Pitch Your Fund by Highlighting What Makes It Noteworthy

|

written by: |

Best Practices for Making a First-Time Fund Stand Out

2020 was a banner year for venture capital. The market has never seen more deals closed, more exits booked or more money raised. But lost in the parade of positive data is a troubling issue for aspiring managers: Among the 321 funds raised, only 50 of them were helmed by first-time managers, which represents a seven-year low.

What accounts for the consistent drop in new first-time funds over the last few years? Returns aren’t the problem. According to the data, emerging managers tend to outperform their more mature counterparts. And limited partners (LPs) recognize that as the startup community grows more diverse across demographic groups, geographies, and industry verticals, it’s important to invest in managers who bring a fresh perspective to the market. Emerging managers generally offer LPs more diversity, easier access, and a more attractive fund size than established firms, a combination that can garner additional attention.

With so many prospective new managers in the ecosystem, there is no shortage of exciting new funds for LPs to choose from. Narrowing down that enormous set of choices appears to be a major obstacle, however. For emerging managers, the challenge is clear: How do I present my noteworthy advantages to LPs in a way that is compelling, provable and memorable?

Differentiating your fund may seem straightforward. Your team, your network, your subject matter expertise, your investment thesis, and your diligence process all could offer potential advantages over other funds. However, communicating these advantages and providing proof points to support them in a way that LPs will remember is much easier said than done.

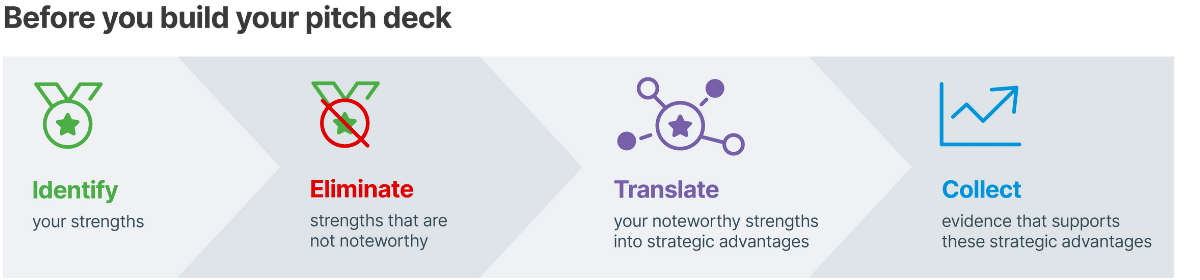

Over the past seven years, we’ve worked with dozens of funds—including numerous first-time managers—to build pitches that are clear, concise, and stand out in the eyes of LPs. What follows is a framework for identifying and validating your core differentiators as a first step toward building the most compelling possible pitch for your fund.

Know Your Audience

Before you can determine what will resonate with a prospective LP, you first need to get inside her head. Alignment of interests is important. Take the time to ask questions so you understand the LP’s existing exposure and how you might fit within it.

- What is she looking for in a general partner (GP)?

- How do you fit into her broader strategy?

- How can you help her achieve her goals?

- Returns that meet or exceed their expectations and market benchmarks for your investment strategy.

- Exposure to a particular asset class, sector or subsector, or stage within venture.

- Insights that they can use to inform their broader investment or business strategy.

- Sourcing – Identifying companies that others miss, or seeing them before others do

- Picking – Evaluating opportunities better than others

- Winning – Earning access to competitive deals

Click below to learn about the three steps to creating a stand-out pitch.

Read the other articles in this Emerging Manager article series

Building a Comprehensive Data Room

Establishing, Navigating and Maintaining LP Relationships

Cash Flow Management for Emerging Managers: How to Approach Capital Calls and Distributions