Key Takeaways

- Healthcare and life sciences investors are looking to solve for a potential market value at exit that ideally represents 10x the amount of capital invested into the company.

- It is essential for all first-time life sciences entrepreneurs to get a clear understanding of how much capital is needed to take your company from inception through exit.

- Putting hard figures to market sizing is important and the TAM/SAM/SOM equation should be a key part to crystallize details of any pitch.

Life sciences entrepreneurs are no strangers to the complex world of novel bio-medical technologies. But when it comes to raising capital to fuel their companies from inception to exit, I have seen many first-time founders struggle with the financial intricacies inherent in wooing long-term investors. It’s no easy feat creating a good life sciences and healthcare pitch deck that summarizes the company mission, the product and target market, the clinical development timeline as well as key stakeholders in a succinct way that builds a singular narrative – ideally in less than 20 slides.

However, if there is one critical component in a good life sciences pitch that consistently trips up most first-time and even many seasoned life sciences entrepreneurs, it is putting together the numbers that tell a compelling story behind the market size and the investment capital required to get the product through clinical trials to market.

When crafting your pitch, you need to put yourself in the shoes of potential investors and get smart about the business logic and math that investors use to evaluate deals. It is crucial that first-time life sciences entrepreneurs seeking investment capital have a clear understanding of how much capital is needed to take their company from inception through exit and the numbers you present as part of your pitch need to back that story up in a credible manner.

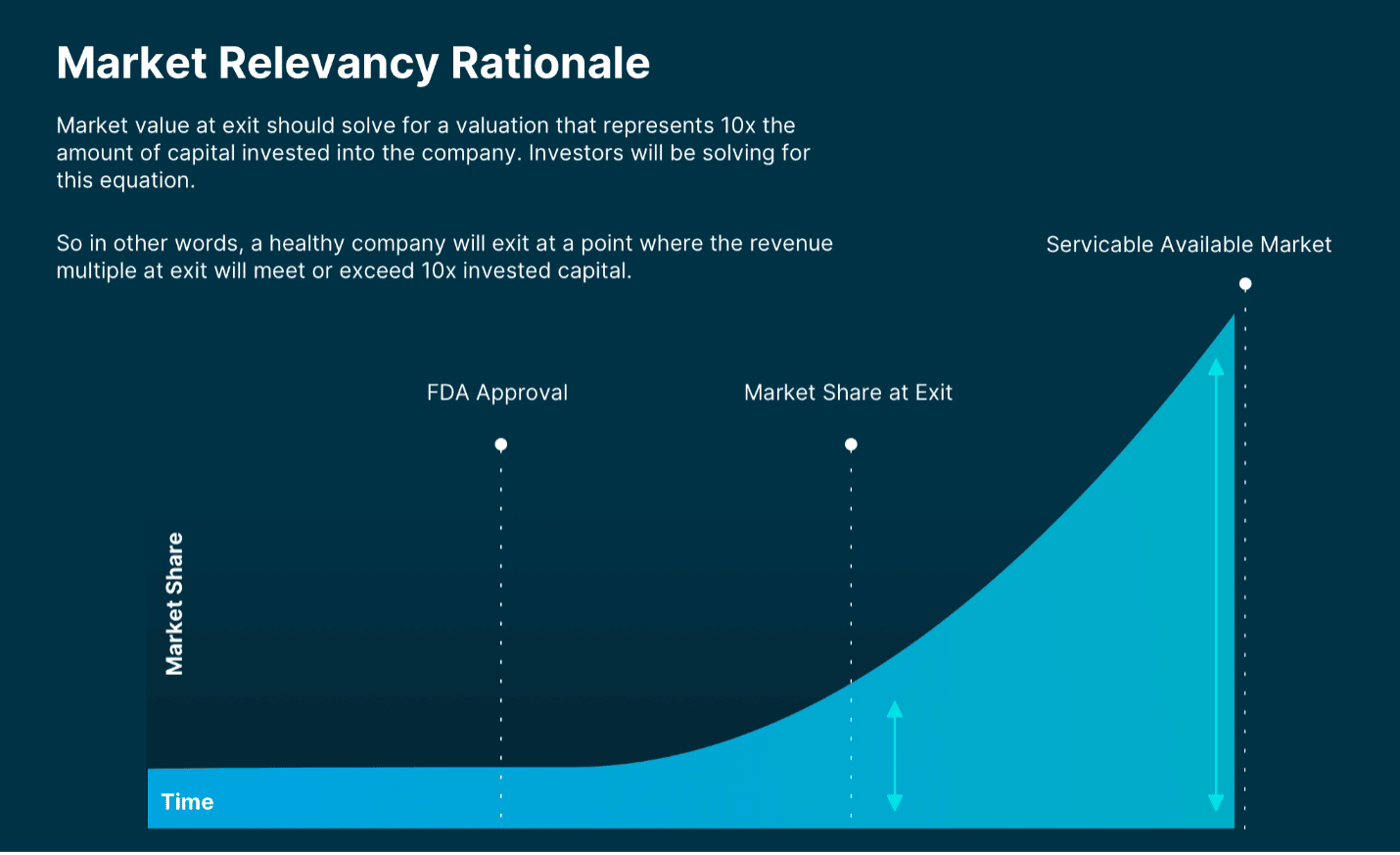

It is important to remember that prospective investors you are pitching to are also looking to solve the same problem. The key consideration driving most investor calculation is: what is the market value at exit that represents ten times (10x) or greater the amount of capital invested into a company? (as shown in the graphic below).

