- Central regions of the US, long overlooked by venture investors, are now attracting a greater share of VC investment and VC funds than ever before. A growing number of firms are doubling down on the “midcontinent” — an eight-state region surrounding Oklahoma.

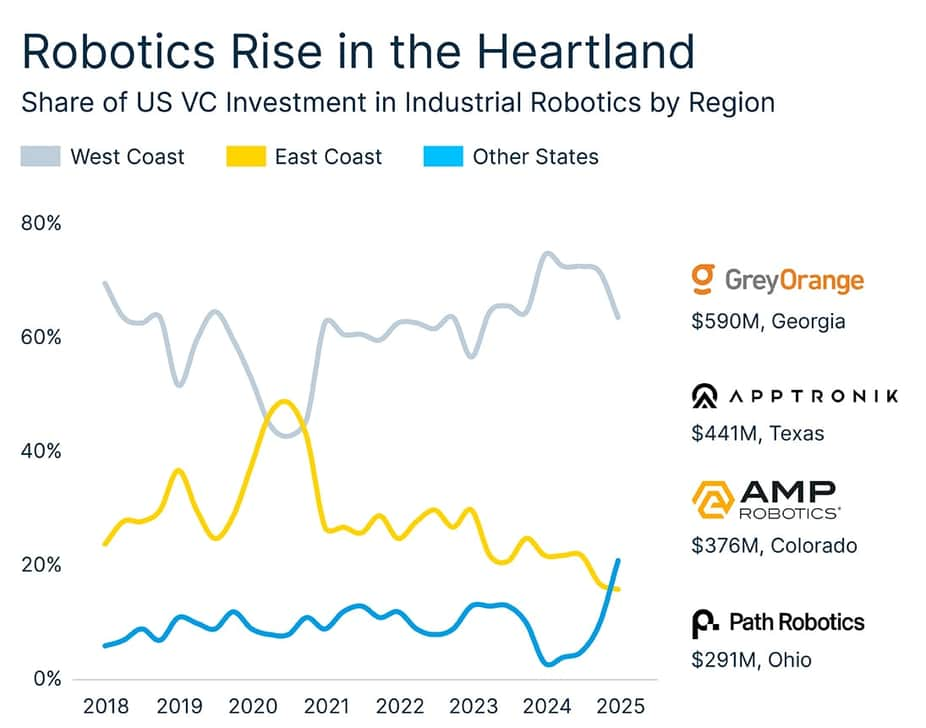

- In 2024, VC investment in industrial automation hit a record high, and non-coastal regions surpassed the East Coast in funding for the first time.

- Deep Tech founders outside of major tech hubs see benefits in cost, government backing and access to industry.

As blockbuster AI deals dominate the headlines, VC investment in physical technology is quietly accelerating across the US. Our recent Future of Frontier Technology report found a 47% year-over-year increase in VC funding for hardware-enabled startups in 2024. Coastal tech hubs still attract the lion’s share of the investment, but middle America is capturing a larger slice of the pie — 23% of all hardware investment in the first half of 2025, totaling $14.3 billion. That’s on pace to double last year’s total.

“People are realizing that innovation doesn’t just happen in the Bay Area or Boston,” said Nathaniel Harding, managing partner at Cortado Ventures, an early-stage VC firm based in Oklahoma City. “There’s deep expertise, real industrial know-how and strong government support here in the middle of the country.”

Cortado is one of a growing number of venture firms doubling down on the so-called “midcontinent” — an eight-state region surrounding Oklahoma. This region’s VC journey reflects the trajectory of other often overlooked areas of the US where startups are flourishing. Cortado has positioned itself as a bridge between coastal capital and inland innovation. For the last three years, the firm has hosted the Midcon VC Summit, a regional event that brings hundreds of investors, founders and public sector leaders to a host city in the midcontinent — this year, to Tulsa.

“Our region represents 20% of the population but receives less than 3% of the capital,” Harding said. “We saw that gap and built the kind of firm we wished existed when we were building companies ourselves.”

