Key Takeaways

- A decentralized, immersive internet is poised to disrupt nearly all sectors of the digital economy, and corporations are paying attention.

- Corporate VC investment in web3 startups totaled $12.5B in 2021, a 5x increase from 2020.

- Corporations are exploring web3 capabilities with the understanding that they cannot afford to miss the next evolution of the internet-based economy.

- With an immersive digital future all but inevitable, it remains to be seen how the metaverse will fully form in a web3 world.

Web 2.0: A user-centric experience

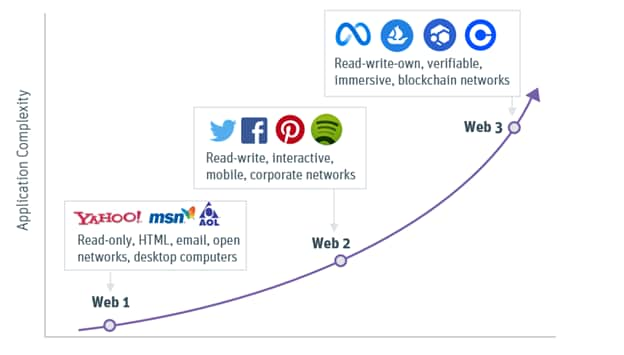

In 1999, tech designer Darcy DiNucci wrote an article for Print Magazine describing a new era of the internet. She described the future internet as a “transport mechanism” built into all sorts of devices — from household appliances to cell phones — creating a more connected world. In web 2.0 — a term she coined — internet users would no longer be confined to static screenfuls of text and graphics but would engage with content interactively.Evolution of the internet

Source: SVB analysis.

Two decades later, we live in that reality. Web 2.0 companies such as Facebook, Twitter and YouTube have reshaped the internet into a user-centric experience, enabling people to create content rather than just consume it. Now, we’re now on the cusp of the next evolution. Web3, perhaps best described as a movement to create a fully decentralized internet, is poised to disrupt the digital economy. No group is more focused on defining web3 than the tech giants of web 2.0. The companies that built their success on the rails of the internet are now finding their role reshaping it.

What is web3?

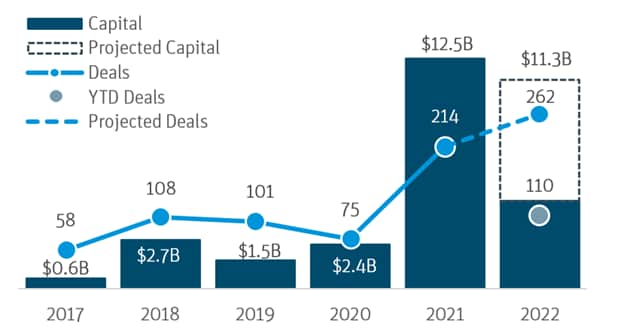

Web3 describes the movement to create that decentralized digital economy built on public blockchain networks and leveraging crypto tokens instead of corporate-controlled servers. Advocates of decentralization argue that web 2.0 tech companies have considerable power and control over the internet. Decentralization can give control back to users and will change the way people access money, work, make friends, protect their privacy, build wealth and own property. To achieve decentralization, web3 services must scale beyond crypto enthusiasts and niche early adopters to reach millions of everyday users.Today’s corporations are taking web3 seriously as both an opportunity and a threat. Executives see the push toward decentralization as a trend they can’t afford to ignore, even if the implications — or use cases — aren’t always fully understood. Some are developing web3 capabilities in-house or collaborating with crypto-native companies, while others are using corporate venture capital (CVC) to invest in key innovators within web3. In 2021, US CVC deals in web3-related startups reached $12.5 billion, up from $2.4 billion in 2020. That trend has continued in 2022, with $4.8 billion invested through May.

US corporate VC Investment in web3

Notes: All deals with CVC participation as of 6/1/2022. Web3 includes crypto/blockchain, AR/VR, metaverse, NFTs and content creation. Source: Pitchbook and SVB analysis.

Corporations are scrambling to get their foot in the web3 door, whether they choose to invest, partner, build or buy. Innovative companies understand that carving out their place in a changing internet landscape is critical to their continued survival and positions them as powerful partners for tomorrow’s startup disruptors.