For instance, if investors pour $100 million into a company and expect to get about 10% market share of a $10 billon market, an eventual selling price or exit of $1billion would equate to a 10x valuation and return for a healthy exit. Why 10x? Because VC firms know that most of the companies they back will fail, they are therefore looking for enough 10x exits in their portfolio of companies to meet their goal of an overall 3x return on their fund.

Defining the market size - Solving for the TAM/SAM/SOM equation

Framing your thinking by working backwards from that 10x number mentioned above is important. Your pitch should demonstrate that, once you get to the other side of clinical trials, the market opportunity is big enough to compensate for the capital requirements to get there.

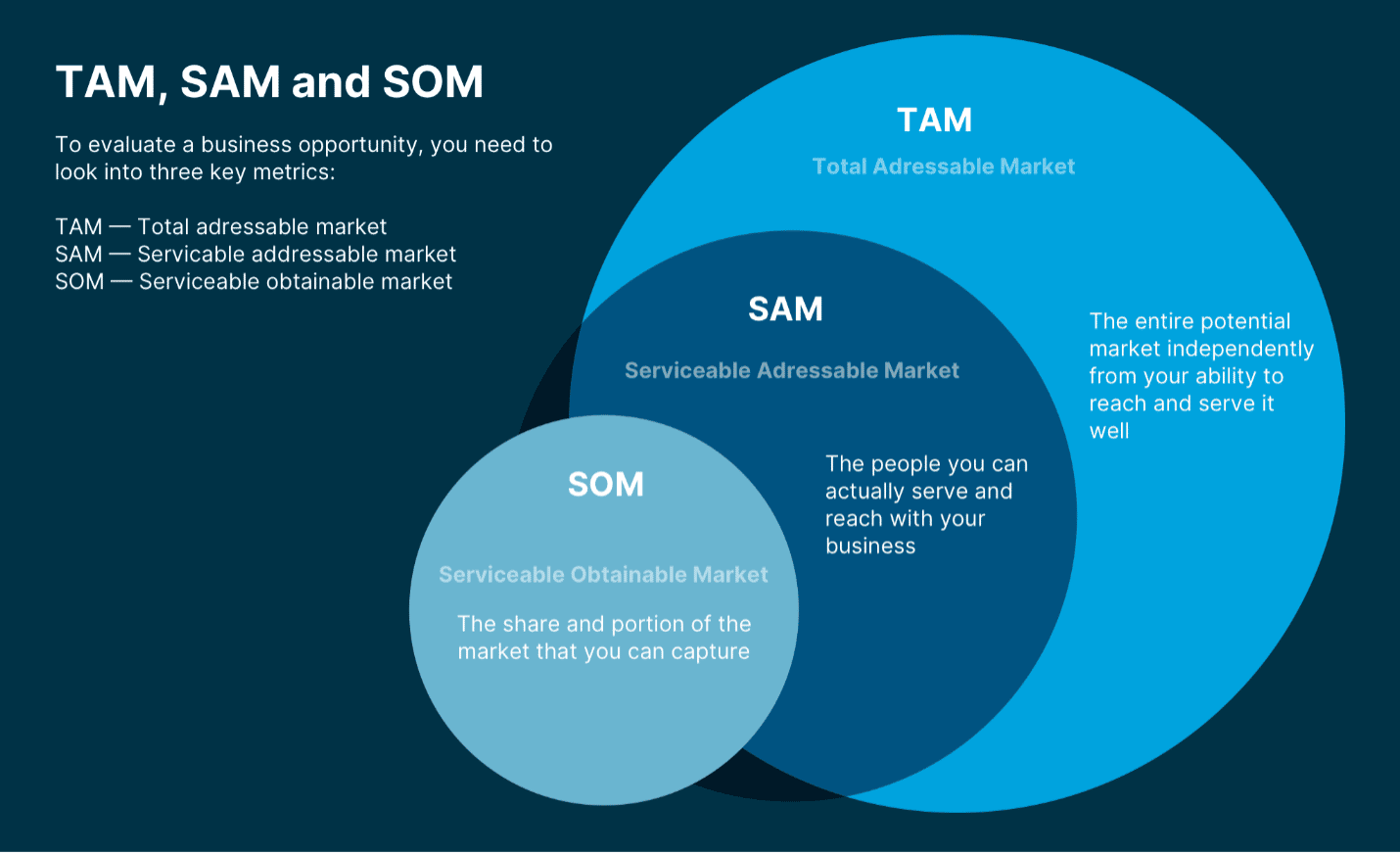

Accurately estimating the size of the commercial market potential that could result in that 10x goal for your investors is crucial to your pitch. A great starting point to get to that number is the TAM/SAM/SOM calculation for sizing your market as shown below.

