- FHLBs, a type of agency bond, have gained popularity thanks to their yield potential, lower perceived risks, and diversification benefits.

- FHLBs have a strong track record and carry the implicit backing of the U.S. government, making them an intriguing option to Treasuries given the rancorous debt ceiling discussions.

- Although FHLB demand and issuance as surged to record levels, their embedded risk protocols should not worry investors, in our opinion.

Also included are the following themes:

- Credit Vista: Liquidity safety nets for banks

- Trading Vista: FHLBs at the forefront

Economic Vista: FHLBs are in vogue

Jose Sevilla, Senior Portfolio Manager

In today’s environment replete with many cross currents, U.S. government agency bonds — a type of fixed income investment based on debt obligations issued by government-sponsored enterprises (GSEs) — appear to be an attractive investment opportunity thanks to their current attractive yields that come with the backing of Uncle Sam. After all, what’s not to like about this potent combination?

Agency bonds are issued by federal agencies, such as Freddie Mac (FHLMC), Fannie Mae (FNMA), and the Federal Home Loan Banks (FHLB), and they carry the implicit guarantee of the U.S. government. Agencies are rated similar to U.S. Treasuries; however, they typically offer a higher yield alternative for investors also seeking a combination of safety, liquidity and diversification. Of these agencies, we will focus on FHLBs in this article, as they have come back into vogue given the increase in bond issuance.

Like FNMA & FHLMC, FHLB is a GSE regulated by the Federal Housing Finance Agency (FHFA). Chartered by Congress in 1932 during the Great Depression, FHLB provides their 6,500-plus member banks with low-cost financing to support mortgage lending and community investment. They are unique in that they are structured as cooperatives where each member institution (made up of banks, thrifts, credit unions, insurance companies, and community development financial institutions) is a shareholder in one of the 11 regional FHLBs. And each regional FHLB is an individual corporate entity governed by strict management and capitalization standards befitting its status as a GSE. Federal oversight, in conjunction with normal bank regulation and shareholder vigilance, assures that each regional bank remains conservatively managed and well capitalized.

So how, exactly, do these debt instruments work? Each regional FHLB provides long-term and short-term secured loans, called “advances,” to their member banks. These advances are basically secured loans where the members are required to put up high-quality collateral in return for cash. By requiring substantial collateral, FHLB ensures that their members have sufficient assets to support their borrowing and can meet their obligations. All the government scrutiny and collateral requirements help mitigate the risks of these agencies. It’s no real surprise, then, that FHLBs have never suffered a loss on collateralized advances to their member banks. This simply confirms that the regional FHLBs have a strong credit risk management framework in place and only lend to creditworthy members with sufficient collateral to support their borrowing.

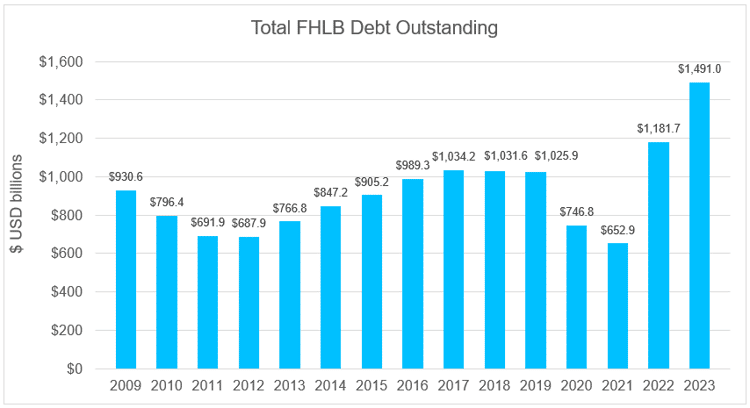

FHLB primarily funds their advances by issuing debt securities in the form of discount, floating rate notes and longer-term bonds. FHLBs have an implicit U.S. government guarantee, which means they can tap the capital markets for more favorable rates on their debt. As the demand for advances increases, it is typically followed by a corresponding increase in debt issuance. This has been the case recently. FHLBs have been issuing more debt to fund the increased demand for advances from their member banks, which picked up markedly as bank funding needs grew while deposits shrunk in the wake of the Federal Reserve’s aggressive rate hikes. As of April 30, 2023, total FHLB debt outstanding has surged to a record $1.49 trillion.

