- Driving sustainable growth relies on smart, data-informed decisions for cash management supported by commercial card metrics.

- Unifying and enriching spend data helps ensure more accurate results for card program KPIs.

- Focusing on commercial card KPIs that track financial returns, efficiency gains, strategic adoption, and risk management help you quantify the business value of your card program.

Why should scaling companies track commercial card KPIs?

Sustaining growth momentum in venture-funded companies relies on effective cash management, backed by data-informed decisions. Successful finance leaders think beyond just tracking spend. They use commercial card metrics to quantify how the card program delivers substantial business value through strategic spending and operational efficiency. It’s a powerful way to demonstrate measurable ROI to C-suite executives, board members and investors.

For example, commercial card program KPIs can:

- Provide insights to better allocate working capital, defend budgets, and quantify operational savings.

- Improve risk management by identifying fraud patterns, expense policy violations, and spending anomalies before they become material problems.

- Identify how the card program is increasing efficiency, and spot utilization gaps that may be hindering cash flow and team productivity.

How can finance teams ensure accurate corporate card metrics?

Before you dive into which card program KPIs to track, you may need to solve some common data challenges. If your company spending is decentralized, it often results in limited visibility and fragmented data across different card providers, expense management tools and ERPs. That makes it nearly impossible to get a unified view and may require a lot of manual work to pull together the data you need for accurate corporate card metrics.

Another roadblock I’ve seen with clients is that they have significant gaps in their card spend data. If you have only limited expense policies, categories and codes in place, it’s harder to track the nuances of how and why money is spent, including card usage compliance. That context matters for your commercial card metrics because it may influence financial decisions.

Consider centralizing oversight and control with a single commercial card program, integrated with a robust spend management platform. At SVB, our corporate card clients can unify and expedite spend data capture with automated expense reporting and reconciliation, and seamlessly data sync to their ERP or accounting software.

4 key metrics for commercial card program KPIs

Once you’re positioned to optimize spend data, you can gain greater insights from card metrics. Growth company finance leaders should prioritize the following four commercial card KPIs:

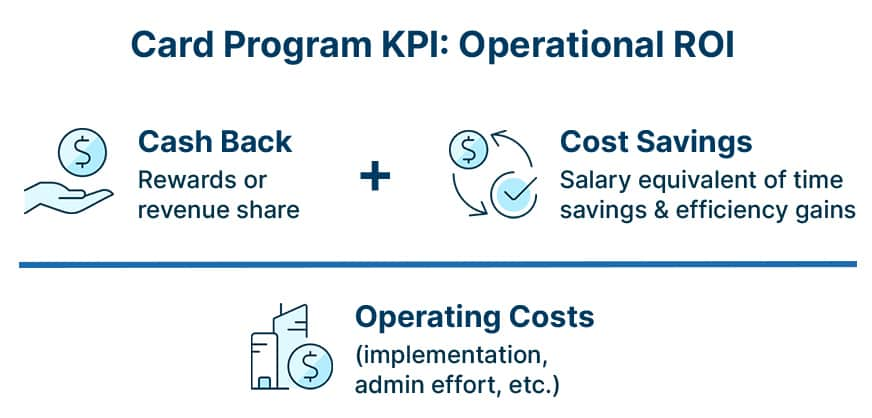

Operational ROI

The Operational ROI metric helps you see beyond financial returns to whether your commercial card program gives you leverage to scale the business. Think of it as your board-ready KPI that supports the program's existence and budget allocation.

As a formula, the metric should combine total cash back yield and the cost value of gained efficiencies, divided by operating costs related to the card program such as implementation and admin effort.

While it may be easy to identify total cash back yield, measuring efficiency in dollars can be tricky. Estimate the hourly rate salary equivalent of time savings – such as efficiency gains from automating expense reporting and reconciliation, and faster month-end close cycles. Also look at cost savings that come from reducing out-of-policy spend and manual reimbursements.

Expense Processing Cycle Time

Next, you want to measure in detail how well your corporate card program supports scalable finance operations. Expense Processing Cycle Time tracks the number of days from a card transaction to final expense approval and reconciliation. A card program that reduces your cycle time from a week to a day or less shows real operational maturity and financial discipline.

If this reporting cycle is still a challenge for your company, it’s time to integrate your card program with spend management controls to automate expense reporting. Employees save time and can stay focused on high-value work with reporting done in a few taps via mobile. And your finance team gains a real-time flow of pre-coded card expense data that automatically syncs to your ERP or accounting software. On top of that, you can issue virtual cards with pre-approvals to further expedite expense processing cycles.

Card Penetration Rate

You also want to track whether you are maximizing the card program’s potential. Card Penetration Rate measures the percentage of eligible employees who have active corporate cards. It helps you gauge card program health in terms of successful adoption across the company.

A high penetration rate may indicate higher business value gained from cash back revenue and cost-saving efficiencies. A low rate could signal the need to consolidate spending, and better enable procurement teams with policy-controlled virtual cards.

Policy Compliance Rate

Another commercial card KPI to include is Policy Compliance Rate, which identifies the total in-policy transactions divided by total card transactions overall. This metric matters for both risk management and cash optimization.

Low compliance can create unexpected costs, audit risks, and potentially more manual admin burden to resolve issues. To optimize for policy compliance, ensure your card program enables you to:

- Create and evolve spend policies as your company grows.

- Auto-enforce policies by pushing alerts or restrictions when employees use their company card.

These capabilities help increase compliant card usage for procurement, business travel and other expenses.

Using these four commercial card metrics, you can demonstrate the tangible business value of your card program. The KPIs encompass financial returns, operational efficiency, strategic adoption, and risk management — which are fundamentals for driving sustainable growth.

Learn how SVB commercial cards and spend management give you robust capabilities and data-driven insights to support a scalable innovation journey.

Frequently asked questions

What's the minimum card program size to track these KPIs effectively?

To effectively measure card program KPIs, it’s best to have at least 25-30 active cardholders. At this stage you get enough data to identify meaningful trends and insights. Below this amount, individual usage patterns could skew results. For instance, if a couple employees rarely use their company card it could make Card Penetration Rate look artificially low.

How often should we review these commercial card metrics?

Plan on weekly or monthly spot-checks for Policy Compliance Rate and Expense Processing Cycle Time so you can find and fix issues quickly. Monthly or quarterly tracking is sufficient for Card Penetration Rate and Operational ROI to support program optimization and board reviews.

What benchmarks should we use for these corporate card KPIs?

Benchmarks may vary by industry and company size. For venture-funded growth companies with mature commercial card programs, here are some good targets for card metrics:

- Operational ROI should deliver 200-400% returns when factoring in cost-saving efficiencies, cash back rewards, and more controlled, compliant spend.

- Card Penetration Rate that reaches 70-85% indicates strong adoption, which translates to more benefit to the business.

- Expense Processing Cycle Time should drop dramatically as automation replaces manual processes, reducing 7-14 day cycles to 5 days or less.

- Policy Compliance Rate should attain at least 90-95%, anchored by policy-controlled cards and auto-enforcement of expense policies.