting US President to focus on near-term growth without regard for inflation implications, an independent Fed will target both growth and low inflation to promote economic stability.

Despite elevated risk to Fed independence by the current administration, the composition of the FOMC and the fact that changes in the fed funds policy rate require a majority vote by seven of the 12 governors, make it very difficult to take away Fed independence. That’s a good thing, in our opinion. Further, attempts to remove the Fed Chairman have already seen a quick reaction in the bond market through higher yields and increased volatility, so the bond market seemingly agrees with us too. An independent Fed should be valued because it provides the greatest support for the future stability of the US economy, regardless of political agenda.

Trading vista: Fed in focus

Jason Graveley, Senior Manager, Fixed Income Trading

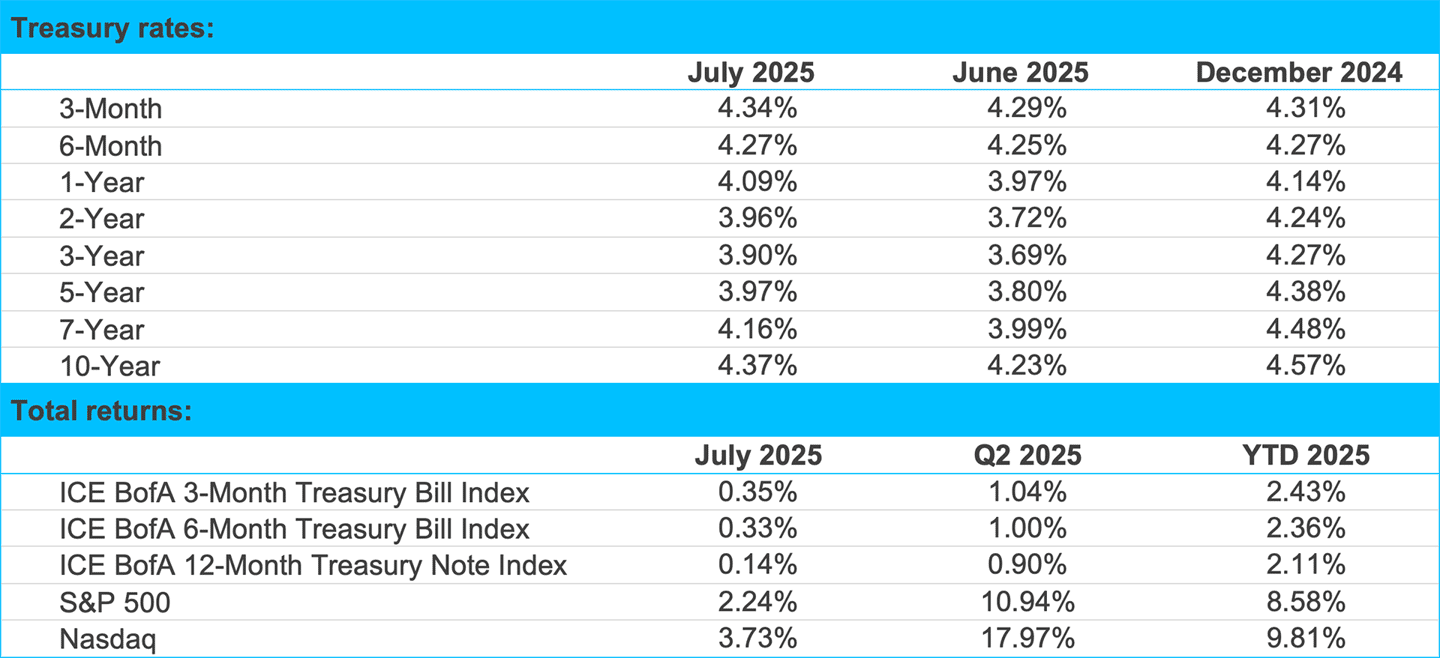

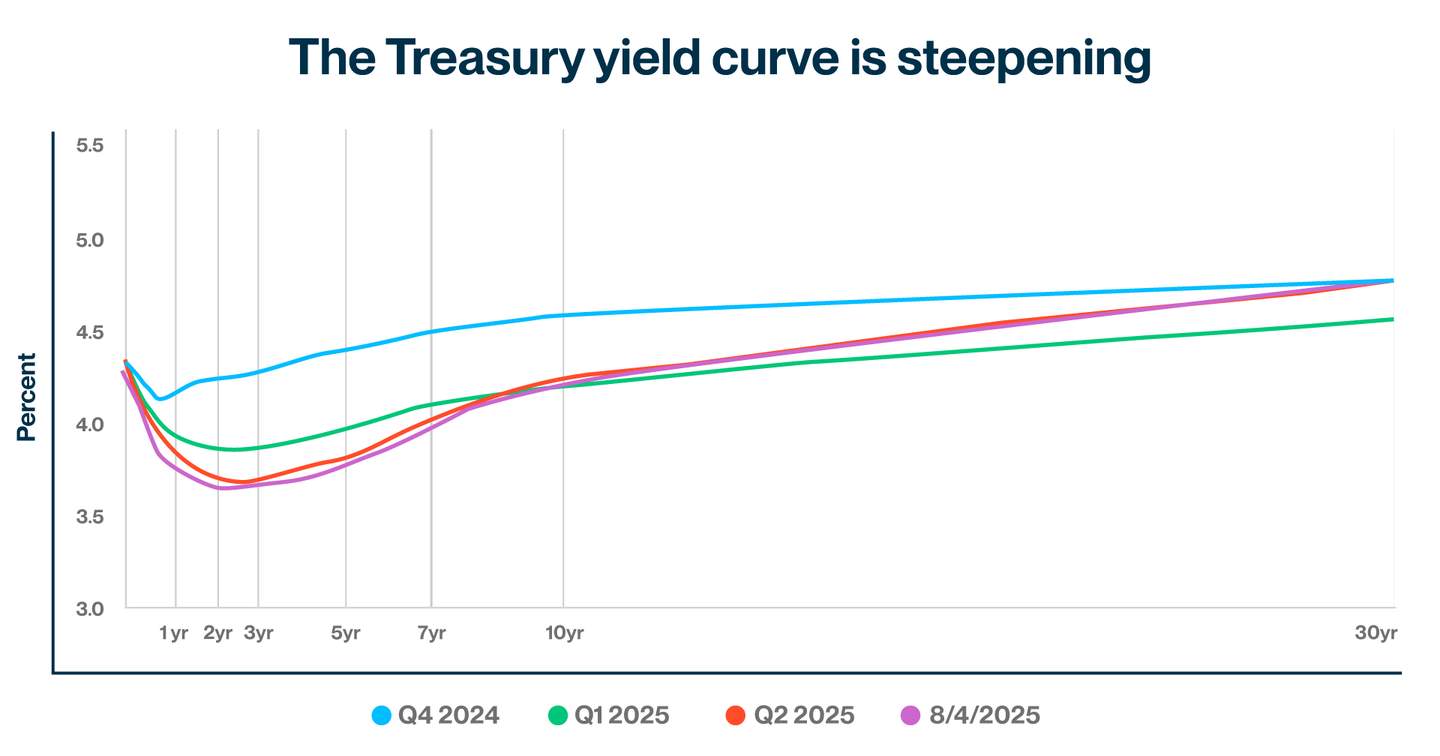

Truth be told, Fed watching is always top of mind for fixed income traders and investors. But as we approach the next FOMC meeting in September, everyone is on high alert. Are we now on the cusp of restarting the Fed’s easing cycle? It certainly seems that is where investors (and strategists) have settled after the latest string of economic data. The July employment report was the key catalyst for the shift in sentiment. Softer-than-expected job creation, coupled with large downward revisions to prior months’ employment numbers (incidentally the largest downward revisions since 1979, excluding the COVID outliers), surprised the market. Given the disappointing July payrolls report and an uptick in the unemployment rate, Treasury yields moved sharply lower and have mostly remained there over recent weeks. The yield on the 2-year Treasury, generally the most sensitive to potential changes in monetary policy, fell more than 25 basis points as investors moved up the timing and pace of expected rate cuts. Before the report, the implied probability of the next rate cut sat firmly at the December FOMC. At the time of this writing, September is now the betting choice with a 98% likelihood of a rate cut priced in.

