- Institutional adoption accelerates, driving larger venture capital checks, crossover products and bank-led custody, lending and settlement.

- Stablecoins are poised to become ‘the internet’s dollar’, due to clearer regulations and enterprise adoption for payments, cross-border settlement and treasury operations. Meanwhile, real-world asset tokenization is going mainstream.

- Conditions are ripe for continued growth in VC investment in crypto, including at the late-stage, as demand intensifies for sophisticated, institutional-grade products from established companies.

2025 marked crypto’s return to the financial mainstream. Regulatory standards advanced, institutional engagement accelerated, and capital markets began to thaw after years of frost. Now the narrative is advancing. In 2026, digital assets will integrate more deeply into payments, market infrastructure and global commerce.

Each January, we deliver our crypto outlook, shaped by proprietary data and transaction flows, line-of-sight into our 500+ blockchain clients, and our deep ties with innovators and investors.

Last year, we predicted stablecoins and payments would be the breakout use case for the next phase of adoption. That expectation was realized in 2025’s surge in global stablecoin volumes and corporate uptake. Circle’s summer IPO catalyzed visibility and mentions of stablecoins on US corporate earnings calls increased more than 10x over the year.

This article outlines five themes we expect will define crypto in 2026:

- Institutional capital goes vertical.

- Mergers and acquisitions (M&A) post another banner year.

- Stablecoins become the internet’s dollar.

- Real-world asset (RWA) tokenization goes mainstream.

- Artificial intelligence (AI) and crypto redefine digital commerce

While headlines will impact the narrative — and asset prices will ebb and flow — we are more interested in the fundamental forces that are propelling crypto toward long-term value. These structural shifts will push blockchain to underpin the financial architecture of our lives.

1: Institutional capital goes vertical

The suits and ties have arrived. Corporate adoption of crypto is accelerating confidence on both sides of the market. As enterprises integrate digital assets into treasury operations and payments through custody, tokenization and stablecoin settlement, venture investors are responding with renewed conviction.

Venture capital rebounds in 2025

VC investment in US crypto companies rebounded sharply in 2025 after two slow years.

- Investors deployed $7.9 billion, up 44% from 2024, according to PitchBook.

- More capital concentrated in fewer companies. Deal volume fell 33%, but the median check size climbed 1.5x to $5 million as investors prioritized higher-quality projects and follow-ons into proven teams.

- Median valuations rose meaningfully across stages. Seed companies had a median valuation of $34 million, up 70% from 2023 levels.

This pattern suggests crypto startups are finding clearer product-market fit, driven by enterprise and retail demand rather than fragile speculation.

Source: PitchBook Data, Inc. and SVB analysis.

Corporate adoption deepens

Institutional balance sheet adoption reinforces this trend. Bitcoin has become a mainstream corporate asset, used both as a long-term treasury allocation and as collateral. At least 172 publicly traded companies held Bitcoin in Q3 2025, up 40% quarter-over-quarter, according to Bitwise. In aggregate, these companies hold about one million BTC, or roughly 5% of circulating supply.

The rise of digital-asset treasury (DAT) companies is another aspect of corporate adoption.

Think of DATs as the Saylor/Strategy playbook turned into a category: companies that treat crypto accumulation as a core operating strategy, not a sidecar treasury allocation. DATs also give their investors an alternative avenue to crypto exposure without the complexity of custody. These companies reflect the trend of deeper vertical integration, but they also amplify balance sheet risk by tying operating outcomes to price volatility. Undoubtedly, a wave of DATs has emerged, and we expect standards to consolidate and the number of formations to cool.

Crossover products emerge

Corporate adoption is also enabling an emerging class of crossover crypto-native and traditional financial products.

-

Centralized crypto companies such as Ledn and Unchained have long offered crypto-secured lending at modest loan-to-value ratios.

-

While incumbents grow, adjacent companies have expanded their offering to include lending, such as Strike.

