Three Steps to Creating a Stand-out Pitch

Step1: What makes you stand out?

No two funds are created equally, and there is no shortage of factors that could theoretically set you apart from other managers. The first step in differentiating your fund is to identify what you do better, faster, smarter, or more efficiently than other funds. Bear in mind that when we say, “other funds,” we’re not just talking about the hundreds that already exist. We’re also talking about the hundreds more that are being raised every year by emerging managers like you. To stand out, your pitch must truly be one in a thousand.

The real question, however, is not what makes you a good investor. You wouldn’t be a venture capitalist if you didn’t have a deep network, empathy for founders or subject area expertise. When it comes to differentiation, what matters is what makes you truly singular. If a trait is going to differentiate your fund from others, by definition it must be noteworthy.

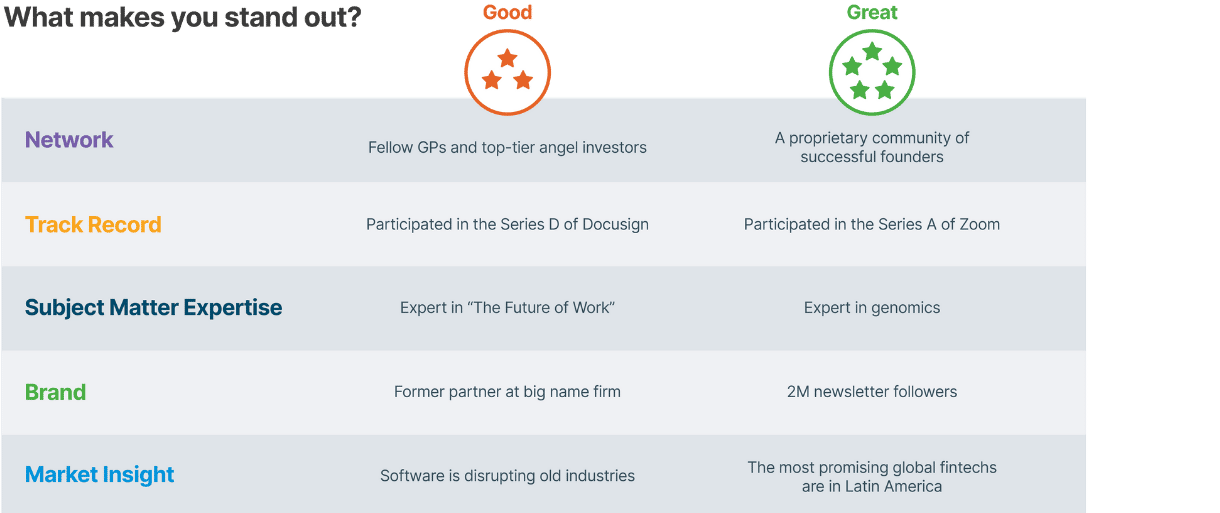

As these examples demonstrate, the more specific you can be about your traits and accomplishments, the more you’ll stand out from the crowd:

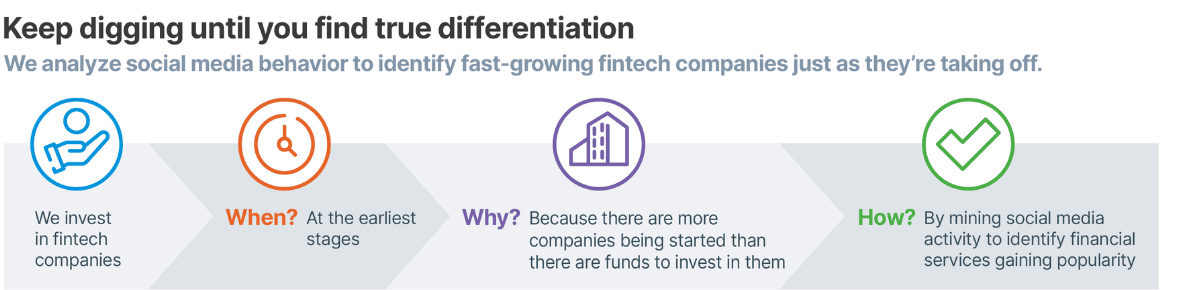

To uncover what makes a fund noteworthy, managers must push themselves to dive below the surface until they reach a signature insight, perspective, approach, or tactic. And that means they need to keep asking questions—Why? How? Where? When? —until the answer is something that (1) only you believe, or (2) only you are doing.

We recommend this exercise to all managers. When you’re doing this type of digging, it helps to be your own worst enemy. Challenge yourself to come up with existing firms that could make the same argument. Screen out qualities that could be perceived as generic and hone in on those that you can truly own. Keep pushing yourself to make each differentiator as specific as possible.

Don’t worry if this process leads you to differentiators that don’t feel either critical or central to your fund’s thesis. At this stage, you’re leaning into the idea that different is better than good. During the next step in the process, you’ll determine whether being different in a particular way matter.

Step 2: Are Your Differentiators Compelling?