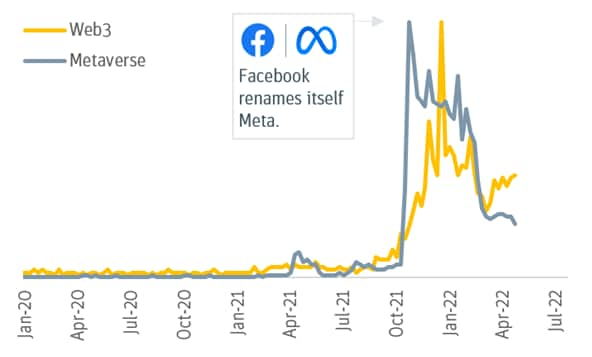

Web3 meets the metaverse

One on-ramp to web3 is the more immersive internet known as the metaverse. While web3 is defining how creators own internet IP and content, the metaverse describes how users will experience that content. Worlds in the metaverse will mimic or blend with the physical world: board rooms, nightclubs and art galleries offering people the chance to put on a virtual reality (VR) headset and experience imagined places, make friends, acquire assets, build businesses and spend money.Search interest: Web3 and the metaverse

Note: An index of search interest over the last five years. The highest point is peak popularity. Source: Google Trends and SVB analysis.

These ideas aren’t new to gamers. But the digital shift brought on by the COVID-19 pandemic has primed the metaverse for greater adoption. Zoom-fatigued employers want to meet up in digital spaces. Musicians want to sell out virtual auditoriums and brands want to dress your avatar.

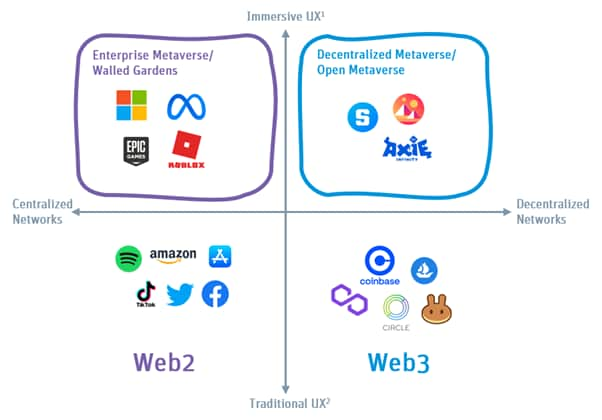

But an immersive space built by Meta — or any other large corporate player — isn’t necessarily the decentralized vision that web3 advocates want. Tension exists between those who envision the metaverse as an open-digital commons and web 2.0 companies who want a more immersive version of the corporate-owned networks we have now.

In the real world, the infrastructure — roads, utilities, airspace — runs on public ownership. But in the metaverse who owns the world around you? If it’s a Disney metaverse platform, then they do. A metaverse that truly mimics the public spaces of the real world must be built on the protocols of web3.

The potential of web3 is boundless

Web3 can transform the way businesses are built, transactions are conducted, and data is shared or protected. The metaverse is one arena where web3 applications are taking shape. A more immersive internet will blur the line between physical and digital worlds. These seismic shifts offer growth opportunities for content creation as well as hardware and software development.

The metaverse alone represents an $8 trillion market opportunity, according to Goldman Sachs analyst Eric Sheridan, and in many ways is proving a convenient entry point for corporations to explore a web3 footprint.

Web3 and the metaverse

Notes: 1) Users explore 3D worlds with avatars, typically using virtual reality or augmented reality headsets. 2) A standard mobile or web interface. Source: SVB analysis.