Source: https://www.fhlb-of.com/ofweb_userWeb/pageBuilder/debt-statistics-61

Source: https://www.fhlb-of.com/ofweb_userWeb/pageBuilder/debt-statistics-61

Nevertheless, market participants are not worried about the surge FHLB demand and issuances. This simply reflects the current dynamics of the market, and investors should not overlook FHLB’s track record and strong underlying collateral requirements. After all, FHLBs are well regulated and carry the implicit backing of the U.S. government. Thus, we believe that for investors who desire a secure investment with potentially attractive returns — not to mention a way to diversify and steer clear of risks related to debt ceiling discussions — FHLBs present an appealing alternative to U.S. Treasuries.

Credit Vista: Liquidity safety nets for banks

Darrell Leong, CFA, Managing Director, Head of Investment Research

If we have learned anything from the events of the past couple months, it is that liquidity doesn’t matter to the average banking customer — until it suddenly does. Consider how the turmoil impacting regional banks in recent weeks has heightened everybody’s concerns. Before these recent events, when was the last time you wondered about your bank’s insured versus uninsured deposit mix, or the unrealized losses in balance sheet investment securities at regional banks? This simply underscores the importance of maintaining adequate liquidity, even if it’s something we don’t think about during “normal” times.

When a bank is unable to tap into its traditional funding sources, such as deposits, it is forced to search for alternatives. Many wonder where a bank can turn to meet its short-term liquidity needs during times of stress. The answer, of course, is the U.S. Federal Reserve. The safety nets provided by the Fed — both old and new — have been the primary backstop for the banking system in challenging times. These programs are the reason why our system of banking is so reliably safe.

The Federal Home Loan Bank (FHLB) is a liquidity provider banks use as part of daily operations and there are two long-standing programs operated by the Fed to help banks secure the liquidity they need in trying times. First, there is a lender of last resort, the Federal Discount Window. This program was enhanced by the Fed on March 12th with the introduction of the Bank Term Funding Program, which is an emergency liquidity lending facility. The Fed also relaxed some of the conditions for borrowing through the Federal Discount Window, which is yet another means of liquidity support during trying times. Let’s look at how some of these programs work in concert.

Federal Home Loan Bank: Lender of First Resort

Before tapping the Federal Discount Window, banks’ traditional source of liquidity is the FHLB, the lender of first resort. The FHLB system is somewhat complex and not very well known. Established over 90 years ago during the Great Depression in 1932, the FHLB is a network of 11 banks that are owned and governed by the financial institution members. One of the primary benefits of FHLB is providing liquidity through secured loans to depository institutions. The FHLB taps the debt capital markets to raise short term funds that are requested by its members. FHLB debt is treated as government debt. It is a common form of financing for most depository institutions with no stigma attached to those who borrow from the FHLB.

The FHLB finances advance loans to members largely by borrowing in short-term markets because most of these secured loans have fairly short maturities or are repaid early. Banks can turn to the FHLB to attract funding to guard against potential liquidity crunches. According to a May 16, 2023 report from rates strategists at Bank of America Securities, FHLB cumulative debt has increased by $255 billion since the beginning of March as banks boosted precautionary liquidity in case deposit outflows rose. Clearly there was some stress in the system.

Federal Discount Window: Lender of Last Resort

There are, of course, times when banks need look beyond the FHLB. The Federal Discount Window is another financial tool created by the Fed to further support the stability of the banking system, particularly during times of crisis. It is a mechanism through which the Fed lends money to eligible financial institutions, like commercial banks. This short-term credit facility helps banks manage their liquidity needs, maintain reserve requirements, and bolster the overall stability of the financial system. The Fed operates the discount window and offers primary credit to financially sound banks with minimal risk of default. There is a wide range of eligible collateral that can be used to support the loans, which can have a maturity of up to 90 days. The interest rate charged on these loans is called the primary credit rate, or discount rate. In contrast to borrowing from the FHLB, there is a bit of a negative stigma attached to its usage due to the discount window’s nature as “lender of last resort.” Nevertheless, it’s an important part of the overall banking safety net.