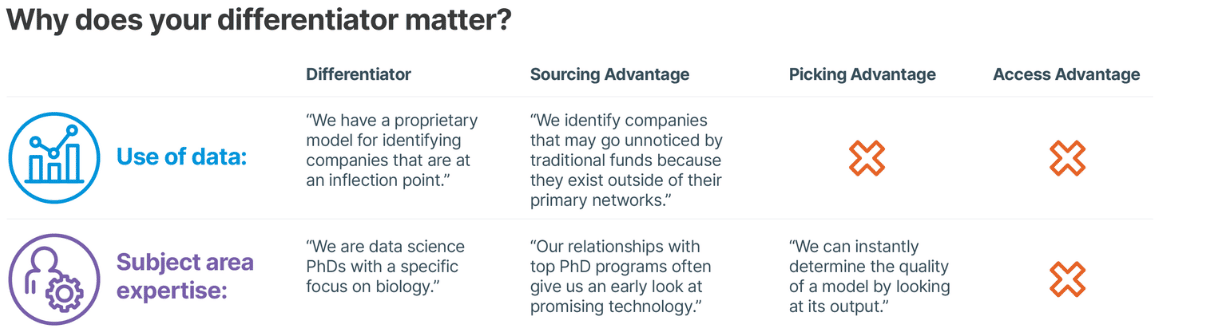

Being distinct is one thing. Being useful is another. LPs aren’t just looking for managers who have an “edge.” They also want managers who are well positioned to help them achieve their goals. In practical terms, they must believe you will have better sourcing, better diligence, or better access to competitive deals than similar funds. In other words, an effective differentiator should feel to investors like it will inevitably lead to higher returns.

Here is a model that you can use to evaluate whether a fund’s noteworthy qualities are also compelling value propositions for its investors.

As you can see, some differentiators make a better case for a fund’s advantages than others. The key is to draw a distinction between what you believe to be compelling about your fund and how investors are likely to receive that message.

Step 3: Can you Prove It?

Interestingly, many first-time managers have relatively little difficulty uncovering compelling differentiators for their pitches. The bigger challenge is providing evidence that those differentiators exist. When funds have a limited track record, GPs have few tools to document the claims they make. But that doesn’t mean it’s impossible to do so, or that you shouldn’t try. Of course, not everything can be proven in the context of a pitch. It may feel like you can provide a high level of founder support, but LPs are unlikely to believe that promise if you haven’t already done so. Similarly, you may lean on your network as a core differentiator, but if that network doesn’t have a track record of return-generating leads, the names on your contact list won’t be meaningful to an LP.

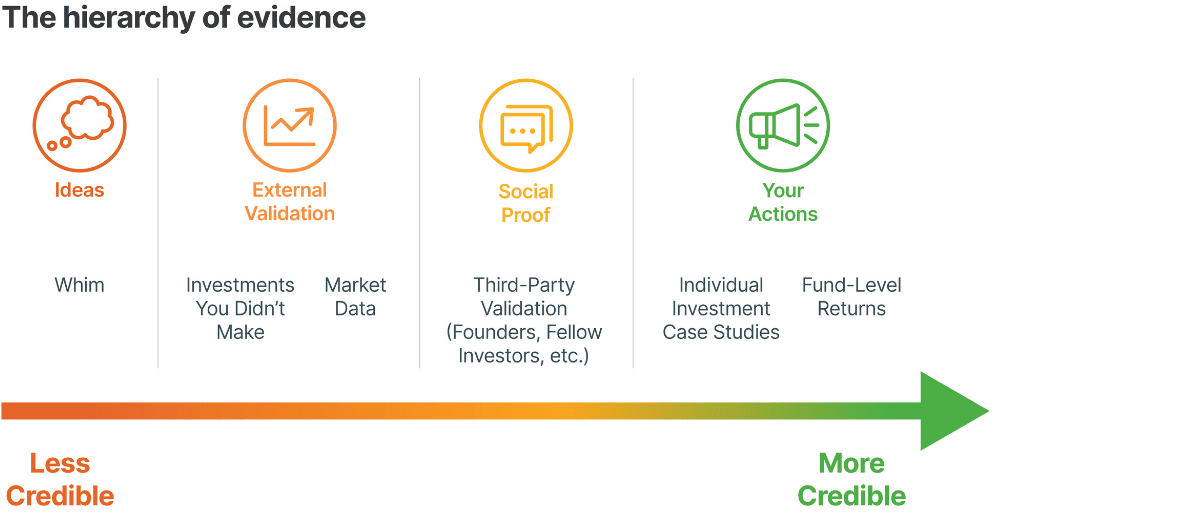

And even if you can garner evidence to support your claims, not all evidence is compelling. In our experience, there is a hierarchy of credibility that resonates with LPs.

Evidence based on your own actions is most credible, especially if the impact is measurable. The next-best class of evidence is social proof—what others are willing to say about you. It’s also good to gather any validation that you can derive from developments or trends in the market that are independent of you and your fund.

The final step in assessing the strength of your differentiators is to generate the best, most compelling evidence for each one, using this hierarchy as a guide. Once you’ve completed this process, you will ideally have identified at least two or three differentiators that are compelling and provable—laying the groundwork for an effective pitch.

Building on your key differentiators

Unfortunately, core differentiators alone are not enough to develop a compelling pitch. Consider a memorable hook, a compelling thesis and strong alignment with your potential LPs. Clean design and confident delivery may also help. However, your key differentiators should serve as the primary building blocks of your story.

Because compelling differentiators are so critical to a solid pitch, you should take every advantage to field test them. Even before you build your pitch, every conversation you have with potential LPs is an opportunity to test differentiators and adapt—or even abandon—the ones that don’t resonate. Ideally, the differentiators that do resonate will help you crystallize your pitch before it takes the form of a presentation. They can also help you to establish the identity of your firm—or even its name—as you orient your fund around what makes you noteworthy.

Landing your first set of LPs is never easy. But if you know what makes your fund stand out and how to communicate those advantages strategically, you’ll have a much better shot at rising above the sea of new funds where it matters most: in the eyes of GPs. After all, you can’t stand up a fund without first standing out.

Read Main Article

Pitch Differentiation

Best practices for making a first-time fund stand out.