Lending products designed to fuel the innovation economy

SVB provides tailored credit solutions for VC-backed startups and investors in the innovation economy.

We support our clients as they grow with the solutions and financing they rely on, with

$40B in loans*

*Period end total loans as of 9/30/2025

Lending solutions tailored for growth

As a patient lender to the innovation economy, we have a unique perspective for your industry vertical.

- Extending runway for VC-backed startups

- Financing growth activities and customer acquisition

- Funding CAPEX and purchasing long term assets

- Managing a VC / PE fund and firm

A partner through the cycles. SVB has over 40 years of experience banking innovators and investors, further strengthened by the backing of First Citizens Bank’s 125-year history and fortress balance sheet.

SVB offers a full suite of lending solutions with specializations for your industry vertical

Choosing the right credit partner is one of the most critical decisions a business leader can make.

SVB understands the unique pressures of establishing a new business while managing funding cycles and rapidly scaling an organization. We have pioneered innovative lending options such as venture debt and recurring revenue lines of credit, and provide a full solution set beyond lending to help you start, and grow your business.

Elevated service and value beyond the transaction

We offer unparalleled client service and foster community in the innovation ecosystem with curated industry events and insights, as well as exclusive offers for SVB clients.

Ability to tailor solutions to your unique circumstances

We invest time to understand your objectives and design a unique credit solution tailored to your needs, enabling you to concentrate on propelling your success.

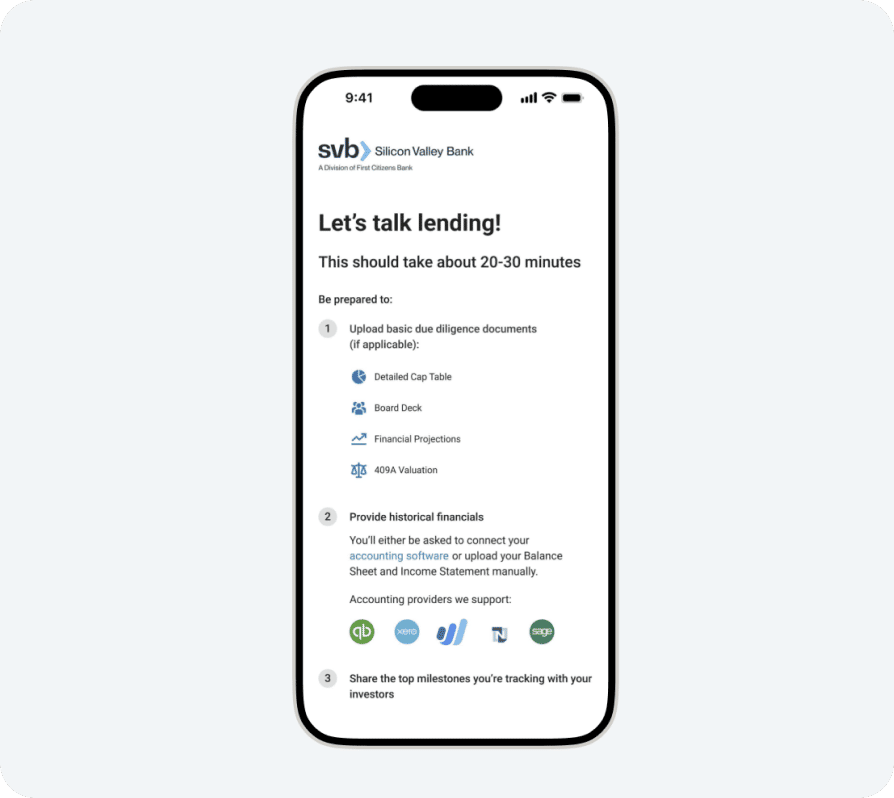

Save time and money

Use our innovative digital lending app and Streamline closing process to expedite the process from beginning to end.

Lending to fit your business needs and stage of growth

Working Capital

Flexible capital solutions for fast-growing clients. Lending is assessed based on accounts receivable, inventory or the quality of recurring revenue and can be put to work to accelerate working capital cycles and to fuel business growth.

SVB is made stronger with the diversified platform and backing of First Citizens Bank

1 Moody’s Investor Service, S&P Global Ratings data as of 9/30/2025.

2 Large Commercial Banks, Federal Reserve Statistical Release 9/30/2025.

Ready to talk with our team?

Contact your SVB Relationship Manager for more information about SVB lending solutions or click below to get started.

Frequently asked questions

Where can I learn more about Venture Debt?

Please reach out to your SVB Relationship Manager to learn if Venture Debt is right for your company. Learn more about venture debt.