- Large banks are preparing to offer similar services to their institutional clients. Bloomberg reported in October 2025 that JPMorgan plans to accept Bitcoin and Ether as collateral (initially through ETF-based exposures, with plans to expand to spot holdings).

As regulatory clarity improves, more banks will enter Bitcoin lending, custody and settlement. This should also expand to other tokens as well.

The integration is not limited to lending. Major financial institutions are building crypto rails into payments and brokerage.

- SoFi announced that it became the first US chartered bank to offer direct digital asset trading from customer accounts.

- Morgan Stanley, PNC and JPMorgan are developing crypto trading and settlement products, typically through partnerships with exchanges.

- Citi is more active in tokenizing their infrastructure than in offering crypto retail trading.

- US Bank offers crypto custody through a partnership with NYDIG (New York Digital Investment Group).

- Through its Kinexys platform, JPMorgan is piloting tokenized deposit and stablecoin-based settlement tools and exploring hybrid on-chain payment networks for institutional clients.

We expect more institutions will follow suit as product announcements and partnerships scale and as their crypto capabilities form a center of gravity.

These conditions set the stage for continued growth in VC investment, including at the late-stage, as demand intensifies for sophisticated, institutional-grade products from established companies. This time next year, the industry could be looking at another record VC year in crypto. In fact, demand for investible companies may outstrip supply.

2: M&A posts another banner year

Why build when you can buy? Crypto-native companies are using acquisitions to vertically integrate.

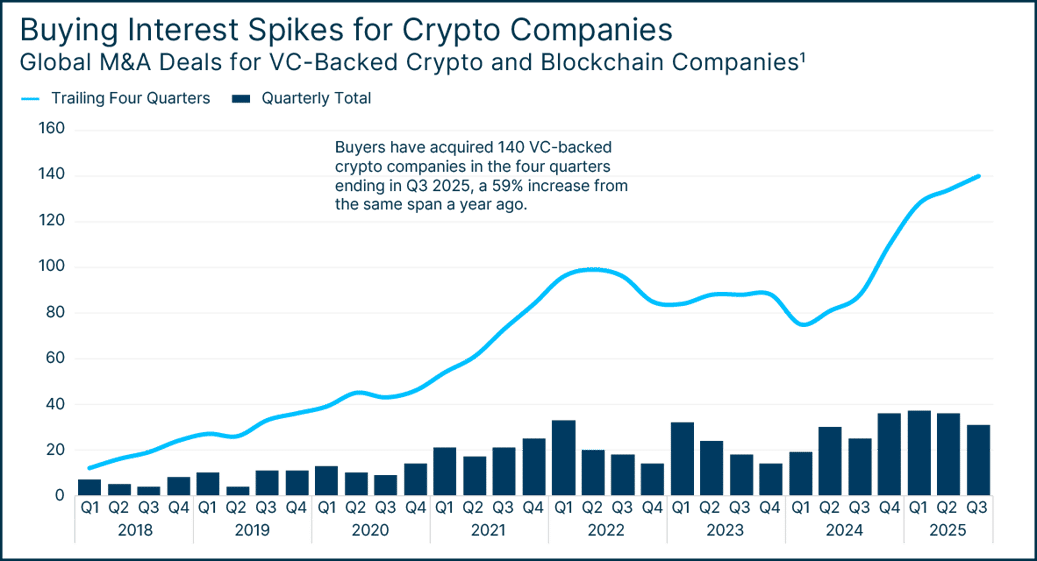

Record M&A activity

M&A is at an all-time high. In the four quarters ending Q3 2025, more than 140 VC-backed crypto companies were acquired, a 59% year-over-year increase by deal count and the strongest run the sector has seen.

Among the largest acquisitions: Coinbase bought derivatives exchange Deribit for $2.9 billion, and Kraken paid $1.5 billion for the futures trading platform NinjaTrader.