Investments, acquisitions and partnerships

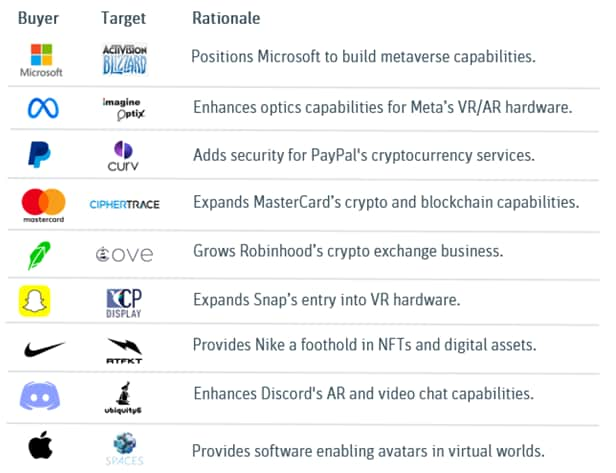

Following Meta’s name change and $10 billion pivot to the metaverse last year, other tech companies are making moves of their own to rebrand and prepare for a web3 future. Microsoft bought game developer Activision Blizzard for $69 billion in January and is developing an avatar version of Teams for a more immersive office environment. With Meta’s VR headset Quest 2 accounting for 80% of VR sales in 2021, Apple and Google are each developing headsets of their own, including see-through versions that augment the physical world with digital displays.

Notable web3 acquisitions

Notes: 1) Includes strategic acquisitions targeting crypto and blockchain and AR/VR technology. Source: PitchBook and SVB analysis.

Some companies are investing in virtual real estate. In February, Samsung partnered with the web3 platform Decentraland to host a virtual launch of its new Galaxy S22 smartphone and Galaxy Tab S8 tablet. Visitors in avatars wandered through a digital twin of Samsung’s flagship New York showroom and competed for custom non-fungible tokens (NFTs). This wasn’t the first crypto collaboration for Samsung. The company’s latest line of smart TVs will feature a built-in NFT platform, a joint project with the web3 marketplace Nifty Gateway. Partnerships like these offer ways for web 2.0 companies to participate in the web3 ecosystem while also onboarding new users into web3 platforms.

Notable partners

Source: SVB analysis.

Notably, it’s not just tech companies buying in. Consumer brands see opportunities for advertising and direct sales in the digital universe. In November, Nike bought the digital apparel company RTFKT to gain a foothold of NFTs and other digital goods. Gucci, Prada, Adidas and dozens of other brands have launched virtual apparel projects of their own.

Web3 creator economy

Another significant area of focus for corporations is in the creator economy that web3 further enables. Compared to corporate-controlled networks, blockchain networks give creators a greater share of the value they create. For example, some musicians are tokenizing their music to sell directly to fans. In March 2021, the rock band Kings of Leon generated $2 million from an NFT release of their latest album. With greater ownership and control over their content, creators are beginning to challenge the dominance of platforms such as Spotify and Instagram — amongst other gatekeepers, like music labels — who may need to rethink their business models to adapt to this new norm.

“The reality is that in web 2.0 there were a lot of challenges with how creator incentives worked,” Sim Blaustein, a partner at Bertelsmann’s investment arm, BDMI, said in a recent interview with Silicon Valley Bank. “Web3 is seeing blockchain and other technologies right those wrongs.”

Web3 creators have ownership over their content and, in theory, greater ability to monetize their work. An up-and-coming musician might fund an album by selling tokens that appreciate as their career takes off. A writer might sell an article as an NFT and collect a commission from every view or future sale.

Decentralized ledgers could lower distribution costs by making it easier for companies to track and verify complex transactions, thereby cutting out intermediaries. For example, in the travel industry, blockchains could further reduce the need for online travel agencies.

The trend of cutting out third parties could extend to new opportunities for user-owned and operated models. The most vulnerable industries for this kind of disruption are web 2.0 marketplaces. Take Airbnb, for example: If the blockchain makes peer-to-peer transactions secure and verifiable, does Airbnb lose its footing as the trusted broker? Ultimately, the benefit undercuts the value that platforms like Airbnb and Uber offer, but it doesn’t replace the value of sleek user interfaces and intuitive design, or even intangible elements like trust and credibility — areas where web 2.0 may still hold an advantage.

Web3 challenges: From scammers to a massive carbon footprint

For all its opportunities, web3 also carries challenges. Decentralization doesn’t eliminate bad actors. Scams are still possible, and nascent regulation exposes users to risks that exist to a lesser extent in web 2.0.

