- Successful fixed income investing across all four phases of the economic cycle requires the ability to adapt and build portfolios suited to the prevailing environment.

- Staying in tune with central bank activity and monetary policy is critical since interest rate moves can have a material impact on when and how the economic cycle is shifting.

- Corporate bonds, asset backed securities, commercial paper, Treasuries and agency bonds can all play important roles at different times of the economic cycle. Your investment partner can help develop the right asset mix based on your objectives and risk tolerances.

Economic vista: Riding the economic cycle

Christi Fletcher, Senior Portfolio Manager

Fixed income investing is a bit more challenging than riding a bike. But once you’ve been through a few economic cycles, you can get a good feel for portfolio construction as the environment changes. This might be especially helpful during days of financial market turmoil, spiking volatility, and heightened anxiety. Remember, investing in fixed income over the long term requires an even keel and the ability to shift gears—even if it’s nuanced—depending on where we are in the economic cycle.

The four phases

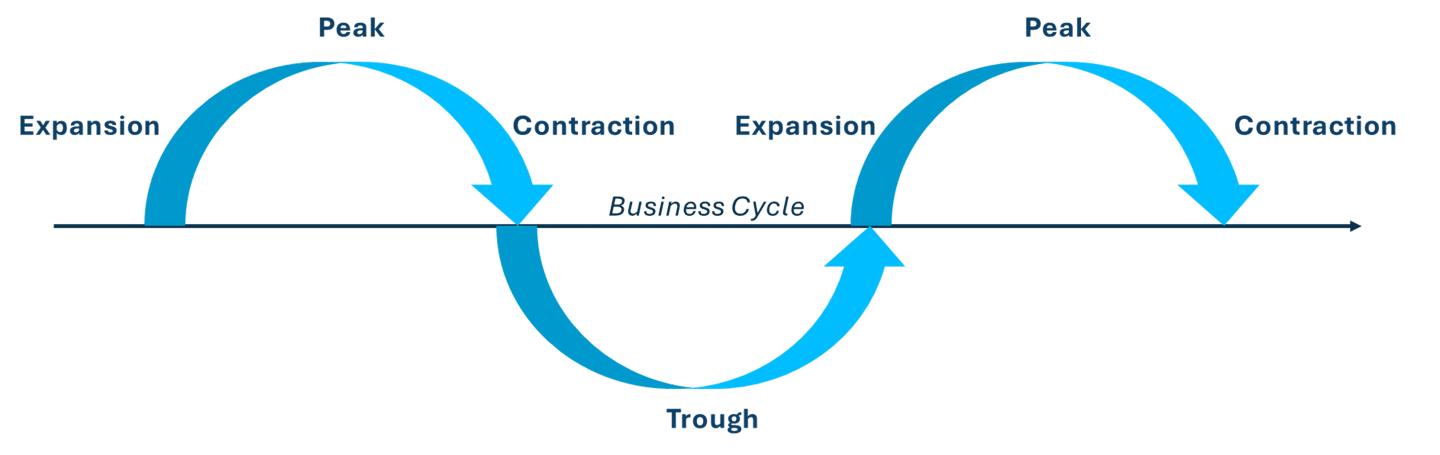

Economic cycles refer to the oft-repeated ups and downs in economic activity over time. Successfully investing in fixed income across economic cycles requires an understanding of the four key phases of the business cycle—Expansion, Peak, Contraction and Trough—and how various fixed-income assets tend to react in these different phases. I like to think of the phases in an economic cycle like seasons, even though we typically don’t experience them all in a single year. The average economic cycle normally runs for five years, though cycles can be more compressed or stretch out longer depending on a variety of external influences.

Source: SVB Asset Management

Chief among these may be interest rates. Central banks use their authority to set interest rates to stabilize the economy, fuel employment, and control inflation. It’s a tricky balancing act. These efforts will undoubtedly influence economic cycles. Central banks typically raise interest rates to control inflation during economic expansions, and they commonly lower rates to spur growth during periods of economic contractions. Changes in interest rate affect borrowing costs, which can either spur or dissuade consumer spending and business investment. This shapes where we are in the overall economic cycle, and in turn it’s up to investors to position properly to manage the risks and take advantage of the opportunities.

Different seasons, different strategies

Central bankers often raise interest rates in the best of times when GDP is expanding. In theory, this helps prevent the economy from overheating if demand for goods and services is outpacing supply and prices (and often wages) are rising too quickly. Thus, in the expansionary phase when the economy begins growing rapidly, interest rates tend to be low as production increases. Employment is robust. Corporate balance sheets look healthy. And the cost of money is cheap!