Source: PitchBook Data, Inc. and SVB analysis.

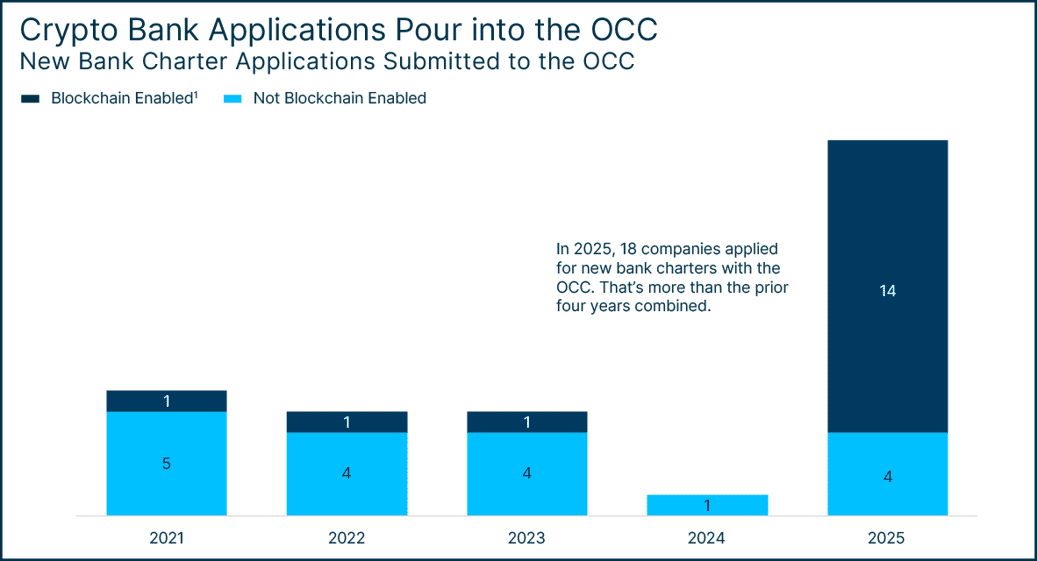

Why build when you can bank? In 2025, 18 companies filed new charter applications with the Office of the Comptroller of the Currency (OCC), up from one last year and more than the prior four years combined. Fourteen applications came from blockchain-enabled companies, many also being the largest acquirers.

On Dec. 12, 2025, the OCC granted conditional approval for five national trust bank charters tied to digital assets: BitGo, Circle, Fidelity Digital Assets, Paxos and Ripple. This moves stablecoin and custody infrastructure inside the federal banking perimeter. Watch who clears final approval and how strict the OCC’s supervisory playbook gets.

Source: Office of the Comptroller of the Currency and SVB analysis.

We expect this momentum to continue into 2026. As digital asset capabilities become table stakes for financial services, incumbents are accelerating acquisition strategies rather than building products from scratch. Exchanges, custodians, infrastructure providers and brokerages are consolidating into multi-product companies, a spectrum that stretches from those wanting stablecoin capabilities to full-stack crypto banks that mirror the integrated services of traditional financial institutions.

Full-stack strategies drive consolidation

Ripple is the clearest example of this full-stack strategy, acquiring seven startups in the past two years to expand beyond payments into brokerage, custody and treasury services. Its three largest deals – Hidden Road, a prime brokerage ($1.25 billion), GTreasury, a treasury software provider ($1 billion), and Rail, a stablecoin platform ($200 million) – illustrate the ambition to assemble a vertically integrated global financial platform. These acquisitions helped to vault Ripple’s valuation to $40 billion in November, making it one of the highest-valued unicorns in the US.

In addition, public market activity is reinforcing the IPO cycle. Successful IPOs from Circle, Figure and other blockchain-native companies have reopened the equity window for the sector. These offerings establish valuation benchmarks, return capital to LPs and sharpen investor conviction that mature crypto infrastructure companies can perform like fintech or payments companies in public markets. The result is renewed M&A appetite, both from strategic acquirers seeking to broaden offerings and from VC-backed companies looking to scale through acquisition.