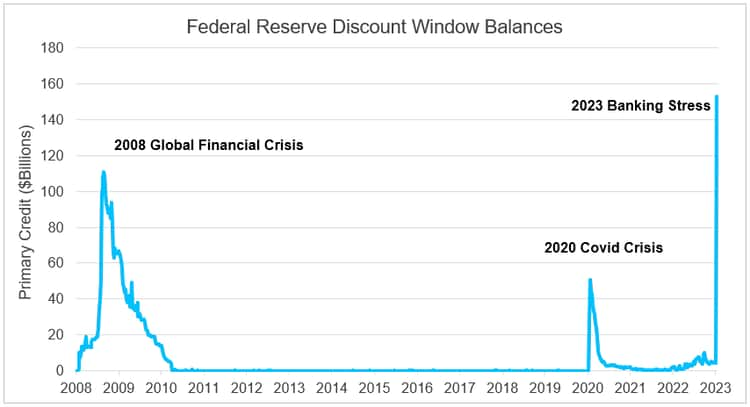

Given all the chaos and swirling news of the past several weeks, it’s important to remember that periodic sharp increases in discount window borrowing are common during periods of banking system stress. For example, during the height of the Great Financial Crisis in October 2008, the Fed loaned approximately $112 billion to banks. After that, however, discount window lending remained low until March 2020 when banks borrowed almost $60 billion at the peak of the Covid-19 pandemic. Most recently in March 2023, the borrowing activity rose to a historic high of $153 billion.1 The recent spike in discount window borrowing illustrated the deposit and liquidity stress facing commercial banks, which has been exacerbated by the sharp increase in short-term interest rates.

On March 12, 2023, the Fed relaxed conditions for borrowing from the discount window by providing par valuation for discount window-pledged assets. This effectively shields borrowers from the impacts of recent interest rate increases. As of May 10, 2023, borrowing stood at $9.3 billion, well below the record high set in mid-March. Despite the fall in usage, we believe the ability for banks to borrow against par value is a key component of this safety net.

Source: Federal Reserve. Data from March 2008 through May 10, 2023.

Source: Federal Reserve. Data from March 2008 through May 10, 2023.

Bank Term Funding Program: The Newest Emergency Lender of Last Resort

On Sunday March 12, 2023, the Federal Reserve established a new emergency asset-backed lending facility allowing banks to pledge select investment securities, valued at par, in exchange for loans with a maturity of up to one year to banks and other eligible depository institutions. This new facility, the Bank Term Funding Program (BTFB), can be considered the emergency lender of last resort.

In effect, the Fed is creating dollars to lend to stressed banks and is not purchasing any assets. What they are providing instead is a short-term loan against eligible collateral for a fixed period of time.

This provides significant relief to banks who have invested in high quality, eligible securities, such as super-safe U.S. Treasuries, agency debt and mortgage-backed securities. This will provide institutions the ability to gain the liquidity they need without forcing them to quickly sell securities at a loss. In addition, the U.S. Treasury will provide a backstop facility in the form of a $25 billion Exchange Stabilization Fund. The Federal Reserve does not believe it will need to draw on these funds, but merely establishing it solidifies confidence in the overall system. Borrowers of the BTFB will be disclosed after the programs’ current end date of March 11, 2024.