With the employment report in the rearview mirror, market attention pivoted quickly to the inflation data. Although this reinforced the likelihood of a September cut—the market is ever-hopeful—the data was a bit of a mixed bag even if the headlines were largely in line with expectations. For the time, it relieved some fears that tariff-related costs would start putting upward pressure on consumer prices, which left the Treasury market reaction rather muted. So, while investors have been a bit unsettled by trade policy uncertainty, fiscal policy and the decelerating labor market, the inflation report fueled the belief that a new rate-cut would begin sooner rather than later.

As always, caveats apply. Remember, the outlook for monetary policy can pivot quickly, and investors have come to expect some level of volatility during a Trump administration. After all, the “Liberation Day” shock wasn’t that long ago! But if we look ahead into next year, there are approximately three rate cuts priced in through January 2026, and five total rate cuts expected through the end of next year. If we concentrate on the forward curve for Treasuries, the market now expects the 1-year Treasury to move directionally lower over the coming quarters, down from its current level of roughly 4%. Lower rates seem to be on our doorstep now.

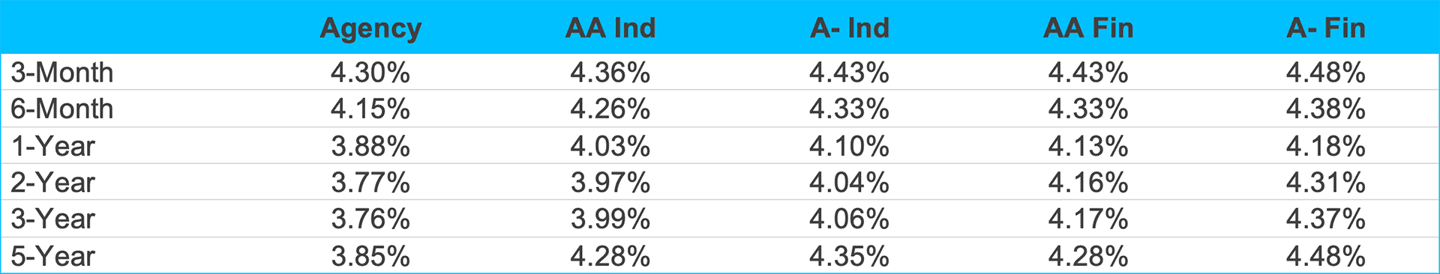

As we approach the fourth quarter of 2025, the technical backdrop remains strong for credit ahead of a potential easing cycle as well. Credit demand appears yield driven as investors get ahead of any cuts and look to lock in higher rates for longer periods. Even though credit spreads have tightened considerably and are now approaching their tightest level of the year, investors are not yet moving to the sideline or waving the white flag. Yes, valuations remain a concern for some, but current prices don’t appear to be a deterrent. In this environment, we believe that security selection and fundamental analysis remain critical.

Source: Bloomberg and SVB Asset Management as of 07/31/2025.

Source: Bloomberg, Tradeweb and SVB Asset Management as of 08/04/2025.

Source: Bloomberg, Tradeweb and SVB Asset Management as of 08/04/2025.

Source: Bloomberg and Silicon Valley Bank as of 07/31/2025. US Bureau of Economic Analysis (BEA) and US Bureau of Labor Statistics. *Current GDP release as of 07/30/2025. †QoQ — Quarter-over-Quarter. **Core Personal Consumption Expenditures. ‡Current PCE release as of 07/31/2025.