With crypto capabilities increasingly embedded in mainstream finance, 2026 is shaping up to be another year of aggressive consolidation as companies race to build comprehensive, end-to-end platforms. Traditional finance companies are quickly recognizing that they must adapt to crypto or run the risk of being disrupted by it.

3: Stablecoins become the internet’s dollar

Stablecoins are becoming the backbone of digital money. These tokens – typically backed 1:1 by cash and cash equivalents – enable near-instant settlement, programmable compliance and global operability. Compared to ACH or credit card networks, which can take days to clear, stablecoin transactions settle in seconds at materially lower cost.

Corporations are increasingly recognizing the advantages of stablecoins as they modernize treasury and payment operations. Shaving settlement times, and even a few basis points off the cost of each transaction could create significant savings for a company doing billions of dollars in transactions each year. Acknowledging competitive urgency, incumbents don’t want to be left on the sidelines as a new technology disrupts payments.

Regulatory clarity accelerates stablecoin adoption

Regulatory clarity from the GENIUS (Guiding and Establishing National Innovation for U.S. Stablecoins) Act in July 2025 has further accelerated adoption by establishing consistent federal standards.

The US joins regions such as the EU (Markets in Crypto Assets, or ‘MiCA’), UK, Singapore and UAE in explicating frameworks for fiat-backed digital money. With compliance guardrails in place, enterprise integration has picked up pace.

How will stablecoin issuers comply with GENIUS Act mandates in 2026?

Under the law set to take effect in January 2027, only permitted entities will be allowed to issue stablecoins. For now, this group is limited to licensed depository institutions like banks or credit unions, as well as nonbanks that are approved by the OCC or state regulators. Stablecoins will be required to have a 1:1 backing of reserves in either short-term treasuries or currency, and issuers must comply with KYC/AML rules and disclose the composition of their reserves monthly. Notably, Tether, which issues USDT, the largest stablecoin by market cap, plans to comply with the federal law by issuing a new, compliant stablecoin and then bringing USDT into compliance over time.

Global stablecoin expansion

Global stablecoin supply is now expanding as banks and fintechs issue tokens for remittances, B2B payments and card settlement.

- Société Générale launched its EUR CoinVertible in August.

- JPMorgan extended JPM Coin functionality to public blockchains in November 2025.

- A consortium of US banks – including PNC, Citi and Wells Fargo – is exploring a joint stablecoin initiative through Early Warning Services, the parent company of Zelle.