TAM, or Total Addressable Market, refers to the universe of total possible users that can be targeted for your product or service. The Serviceable Addressable Market (SAM) is the realistic number of customers, which can be targeted given limitations of factors such as market access and regulations etc. Finally, SOM is the Serviceable Obtainable Market or the actual share of market your company expects it can address. These are each concentrically smaller subsets of the same market. In the context of your pitch to investors, SAM and SOM would be key areas of commercial focus.

Here’s a real-world example of how TAM, SAM and SOM would effectively play out in a life sciences pitch. Let’s say I have a therapy to cure scoliosis. The TAM for my product is all of the people in the world who have scoliosis. However, the first market I will pursue is the United States because that’s where I have cleared clinical trials which makes the USA my SAM. My SOM would possibly be the top ten medical centers in the southern United States that specialize in treating scoliosis.

The size of the addressable market and the estimated percentage market share are, for a company – and its potential investors – critical factors in creating the 10x calculation. In the example above, the total addressable market for a scoliosis therapy could be $5 billion worldwide, for illustrative purposes. The SAM or the addressable market in the US, is $1 billion. If the company can achieve 20 percent market share, the resulting SOM would be $200 million.

Subject-verb agreement between market size and investment capital

Putting hard figures, like mentioned in the example above, to the market sizing data is absolutely important. SVB’s life science and healthcare sector reports like the Healthcare Investments and Exits reports and the CipherBio platform, provide up-to-date science and funding data and can be valuable resources to help you source credible data in order to weave a compelling pitch to investors.

The other important number in your pitch is to accurately assess the investment capital that the company will need funded to see it through all the stages of regulatory approvals, preclinical and clinical timelines all the way to the point where it can exit through a M&A or IPO. Founders need to be sure to account for the impact lengthy preclinical and clinical timelines have on the cost of capital and rate of return.

Looking back at our earlier example of a scoliosis therapy company estimated to generate $200 million in revenue in a $1 billion market in the US. If the company requires an investment of $25 million to get to the point of exit, then 10x would be a valuation of $250 million. In our example however, with SOM equaling $200 million, the company would only generate 8x return for investors. In this case, the company may have to demonstrate that they could get to market more efficiently or capture a larger share of the market to solve for the 10x end game.

Find the right match

Ultimately, life sciences entrepreneurs should be looking for the right fit in terms of investors who have a track record of success, synergistic outlooks and are keen to be long-term business partners. This also means finding investors who have the staying power to finance a company’s long-term needs.

The last, albeit, important part of this formula is estimating the amount of capital you need at each stage of your company’s development - as accurately as you can. One trap that I’ve seen a number of entrepreneurs fall into is having to ask for significantly more capital in subsequent rounds than initially planned. One consequence of this is that any large later-stage investments end up creating hardship for the earlier investors who may have limited follow-on funds, and who in turn, see their pro-rata share get significantly diluted. That has a direct downstream effect on their expected 10x return. This often results in a toxic situation that causes a lot of friction that founders would do well to avoid.

This friction between investors manifests itself primarily because of how new and existing investors approach subsequent rounds of funding from very divergent standpoints. Existing investors in any company will always like follow-on rounds of funding to occur at the highest possible valuation as that gives their original investment the greatest value. Conversely, for new investors coming into the company for the first time, it behooves that they deploy capital at the lowest possible valuation as that provides them the maximum benefit in ownership terms vis-à-vis their investment. So, for life sciences founders the true value of their company is somewhere in-between these two investor valuation polarities.

Considering the long incubation processes of the life sciences industry it is nearly impossible for most founders to have their earliest investors see them through all the way to a successful exit. More often than not, they will have to bring in new investors and that will invariably cause some friction with their existing investors from previous rounds.

One way that founders can mitigate the risks associated with bringing in new investors is by clearly identifying the true value driving milestones in the business. Also, it is important to assertively state the reasoning behind why achieving each milestone is so critical in the journey to that 10x exit scenario. What founders are doing is explaining why reaching each milestone is essentially de-risking future investment in the company. This in turn will increase the propensity of new investors to come in at subsequent rounds of funding at the highest possible valuation and better protect the positions of your existing investors from decay.

This is a fundamental truth in all innovation industries and it all really ties into how clearly you understand your business and its success milestones - all of which are intricately tied into your accurate estimations of clinical timelines, market size, commercial development, operational costs and capital requirements. Basically, all the pieces listed above that help you chart a course to that 10x point of exit.

SVB’s CipherBio can provide insight as well as business intelligence into specific VC funds, average funding numbers for various life science and healthcare sub-sectors as well as the areas and size of investments being made by investors across the industry.

Working backwards from the 10x exit, the TAM/SAM/SOM formula, accurate estimations of capital requirements and managing investor relations at each stage of the company’s journey are important details investors pay particular attention to and should not be overlooked by any life sciences founder. Not all of us love math but doing your homework may give you and your investors clarity into your business and that can be a critical differentiator to set a successful pitch apart in your next round of funding.