So how do investors like to position during these early cycle good times? Typically, it’s smart to add short-term bonds and floating-rate securities to your portfolio. After all, short-term bonds are less sensitive to interest rates. And because interest rates are typically low at this juncture, it’s more likely that central banks will eventually raise rates to keep the economy from overheating. If the next move in rates is up, shorter-duration bonds may be a safer bet. Floating-rate securities may be particularly attractive at this juncture since they adjust their coupon rates periodically based on current interest rates, plus a spread. This can help protect against declining bond prices in other parts of the portfolio if rates move higher. In fact, floating rate securities are among the few fixed income vehicles that tend to appreciate in price during rate-hike cycles.

During the peak of the cycle, interest rates may have moved higher and the economy may be showing signs of potential constraints, such as elevated inflation readings. Growth tends to hit its maximum rate here, and prices and economic indicators may stabilize for a short period, though nothing lasts forever. The peak cycle typically creates some imbalances in the economy that need to be corrected. Here, adding high-quality investment-grade bonds can be smart, though the looming risk of corporate defaults needs to be managed. Selecting highly rated bonds without taking on too much credit risk is key, and mixing in a blend of government bonds across different sectors and maturities can help insulate the portfolio from any potential market volatility.

As the cycle matures further and the economy begins to contract, investors may need to pivot again. This is the part of the business cycle when central banks typically look to cut interest rates in order to stimulate economic activity. As growth slows, employment falls and prices stagnate. Thus, a fixed-income strategy might include only the highest-quality, highly rated corporate bonds, as the likelihood of corporate defaults rises during a recession. U.S. Treasuries, which are considered a safe haven during periods of high volatility, would also provide stability and should generate a positive return in a falling-rate environment.

Finally, the fourth phase of the cycle would be the trough, or better known as the recovery phase. At this point the economy is coming off a period of low interest rates, and central banks may be headed on the path of slowing rate hikes once the economy becomes more stable. Here we are likely to see earnings expectations improve in anticipation of a recovery. A good strategy at this juncture may be to invest in short-term bonds, as the economy is generally growing but interest rates are slowly rising. These securities carry lower interest rate risk versus longer bonds, and thus allow you the flexibility to reinvest sooner as rates rise.

Flexibility is key

As you can see, there is no set-it-and-forget it strategy that works at all stages of the economic cycle. Investors must be able to move deftly between fixed income assets, always creating a diversified and balanced mix that can meet the challenges of the day. Corporate bonds, asset backed securities, commercial paper, Treasuries, and agency bonds can all play important roles at different times of the economic cycle. The goal is to deliver strong returns over the entire cycle, while providing stability (especially during challenging times and at the lowest point in the economy). And by adjusting duration, credit exposures and sector allocations, investors can enhance returns and manage risks appropriately. We can help as we’ve been riding the cycles for a long time.

Trading vista: Trading around tariffs

Jason Graveley, Senior Manager, Fixed Income Trading

Tariffs! It’s just about all anyone can talk about these days. Are tariffs for real, or just a near-term negotiating ploy? What products and sectors will be impacted the most, and what will our trading partners do in retaliation? Given all these uncertainties and the unknowable ramifications, volatility has jumped, and the market reaction has been stark. On the equity side, more than $6 trillion in market capitalization vanished over a mere two-day period in early April. Not surprisingly, bond yields rallied sharply during the same period thanks to a persistent safe-haven bid. And with the corporate profit outlook murky at best, credit spreads moved materially wider as investors demanded compensation for taking on credit risk.

Volatility, which was also a factor during much of the first Trump presidency, spiked to its highest levels in more than a year in early April, as measured by the VIX Index. The VIX index is commonly referred to the Wall Street “fear gauge,” and it measures implied volatility based on S&P 500 Index options. The last time the VIX was this high was during the unwinding of the yen carry trade in August 2024. But even that volatility felt different. That was always perceived as a short-term blip and never really considered a true threat to GDP growth. That was more of a technical correction for markets. This time, however, there is a great deal of uncertainty. Are we really on the cusp of a fundamental de-globalization of trade and corporate supply chains? This bout of volatility just might have more staying power, especially since the tariffs are so sweeping and the path to de-escalation seems limited. There are more than 50 countries facing an array of customized tariff rates, and the ramifications might be a trade-induced recession. Some market strategists have pegged the odds of a recession at 60% as of early April, and this despite a recent employment report that exceeded consensus expectations.

Why might it be different this time? Investors have little clarity ahead, and there is nothing the market likes less than uncertainty. The Trump presidency has always carried with it a level of unpredictability, but in the immediate aftermath of the election, the general thinking was that the president would prioritize deregulation and tax cuts over an ambitious trade war. The economy was clipping along, employment was near full, and inflation had retreated. The outlook was rosy.