Stablecoin-as-a-Service

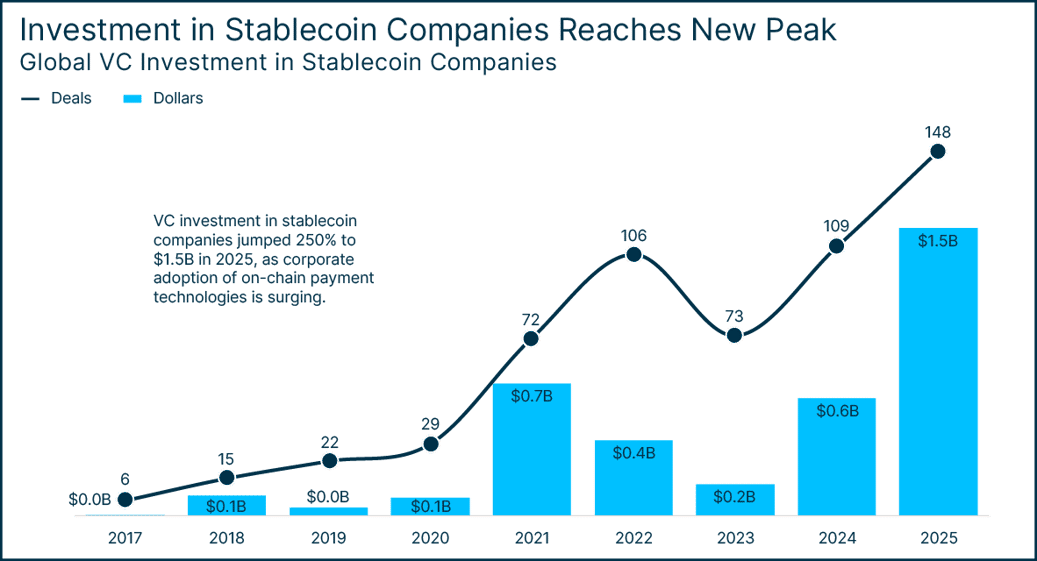

As more institutions turn to on-chain settlement, a new category of infrastructure providers – “Stablecoin-as-a-Service” – has emerged to help corporates launch and manage regulated tokens. Investors have taken note.

- VC investment in stablecoin-related companies totaled less than $50 million in 2019; this year, it exceeded $1.5 billion, flowing to firms such as Tempo and MeshConnect that enable enterprise adoption.

- Paxos, a $2.5 billion VC-backed issuer, mints stablecoins for PayPal, Fiserv and other major payments companies.

Source: PitchBook Data, Inc. and SVB analysis.

Looking ahead, digital dollarization is poised to reshape financial plumbing. Corporates increasingly treat tokenized dollars as 24/7 liquid cash, stablecoin issuers are becoming significant buyers of T-bills, and ETF and custody approvals are nudging banks toward deeper integration of on-chain dollars into core financial systems. In 2026, we expect on-chain dollars to graduate from pilots into enterprise plumbing – inside treasury workflows, cross-border settlement and programmable B2B payments.

4: Real world asset tokenization goes mainstream

Tokenization is moving from pilot experiments to production-scale financial infrastructure. In 2025, on-chain representations of cash, treasuries and money market instruments crossed $36 billion, calculating supply across public and permissioned blockchains, according to RWA.xyz. This momentum is carrying RWAs (real world assets) into the financial mainstream.

In crypto, real-world assets (RWAs) are conventional financial assets – stocks, bonds and real estate – issued as blockchain tokens that represent ownership rights to the underlying assets. Tokenization lets managers fractionalize ownership more easily, increasing liquidity and enabling more efficient administration of the asset. A token might represent a small portion of a commercial building or a corporate bond.

This is bringing Ethereum and Solana to Wall Street. RWAs are increasingly seen as a bridge between crypto and traditional finance. As BlackRock CEO Larry Fink and COO Rob Goldstein wrote in an opinion piece for The Economist in December 2025, tokenization will help merge digital-first innovators with traditional institutions. “In the future, people won’t keep stocks and bonds in one portfolio and crypto in another,” they wrote. “Assets of all kinds could one day be bought, sold, and held through a single digital wallet.”

Tokens and T-bills

Tokenized T-Bills and short-duration T-bills now power emerging on-chain money markets repo markets, and programmable cash-management tools for funds and corporations.

- BlackRock’s USED Institutional Digital Liquidity fund (BUIDL) surpassed $500 million just months after launching.

- Franklin Templeton’s tokenized funds have scaled past $400 million.

Money market funds are increasingly settling redemptions, subscriptions and collateral flows directly on chain. If tokenized T-bills show what tokenization looks like for institutions, prediction markets show what it looks like for consumers.

