- Extending duration is always a key question facing investors, and it seems more important than ever now that the Fed is kicking off a new rate-cut cycle.

- The arrow is pointing downward for money market fund yields, which may motivate some investors to consider reallocating.

- Extending duration may be appropriate for some clients given the current market dynamics, though individual investment circumstances always matter.

Economic Vista: The duration dilemma

Jon Schwartz, Senior Portfolio Manager

To extend, or not to extend, that is the question.

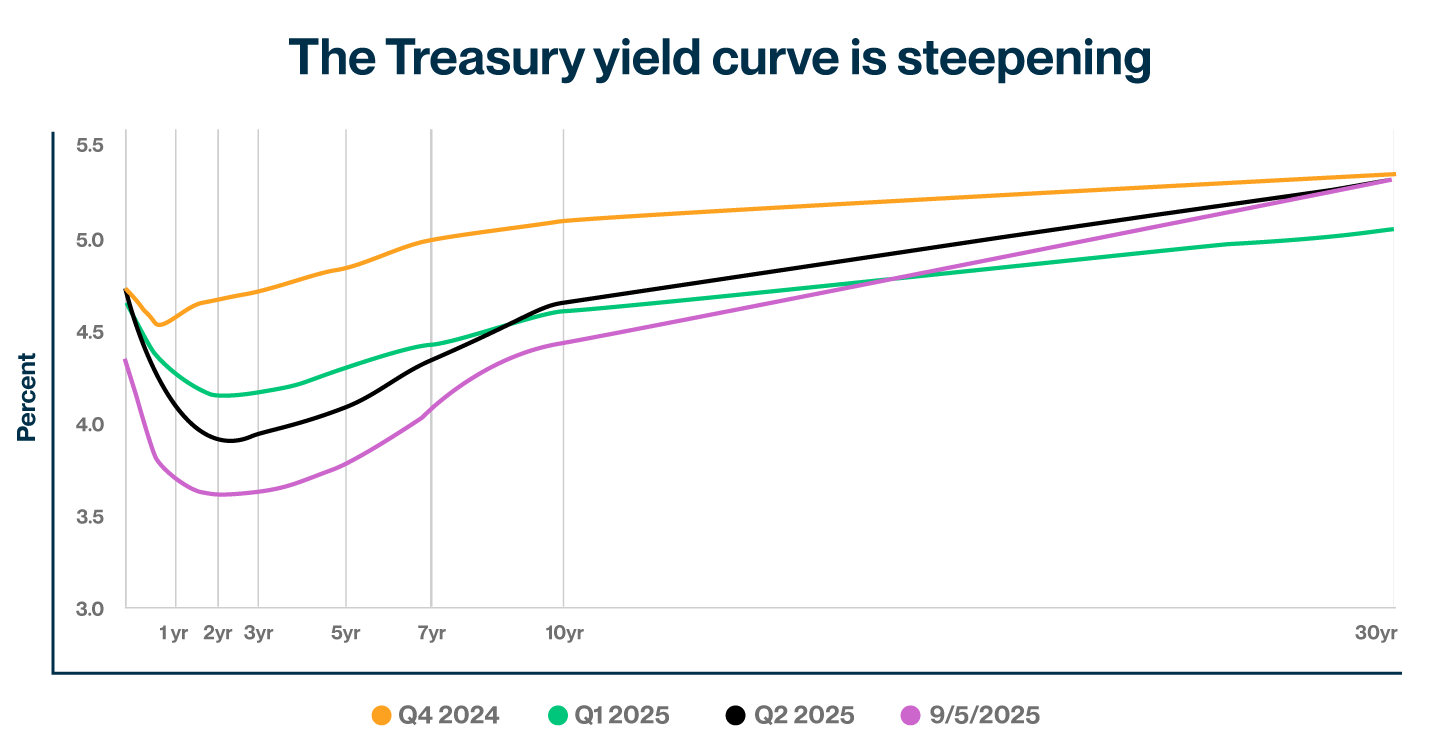

Fixed income investors are constantly presented with a dilemma surrounding duration. If you believe that the Fed will continue cutting rates in the future, it would be prudent (in theory) to lock in higher yields with longer duration investments. On the flip side, if you believe the markets may be over-estimating the magnitude of future rate cuts, your portfolio will likely benefit from less duration. This duration decision will have a material impact on the performance of your fixed income portfolio.