The midcontinent region is a microcosm of trends playing out across the country where technology is digitizing legacy industries such as agriculture and manufacturing. In 2024, VC investment in industrial automation hit a record high, and companies outside of the two major coasts surpassed the East Coast in funding for the first time.

Source: SVB’s Future of Frontier Tech Report 2025.

More firms are taking notice. VC funds in the midcontinent accounted for 12% of all funds raised over the past three years — double the share from a decade ago. In many ways, VCs feel the love in smaller markets. Access to industrial expertise, favorable deal terms and strong government backing are all factors that encourage deal flow.

Cortado leans heavily on its network of industry-aligned limited partners (LPs). Out of 100 LPs across two funds, roughly two-thirds are C-suite executives in the sectors where Cortado invests, Harding said. This approach creates a powerful flywheel: executives bring operational insights, offer pilot opportunities and stay close to emerging technologies in industries where corporate venture arms may be absent.

“A lot of these companies don’t have corporate VC arms,” Harding said. “So this is a way for executives to stay close to innovation while helping startups solve real problems.”

Why Middle America is ripe for deep tech innovation

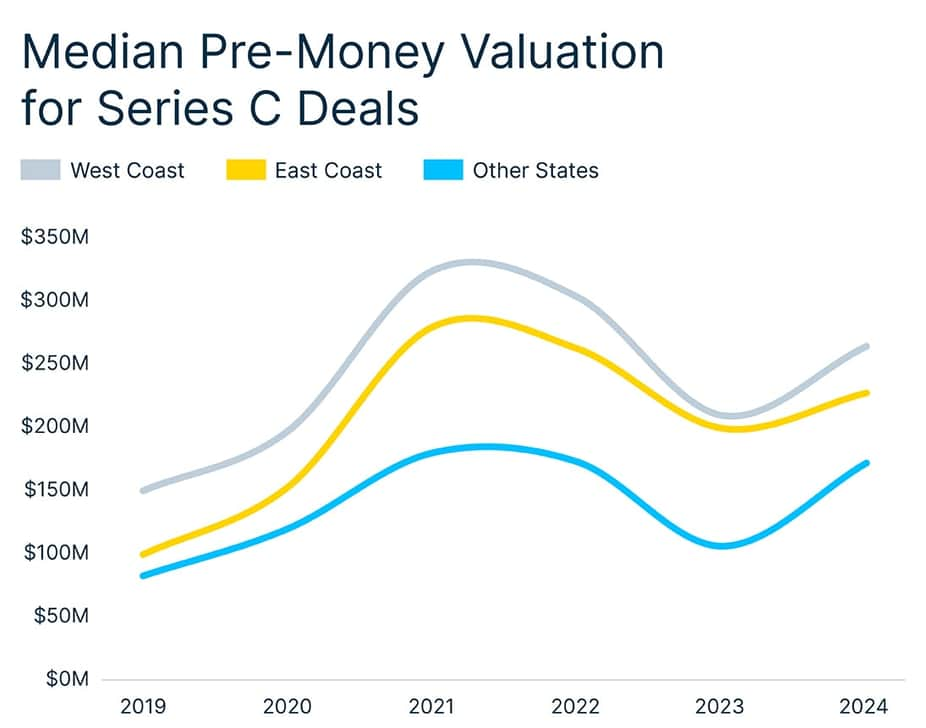

Founders outside of the elite tech hubs see a benefit when it comes to stretching their dollars. Lower labor costs and operating expenses often mean startups can raise smaller rounds and still achieve meaningful milestones. While lower deal sizes and valuations might sound like a downside, they’ve been a blessing in disguise in the current market. During the 2021-22 boom, midcontinent valuations didn’t inflate to the same level as coastal tech hubs, which has helped some companies grow into those valuations more easily. In fact, median valuations for Series C companies in non-coastal regions have returned to its prior peak.

Source: PitchBook Data, Inc. and SVB analysis

“Startups here were never priced for perfection,” said Harding. “That’s helped them avoid some of the valuation overhang we’ve seen in overheated markets.”

The non-coastal markets also tend to produce startups with a bias toward efficiency and profitability. Many come from legacy industries where failure is expensive and operational rigor is second nature.