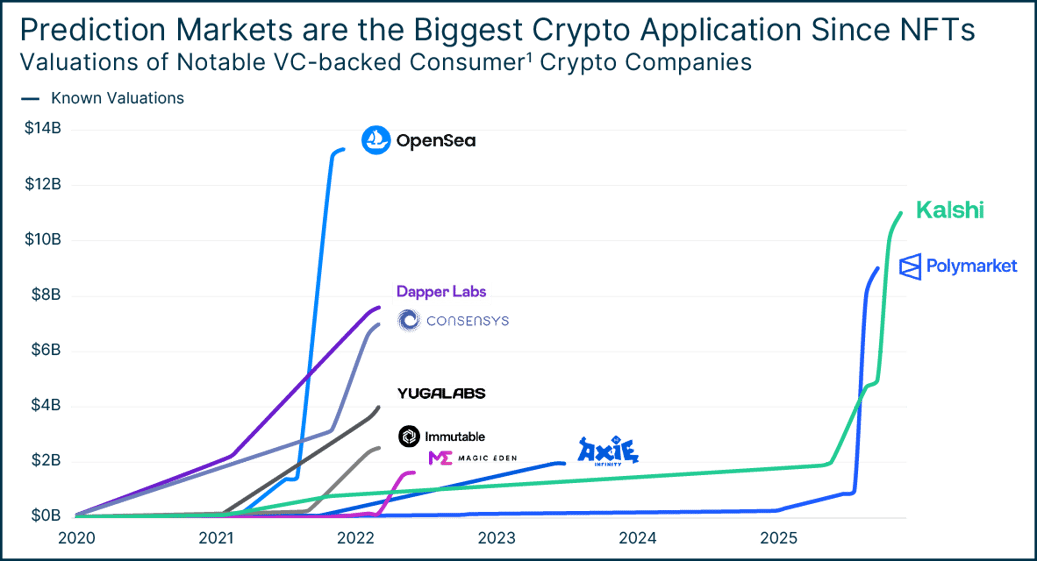

Tokenization expands beyond treasury

ETF issuers and fund managers are also testing on-chain wrappers to reduce transfer costs and enable intraday settlements. WisdomTree, 21Shares and Hashnote are all running tokenized fund pilots. In addition, crypto-native RWAs are expanding, most visibly in prediction markets, where on-chain tokens represent real-world outcomes and settle automatically.

- Polymarket reached $3.7 billion in monthly trading volume in November 2025 and was reportedly valued at $8 billion, the highest value for a crypto-native consumer app since OpenSea (excluding exchanges and wallets).

- In parallel, prediction market Kalshi reached a reported $11 billion valuation in December 2025.

Source: PitchBook Data, Inc. and SVB analysis.

Equity markets

Even equity markets are experimenting with tokenization. Robinhood, Figure and Securitize have explored tokenized company stocks. Robinhood has launched tokenized security trading for European users. The offering allows traders to buy and sell tokenized contract that track stocks and ETFs over Arbitrum. It plans to expand this offering to US markets, including tokenized secondary trading for still-private companies.

While these plans will face additional regulatory scrutiny, the efforts signal a future where private and public markets converge on the same settlement networks. Similarly on the crypto-native side, Coinbase’s Echo platform – acquired for $375 million in October 2025, per company disclosures – allows startups to raise capital through token sales.

While these plans will face additional regulatory scrutiny, the efforts signal a future where private and public markets converge on the same settlement networks.

In 2026, we expect tokenization to expand beyond T-bills into tokenized funds, private markets and consumer-grade applications, bringing distribution and compliance, not just issuance, on chain.

5: AI and crypto redefine digital commerce

AI and crypto are converging to create a new layer of digital commerce: autonomous agents that transact, verify and coordinate economic activity without human involvement.

- AI wallets that are capable of self-managing digital assets are now moving from prototypes to pilot programs.