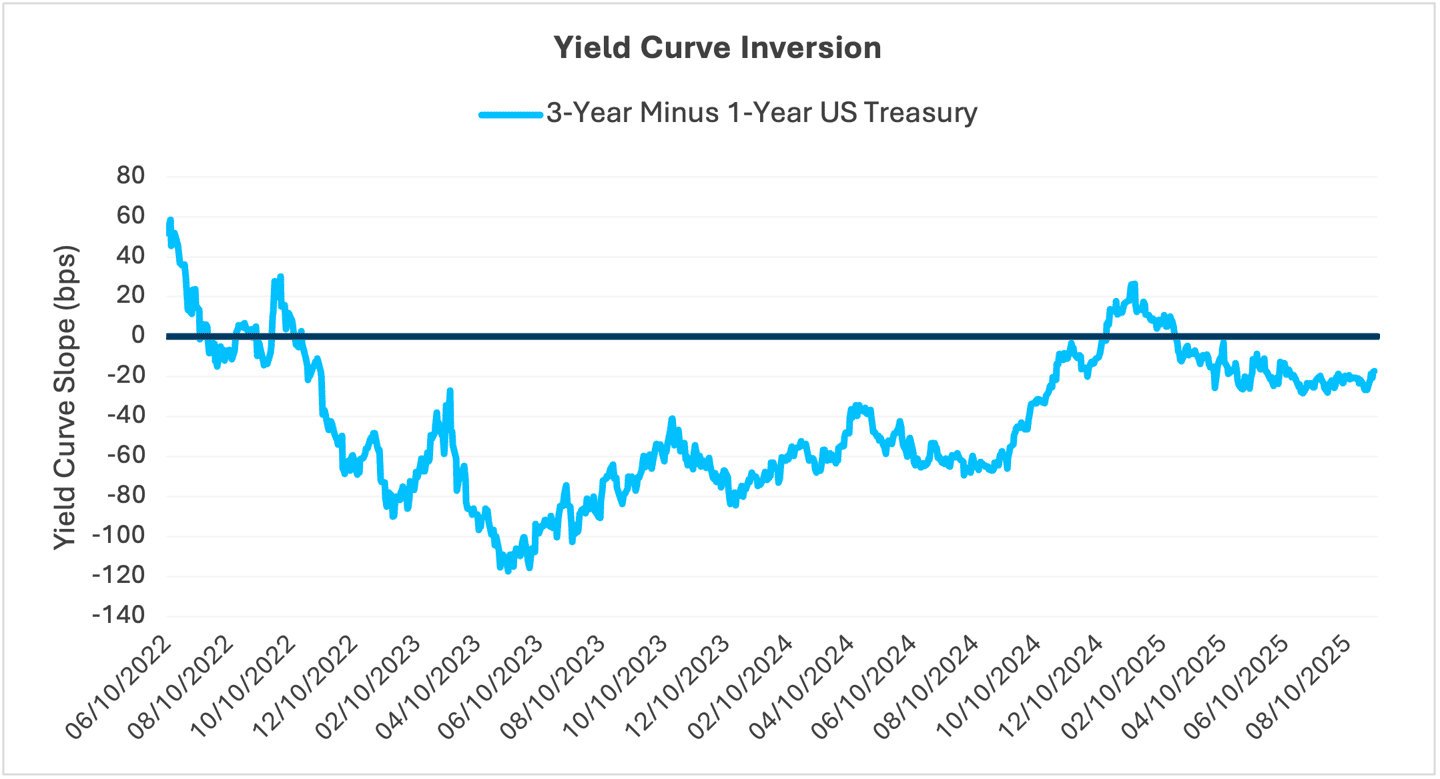

Your investment objectives and near-term cash requirements should drive any duration decision. But considering your own expectations for future Fed moves versus the market’s overall expectations will also play a role. Another major factor is evaluating the income premium that investors can earn by adding more duration over their investment horizon. Investors demand to be compensated for taking on more risk. In a “normal” environment the yield curve is upward sloping with short-term yields being lower than long-term yields. Thus, the longer the term of the investment, the more interest income the investor tends to earn. Importantly, this can still be the case even when we have an inverted yield curve (like now). The decision to move funds from deposit products and money market funds will preserve high quality predictable income when the Fed is cutting. The graph below reminds us that the Treasury curve was inverted for the majority of the past three years.

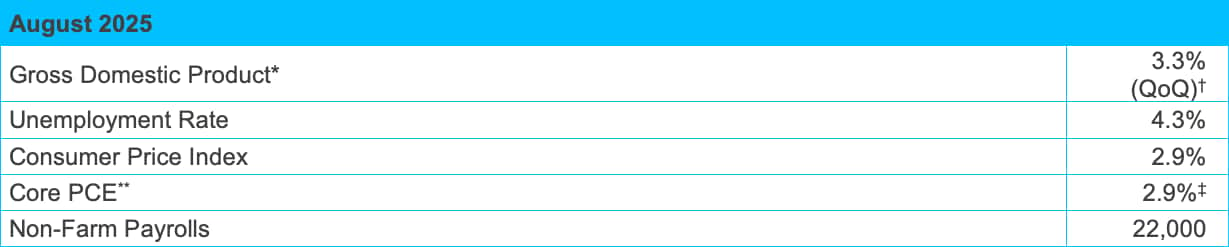

Any decision on duration should also consider the monetary policy outlook, which in turn will be driven by the economy. As the Federal Reserve likes to point out, all future rate-cut decisions are data dependent, particularly with regard to inflation and employment. It seems clear that the employment outlook has been deteriorating over the past few months, and this is why the Fed has kicked off a new rate-cutting cycle. Below is a summary of some recent concerning jobs data:

- Payrolls have been steadily dropping, with only 29,000 new jobs added per month on average over the past three months. This is far less than the 167,000 average monthly jobs added throughout 2024.

- The unemployment rate has drifted up to 4.3%, the highest level since 2017 (excluding the pandemic months).

- Job openings have been on a steady downward trend since mid-2022 and continuing jobless claims have been climbing to new levels not seen since late 2021.

Federal Reserve Chairman Jerome Powell noted this deterioration in recent blunt remarks stating, “…the downside risks to employment are rising.” This locked in the September rate cut while also raising expectations for additional cuts at future FOMC meetings.

