- America's mounting national debt poses underlying challenges for both the U.S. economy and global financial markets.

- The soaring national debt could significantly impact financial markets, particularly the fixed income sector, if it pushes yields on Treasuries too high.

- Ultimately, the federal government must maintain a delicate balance between the needs of the country and the safe-haven status of U.S. Treasuries, which remains intact today.

Economic vista: Beyond the big numbers

Jose Sevilla, Senior Portfolio Manager

The numbers are so large that it’s hard to get your head around them. On top of that, many investors are not clear on the differences between deficit and debt. Nevertheless, we think investors should endeavor to understand a bit more about the nation’s mounting national debt, as well as its potential impact on U.S. and global markets.

The national debt represents the total amount of money the federal government has borrowed to cover expenses over time. When annual spending (e.g., on healthcare, defense, and infrastructure) exceeds revenue (from taxes), a budget deficit occurs. To finance this deficit, the government issues U.S. Treasury bonds. The national debt is the sum of these borrowings plus interest owed.

Annual deficits, a common occurrence, is the main cause for the mounting national debt. "On Oct 20, the U.S. government posted a $1.695 trillion budget deficit in fiscal 2023, a 23% jump from the prior year as revenues fell and spending on Social Security, Medicare and record-high interest costs on the federal debt have risen. The Treasury Department said the deficit was the largest since a COVID-fueled $2.78 trillion gap in 2021."1 The United States faces a daunting fiscal challenge as its national debt continues to soar. Given the size and scope, this debt has far-reaching implications for both the U.S. economy and markets. Let’s consider some of the causes, consequences, and potential impact on the markets.

As of the fourth quarter 2023, the national debt had surpassed $33 trillion, equating to 122% of U.S. GDP. Several factors contributed to this growing debt. High spending on entitlement programs like Social Security and Medicare, defense, and debt interest payments have resulted in consistent budget deficits, even during economic growth. The challenges are exacerbated during times of economic downturns, which tend to result in lower tax receipts and higher spending on safety net programs (programs like unemployment benefits, food assistance, and healthcare). This naturally increases annual deficits and was clearly illustrated by the economic turmoil caused by the COVID-19 pandemic. But remember, if the federal government continually carries such high debt levels, it can potentially restrict policymakers' ability to respond to future crises. If another recession occurs, stimulus options may be limited due to the mounting national debt. Finally, tax reforms, such as the Tax Cuts and Jobs Act of 2017, have reduced government revenue, also exacerbating the deficit.

Market Implications

Through an investment lens, it’s hard to ignore the implications. As national debt grows, so do the interest payments required to service this debt. In 2023, the U.S. government spent $658 billion on net interest costs, a 38% increase from 2022, representing 2.4% of GDP. Interest payments to holders of U.S. government debt is the fourth-largest government expense, behind Social Security, Medicare, and defense, and is currently the fastest growing part of the federal budget. Increases in these payments divert capital resources from critical areas like infrastructure, education, and healthcare, and can hinder long-term economic growth and societal well-being. This “crowding out” effect also discourages private investment due to the higher borrowing costs.

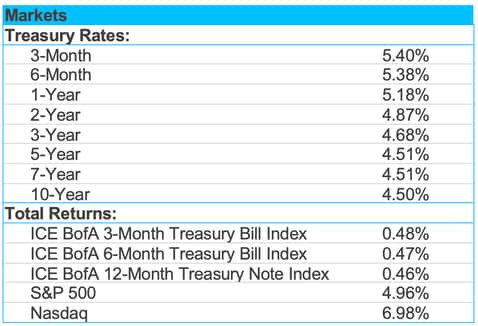

The soaring national debt significantly impacts financial markets, particularly the fixed income sector. U.S. Treasury securities are considered the safe-haven asset (with yields on Treasuries sometimes referenced as the “risk-free rate”) and a cornerstone of the bond markets. Their yields directly impact other fixed income instruments. To fund its spending, the U.S. government issues more bonds. This increased supply can lead to higher yields to attract buyers and as investors demand compensation for the added risk.

