Key Takeaways

- VC funding both in size and number of deals for early-stage companies continues to grow at an unprecedented rate across most subsectors.

- The pandemic has accelerated the emergence of more life sciences and healthcare startups outside of traditional industry hubs.

- The growing appetite of investors to engage earlier in the process is changing the nature of Series A and how institutions are approaching companies to get the best deals.

Despite the continuing COVID-19 pandemic, the life sciences and healthcare industry is seeing massive acceleration in market activity across the board that has translated into record venture fundraising, growth in private investments as well as elevated IPO activity. It seems that the industry has chosen the path of resilience – catalyzing developments that have the potential to change the face of healthcare.

Against this bullish market backdrop, SVB published the mid-year edition of its signature Life Science and Healthcare Investments and Exits Report that looks at emerging industry-wide trends from a variety of different sources including interactions with leading VCs, investors, entrepreneurs as well as various proprietary datapoints.

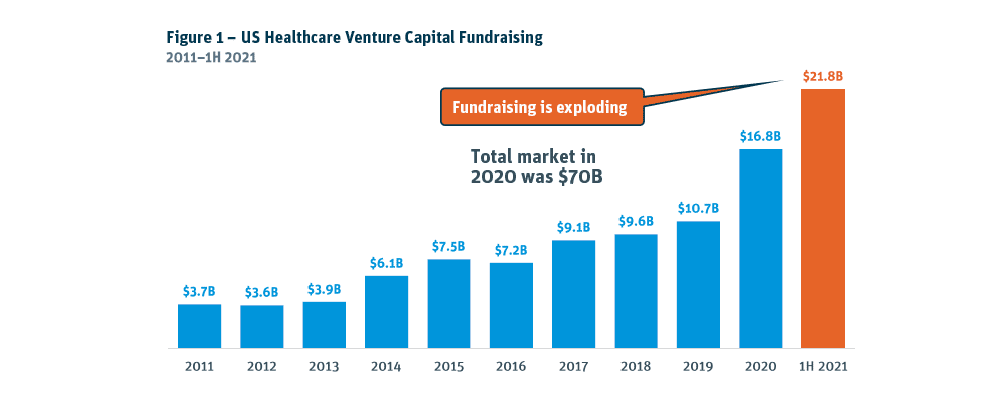

The overarching message of this year’s report is that the market for life science and healthcare remains buoyant with venture fundraising dedicated to healthcare continuing to rise meteorically as shown in Figure 1 below. Fueled by venture healthcare’s rapid response to the pandemic, venture capital fundraising boomed in H1 2021 to $21.8B, exceeding the full-year venture healthcare record in 2020 ($16.8B) by 30%.

Similarly, total healthcare investment dollars in H1 2021 hit $47B, more than doubling 2020’s first half with growth straddling all subsectors, albeit in varying degrees. Lastly, IPOs continue to be the preferred path to successful exits with the number of venture healthcare IPOs in H1 2021 (81) close to 2020’s full-year number (111). However, Post-IPO performance in 2021 has been mixed, varying again by subsector.

What does this mean for early-stage founders?

Trend 1 – Its more about the deals than the dollars

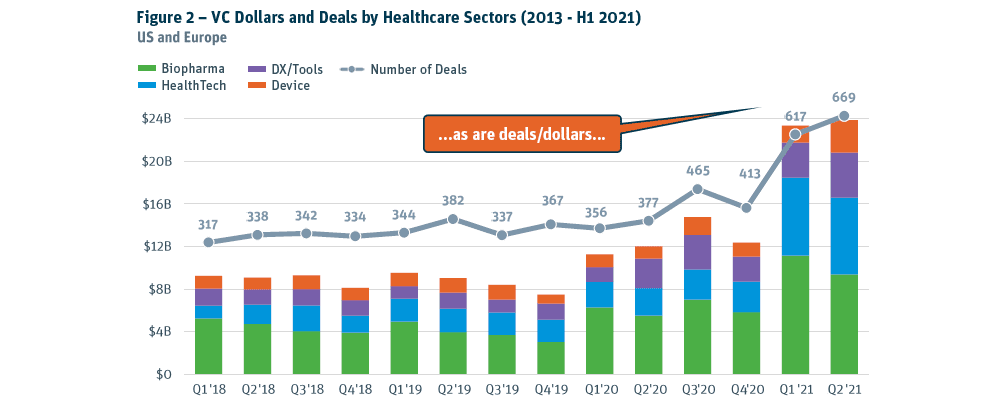

While the overall level of rapid growth across the industry is extremely encouraging, data in the report shows trends that would be of particular interest to early-stage healthcare practitioners. For example, while record-breaking flow of VC dollars has been an ongoing trend over the last few years, the bigger story for early-stage companies is the increase in the number of deals that have been closed during H1 2021 (1,286). This is nearly the same (80%) as the entirety of 2020 (1,611 deals) as shown in figure 2. At the current pace of growth, it is very conceivable that 2021 is on track to double the volume of deals that occurred in 2020 which was also a record-breaking year.