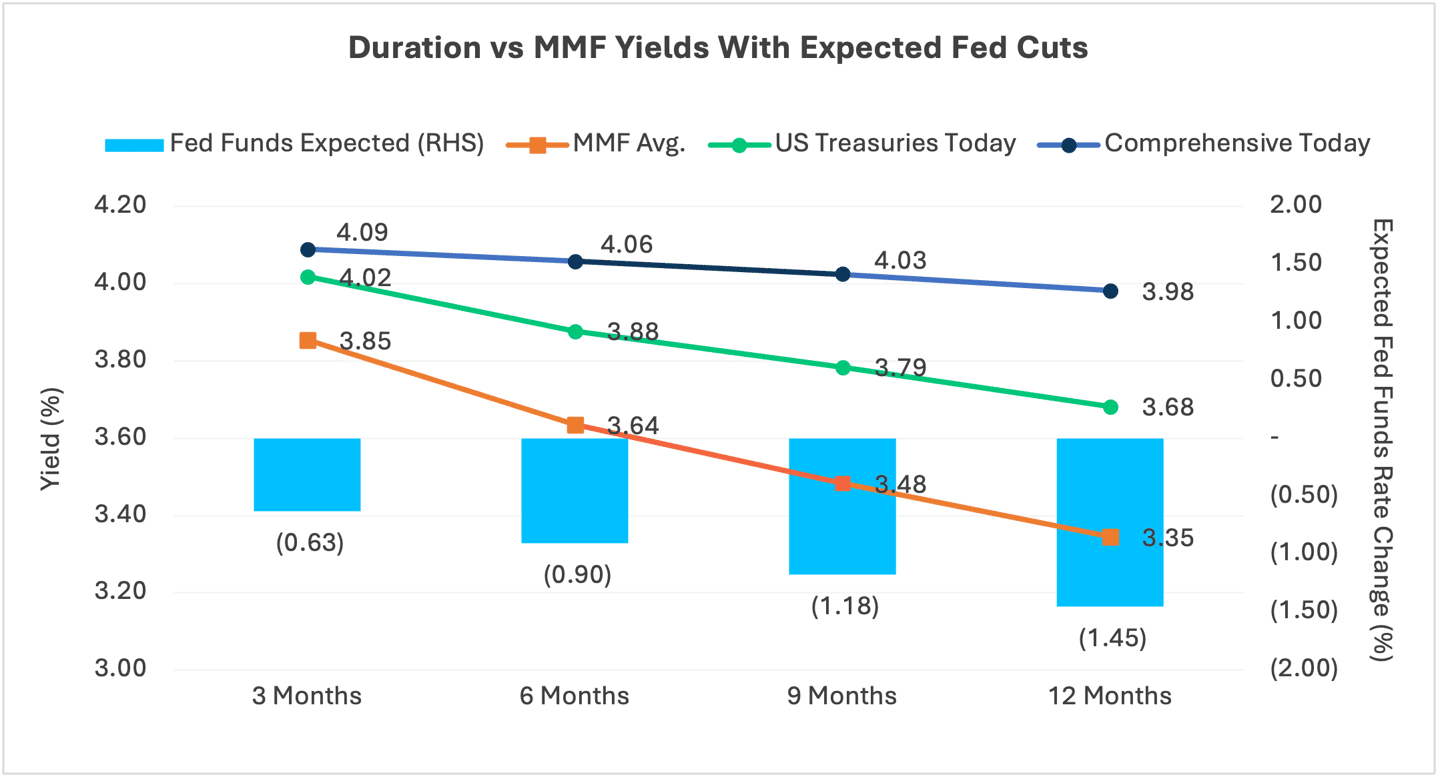

Decision time

So, how might this impact your duration dilemma, and where are the most appealing opportunities in fixed income markets as we enter a new rate-cut cycle? First, consider that Fed funds futures are pricing in roughly 145 basis points (bps) of rate cuts over the next 12 months (as of this writing). If rate cuts match expectations, money market funds would deliver an average yield of roughly 3.35% over the next 12 months. But at this time next year if the Fed delivers the market’s expectations, yields in money market funds will be lower. (The current MMF yield of roughly 4.20% minus 1.45% in rate cuts would leave investors earning just 2.75%).

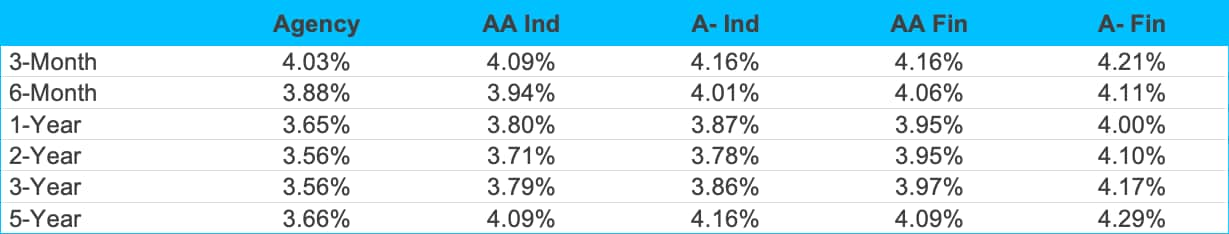

All this gives investors much to ponder. Investors who have parked cash in money market funds need to think about the yield that their fund will average over the investment period in relation to their income needs and the various investment alternatives. Referencing the chart below, you can see the incremental yield earned over the money market fund increases as we go longer in duration. This increase represents the “term premium” of interest rates. In other words, there is an increasing amount of yield investors can earn by adding incremental duration.