But today, sentiment has shifted decidedly. The most recent tariff announcements of early April have prompted investors to reset expectations. Even Chairman Powell, in remarks shortly after the tariff announcement, worried about the potential for higher inflation, higher unemployment, and slower growth. That type of rhetoric doesn’t instill much confidence in the market. “Coming quarters” was the vague term used by Chairman Powell when discussing when we might have a better feel for the future. In other words, investors might not know for some time how the tariffs will manifest in the economic data. Buckle up.

What does this mean for investors? We believe that a commitment to discipline, security selectivity, and prudent duration management are more important than ever. Fortunately, those are among the pillars of our investment philosophy, and that gives us confidence that we will be able to navigate this uncertain time no matter how long it lingers. Over the last three years, yields on the 2-year Treasury note have gone from 3.8% to over 5%, before recently retracing to 3.65% (as of the time of this writing in early April). This illustrates just how unusual the action has been in fixed income markets. So while the new administration has undoubtedly ushered in a new level of higher volatility, we like to remind investors that we’ve seen it before, and we aim to use it to our advantage.

Sources: Bloomberg and SVB Asset Management as of 03/31/2025.

Sources: Bloomberg, Tradeweb and SVB Asset Management as of 03/31/2025.

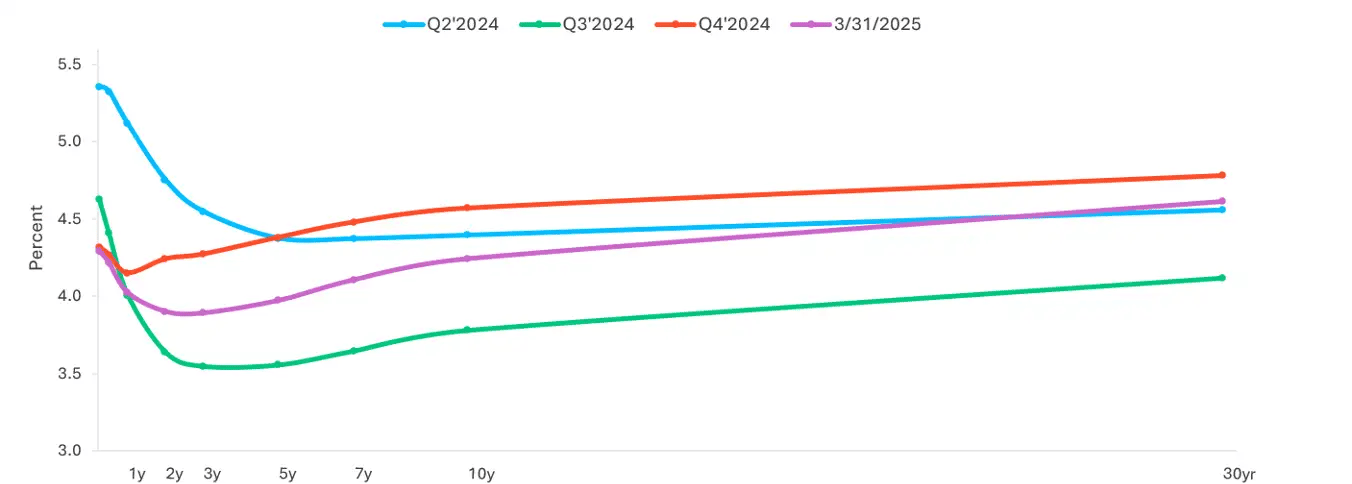

The Treasury yield curve remains flat

Sources: Bloomberg, Tradeweb and SVB Asset Management as of 03/31/2025.

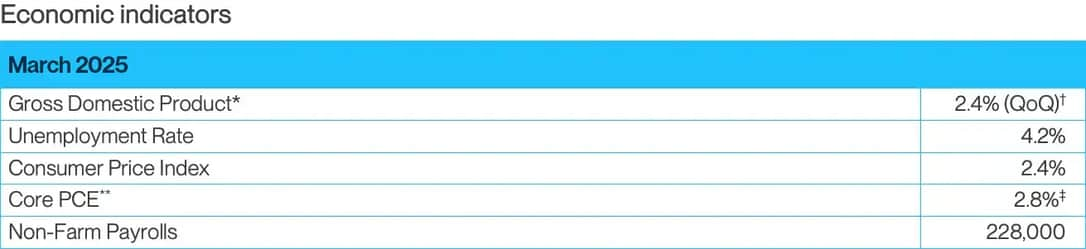

Source: Bloomberg and Silicon Valley Bank as of 03/31/2025. US Bureau of Economic Analysis (BEA) and US Bureau of Labor Statistics. *Current GDP release as of 03/27/2025. †QoQ — Quarter-over-Quarter. **Core Personal Consumption Expenditures. ‡Current PCE release as of 03/28/2025.