Lending through the BTFP grew rapidly during the first few weeks of operation reaching $79 billion on April 5, 2023. Since then, BTFP weekly outstandings have been range bound and as of May 10, 2023; borrowings from the BTFP stood at $83.1 billion.2

Closing Thoughts

Modern banking is complex, and during most periods customers and investors give the system little thought. Fortunately, the Federal Reserve has given the issue a great deal of thought and has developed an array of programs to keep the overall system running smoothly during periods of unusual stress. We acknowledge that these episodes can be disconcerting, but it’s reassuring to know that there is a safety net in place. History has shown that in periods of stress, banks may need to boost liquidity and meet short-term funding requirements. While the Federal Home Loan Bank is primarily used by bank borrowers to provide liquidity under normal conditions, banks can also tap the Federal Discount Window and the newly established BTFP. This alphabet soup of banking backstops demonstrates the Fed’s willingness to deploy all the tools necessary to ensure sufficient liquidity is maintained across the banking system.

Trading Vista: FHLBs at the forefront

Jason Graveley, Senior Manager, Fixed Income Trading

Given the robust demand for shorter-term securities in the current environment, agency bonds and discount notes continue to be in the spotlight. These securities are having a moment positioned at the forefront of the money markets, particularly as issuance and spreads have ebbed and flowed with market volatility. Investors have been monitoring issuance volumes throughout the recent turbulence, where the Federal Home Loan Bank (FHLB) in particular has been a dominant player in the issuance space.

If we look at the pattern of issuance over the course of this year, there has been consistent demand from investors. FHLB debt issuance grew from over $436 billion in February to $947 billion in March, as bank demand surged, before resetting to lower-but-still strong monthly amount of $475 billion in April. And although the increase in volumes commanded a higher spread and return from investors, there was no shortage of participation nor any significant concern. This largely reflects the implicit guarantee of the U.S. government’s backing of FHLBs, as well as the Aaa/AA+/AAA ratings granted to these securities from the big three rating agencies.

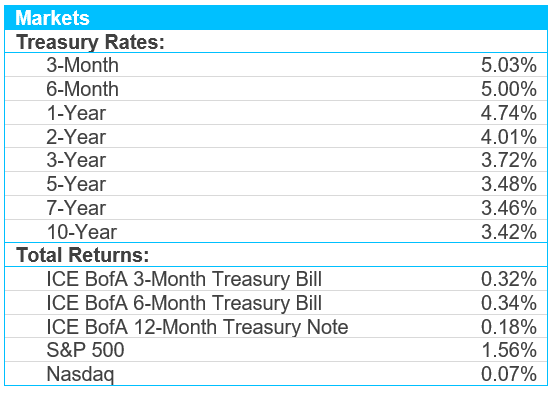

Despite the move back to a lower “more normal” issuance level in April, the figures still represent a significant jump in the year-over-year role of FHLBs in the market. The average monthly issuance so far this year has been more than 2.5 times that of 2022, while the average bond trade size has more than doubled compared to last year. This significant jump in demand led to a dislocation in front-end spreads, one that many investors were able to use to their advantage. If investors were to look back on the longer-run behavior of the Treasury curve relative to agencies, they would see that this relationship tends to trade in a very tight range. For much of the zero-interest rate period, for example, it was not unusual for Treasuries and agencies to trade within a basis point of each other. This year, however, it’s been a very different story. In the structures where there has been a significant uptick in volume, specifically callables (i.e., bonds that can be paid off prior to the maturity date) and discount notes, spreads have moved to some of their widest levels in recent years.

Discount notes, which are short-term obligations with maturity dates up to a year, have traded more than 20 basis points wider than Treasuries. Certainly there are idiosyncrasies currently at play, including the debt ceiling debate, which have skewed this relationship at certain maturities, but thematically investors are receiving more concessions to absorb the additional flow. Callables, which have always been a way to generate incremental yield for fixed income investors, have surged in popularity, and volumes to date this year have already outpaced all of 2022. In fact, total volumes are tracking close to 75% of their decades-long high already, while continuing to offer a higher spread as investors seek higher return to offset the call feature.

Thus, while agency debt has garnered more attention than usual from a headline perspective, the robust demand seems justified, and the market continues to maintain full faith in its debt. This is thanks in no small part to the implicit backing by the U.S. government. Sources: Bloomberg and Silicon Valley Bank as of 04/30/2023.

Sources: Bloomberg and Silicon Valley Bank as of 04/30/2023.