This analysis highlights the benefit of adding duration in corporate bonds as well. Investors are right to demand wider spreads over Treasuries for longer duration investments, including corporate bonds. So, while it’s prudent to understand how rate cuts are “priced in” to various investment options, investors should also consider the term premium of interest rates to determine if there is enough compensation for the level of risk taken. Although the yield curve is currently inverted, there is still a positive term structure given what is expected from the Fed and where US Treasuries and corporate bonds are currently trading. Thus, for many clients, extending duration may be appropriate. Of course, individual circumstances always matter, and our team can help you answer your own personal duration dilemma.

Credit Vista: The AI & FI (fixed income) revolution

Emelynn Abreu, Credit Analyst

There’s nothing fake about it. Artificial intelligence (AI) is reshaping corporate strategy in all sectors across the economy. As with any tectonic changes that fundamentally change the business landscape, there will be ramifications for investors and, especially, their fixed income portfolios. Sound credit research and astute active management will be critical in navigating this new era of AI investment.

A massive wave

Just how big is this AI investment wave? Spending projections are rivaling past technology buildouts associated with proliferation of the internet, the dot-com boom, and the widespread adoption of cloud computing. The four large hyperscalers—Alphabet, Amazon, Meta, and Microsoft—are on track for approximately $340 billion of capital spending this year, up a staggering 36% from the prior year, with the majority earmarked for AI investment and data center buildouts. That’s exciting. But the massive scale of required investment also has the potential to pressure balance sheets, change financing patterns, and alter credit trajectories. For bondholders, understanding sector and issuer-level dynamics is critical to navigating the opportunities and potential risks.

Throughout the AI capex investment cycle, companies commit to heavy R&D and capital expenditures, spending on data centers, chip purchases, model training, engineers, etc.—all of which have the potential to strain balance sheets. In some cases, free cash flow can turn negative, cash can be depleted quickly and debt financings can rise. Eventually, barriers to AI adoption will decline and the range of viable applications for AI across industries will grow. Cloud offerings, agents and enterprise productivity tools should gain traction, and this broad AI adoption should translate to rising revenues and/or cost savings for many. We're already seeing some AI investments yield returns; however, not all AI investments will be prudent nor revenue accretive. The question remains whether revenue growth will keep pace, and companies will generate enough additional AI revenue to justify their massive data center investments. It’s really a case-by-case basis.

As broad-scale AI adoption continues to gain traction, constraints have emerged. For example, legacy IT systems with unstructured data represent a potential roadblock and may require additional data infrastructure spending. Other constraints include power, compute, network and security, to name a few. How firms respond to these constraints will ultimately shape AI outcomes in the coming years. Yet, one thing is increasingly clear: AI adoption will require significant resources, and companies will need to ramp up capital spending. Deloitte estimates the generative AI chip market was worth approximately $125 billion in 2024, roughly 20% of total chip sales, and they forecast $150 billion of sales in 2025 as AI capex continues to grow.i Further illustrating the scale of the market, Lisa Su, CEO of AMD, reportedly sees the total addressable market for AI accelerator chips reaching $500 billion by 2028.

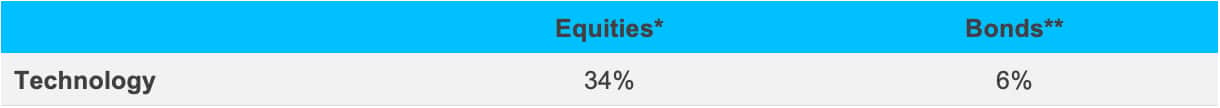

By some estimates, investment needs across buildout and hardware for global data centers will reach $2.9 trillion through 2028, with about $1.7 trillion in the US alone.ii While a significant portion of spending will be funded by hyperscalers' cash flows, there looks to be a significant financing gap of roughly $1.5 trillion.iii This will need to be addressed by external capital, with credit markets expected to fill a portion of that gap. As regular issuers in the corporate bond market, investment-grade technology companies remain under-indexed relative to the stock market and maintain significant capacity to increase debt issuance without overwhelming the market.