Looking at the volume of Series A deals that occurred during H1 2021, the same trend holds true as the industry-wide number above, with the gap being even closer with 2020. In H1 2021, there were 514 Series A deals – 95% of the 536 deals occurring in all of 2020. In terms of dollar value, H1 2021 fundraising volume of $7.339 billion almost matches (93%) the 2020 total which was $7.857 billion. All indicators seem to point towards both dollar and deal volumes for Series A funding doubling during 2021 as investors work to ensnare technology ownership at earlier stages of company lifecycles.

Trend 2 – Geographic dispersion continues to broaden

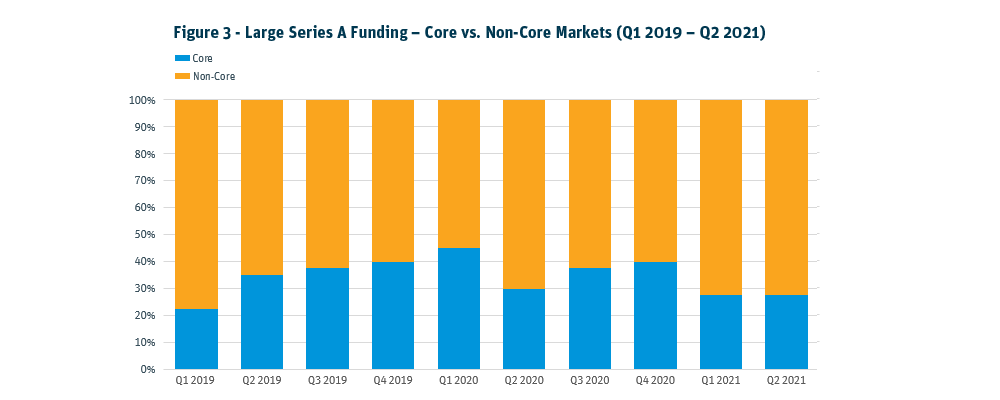

The onset of the pandemic and the resultant rise of remote work culture as well as increased access to shared work environments, wet lab spaces and research facilities has accelerated the emergence of new companies beyond the traditional life science and healthcare hubs in America’s super cities. During H1 2021, this trend has continued with over two-thirds of the Top 10 deals across each industry subsector originating outside of the traditional industry hubs such as Boston and Northern California - as shown in Figure 3.

Trend 3 – Not all subsectors are equal

While the report points to robust growth across life sciences and healthcare that is set to double with more companies in expanded geographies – some subsectors are leading the charge more than others. Many industry watchers believe that this accelerated pace is not due to COVID-19 but rather to a larger, longer-term trend. They believe the true raison d'être of this growth cycle is that we are witnessing the largest revolution in healthcare possibly since the era of Charlemagne.* They point to paradigm shifting advancements such as in the realm of genomics, e.g. the mapping of the human genome. These scientific breakthroughs coupled with advancements in artificial intelligence and machine learning to interpret metadata at a phenomenal scale has enabled scientists to embark upon personalized medicinal therapies based upon a patient’s genome. Breakthroughs like these are fueling this unprecedented growth across all subsectors in the industry.

Biopharma Series A Performance

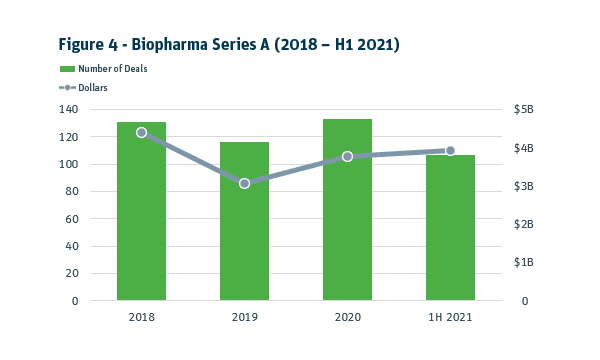

During H1 2021, the number of biopharma Series A deals is almost equal to all of 2020 (153 versus 191) with the average value of deals hovering around the $30 million mark. Current growth trends all point to biopharma having 200 Series As during 2021. Pre-money valuations in Series A biopharma have continued to climb. For smaller deals (<$15M), the median pre-money valuation grew 63% ($13M in H1 2021 versus $8M in H1 2020). For larger deals ($15M+), there was an even larger increase of 65%.