U.S. Treasuries have long been considered a rock-solid, lower-risk investment. A default or loss of confidence in U.S. debt seems unthinkable and could disrupt global financial stability. Interestingly, foreign investors are the biggest holders of U.S. government debt. Any doubts about repayment would put pressure on the high-quality credit ratings that Treasuries currently enjoy. This could trigger a capital flight, raise volatility and cause a ripple effect throughout global markets. After all, investor confidence in U.S. debt influences demand for U.S. Treasury securities. And persistent concerns about debt sustainability could result in a vicious cycle whereby higher interest rates further increase the cost of servicing the debt.

By no means are we doomsayers or sounding alarm bells. However, we want to highlight that America's mounting national debt matters and could pose significant challenges for both the U.S. economy and global financial markets. The mounting debt (and interest payments) ultimately could divert resources from crucial public spending, crowding out private investment, and limiting any fiscal response during crises. Moreover, the global impact is profound, as the safe-haven status of U.S. Treasuries and the stability of the dollar are vital to global financial stability. We continue to have the utmost confidence in the safe-haven status of U.S. Treasuries; however, we simply are reiterating that the U.S. government has a fiscal responsibility to manage the national debt and ensure the long-term economic stability and growth of the economy.

Credit vista: Good grades for IG

Darrell Leong, CFA, Managing Director, Head of Investment Research

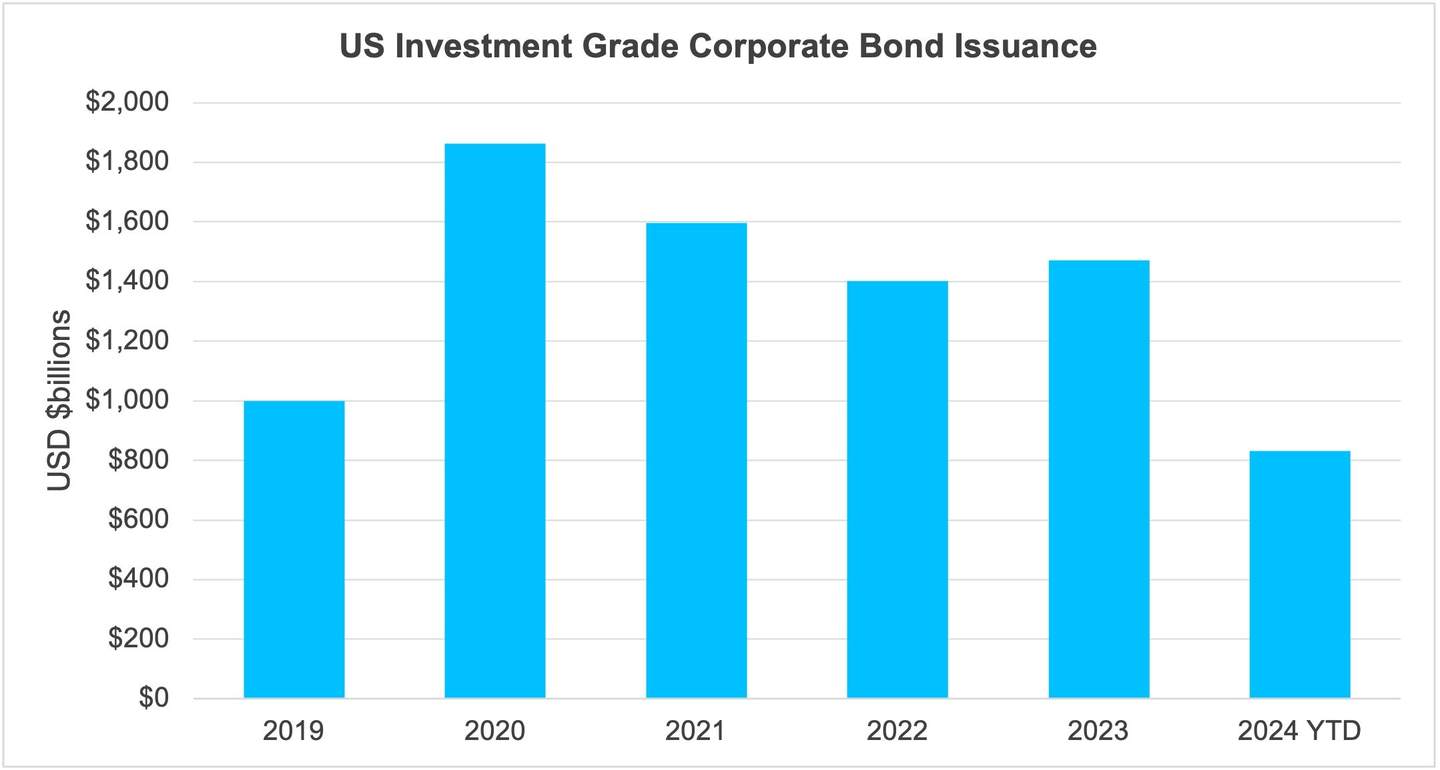

It was a fast start, but will it last? The new issue investment grade (IG) corporate bond market got off to blazing start in the beginning of 2024. January and February had robust market activity with a pace of issuance that was on track to exceed $2 trillion for 2024. That would qualify as an annual record. While primary issuance has moderated over the past few months, it continues growing at a healthy clip.

Corporate America has been very successful issuing new bonds this year, and why not? Earnings have been relatively strong on the whole, and there has been no recession despite interest rates that have remained “higher for longer,” as the Federal Reserve had been warning. While financials represent approximately 40% of IG bond issuance, non-financial sector issuance has been gaining momentum as well, thanks in part to significant M&A activity in the healthcare sector. During the first two months of the year, buoyed by U.S. pharmaceutical M&A activity, the healthcare sector has seen impressive issuance from the likes of AbbVie for $15 billion and Bristol Myers Squibb for $13 billion. Expectations are rising for additional deals in 2024, which could push overall new issuance forecasts even higher.

IG Corporate Issuance Are at Robust Levels in 2024

Drivers for New Deals