Technology sector weights - equity and bond markets

Opportunities & risks

For bond investors, increased corporate issuance provides a potential opportunity to capture additional credit spread as investors find attractive risk premiums in companies funding AI expansions. There may also be ratings upside for firms that successfully monetize AI and strengthen their credit profiles. Of course, along with these opportunities new risks may also emerge. For bondholders, one key risk lies in the timing mismatch, as cash outflows are almost immediate, while revenue realization may take years (if they occur at all). Particularly in the early investment phase, issuers may see leverage metrics deteriorate, potentially risking downgrades from the public rating agencies. Firms need to prudently manage capital spending needs and investment planning in order to keep finances stable.

Throughout the investment cycle, it is important that bond investors maintain diversification across sectors to avoid overexposure. Here, SAM Credit Research can help though our fundamental analysis and credit selection, prioritizing issuers with robust liquidity and good market positioning. Moreover, it will be imperative to closely monitor capex guidance, debt pipelines and free cash flow infection points as leading indicators of credit trajectory. But with active credit monitoring and diversification, we aim to identify the most attractive securities while balancing the risks. AI is about to get real for bond investors.

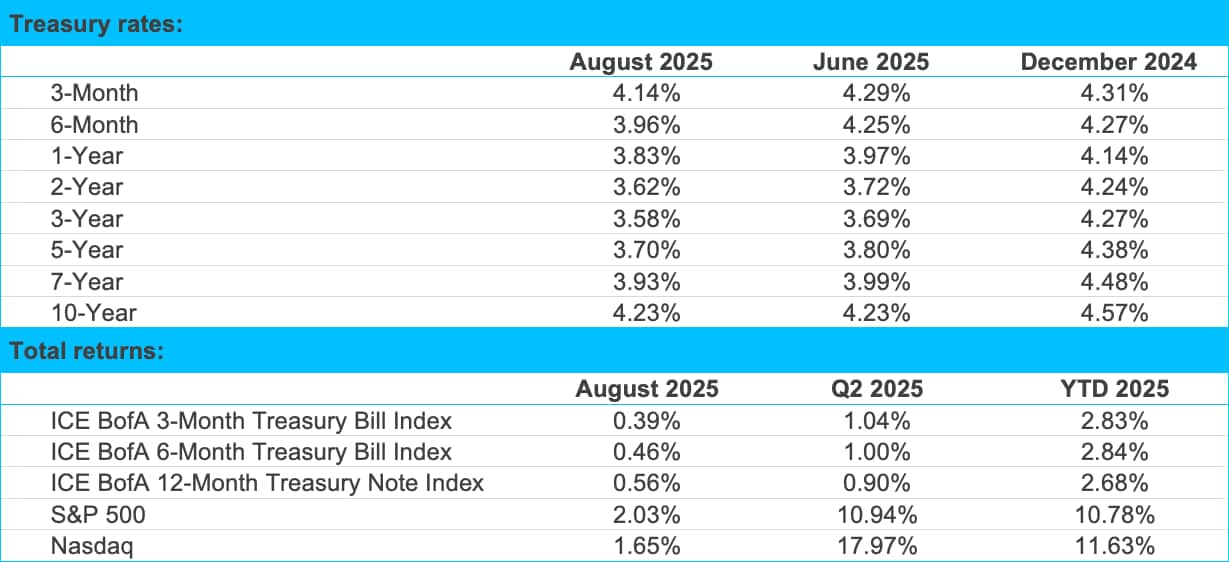

Markets

Agency and corporate yields

Economic indicators

i 2025 semiconductor industry outlook | Deloitte Insights

ii https://ny.matrix.ms.com/eqr/article/webapp/

iii https://ny.matrix.ms.com/eqr/article/webapp/