Startup banking products and services for founders

Navigate startup banking events, insights and trends

Ready to begin startup banking?

FAQs

Yes. While SVB doesn't directly fund startups, we're deeply committed to helping your startup secure investment. We can connect you with the resources and network you need, focusing on:

Investor connections: Access our extensive network of VCs, angels and other investors. Expand your reach and connect with potential funders.

Fundraising support & events: Refine your pitch deck, navigate the fundraising process and leverage our curated events and webinars to connect with investors. Increase your chances of securing funding and build valuable relationships.

Market insights reports: Access our industry-specific research and trend analysis. Stay informed about market dynamics and make data-driven decisions.

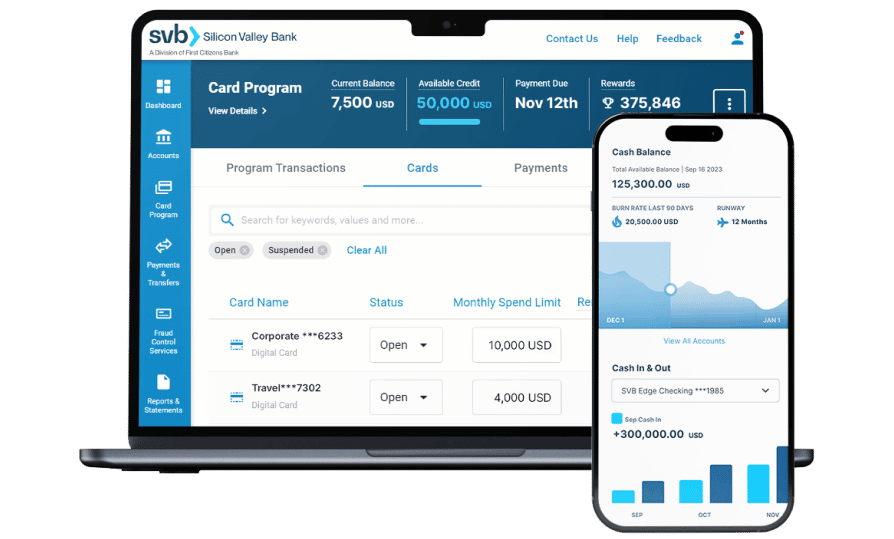

Digital banking for founders: Complement your funding efforts with specialized banking services and capital strategies. Manage finances efficiently and fuel your growth via our award-winning digital banking platform.

A bank should be a true financial partner, adapting to your evolving needs. SVB provides scalable solutions as you grow:

Flexible credit lines: Access the capital you need to seize opportunities. Fund growth and expansion.

Treasury management: Optimize your cash flow and manage finances. Improve financial control and efficiency.

Cash management accounts: Maximize your returns with competitive interest rates on deposits and money market accounts (MMAs). Make your cash work harder for you.

Discounted partner offers: Access deals on partner software and services. Reduce costs and access valuable tools that support your growth.

Yes! A dedicated startup business bank account offers essential tools for managing cash flow:

Automated Bill Pay: Streamline payments and avoid late fees. Save time and reduce administrative hassle.

Integrated expense tracking: Gain clear visibility into your spending. Control expenses and identify areas for savings.

Higher-yield Money Market Accounts: Make your money work harder. Maximize returns on your cash reserves.

Real-time reporting: Monitor your financial health and make informed decisions. Stay on top of your finances and make data-driven decisions. Explore our digital banking platform.

Yes, SVB has deep expertise across diverse industries in the innovation economy, including:

- Cleantech & Sustainability

- Consumer Internet

- Defense Tech & Aerospace

- Enterprise Software

- Fintech

- Hardware & Frontier Tech

- Life Science & Healthcare

- Premium Wine

We understand your industry's unique challenges and opportunities. Explore our recent transactions to see how we've supported companies across these industries.

SVB Startup Banking is a collection of tailored products and services designed for the specific needs of early-stage companies in the innovation economy. Pioneered by SVB over 40 years ago, it goes beyond traditional banking by offering:

- Tailored financial solutions: Access products and services built for startups. Streamlined finances and efficient operations.

- Expert guidance: Receive support from advisors who understand your challenges. Make informed decisions and navigate complex situations.

- Networking opportunities: Connect with investors and other key players in the innovation ecosystem. Access funding and strategic partnerships.

- Scalable support: Partner with a bank that can grow with your business. Long-term support and adaptable solutions.

Get started with SVB Startup Banking today.