These problems are compounded because decentralization makes it hard to create legislation for web3 companies. Navigating a patchwork of legal requirements between state and federal rules for crypto companies is expensive and time-consuming. Another area of concern is security. Blockchains make transactions more transparent, but they also provide anonymity, which raises liability concerns and could give cover to scammers. These issues are solvable, but they will take time to work out.

“So much of web3 feels like the Wild West,” Blaustein said. “It's hard to actually know who are legitimate players on the up and up, who are people who might not be any better than a get-rich-quick or fly-by-night scheme.”

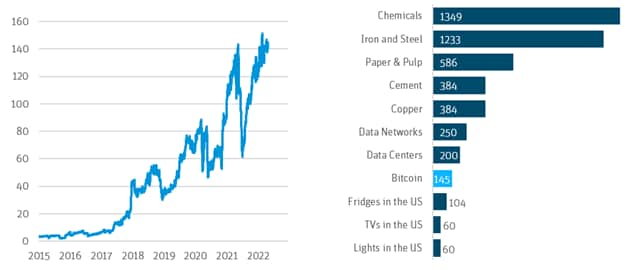

Moreover, with environmental, social and governance (ESG) concerns top of mind for most corporations, another serious criticism of web3 involves its massive carbon footprint. Base layer blockchain networks like Bitcoin and Ethereum require huge amounts of energy to mine.

One study found that a single bitcoin transaction uses over 1,100 kWa of electricity, enough to power an average American home for over a month.

Bitcoin energy and electric usage

| Bitcoin energy consumption (TWh)1 | Electricity usage per year (TWh)2 |

Notes: 1) Annualized energy consumption 2) Estimates from Cambridge Bitcoin Electricity Consumption Index and SVB analysis.

These concerns have become a major barrier to the adoption of cryptocurrency — and web3 more broadly. Tesla stopped accepting bitcoin payments in 2021, and Wikipedia recently banned all cryptocurrency donations.

However, solutions are on the way. Crypto projects are becoming more energy efficient in three ways:

- Using renewable energy. Because crypto miners are mobile, they have the potential to use stranded forms of power. One method gaining traction is flare gas from oil and gas drilling sites. Recovered flare gas has the potential to power the entire bitcoin network, according to researchers at Cambridge University. Cue energy corporations: in one pilot project with ExxonMobil last year, the startup Crusoe Energy diverted 18 million cubic feet of gas per month into crypto mining.

- Using Layer 2 protocols. These secondary networks are designed to operate faster and more efficiently than base layer networks. Layer 2 networks are crucial for scaling web3 applications globally, but the tradeoff for that speed is security. Hackers recently stole $620 million in crypto from the web3 gaming community Axie Infinity, built on a Layer 2 network.

- Switching to proof-of-stake. Bitcoin and Ethereum were designed to verify transactions using the energy-intensive proof-of-work consensus mechanism. But ESG-minded crypto projects have embraced proof-of-stake. This method minimizes ESG concerns by removing up to 99% of energy usage. Ethereum plans to switch to proof-of-stake later this year, joining networks like Solana and Polkadot.

Web3 is here to stay

The hype around web3 is only heating up. While it’s unlikely that a decentralized internet will entirely replace the tech giants of today, corporations aren’t taking any chances. Companies are adding web3 elements into their current businesses. Shopify accepts bitcoin payments, and Twitter verifies NFT profile pictures. Some companies are taking it a step further. Google launched a “digital assets” team to focus on blockchain projects. The payments company Square renamed itself Block to signal its new mission in crypto payments.

In the same way corporations understand they must share in value creation with their users — they know partnerships with disruptors will be key to success in web3. This poses an incredible opportunity for startups, innovators and new entrants to leverage the expertise, resources, and scale of these giants in co-creating the next evolution of the Internet, which is sure to be its most impactful iteration yet.

Our corporate relationship management team not only serves as the connective tissue between SVB’s client ecosystem and the most active corporate investors, acquirers and partners of today, but also provides insight into the trends of tomorrow. If there are ways we can partner to be of help, please don’t hesitate to reach out.