Similarly, biopharma platform activity is also on the rise, with H1 2021 Series A dollars ($2.2 billion) already exceeding both full-year 2019 ($895 million) and 2020 ($1.4 billion).

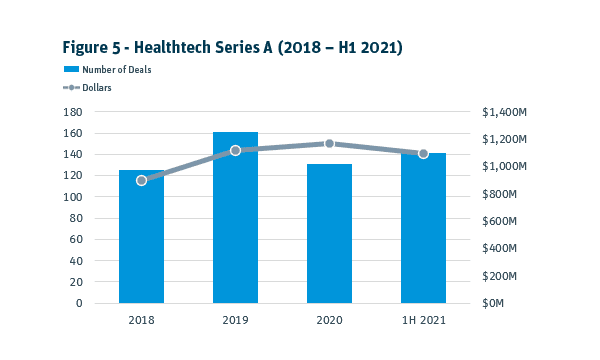

Healthtech Series A Performance

Healthtech has definitely registered as the brightest spark across the industry producing the greatest number of startups. Responding to the challenge of the pandemic, healthtech companies have pulled the sector 5 to 10 years ahead in record time with startups emerging that have improved the logistics of healthcare provision. However, the sector continues to struggle with rising demand pressure due to inelasticity. Series A performance of healthtech during H1 2021 again, has eclipsed last year with 208 deals within the first six months compared to 185 during 2020. In the US alone, healthtech has already scored 140 Series As during H1 2021 and is now the largest component in the life sciences and healthcare industry. This subsector is continuing its explosive growth with industry watchers estimating over 300 Series A deals by the end of the year with an average deal size ranging between $7 to $8 million.

Another major trend in healthtech, again, due to advancements in AI/ML, is the change in the way that we think about the patient care continuum. With the rise of effective technologies such as the use of meta-data coupled with the Internet of Things and cutting-edge sensors – healthtech companies are managing to scale the provision of treatments and services in more efficient and effective ways than ever before. These technologies are enabling healthtech companies to connect patients with their doctors making it easier to make clinical decisions remotely that result in more efficient throughputs with better patient outcomes. During 2020, this trend greatly accelerated because of the pandemic and in 2021, we are seeing the investment ecosystem support these technologies at an unprecedented scale.

Additionally, the increased appetite of investors in the alternative care space has led to substantial investment and valuations in support of alternate models for healthcare provider operations. These include companies that are selling into existing healthcare ecosystems as well as for alternative care companies including mental health and chronic care management. These companies have continued to attract high volumes of invested capital repeatedly over the last three years.

The increased appetite of investors in the alternative care space has led to substantial investment and valuations in support of alternate models for healthcare provider operations.

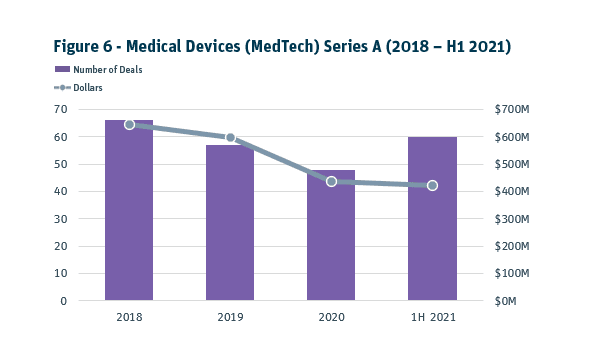

Medical Devices Series A Performance

Another bright spot highlighted in the report is the Medical Devices (Medtech) sector that has reversed its decline from recent years – especially since the advent of the Affordable Healthcare Act (ACA), which had a debilitating impact on the level of innovation in the subsector. Interestingly, after two years of a downward trend in invested capital into Series A, H1 2021 dollars are up substantially, close to 2020’s full year investment. This is driven by the availability of more later stage capital sources. Namely, PE funds and hedge funds that see late-stage device investing as a great opportunity to get into companies prior to an IPO. Having an open IPO window is driving this increased capital availability, which allows more early-stage investors to feel like there is ample later stage capital to support their companies through their development cycle.