In deep tech, that experience matters. “To innovate in sectors like advanced manufacturing or energy, you need industry insiders,” Harding said. “You can’t just move fast and break things when you’re dealing with physical infrastructure.”

Meanwhile, local and state governments are getting creative. Oklahoma has one of the highest shares of accelerator-backed VC deals in the country, and Tulsa’s well-known remote work program offers $10,000 to out-of-state workers who relocate to the city. Other incentives range from early-stage grants to commercialization support and tax credits for investors.

“These governments aren’t trying to pick winners,” Harding said. “But they’re doing a good job of creating the conditions for innovation.”

Midcontinent momentum

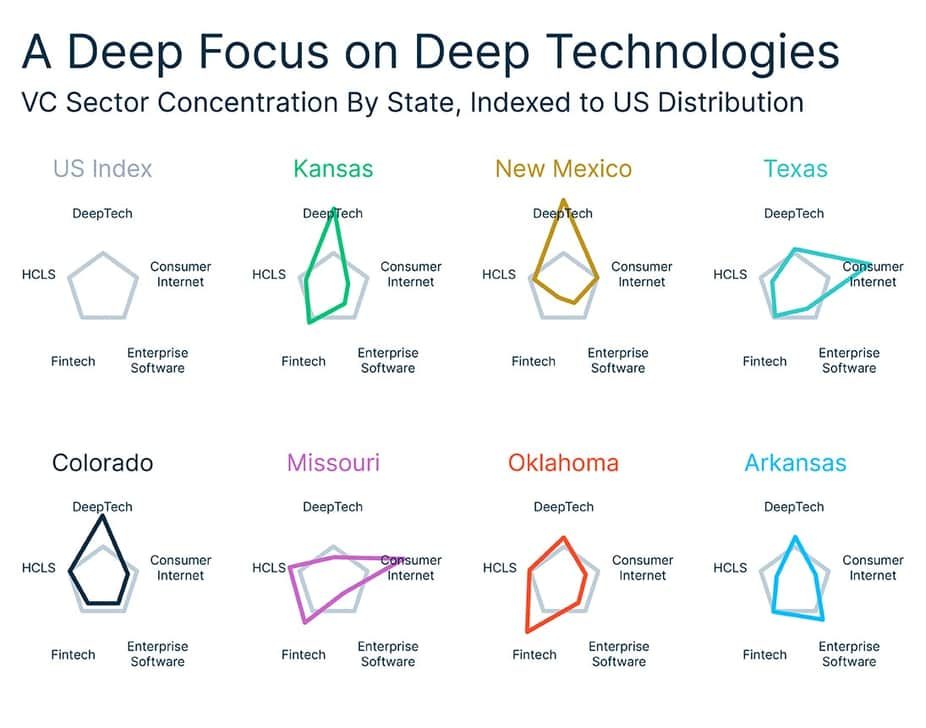

As demand for industrial tech investment grows, these efforts should amplify the competitive advantages that already exist. Six of the seven midcontinent states show above-average concentration of deep tech investment, according to SVB analysis. Oklahoma in particular has become a hub for drone and aerospace startups, many of which are benefiting from defense-related pilot programs and public-private partnerships.

Notes: Deep Tech includes hardware-focused sectors, including frontier technology and climate technology.

Source: PitchBook Data, Inc. and SVB analysis.

Harding points to an energy startup in Cortado’s portfolio that exemplifies the model: the company uses a novel electrolysis innovation to efficiently convert heat waste into usable green hydrogen. It was able to run early pilots with LPs who had a direct need for the technology.

“We connect early-stage startups with the executives who need what they’re building,” he said. “That’s our playbook. It makes the LPs happy, and it gives the startups a real shot at product-market fit.”

Harding estimates that VC capital in the region has grown fivefold in recent years — a leading indicator of a maturing ecosystem. As more capital flows in, more companies take root. And as more companies grow, more founders spin out to start the next wave.

“When the key pieces — capital, talent, universities, policy — start to work together, the results are exponential,” he said. “That’s what we’re seeing here. The pieces are all here. Now it’s just about connecting them.”