- Passive repatriation of foreign revenues, where the timing of conversions takes place without plan or structure, can materially alter business performance.

- Making foreign exchange (FX) hedging an integral part of a structured repatriation strategy may help stabilize results and enable more confident planning.

- The turn lower in the US dollar (USD) offers an attractive entry point for FX hedging, and due to the still elevated US interest rates versus most developed economies, FX forward pricing delivers an extra boost to the USD value of revenues brought home through hedging.

Currencies can be difficult to forecast

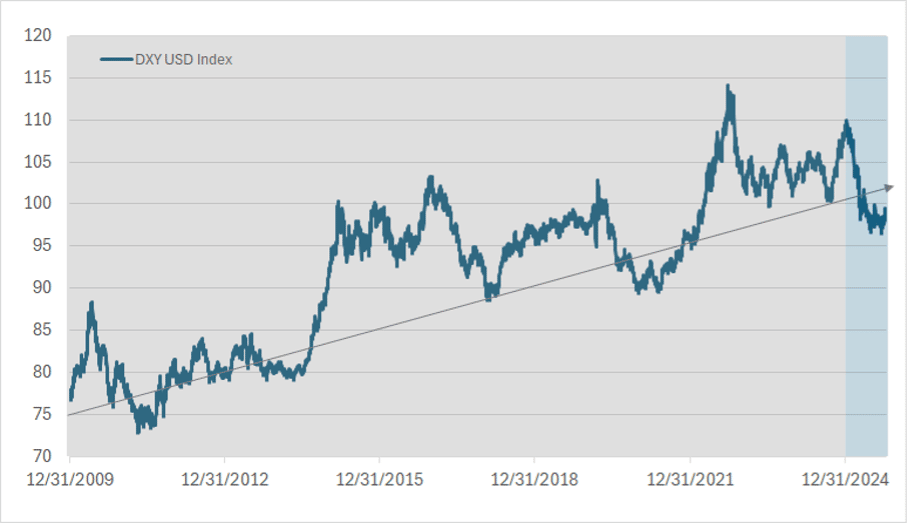

While we know much about the fundamental drivers that determine currency movements, individual contributions will vary over time and drivers may fall in and out of favor without notice. The latest bull run in the USD for example, which lasted between 2010 and 2024, was propagated by the potential collapse of the European Monetary Union in the first few years, then by the global growth slowdown mid-decade, and finally by Fed rate hikes following the post-COVID inflation spike.

Furthermore, currencies never move in a straight line. Despite the strong upward trajectory highlighted in Chart 1, the USD depreciated in 27 of the 60 quarters in this bull run period. In other words, the direction over a given quarter was a near coin toss at 45-55%, down versus up.

Chart 1: USD bull run (2010-2024)

Source: Bloomberg Oct 2025

And, just when it seems that currencies are behaving as predicted by theoretical constructs, an external shock such as a global pandemic, geopolitical event, or global trade policy change will derail trends and inject two-way FX uncertainty.

Structure beats reaction

Forward-looking finance teams do not wait for FX volatility to dictate business outcomes--there are strategies designed to manage it.

A clear revenue repatriation framework which includes FX hedging – ideally aligned with the financial planning and analysis (FP&A) process – replaces ad-hoc decisions about conversions with deliberate trading activity. It allows the organization to align cross-border cash movements with broader business objectives, while reducing the emotional bias that creeps in when markets move fast or trends shift, as happened recently with the USD. A structured approach cannot eliminate volatility, but rather it turns volatility into something that is measurable, monitorable, and manageable.

Hedging is a compromise

By its very nature, FX hedging is designed to mitigate financial risk, which is a two-way proposition as currencies can move for or against. The product choice is what determines the distribution of hedged outcomes. Below is a characterization of this compromise for the FX hedge alternatives most widely used by US-based corporations due to their simplicity, ample liquidity, and favorable accounting treatment:

- If forwards are used, the spot risk mitigation is symmetric (e.g., no downside risk but no upside potential).

- Collars and participating forwards are designed to offer limited degrees of both protection and upside potential.

- When hedging with purchased options, the spot risk mitigation is asymmetric in favor of the hedging institution. In exchange for downside protection and upside potential, however, a premium is paid upfront.

The favorable carry profile tilts the compromise in favor of revenue hedgers

Although trending lower, US interest rates remain above those in most developed economy currencies.

Table 1: Policy interest rates and differentials

| (A) Country | (B) Policy interest rate | (C) US rate advantage |

| United States | 4.25% | – |

| Australia | 3.60% | 0.65% |

| Canada | 2.50% | 1.75% |

| China | 3.00% | 1.25% |

| Euro Zone | 2.00% | 2.25% |

| Japan | 0.50% | 3.75% |

| New Zealand | 3.25% | 1.00% |

| Switzerland | 0.00% | 4.25% |

| UK | 4.00% | 0.25% |

Source: Bloomberg. Data as of Q4 2025.

This market dynamic favors US-based revenue hedgers. Because interest rate differentials determine FX forward curves , buying USDs on the hedges (e.g., selling foreign currencies) is done so at a more favorable prices than prevailing spot rates. Intuitively, buying USD means the hedger is long USD, the higher-yielding currency, and short the lower-yielding foreign currency, and the forward rate is an expression of this favorable carry profile.

Crucially, the existence of the favorable carry profile for hedging revenues from Europe, UK, Canada and other key innovation-sector business destinations skews the distribution of hedged outcomes in favor of the US-based hedging institutions.

If forwards are used, the hedger forfeits upside potential, but the FX rate for revenue conversion will be improved by the amount of the forward carry boost, which is estimated in Column C of Table 1. Euro-denominated revenues, for example, may be brought back to USDs at an approximate 2.25% annualized improvement over prevailing spot rates.

For other hedging alternatives, the forward carry profile improves the ratio of upside potential to downside risk for collars and participating forwards, and cheapens the premium paid for FX options for any given strike.

Conclusion

The entry point for FX hedging programs aimed at foreign revenues is attractive given the sharp turn in the USD. Due to the still elevated US interest rates versus most developed economies, revenues brought home through FX hedging receive an extra boost from the favorable carry profile.

The end goal of FX hedging is building predictability into cash flows and reported results. Well-designed repatriation frameworks which include FX hedging can transform this unavoidable exposure into a managed process that protects earnings, supports capital planning, and demonstrates disciplined financial stewardship.