Though the number of Series A deals in Medtech has gone up, the overall dollar amount is also on track to beat 2020’s full numbers. ($614 million in 2020 to $520 million during H1 2021). This growth is driven by the reemergence of more 510(k) products that are based on a predicate technology already in the market that a company can build on. With 510(k) investment up, we see companies being able to achieve more with less capital but get to exit faster with better outcomes over the last few years (2018-2021) versus the previous cycle (2015-2017). The open IPO window and available late-stage capital also drives more investment into novel PMA pathway companies. This preference for 510(k) (as opposed to the standard PMA process that generally require very large Series As) coupled with increased activity is leading to many industry observers estimating that there will be over 100 Medtech Series As during 2021.

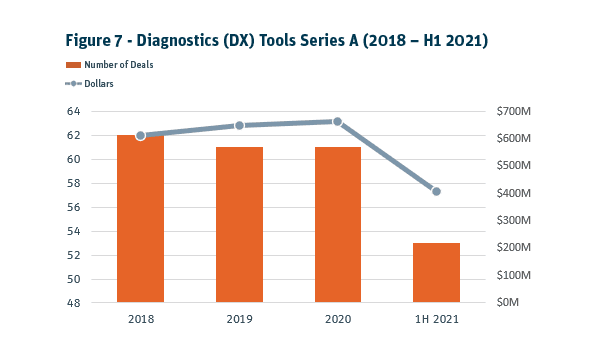

DX Tools Series A Performance

Diagnostics (DX) and Tools has been one of the smaller segments of the life sciences and healthcare industry and looks set to repeat the same level of performance as last year. Series A investment in the subsector is slightly ahead of H1 2020’s pace, led primarily by R&D tools and DX tests, but Series A activity in the sector has not grown at the same level as other subsectors in the industry. Although Dx/Tools performance has been very strong over the last few years, most of that capital is being invested in large, later stage rounds. Series A appears to be on track to beat 2020’s investment but remains a small percentage of overall DX/Tools activity.

Given the ongoing impact of the pandemic and the emergence of new variants, COVID-19 testing companies continued to see increased interest from investors with six of the 24 DX tests deals during H1 2021 focused on anti-infectives. Another area in the subsector that sparked activity was Oncology with several Series A deals in the liquid biopsy space.

Another important consideration when looking at DX tools’ performance is that the DX market powers the biopharma market. This is because a lot of the work being done on the biopharma side is fueled by functions such as genomic sequencing and analysis which are inclusions in the DX tools market.

Trend 4 – Convergence of technology is here to stay (subsector lines are getting blurry)

Dovetailing from the point above about DX tools essentially fueling growth and activity in the biopharma market, another key emerging trend is the blending between many subsectors. For instance, we are now seeing health tech companies that are leveraging diagnostic technology in proprietary cloud applications to make it easier for patients to be compliant with the drugs that they're taking. What is happening, in essence, is that the market is seeing these new companies emerge that straddle multiple traditionally different subsectors. For instance, these healthtech companies (in the example above) that are taking biopharma and DX tools and putting a cloud-based overlay to create bundled solutions.

Conversely, we are seeing medical devices that are not just implementing or delivering treatment but are also delving into the traditional DX tools arena and monitoring patient well-being and treatment outcomes.

With this confluence of technology, many subsectors are converging into single companies. As this trend continues, it may change how the industry delineates these traditional subsectors and more importantly from a founder’s perspective, how these companies get valued and funded by investors.

Trend 5 –The nature of Series A is changing and is seed the new Series A?

Another key trend highlighted in the report that would interest early-stage founders, is that the average time between rounds of funding has narrowed between companies. Fundraising cycle times for life science funds now averages two to two-and-a-half years, and sometimes close even faster. The median time to IPO from the close of Series A round for life science companies during 2021 was just 2.1 years.

Fundraising cycle times for life science funds now averages two to two-and-a-half years, and sometimes close even faster.

These findings are in line with emerging trends in the life sciences and healthcare industry where many Series A transactions are no longer the first institutional money invested into a company. The term “pre-seed” is becoming more common in the lexicon of the life sciences ecosystem. The primary driver of this change has been because many institutions are opting to venture seed companies earlier in the process and have already planned a larger Series A round as part of that seed funding for a later, predetermined time. We're also starting to see more and more venture capital firms creating venture studio concepts and explicitly incubate companies through them. While this is not new, these venture studios are now becoming more common.

The implication here for early-stage founders is that investors are increasingly cherry picking only the best technologies. This evolving market scenario may put some startup founders in a very difficult position to find the right investor despite having a really good solution that addresses a viable market need. One work-around for this can be to partner with a bank that has the industry connections to help you open doors and unlock opportunities with key investor and VC communities. At SVB we have helped many early-stage life sciences and healthcare companies do just that for nearly four decades.

Read the latest Life Science and Healthcare Investment and Exits Report.