One main driver for new corporate bond issuance is the need to refinance pending maturities. IG borrowers are proactive in managing their debt maturity profiles, and savvy management teams like to tap the bond market at opportune times. The economic backdrop is supportive for issuance at these levels, with 5% yields seeming to be a magic number for a broad range of investors. The 5% yield seems to represent a level that is an attractive alternative to cash. Fears of a recession in 2024 have largely faded, and U.S. GDP forecasts remain strong. As a result, those companies with good credit profiles seem to have access to a wide pool of potential investors.

Nevertheless, market volatility remains at the forefront of many investors’ minds due to concerns about the ultimate trajectory of monetary policy, the potential stickiness of inflation, ongoing geopolitical risks, and the particularly rancorous U.S. presidential elections later this year. Cash has moved off the sidelines to take advantage of attractive yields, and IG corporate credit offers an attractive risk-reward trade-off for many investors. After all, one way investors can receive additional compensation beyond Treasuries is by taking on corporate credit risk. Although spreads are a bit tight with average IG corporate bond spreads moving below 100 basis points (bps) for the first time in five years, it’s important to remember that on a total return basis, yields remain above long-term averages. Through this lens, IG bonds remain attractive, in our opinion. As of the end of May 2024, IG bonds were providing investors with a yield of 5.60%, based on the ICE BofA US Corporate Index. A subset of the measure which looks at shorter tenor bonds, the ICE BofA 1-3 Year US Corporate Index, also offered similarly attractive yields in the neighborhood of 5.56%.

Looking Ahead

One reason that IG bonds remain attractive on a risk-reward basis is the fact that they have lower default rates compared to other credit asset classes. Thus, they can offer diversification benefits, attractive return potential, and relatively low credit risk. Tighter spreads may limit further appreciation in this asset class, so that should be factored into any new allocation. Yet if the Federal Reserve finally pivots and begins to cut rates, those investors who have locked in higher yields might see bond prices rise.

After years of low rates, investors now are enjoying an environment with more ways to boost income potential. Under the right circumstances, U.S. IG corporate bonds remain a solid option thanks to a strong domestic economic outlook relative to global growth. That’s been evident as investors have happily snapped up the robust levels of new issuances. Furthermore, there may be technical drivers at play in the market that can provide additional intriguing opportunities. Ultimately, we believe that active portfolio management and prudent credit selection are essential to navigate risks in the credit markets. Fundamental credit analysis matters, and that’s been a hallmark of SVB Asset Management for more than two decades.