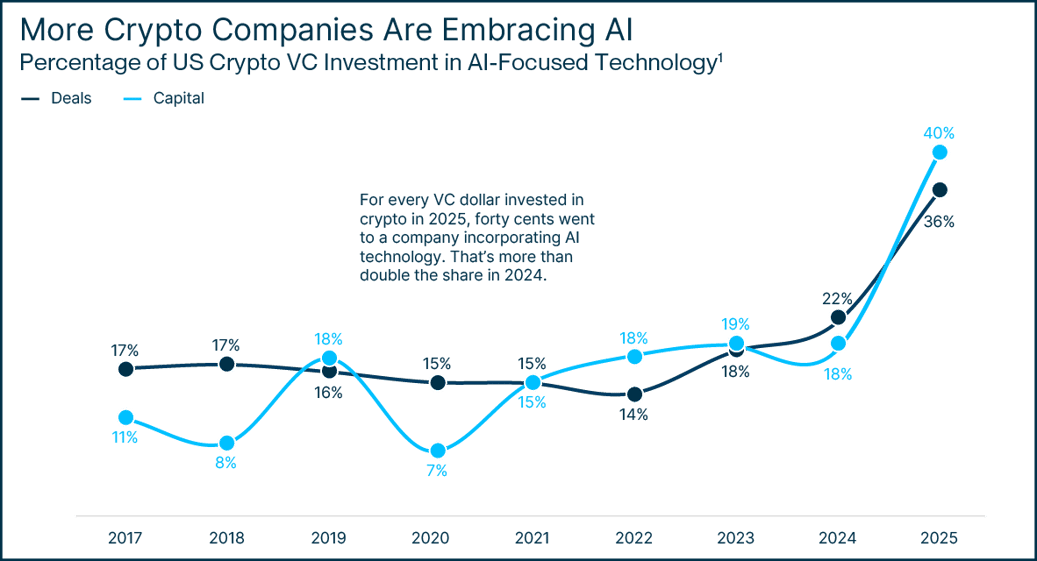

- VC-backed companies are increasingly merging AI and crypto technology. For every VC dollar invested into crypto companies in 2025, 40 cents went to a company also building AI products, a jump from just 18 cents last year.

- Startups like Ritual, Fetch.AI and Grass are building agent-to-agent commerce protocols while Coinbase, Solana and Polygon are working on integrating AI inference into crypto wallets.

Source: PitchBook Data, Inc. and SVB analysis.

Solving AI’s trust problem

While these integrations are building a truly crypto-native economy, blockchain is also helping to solve one of AI’s fundamental problems: trust.

- Blockchain provenance protocols can help verify AI content, trace model outputs and enforce copyright and ownership claims.

- Crypto projects like Worldcoin and Provenance Labs are being applied to enterprises to sniff out deepfakes and other synthetic content.

- Adobe’s Content Authenticity Initiative is creating a toolset that adds credentials to content containing a record of its creation and edit history.

A second act for DePIN

Meanwhile, AI is helping to give DePIN (decentralized physical infrastructure networks) a second act. Networks such as Akash and io.net are attracting AI compute workloads as miners shift from token incentives to actual revenue. Enterprise cloud buyers are tapping these networks for compute overflow capacity, edge computing and distributed storage.

The next wave of consumer crypto apps emerges at this intersection – fast, invisible and capable of performing transactions autonomously. In 2026, the breakout consumer apps won’t market themselves as ‘crypto’, they’ll feel like modern fintech, with agents, stablecoin settlement and provenance running quietly under the hood.

In 2026 and beyond

Our predictions represent just a few of the many promising areas in crypto today. The UX for consumer applications is massively improving, the promise of blockchain for identify verification is reaching wider understanding and tokenized gaming remains an important, and growing, on-ramp for crypto users. Regardless of how tangible or visible, all the forces shaping crypto today share a common thread: crypto is moving from expectations to production. Pilot programs are scaling, and capital is consolidating.

Treat crypto as infrastructure in 2026. Build or partner now around stablecoin settlement, custody/compliance rails and tokenized-asset distribution. The winners will be the platforms that make these capabilities invisible, regulated and usable at scale.

For end-users, the result will be a more seamless experience across everyday financial interactions, from sending cross-border payments to managing an investment portfolio. We’re optimistic about that future and about the role that technology will play in delivering it.